Gibraltar Industries (ROCK) Earnings Preview: What To Expect

Table of Contents

Analyzing Gibraltar Industries' Recent Performance (ROCK Stock)

Gibraltar Industries' recent performance provides a crucial backdrop for understanding the upcoming earnings report. Analyzing key metrics allows us to anticipate potential outcomes and assess the company's trajectory.

Revenue and Growth Trends

Examining Gibraltar Industries' revenue growth is essential. Recent quarterly and annual reports reveal [Insert latest revenue figures and percentage change from previous periods]. This growth can be attributed to several factors:

- Revenue Growth Rate: [Insert percentage and compare to previous quarters/years]. This shows whether ROCK is maintaining momentum or experiencing a slowdown.

- Key Revenue Drivers: Strong performance in [Mention specific product segments, e.g., building products, renewable energy infrastructure] appears to be driving growth.

- Acquisitions and Divestitures: [Mention any recent acquisitions or divestitures and their impact on revenue].

Analyzing financial ratios such as the revenue growth rate and gross margins provides further context. A higher revenue growth rate suggests strong market demand and successful execution of the company's strategies. Gross margins reveal insights into pricing power and cost efficiency.

Profitability and Margins

Profitability is another key performance indicator. Analyzing gross profit margin, operating margin, and net income provides a clear picture of Gibraltar Industries' financial health.

- Trends in Profitability: [Discuss trends in gross profit margin, operating margin, and net income. Show if they are increasing, decreasing, or stable].

- Factors Affecting Margins: Fluctuations in raw material costs, particularly steel and aluminum, significantly affect margins. Gibraltar Industries' pricing strategies will be crucial in mitigating these impacts. [Insert data showing impact of raw material costs]

- Industry Benchmarks: Comparing Gibraltar Industries' profitability metrics to industry benchmarks helps determine its relative performance within the sector. [Insert comparison data if available].

Analyzing operating margin and net profit margin provides investors with a deeper understanding of the efficiency of the company's operations and the overall profitability.

Key Factors to Consider for the Gibraltar Industries (ROCK) Earnings Report

Several factors beyond Gibraltar Industries' historical performance will influence the upcoming earnings report.

Market Conditions and Industry Outlook

Gibraltar Industries operates primarily within the construction and infrastructure sectors. Understanding the current market climate is crucial.

- Macroeconomic Factors: Interest rates, inflation, and overall economic growth significantly influence construction activity. [Discuss the current macroeconomic environment and its potential impact].

- Competitive Landscape: The competitive landscape within the construction materials industry is [describe the competitive landscape - e.g., intense, fragmented etc.]. Analyzing competitors' performance provides additional context.

- Regulatory Changes: Any potential regulatory changes affecting the construction industry, such as building codes or environmental regulations, could impact Gibraltar Industries' operations.

Guidance and Management Commentary

Management's guidance regarding future performance is a critical aspect of the earnings report.

- Previous Guidance Accuracy: Analyzing the accuracy of past guidance provides insights into the reliability of future projections.

- Potential Adjustments: [Discuss any potential adjustments to guidance based on current market conditions and the company's recent performance].

- Key Statements to Watch: Pay close attention to management's commentary on key issues such as revenue growth, profitability, and future strategic initiatives. [Mention any recent press releases or investor presentations relevant to guidance].

Potential Risks and Opportunities for Gibraltar Industries (ROCK)

Understanding the potential risks and opportunities facing Gibraltar Industries is essential for investors.

Supply Chain Disruptions and Inflation

Supply chain disruptions and inflation pose significant challenges to Gibraltar Industries' operations and profitability.

- Mitigating Risks: Analyze the strategies Gibraltar Industries employs to mitigate supply chain risks, such as diversifying suppliers or securing long-term contracts.

- Impact of Inflation: Inflation significantly affects raw material costs. Assess how Gibraltar Industries' pricing strategies can offset these increases while maintaining market competitiveness.

Growth Strategies and Innovation

Gibraltar Industries' growth strategies and innovative capabilities will be critical drivers of future performance.

- Market Share Gains: Analyze the potential for Gibraltar Industries to gain market share through new product launches or strategic partnerships.

- New Product Launches: Assess the success of any recent or upcoming new product launches, and their potential impact on revenue and profitability.

- Market Expansion: Examine Gibraltar Industries' plans for geographic market expansion and their potential impact on future growth.

