Gold Market Volatility: Examining The Recent Two-Week Decline In 2025

Table of Contents

Macroeconomic Factors Influencing Gold Price Decline

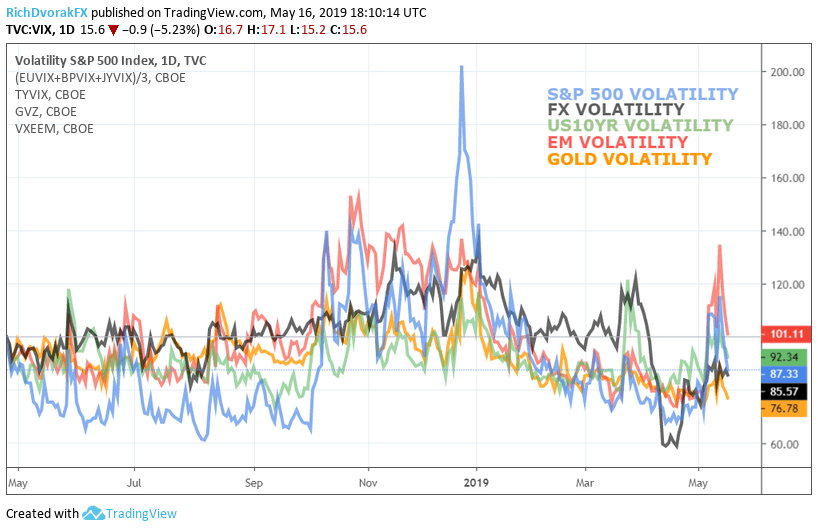

Several macroeconomic factors played a significant role in the recent gold price decline. Analyzing these interconnected elements is crucial to understanding the broader market trends.

Rising Interest Rates and the Dollar's Strength

Gold prices often share an inverse relationship with interest rates. As interest rates rise, the opportunity cost of holding non-yielding assets like gold increases. Investors may shift their funds towards interest-bearing instruments, leading to reduced demand for gold and consequently, a price decline. Furthermore, a stronger US dollar typically exerts downward pressure on gold prices. This is because gold is priced in US dollars, so a stronger dollar makes gold more expensive for holders of other currencies, dampening international demand.

- Increased treasury yields: Higher yields on US Treasury bonds make them a more attractive investment compared to gold, diverting capital away from the precious metal. (Hypothetical data for 2025: Assume 10-year Treasury yields rose from 3.5% to 4.2% in the two weeks preceding the gold price decline).

- Dollar index strength: A rising US Dollar Index (DXY) indicates a strengthening dollar against other major currencies. This makes gold more expensive for international buyers, reducing demand and putting downward pressure on the price. (Hypothetical data for 2025: Assume the DXY increased by 2.5% during the period of the gold price decline).

- Impact on investor sentiment towards gold: The combined effect of rising interest rates and a strong dollar negatively impacts investor sentiment, reducing the appeal of gold as a safe-haven asset and contributing to selling pressure.

Inflationary Pressures and Central Bank Policy

Inflation's impact on gold prices is complex. While historically, gold has served as a hedge against inflation, the effect of inflationary pressures on gold demand is influenced heavily by central bank policies. If a central bank successfully controls inflation through monetary tightening, the demand for gold as an inflation hedge may diminish, leading to lower prices. Conversely, unexpectedly high inflation could increase gold's appeal.

- Discussion on the effectiveness of monetary policy: The effectiveness of a central bank's measures to combat inflation directly affects investor confidence and market stability, influencing the gold price. Aggressive rate hikes, for example, might initially suppress gold prices but could later stimulate demand if inflation remains stubbornly high.

- Its influence on investor confidence: Successful inflation control boosts investor confidence, potentially leading to a shift away from perceived safe-haven assets like gold toward riskier investments with higher returns. Conversely, failure to control inflation erodes confidence, driving investors back to gold.

- Correlation with gold price changes: The correlation between inflation rates and gold prices is not always linear and depends significantly on market expectations and central bank actions. (Hypothetical data for 2025: Assume a slight slowdown in inflation, from 3.8% to 3.2%, coupled with central bank announcements of further rate hikes).

Geopolitical Uncertainty and its Impact on Safe-Haven Demand

Geopolitical instability often fuels demand for gold as a safe-haven asset. Investors seek refuge in gold during times of uncertainty, driving up prices. However, if geopolitical tensions ease, or if the perceived threat diminishes, gold's safe-haven appeal may wane, leading to price declines.

- Specific geopolitical events of 2025 (if applicable): (Example: Hypothetical escalation of trade tensions between major economies, or a sudden political upheaval in a key gold-producing region). These events could create uncertainty in the market, leading to increased gold demand, before subsequently easing and reversing this effect.

- Their impact on market sentiment: Geopolitical events significantly affect investor sentiment and risk appetite. Uncertainty typically drives investors towards safe-haven assets like gold, while a reduction in uncertainty can lead to selling.

- Subsequent effect on gold prices: The impact of geopolitical events on gold prices can be both immediate and long-lasting, depending on the severity and duration of the event.

Supply and Demand Dynamics in the Gold Market

Fluctuations in the gold market are also heavily influenced by the interplay of supply and demand factors.

Changes in Gold Mine Production

Global gold mine production plays a significant role in influencing supply. Any major shifts in production, whether due to operational challenges, geopolitical disruptions, or technological advancements, can affect gold prices.

- Data on gold production from major mining regions: (Hypothetical data for 2025: Assume a slight decrease in gold production from a major mining region due to operational issues, leading to a temporary supply squeeze).

