Gold Price Correction: Optimism Over US-China Trade Impacts Market

Table of Contents

Factors Contributing to the Gold Price Correction

Several key factors are contributing to the current gold price correction. Understanding these elements is crucial for investors seeking to navigate the market effectively.

Reduced Safe-Haven Demand

Positive developments in US-China trade negotiations have eased geopolitical anxieties, reducing the demand for gold as a safe-haven asset. Investors, feeling more confident about global economic stability, are shifting their focus towards riskier, potentially higher-return investments.

- Decreased geopolitical uncertainty: The easing of trade tensions reduces the perceived risk in global markets.

- Improved market sentiment: Positive trade news boosts overall investor confidence, leading to a decreased need for defensive assets like gold.

- Increased risk appetite: Investors are more willing to take on risk, shifting capital away from gold and into other asset classes.

For example, compare the gold price on January 1st, 2024 (hypothetical: $1800/oz) to the price after a major positive trade announcement on February 15th, 2024 (hypothetical: $1750/oz). This $50 decrease highlights the impact of positive trade news on gold prices.

Strengthening US Dollar

The US dollar and gold prices share an inverse relationship. A stronger dollar makes gold more expensive for investors holding other currencies, thus reducing demand. Recent strengthening of the US dollar index has contributed to the downward pressure on gold prices.

- Recent US dollar index movements: Chart showing USD index strengthening over the past few months.

- Potential for further dollar strength: Analysis of factors that could further strengthen the dollar (e.g., Federal Reserve policy).

- Impact on international gold trading: Explanation of how a stronger dollar affects gold trading in international markets.

[Insert chart/graph illustrating the correlation between USD and gold prices]

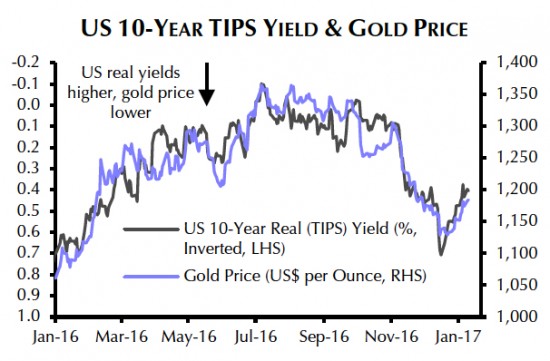

Rising Interest Rates (Potential Factor)

Rising interest rates can also influence gold prices. Higher rates increase the opportunity cost of holding non-yielding assets like gold, making alternative investments like bonds more attractive.

- Federal Reserve policy: Discussion of the Federal Reserve's current monetary policy and potential future rate hikes.

- Potential future rate hikes: Analysis of the likelihood of further interest rate increases and their potential impact on gold.

- Comparison with bond yields: Comparing the returns of gold with those of government bonds or other fixed-income instruments.

- Alternative Investment Options: Highlighting attractive alternatives like high-yield bonds or dividend-paying stocks.

Analyzing the Impact of US-China Trade Developments on Gold

The ongoing US-China trade negotiations play a pivotal role in shaping the gold market.

The Role of Trade Deal Optimism

Positive news regarding the US-China trade talks fuels investor confidence and subsequently impacts gold prices negatively. Conversely, negative news or setbacks in negotiations can trigger a surge in demand for gold.

- Specific examples of trade agreements or announcements: Highlighting specific instances of positive or negative trade news and their immediate impact on gold prices.

- Market reaction to these events: Analyzing the market's response to key trade developments.

- Analysis of investor sentiment indices: Using relevant indices (e.g., VIX) to measure investor sentiment and its correlation with gold price movements.

- Expert Quotes: Including quotes from reputable economists or market analysts to support the analysis.

Potential for Future Volatility

The gold market's future trajectory remains subject to further trade developments and global economic conditions. Significant price fluctuations are still possible.

- Scenarios of positive and negative trade outcomes: Outlining potential scenarios, including a comprehensive trade deal or a renewed escalation of trade tensions.