Conclusion: Gibraltar Industries (ROCK) Earnings – Your Next Steps

This Gibraltar Industries (ROCK) Earnings Preview highlighted several key factors likely to influence the upcoming earnings report. Analyzing revenue growth, profitability, market conditions, and management guidance are critical for informed investment decisions. Monitoring the earnings release and the subsequent conference call is crucial for gaining further insights into the company's performance and outlook.

To stay informed about Gibraltar Industries (ROCK) stock analysis, including future Gibraltar Industries earnings previews and potential ROCK stock forecasts, subscribe to reputable financial news sources, follow the company's investor relations page, and consult with a financial advisor before making any investment decisions concerning Gibraltar Industries (ROCK) stock. Remember, this article is for informational purposes only and is not financial advice.

Featured Posts

-

Byd Ev Di Mas 2025 Rm 800 Kredit Cas And Konsert Rentak Elektrik 9 15 Mei

May 13, 2025

Byd Ev Di Mas 2025 Rm 800 Kredit Cas And Konsert Rentak Elektrik 9 15 Mei

May 13, 2025 -

Landman Ali Larter On Angelas She The Reverse Engineer Arc In Season 2

May 13, 2025

Landman Ali Larter On Angelas She The Reverse Engineer Arc In Season 2

May 13, 2025 -

Families Of Gaza Hostages Endure Lingering Nightmare

May 13, 2025

Families Of Gaza Hostages Endure Lingering Nightmare

May 13, 2025 -

Tory Lanez Prison Attack Singer Reportedly Stabbed Rushed To Hospital

May 13, 2025

Tory Lanez Prison Attack Singer Reportedly Stabbed Rushed To Hospital

May 13, 2025 -

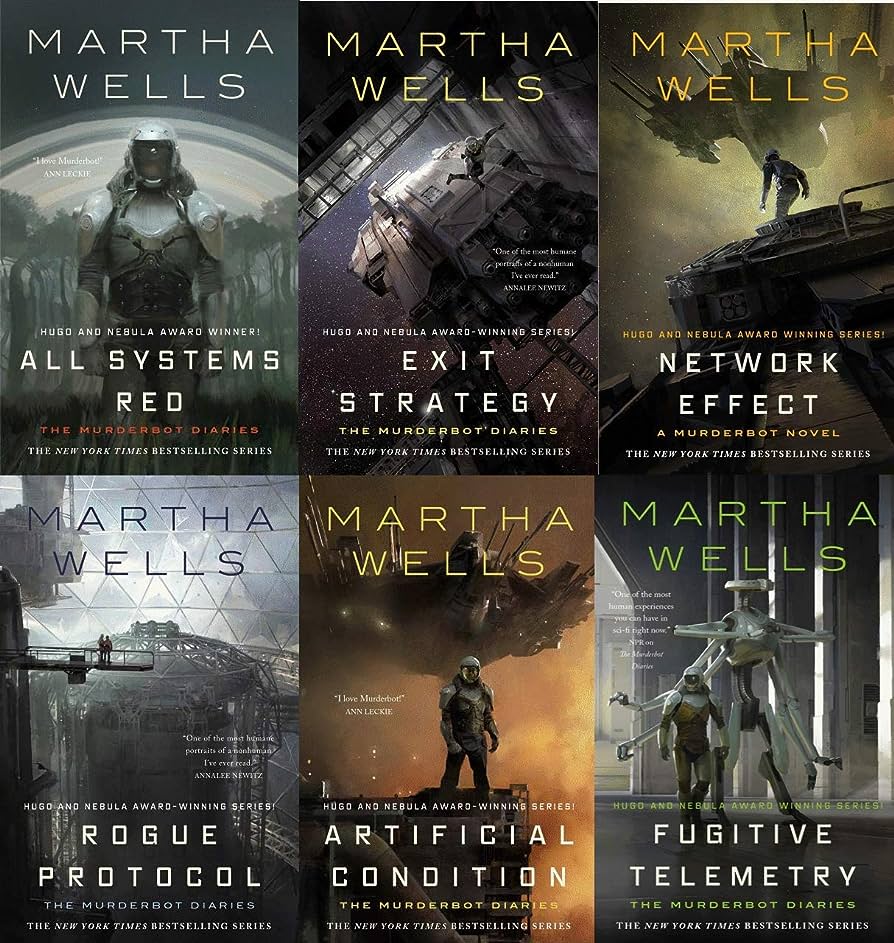

Exploring The Murderbot Diaries Goofy Sci Fi And Deep Thought

May 13, 2025

Exploring The Murderbot Diaries Goofy Sci Fi And Deep Thought

May 13, 2025