Gold Price Dips: Consecutive Weekly Losses In 2025?

Table of Contents

Macroeconomic Factors Influencing Gold Price Dips

Several macroeconomic forces could significantly influence gold prices and potentially lead to sustained declines.

Rising Interest Rates and Their Impact

A key factor impacting gold's price is the inverse relationship with interest rates. Higher interest rates make assets like bonds more attractive, diverting investment away from non-yielding gold.

- Federal Reserve Policies: The Federal Reserve's monetary policy decisions heavily influence US interest rates, impacting global rates and gold demand. Aggressive rate hikes reduce gold's appeal.

- Inflation Expectations: While gold is often seen as an inflation hedge, high inflation can also lead to higher interest rates, negating this effect. If inflation cools and interest rates rise, gold prices may suffer.

- Global Interest Rate Trends: Global central bank actions, such as rate hikes in other major economies, can further suppress gold prices by creating more competitive investment opportunities. For example, a coordinated global rate increase could significantly impact gold.

Predictions from reputable sources suggest that continued interest rate increases could put downward pressure on gold prices in the coming year.

Strengthening US Dollar and Gold Price Correlation

Gold is primarily priced in US dollars. A strong US dollar makes gold more expensive for holders of other currencies, reducing demand and putting downward pressure on the price.

- Economic Performance: Robust US economic growth often strengthens the dollar, negatively impacting gold. Strong economic data can lead to a stronger dollar and lower gold prices.

- Geopolitical Events: Global political instability can sometimes drive investors towards the perceived safety of the US dollar, strengthening the currency and weakening gold. However, significant geopolitical uncertainty can also drive demand for gold as a safe haven, creating a mixed effect.

The correlation between the US dollar index and gold prices is well-documented, often showing an inverse relationship illustrated in many market analyses.

Geopolitical Stability and Gold's Safe-Haven Status

Gold traditionally acts as a safe-haven asset during times of geopolitical uncertainty. However, periods of relative calm can reduce this demand.

- Reduced Global Tensions: Decreased international conflict and improved global relations can diminish the appeal of gold as a safe haven, leading to price declines. A period of global stability might lead investors to seek higher-yield investments.

- Changing Perception of Gold: The perception of gold as a safe haven might shift over time depending on market conditions and the availability of other safe-haven alternatives. This factor adds another layer of complexity to predicting gold prices.

While gold retains some safe-haven appeal, increased geopolitical stability could dampen this effect, contributing to gold price dips.

Supply and Demand Dynamics in the Gold Market

Beyond macroeconomic forces, supply and demand dynamics within the gold market also influence price movements.

Increased Gold Mining Production

Higher gold production can increase supply, potentially leading to lower prices, all other things being equal.

- Major Gold-Producing Countries: Countries like China, Australia, and Russia are major gold producers. Increases in their output could impact overall supply.

- Technological Advancements: Technological advancements in mining techniques can increase gold production efficiency, potentially leading to greater supply. Statistics show a steady increase in global gold mine production in recent years.

Investor Sentiment and Gold ETF Flows

Investor sentiment plays a crucial role. Positive sentiment drives investment, increasing demand, while negative sentiment can cause sell-offs.

- Gold ETF Holdings: Changes in the holdings of gold exchange-traded funds (ETFs) are a significant indicator of investor sentiment and demand. Large outflows signal negative sentiment.

- Market Confidence: Investor confidence in gold as a long-term investment influences demand. Uncertainty in other markets can lead to gold investment, but confidence in those markets could reverse that trend.

Monitoring gold ETF flows provides valuable insight into the prevailing market sentiment.

Central Bank Gold Holdings

Central banks' buying and selling activities significantly influence gold prices.

- Central Bank Purchases: Significant purchases by central banks, particularly those in emerging economies, can increase demand and support prices.

- Central Bank Sales: Conversely, sales by central banks can increase supply, putting downward pressure on prices. Central bank policies can have a significant impact on the long-term gold price trend.

Central bank actions are a crucial factor to consider when analyzing gold price dynamics.

Technical Analysis and Gold Price Predictions

Technical analysis offers another perspective on potential gold price movements.

Chart Patterns and Price Support/Resistance Levels

Identifying chart patterns and support/resistance levels can help forecast potential price movements.