- Potential disruptions (if any): Unexpected disruptions, such as natural disasters or labor disputes in major gold-producing areas, can significantly impact global supply and push prices upwards.

- Their effect on market supply: Changes in gold mine production directly impact the available supply of gold in the market, influencing price levels.

Investment Demand and ETF Flows

Investment demand, particularly through Gold ETFs (Exchange Traded Funds), is a powerful driver of gold prices. Significant inflows into gold ETFs indicate growing investor confidence and increased demand, while outflows suggest the opposite.

- Data on ETF inflows/outflows: (Hypothetical data for 2025: Assume a net outflow from gold ETFs during the two-week period, reflecting a shift in investor sentiment).

- Changes in investor allocations to gold: Investors often reallocate their portfolios in response to market conditions. A shift towards riskier assets could lead to reduced gold holdings and lower prices.

- Their connection to price fluctuations: ETF flows often act as a leading indicator of price movements, reflecting changes in investor sentiment and market expectations.

Jewelry and Industrial Demand

Jewelry and industrial applications of gold also influence overall gold consumption and prices. Changes in consumer spending habits and technological advancements can affect demand from these sectors.

- Trends in jewelry consumption globally: Factors like economic growth in key consumer markets and cultural trends influence gold consumption in the jewelry sector.

- Industrial applications of gold: Gold's unique properties make it essential in various industries, including electronics and medicine. Changes in these sectors can affect industrial gold demand.

- Their impact on overall demand: Combined, jewelry and industrial demand constitute a substantial portion of total gold consumption, influencing market dynamics and price levels.

Technical Analysis of Recent Gold Price Movements

Technical analysis provides valuable insights into short-term gold price trends. By examining chart patterns and utilizing technical indicators, we can gain a better understanding of potential future movements.

Chart Patterns and Support/Resistance Levels

Analyzing charts helps identify key support and resistance levels which represent price points where buying or selling pressure is expected to be strong. Chart patterns, such as head and shoulders or double tops/bottoms, can indicate potential price reversals or continuations.

- Explanation of chart patterns (head and shoulders, etc.): (Include illustrative charts showing hypothetical patterns and explanations of their implications for price movements).

- Key price levels: Identify and explain the significance of key support and resistance levels based on recent price action.

- Potential future price movements based on technical analysis: Based on chart patterns and key price levels, speculate on potential future price movements. (Note: Technical analysis is not foolproof and should be used in conjunction with fundamental analysis).

Technical Indicators and Trading Signals

Technical indicators, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and others, provide signals that can help predict potential price changes.

- Explanation of the indicators' significance: Explain how each indicator works and what it signifies regarding market momentum and potential price reversals.

- Their current readings: Provide hypothetical readings of these indicators for the period in question and interpret what they indicate about market sentiment and potential future movements.

- Potential implications for future gold prices: Based on the indicator readings, discuss the potential implications for future gold prices, acknowledging the limitations and uncertainties inherent in technical analysis.

Conclusion

The recent two-week decline in gold prices in 2025 reflects a complex interplay of macroeconomic factors, shifting supply and demand dynamics, and technical signals. Rising interest rates, a stronger dollar, and potentially slower inflation contributed to reduced investor demand. Simultaneously, changes in gold mine production and ETF flows further impacted the market equilibrium. Technical analysis revealed significant chart patterns and indicator readings pointing towards the price decline. Understanding these interconnected elements is crucial for navigating the volatility in the gold market. While the short-term outlook may remain uncertain, a thorough analysis of gold market volatility, encompassing these diverse factors, helps investors make informed decisions regarding their gold investments. Continue to monitor the gold market for further developments and utilize this information to refine your gold market volatility strategy. Stay informed about gold price fluctuations and gold investment opportunities for optimal returns.

Featured Posts

-

Schwarzenegger Joins Guadagninos Film Details On The New Role

May 06, 2025

Schwarzenegger Joins Guadagninos Film Details On The New Role

May 06, 2025 -

Hos Kokmuyor Mu Itibari Zedelemez

May 06, 2025

Hos Kokmuyor Mu Itibari Zedelemez

May 06, 2025 -

Mindy Kalings Dramatic Weight Change At Series Premiere

May 06, 2025

Mindy Kalings Dramatic Weight Change At Series Premiere

May 06, 2025 -

Crypto Entrepreneurs Father Freed Following Kidnapping Injury

May 06, 2025

Crypto Entrepreneurs Father Freed Following Kidnapping Injury

May 06, 2025 -

Spak Banesa E Motrave Nikolli Nen Hetim

May 06, 2025

Spak Banesa E Motrave Nikolli Nen Hetim

May 06, 2025

Latest Posts

-

Ddg And Halle Bailey The Dont Take My Son Diss Track Explained

May 06, 2025

Ddg And Halle Bailey The Dont Take My Son Diss Track Explained

May 06, 2025 -

The Dont Take My Son Diss Track Ddg Vs Halle Bailey

May 06, 2025

The Dont Take My Son Diss Track Ddg Vs Halle Bailey

May 06, 2025 -

Dont Take My Son Ddgs Diss Track Controversy Involving Halle Bailey

May 06, 2025

Dont Take My Son Ddgs Diss Track Controversy Involving Halle Bailey

May 06, 2025 -

Reaction To Ddgs Dont Take My Son A Diss Track Targeting Halle Bailey

May 06, 2025

Reaction To Ddgs Dont Take My Son A Diss Track Targeting Halle Bailey

May 06, 2025 -

New Ddg Song Dont Take My Son Takes Aim At Halle Bailey

May 06, 2025

New Ddg Song Dont Take My Son Takes Aim At Halle Bailey

May 06, 2025