Get A Loan With Guaranteed Approval: No Credit Check Direct Lender

Table of Contents

Understanding "Guaranteed Approval" Loans

The term "guaranteed approval" can be misleading. While a guaranteed approval loan significantly increases your chances of securing funding, it doesn't mean automatic approval. Lenders still need to verify your income and ensure you can reasonably repay the loan. This differs from traditional loans, which place a much stronger emphasis on credit history. A guaranteed approval loan is designed to be more accessible for those with poor credit, thin credit files, or no credit history.

The advantages are clear:

- Faster processing times: The simplified application process often leads to quicker approvals and funding.

- Less stringent requirements: Lenders focus less on credit scores and more on your ability to repay.

- Accessibility for individuals with challenged credit scores: This opens up financial opportunities previously unavailable.

- Improved financial flexibility: Gain the ability to address urgent financial needs without the hurdle of a credit check.

Finding a Reputable Direct Lender

Choosing the right lender is crucial. Dealing directly with a lender, rather than a broker, offers several advantages, including greater transparency and potentially lower fees. Here's how to identify trustworthy direct lenders:

- Check for licensing and registration: Ensure the lender is legally operating in your state or region.

- Look for customer reviews and testimonials: Independent reviews provide valuable insights into the lender's reputation and customer service.

- Verify their contact information and physical address: Avoid lenders with vague or untraceable contact details.

- Avoid lenders who promise unrealistic terms: Be wary of promises that sound too good to be true.

Watch out for red flags like hidden fees, high-pressure sales tactics, and unclear loan terms. Thorough research is your best protection.

The Application Process for No Credit Check Loans

Applying for a no credit check loan from a direct lender is generally straightforward. However, it's crucial to provide accurate information to avoid delays or potential issues. The process typically involves:

- Online application: Most direct lenders offer convenient online application forms.

- Income verification: You'll need to provide proof of income, such as pay stubs or bank statements.

- Identity verification: You'll need to provide a valid government-issued ID.

- Loan agreement review and signature: Carefully review the loan terms and conditions before signing the agreement.

Types of No Credit Check Loans Available

Several types of loans might offer guaranteed approval without a credit check:

- Payday loans: These short-term, small-dollar loans are designed to be repaid on your next payday. They typically come with high interest rates.

- Short-term loans: Similar to payday loans but often with slightly longer repayment periods.

- Installment loans: These loans are repaid in installments over a longer period, usually offering lower monthly payments but higher overall interest.

Each loan type has pros and cons regarding interest rates and repayment terms. Carefully compare options and choose the loan that best suits your financial situation and repayment capabilities. Remember, responsible borrowing is key. Understand the terms before signing any loan agreement.

Managing Your Loan Responsibly

Securing a loan is only half the battle; responsible repayment is equally important. Here's how to manage your loan effectively:

- Create a budget: Track your income and expenses to ensure you can afford your loan payments.

- Set up automatic payments: Avoid late payments and potential penalties by setting up automatic payments.

- Contact the lender if you face difficulty repaying: Communicate with your lender early if you anticipate problems making payments. They may offer options to help you avoid default.

Conclusion: Securing Your Financial Future with a Guaranteed Approval Loan

Getting a loan with guaranteed approval from a direct lender without a credit check offers a vital lifeline for those facing financial challenges. Remember to prioritize finding a reputable lender, carefully reviewing the loan terms, and creating a responsible repayment plan. By following these steps, you can access the financial assistance you need and work towards a more secure financial future.

Ready to secure your financial future? Start your application for a loan with guaranteed approval from a direct lender today! Find the right no credit check loan for your situation.

Featured Posts

-

Semarang Diprediksi Hujan Siang Ini Bagaimana Cuaca Besok 22 April

May 28, 2025

Semarang Diprediksi Hujan Siang Ini Bagaimana Cuaca Besok 22 April

May 28, 2025 -

U Turn On Rental Contract Ban Government Reconsiders Policy

May 28, 2025

U Turn On Rental Contract Ban Government Reconsiders Policy

May 28, 2025 -

Kawin Kontrak Di Bali Fakta Modus Dan Bahaya Yang Perlu Diwaspadai

May 28, 2025

Kawin Kontrak Di Bali Fakta Modus Dan Bahaya Yang Perlu Diwaspadai

May 28, 2025 -

Nadals Last Roland Garros Sabalenka Secures The Title

May 28, 2025

Nadals Last Roland Garros Sabalenka Secures The Title

May 28, 2025 -

Euro Millions Results Irish Players Win Big Winning Ticket Locations Revealed

May 28, 2025

Euro Millions Results Irish Players Win Big Winning Ticket Locations Revealed

May 28, 2025

Latest Posts

-

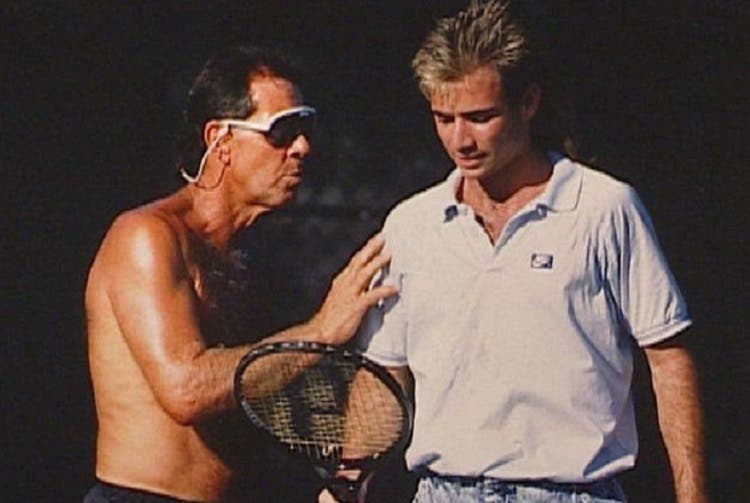

El Recuerdo De Agassi Rios Una Bestia En La Cancha

May 30, 2025

El Recuerdo De Agassi Rios Una Bestia En La Cancha

May 30, 2025 -

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025 -

French Open 2025 Ruuds Knee Injury Costs Him Victory Against Borges

May 30, 2025

French Open 2025 Ruuds Knee Injury Costs Him Victory Against Borges

May 30, 2025 -

Agassi Rios Mi Gran Rival Sudamericano

May 30, 2025

Agassi Rios Mi Gran Rival Sudamericano

May 30, 2025 -

Agassi Schimba Raqueta De La Tenis La Pickleball

May 30, 2025

Agassi Schimba Raqueta De La Tenis La Pickleball

May 30, 2025