Gold Market Update: Two Weeks Of Losses For 2025

Table of Contents

Analyzing the Recent Decline in Gold Prices

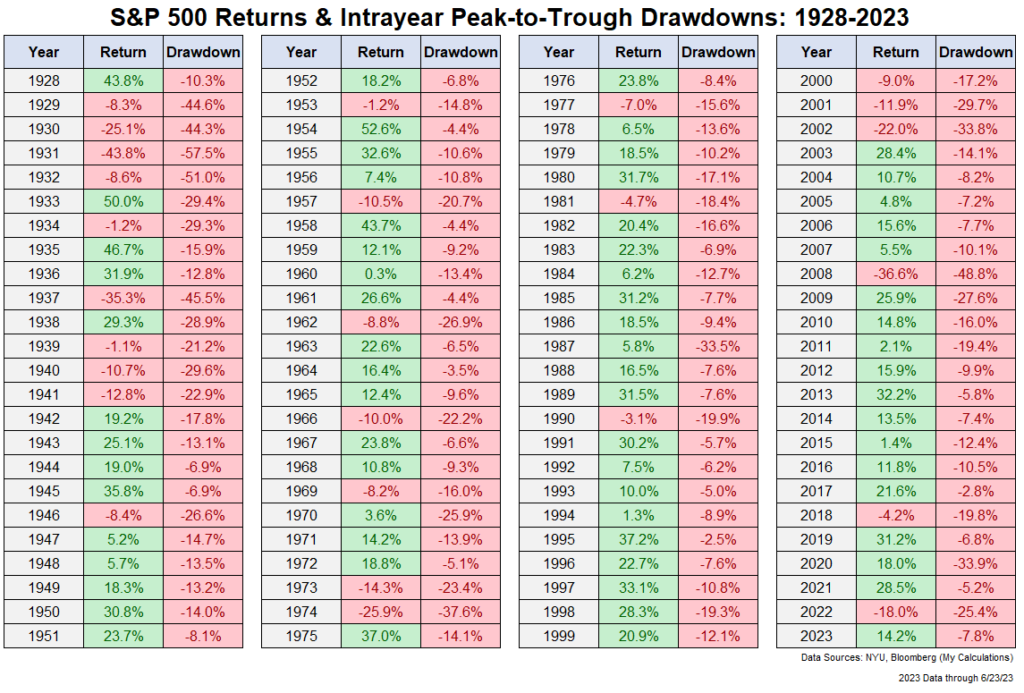

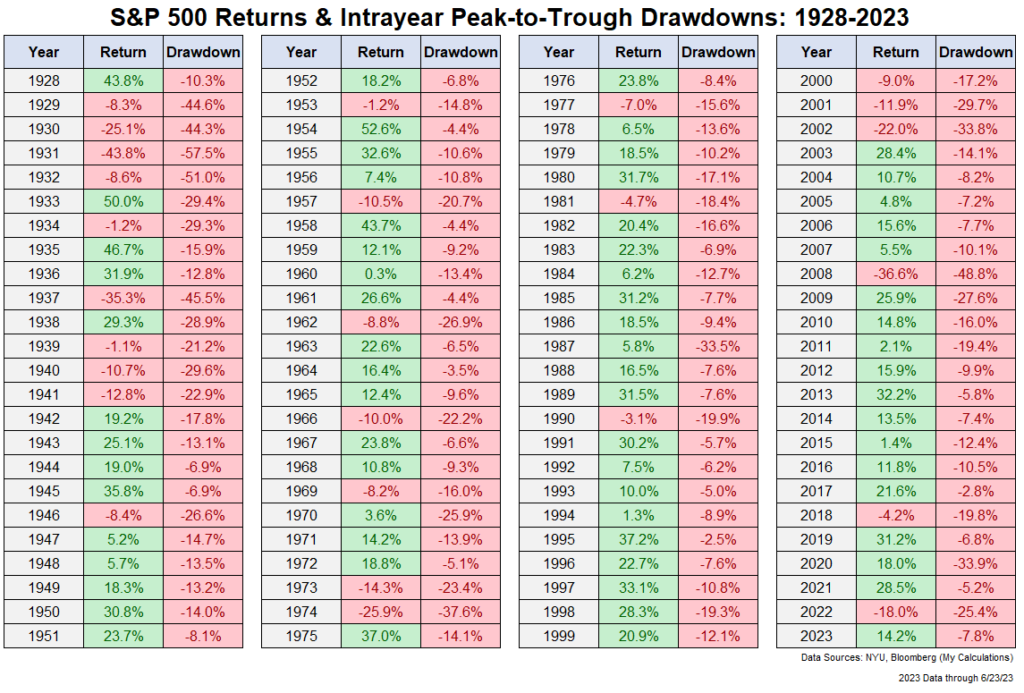

The gold price drop over the past two weeks has been significant, with a reported [Insert Percentage]% decrease. Key dates marking significant price changes include [Insert Dates]. This volatility raises concerns and prompts a closer examination of contributing factors. Several key elements likely played a role:

-

Strengthening US Dollar: A stronger US dollar typically exerts downward pressure on gold prices, as it makes gold more expensive for holders of other currencies. The recent strengthening of the dollar against major global currencies has undoubtedly contributed to the gold price decline. [Link to reputable source showing USD strength].

-

Rising Interest Rates: Increased interest rates, a tool often used by central banks to combat inflation, make non-interest-bearing assets like gold less attractive. Investors may shift their funds to higher-yielding investments, reducing demand for gold. [Link to a source discussing interest rate hikes].