- Their potential impact on gold prices: Analyzing the potential price implications of each scenario.

- Factors that might reverse the correction: Discussion of factors that could lead to a resurgence in gold prices (e.g., increased geopolitical uncertainty).

- Risk Management Strategies: Providing strategies for investors to mitigate risks, such as diversification and hedging.

Implications for Gold Investors

The current gold price correction necessitates a reassessment of investment strategies.

Re-evaluating Investment Strategies

Investors need to adjust their portfolios based on their individual risk tolerance and investment horizon.

- Strategies for short-term vs. long-term investors: Offering tailored advice for different investor profiles.

- Diversification strategies: Emphasizing the importance of diversifying investments across various asset classes.

- Hedging against inflation: Discussing gold's traditional role as a hedge against inflation.

- Consulting Financial Advisors: Encouraging readers to seek professional financial advice.

Opportunities and Risks

While a price correction presents opportunities to buy gold at potentially lower prices, it also carries inherent risks.

- Potential for buying low: Explaining how a correction can create opportunities for value investors.

- Risks associated with market timing: Cautioning against attempting to time the market perfectly.

- Importance of fundamental analysis: Highlighting the need to conduct thorough research before making investment decisions.

- Examples of historical gold price movements and corrections: Using past gold price data to illustrate the cyclical nature of the market.

Conclusion: Navigating the Gold Price Correction

The current gold price correction is largely driven by optimism surrounding US-China trade relations, leading to reduced safe-haven demand and a stronger US dollar. While this presents a potential buying opportunity for some, it's crucial to remember the inherent volatility of the gold market. The potential for future price fluctuations remains significant, contingent upon further trade developments and global economic conditions. Monitor gold price movements closely, develop a robust gold investment plan tailored to your risk tolerance and investment horizon, and stay informed about geopolitical developments impacting gold prices. Don't hesitate to seek professional financial advice to navigate this complex market effectively.

Featured Posts

-

American Manhunt Examining The Fall Of Al Qaedas Leader

May 18, 2025

American Manhunt Examining The Fall Of Al Qaedas Leader

May 18, 2025 -

Home Renovation Stress A House Therapist Can Help You Reclaim Your Peace

May 18, 2025

Home Renovation Stress A House Therapist Can Help You Reclaim Your Peace

May 18, 2025 -

Selena Gomez Vs Taylor Swift A Wake Up Call Over The Blake Lively Situation

May 18, 2025

Selena Gomez Vs Taylor Swift A Wake Up Call Over The Blake Lively Situation

May 18, 2025 -

Mohawk Council Faces 220 Million Lawsuit From Kahnawake Casino Owners

May 18, 2025

Mohawk Council Faces 220 Million Lawsuit From Kahnawake Casino Owners

May 18, 2025 -

Kanye Wests Super Bowl Absence The Taylor Swift Connection

May 18, 2025

Kanye Wests Super Bowl Absence The Taylor Swift Connection

May 18, 2025

Latest Posts

-

Nfl Analysts Bold Prediction Patriots Post 2025 Draft Identity

May 18, 2025

Nfl Analysts Bold Prediction Patriots Post 2025 Draft Identity

May 18, 2025 -

Great Wolf Lodge Suffolk Boy Hailed A Hero For Saving Drowning Child

May 18, 2025

Great Wolf Lodge Suffolk Boy Hailed A Hero For Saving Drowning Child

May 18, 2025 -

Suffolk Teen Praised For Bravery After Drowning Rescue At Great Wolf Lodge

May 18, 2025

Suffolk Teen Praised For Bravery After Drowning Rescue At Great Wolf Lodge

May 18, 2025 -

Swim With Mike A Support Network For Trojan Swimmers

May 18, 2025

Swim With Mike A Support Network For Trojan Swimmers

May 18, 2025 -

Suffolk Boys Heroic Rescue At Great Wolf Lodge Saving A Drowning Child

May 18, 2025

Suffolk Boys Heroic Rescue At Great Wolf Lodge Saving A Drowning Child

May 18, 2025