- Support Levels: These are price levels where buying pressure is expected to outweigh selling pressure, preventing further declines. Breaks below these levels can signal further weakness.

- Resistance Levels: These are price levels where selling pressure is expected to outweigh buying pressure, preventing further increases. Breakouts above these levels could indicate a price rally.

Technical indicators and chart patterns suggest potential for further price declines in 2025. (Include charts here).

Analyst Forecasts and Market Sentiment

Financial analysts offer various predictions about future gold prices, reflecting diverse perspectives on the macroeconomic outlook.

- Expert Opinions: Statements and opinions from leading gold market analysts provide insight into expected price movements. (Include quotes here).

- Market Sentiment: The overall market sentiment towards gold is a crucial determinant of its price. Bearish or bullish sentiment influences investment decisions.

Analyst forecasts often vary, reflecting the complexities of predicting commodity prices.

Conclusion

Several factors could contribute to consecutive weekly losses in gold prices in 2025. Rising interest rates, a strong US dollar, increased gold production, shifting investor sentiment, and potentially reduced geopolitical uncertainty all play a role. Careful analysis of macroeconomic indicators, supply and demand dynamics, and technical analysis is crucial for understanding potential gold price dips. Monitoring gold price dips and understanding the interplay of these factors is vital for making informed investment decisions. To stay updated on gold price movements and analyze gold price trends, continue your research into reputable financial news and analysis. Monitor gold price dips closely, and remember to conduct thorough research before making any investment choices.

Featured Posts

-

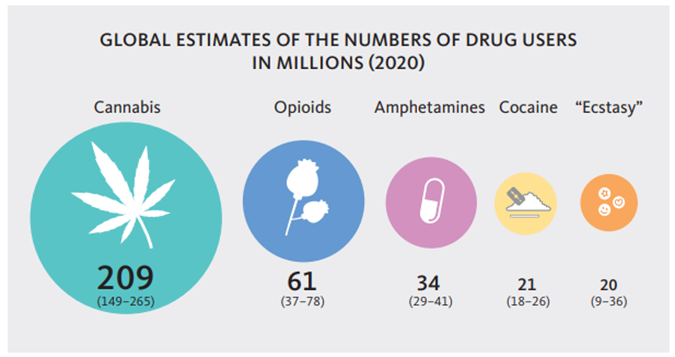

The Impact Of Powerful Cocaine And Narco Sub Networks On Global Drug Trafficking

May 04, 2025

The Impact Of Powerful Cocaine And Narco Sub Networks On Global Drug Trafficking

May 04, 2025 -

Stanley Cup Playoffs Us Ratings Dip Despite International Interest

May 04, 2025

Stanley Cup Playoffs Us Ratings Dip Despite International Interest

May 04, 2025 -

The Blake Lively And Anna Kendrick Feud Truth Or Fiction

May 04, 2025

The Blake Lively And Anna Kendrick Feud Truth Or Fiction

May 04, 2025 -

Carney To Meet Trump At White House Early Next Week

May 04, 2025

Carney To Meet Trump At White House Early Next Week

May 04, 2025 -

Nhl Standings Analyzing The Tight Western Wild Card Race

May 04, 2025

Nhl Standings Analyzing The Tight Western Wild Card Race

May 04, 2025

Latest Posts

-

Ufc 314 Pimbletts Pre Fight Concerns About Chandlers Fighting Style

May 04, 2025

Ufc 314 Pimbletts Pre Fight Concerns About Chandlers Fighting Style

May 04, 2025 -

Paddy Pimblett Calls Out Michael Chandlers Dirty Fighting Ahead Of Ufc 314

May 04, 2025

Paddy Pimblett Calls Out Michael Chandlers Dirty Fighting Ahead Of Ufc 314

May 04, 2025 -

Ufc 314 Ppv Changes And Implications Of Prates Vs Neal Bout Cancellation

May 04, 2025

Ufc 314 Ppv Changes And Implications Of Prates Vs Neal Bout Cancellation

May 04, 2025 -

Ufc 314 Major Ppv Card Alterations Following Prates Neal Cancellation

May 04, 2025

Ufc 314 Major Ppv Card Alterations Following Prates Neal Cancellation

May 04, 2025 -

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 04, 2025

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 04, 2025