-

Geopolitical Stability (or Lack Thereof): While geopolitical uncertainty often drives investors towards safe-haven assets like gold, recent developments [mention specific events if applicable] have surprisingly led to a sense of relative stability, reducing the demand for gold as a safe haven. This contrasts with previous years where geopolitical turmoil fueled gold price increases.

-

Changes in Investor Sentiment: Investor sentiment plays a critical role in gold price movements. Negative sentiment, potentially driven by economic forecasts or market predictions, can lead to selling pressure and price declines. [Link to a source discussing current investor sentiment toward gold].

-

Shifting Market Expectations: The market's expectations for future inflation and economic growth also influence gold prices. If inflation is expected to ease, or if economic growth is anticipated to be robust, the demand for gold as an inflation hedge may decrease.

Impact on Different Gold Investment Vehicles

The recent gold price drop has impacted various gold investment vehicles differently. Let's analyze the effects:

-

Gold ETFs (e.g., GLD): Gold ETFs, which track the price of gold, have experienced a corresponding decline mirroring the overall gold price drop. [Insert data on GLD or similar ETF performance]. Investors holding these ETFs have seen a reduction in their portfolio value.

-

Physical Gold (Bars and Coins): The price of physical gold (bars and coins) has also decreased, reflecting the overall market trend. However, the demand for physical gold might remain relatively stable due to its tangible nature and appeal as a store of value.

-

Gold Mining Stocks: Gold mining stocks generally exhibit a higher degree of volatility compared to the gold price itself. Their performance during this period has likely been even more affected, potentially experiencing a sharper decline than the gold price itself. [Include data on the performance of major gold mining stocks].

Comparing these investment options highlights that while all are susceptible to price fluctuations, their volatility and response to market changes can differ significantly.

Potential Future Scenarios for the Gold Market in 2025

Predicting future gold prices is inherently challenging; however, analyzing current market conditions allows us to explore potential scenarios:

-

Scenario 1: Price Rebound: A potential rebound in gold prices could occur if geopolitical tensions escalate, inflation remains stubbornly high, or investor sentiment shifts back towards gold as a safe-haven asset. This scenario is more likely if [list conditions].

-

Scenario 2: Continued Decline: Further price declines are possible if the US dollar continues its upward trend, interest rates remain high, and economic growth surpasses expectations, reducing the need for gold as an inflation hedge. This scenario is more likely if [list conditions].

-

Scenario 3: Consolidation: The gold market might consolidate around a specific price range for a period before showing a clear directional move. This scenario is likely if [list conditions].

Risk Management Strategies for Gold Investors

Navigating the gold market requires a strategic approach to risk management:

-

Diversification: Diversification is crucial to mitigate risk. Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes, including stocks, bonds, and real estate, in addition to gold.

-

Gold as an Inflation Hedge: Remember that gold's primary role is often as a hedge against inflation and economic uncertainty. While its price can fluctuate, it typically holds its value better than fiat currencies during inflationary periods.

-

Dollar-Cost Averaging: Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of the gold price. This mitigates the risk of investing a lump sum at a market peak.

Conclusion:

This gold market update has explored the recent two-week decline in gold prices, analyzing the contributing factors and their impact on various gold investment vehicles. The short-term outlook remains uncertain. However, understanding the potential future scenarios and implementing appropriate risk management strategies, such as diversification and dollar-cost averaging, is essential for navigating the gold market in 2025. Stay informed about the ever-evolving gold market and adjust your gold investment strategy accordingly. Continue to monitor the gold price and our future gold market updates for the latest insights and analysis. Learn more about effectively managing your gold investments to protect your portfolio.

Featured Posts

-

Nhl Playoffs Showdown Saturday A Look At The Standings

May 05, 2025

Nhl Playoffs Showdown Saturday A Look At The Standings

May 05, 2025 -

Eight Hour Treetop Hideout Migrant Avoids Ice Arrest

May 05, 2025

Eight Hour Treetop Hideout Migrant Avoids Ice Arrest

May 05, 2025 -

Fitness Trainer Shaun T Responds To Lizzos Ozempic Controversy

May 05, 2025

Fitness Trainer Shaun T Responds To Lizzos Ozempic Controversy

May 05, 2025 -

Kentucky Derby 151 Key Information Before The Big Race

May 05, 2025

Kentucky Derby 151 Key Information Before The Big Race

May 05, 2025 -

Cocaines Global Rise The Role Of Potent Powder And Narco Submarines

May 05, 2025

Cocaines Global Rise The Role Of Potent Powder And Narco Submarines

May 05, 2025

Latest Posts

-

Rumours 48 Years After Fleetwood Macs Turbulent Creation Of A Timeless Classic

May 05, 2025

Rumours 48 Years After Fleetwood Macs Turbulent Creation Of A Timeless Classic

May 05, 2025 -

Fleetwood Mac Rumours Of A World First Supergroup

May 05, 2025

Fleetwood Mac Rumours Of A World First Supergroup

May 05, 2025 -

Novo Izdanje Gibonnija Promocija Na Sarajevo Book Fair U

May 05, 2025

Novo Izdanje Gibonnija Promocija Na Sarajevo Book Fair U

May 05, 2025 -

48 Years Of Rumours Fleetwood Macs Implosion And The Creation Of An Iconic Album

May 05, 2025

48 Years Of Rumours Fleetwood Macs Implosion And The Creation Of An Iconic Album

May 05, 2025 -

Gibonni Pojavljivanje Na Sarajevo Book Fair U

May 05, 2025

Gibonni Pojavljivanje Na Sarajevo Book Fair U

May 05, 2025