Gold At $3500: Impact On The Dow Futures And Stock Market Today

Table of Contents

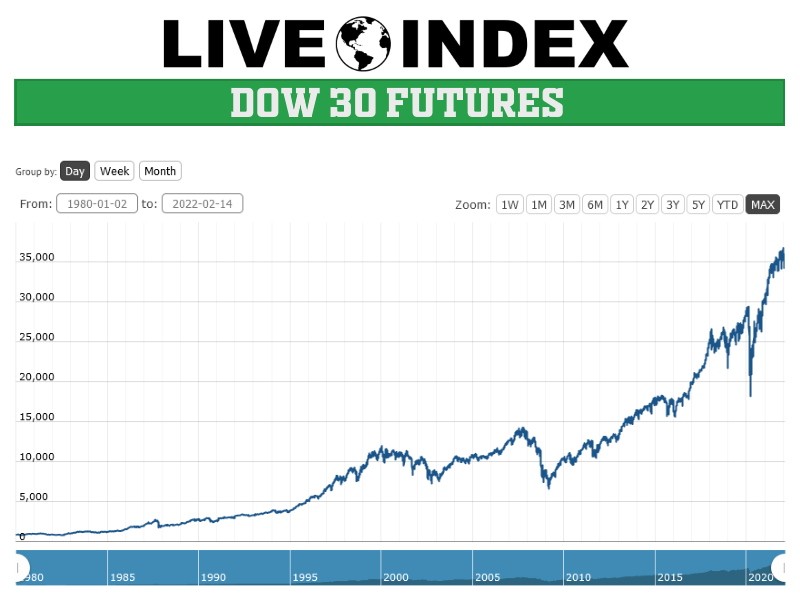

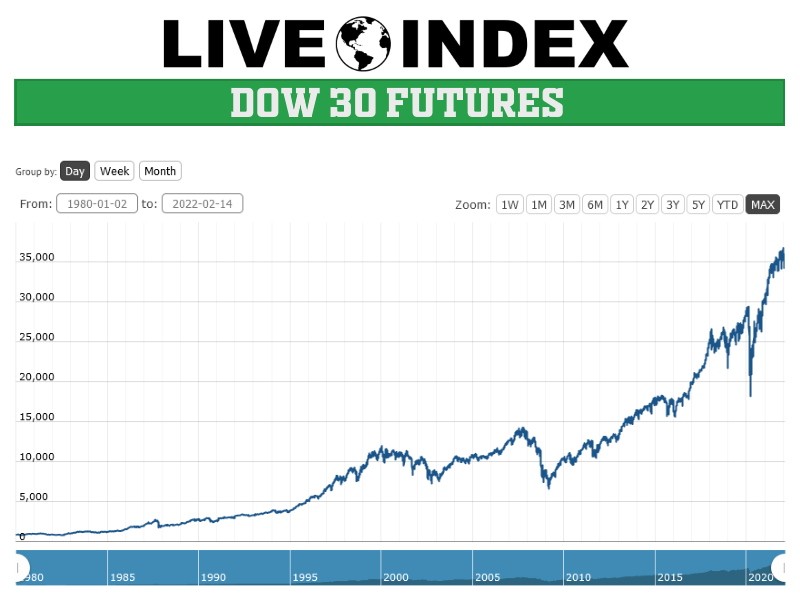

The Inverse Relationship Between Gold and the Dow Futures

Gold and the Dow Jones Industrial Average (DJIA) futures often exhibit an inverse relationship. This means that when gold prices rise, the Dow Futures tend to fall, and vice versa. This inverse correlation stems from gold's role as a safe-haven asset. During times of economic uncertainty, geopolitical instability, or high inflation, investors often flee riskier assets like stocks and seek refuge in the perceived stability of gold. They view gold as a hedge against inflation and a store of value, especially when confidence in the stock market wanes.

Historical examples abound. The 2008 financial crisis saw a dramatic surge in gold prices as investors sought safety amidst the market turmoil. Similarly, periods of heightened geopolitical tension, such as the outbreak of wars or major international conflicts, often lead to increased gold demand and a corresponding decline in stock market indices.

- Increased geopolitical instability often drives gold prices up, as investors seek a safe haven from uncertainty.

- High inflation erodes the value of the dollar, increasing demand for gold as a hedge against inflation.

- Economic downturns can lead investors to seek the safety of gold, reducing investment in riskier assets like stocks represented in Dow Futures.

Impact on Specific Sectors of the Stock Market

A surge in gold prices to $3500 would differentially impact various sectors of the stock market. Some sectors would benefit, while others would likely suffer. This scenario highlights the importance of portfolio diversification.

- Gold mining stocks: A dramatic rise in gold prices to $3500 would almost certainly lead to significant price increases and increased trading volume in gold mining stocks. Companies like Barrick Gold and Newmont Mining would likely see their stock values surge.

- Technology stocks: Technology stocks, often considered growth stocks, are typically more sensitive to changes in investor sentiment. A "risk-off" environment driven by a gold rush to $3500 could lead to decreased performance in this sector, as investors move their capital into safer assets.

- Financial stocks: Banks and other financial institutions could experience a mixed impact. Increased gold prices might reflect concerns about the broader economic climate, potentially impacting lending and profitability.

The Role of Inflation and Interest Rates

Inflation and interest rates play crucial roles in influencing both gold prices and the stock market. High inflation typically boosts gold's appeal, as it erodes the purchasing power of fiat currencies. Investors see gold as a hedge against inflation, protecting the value of their investments. Conversely, rising interest rates can make holding gold less attractive, as investors can earn higher returns on interest-bearing assets.

Central bank policies significantly impact both markets. Actions taken by the Federal Reserve (or other central banks) to control inflation or stimulate economic growth directly influence interest rates and can have knock-on effects on both gold and stock prices.

- High inflation: Boosts gold's appeal as a hedge against inflation, driving up demand and prices.

- Rising interest rates: Can make holding gold less attractive compared to interest-bearing assets.

- Central bank policies: Significantly influence both gold and stock markets, impacting investor sentiment and market conditions.

Analyzing Investor Sentiment and Market Volatility

If gold reached $3500, investor sentiment would likely shift dramatically. A "risk-off" sentiment would likely prevail, with investors moving their capital away from riskier assets like stocks and into the perceived safety of gold. This shift could lead to increased market volatility and uncertainty, as investors adjust their portfolios to mitigate potential risks.

- Risk-off sentiment: Investors would move money from stocks to safer assets, like gold, impacting Dow Futures significantly.

- Increased market volatility: Fluctuations in both gold and stock prices would likely increase significantly.

- Shifting investment strategies: Investors would adjust portfolios, perhaps increasing their gold holdings or moving into more defensive assets.

Conclusion: Navigating the Market with "Gold at $3500" in Mind

A hypothetical surge in gold prices to $3500 would have significant implications for Dow Futures and the overall stock market. The inverse relationship between gold and stocks, the differential impact on various sectors, and the role of inflation and interest rates all contribute to a complex and dynamic scenario. Understanding the relationship between gold and the stock market is crucial for making informed investment decisions.

To navigate this potentially volatile market, stay informed about gold price movements and their potential impact on your investments. Follow market news, conduct thorough research, and consider seeking professional financial advice regarding "gold at $3500" and its effect on your portfolio. Explore diversification strategies and hedging techniques to mitigate risks associated with gold price fluctuations and their impact on broader financial markets. Understanding the potential implications of "gold at $3500" is key to making sound investment choices in today's dynamic market.

Featured Posts

-

Diamondbacks Victory Josh Naylor Delivers Game Winning Rbi

Apr 23, 2025

Diamondbacks Victory Josh Naylor Delivers Game Winning Rbi

Apr 23, 2025 -

Sans Alcool Dry January Et Tournee Minerale Une Tendance Positive Pour Le Bien Etre

Apr 23, 2025

Sans Alcool Dry January Et Tournee Minerale Une Tendance Positive Pour Le Bien Etre

Apr 23, 2025 -

Identifying The Countrys Fastest Growing Business Areas

Apr 23, 2025

Identifying The Countrys Fastest Growing Business Areas

Apr 23, 2025 -

Ser Aldhhb Alywm Balsaght Bed Alankhfad Alakhyr

Apr 23, 2025

Ser Aldhhb Alywm Balsaght Bed Alankhfad Alakhyr

Apr 23, 2025 -

Brewers Postseason Hopes Addressing Two Critical Early Season Issues

Apr 23, 2025

Brewers Postseason Hopes Addressing Two Critical Early Season Issues

Apr 23, 2025