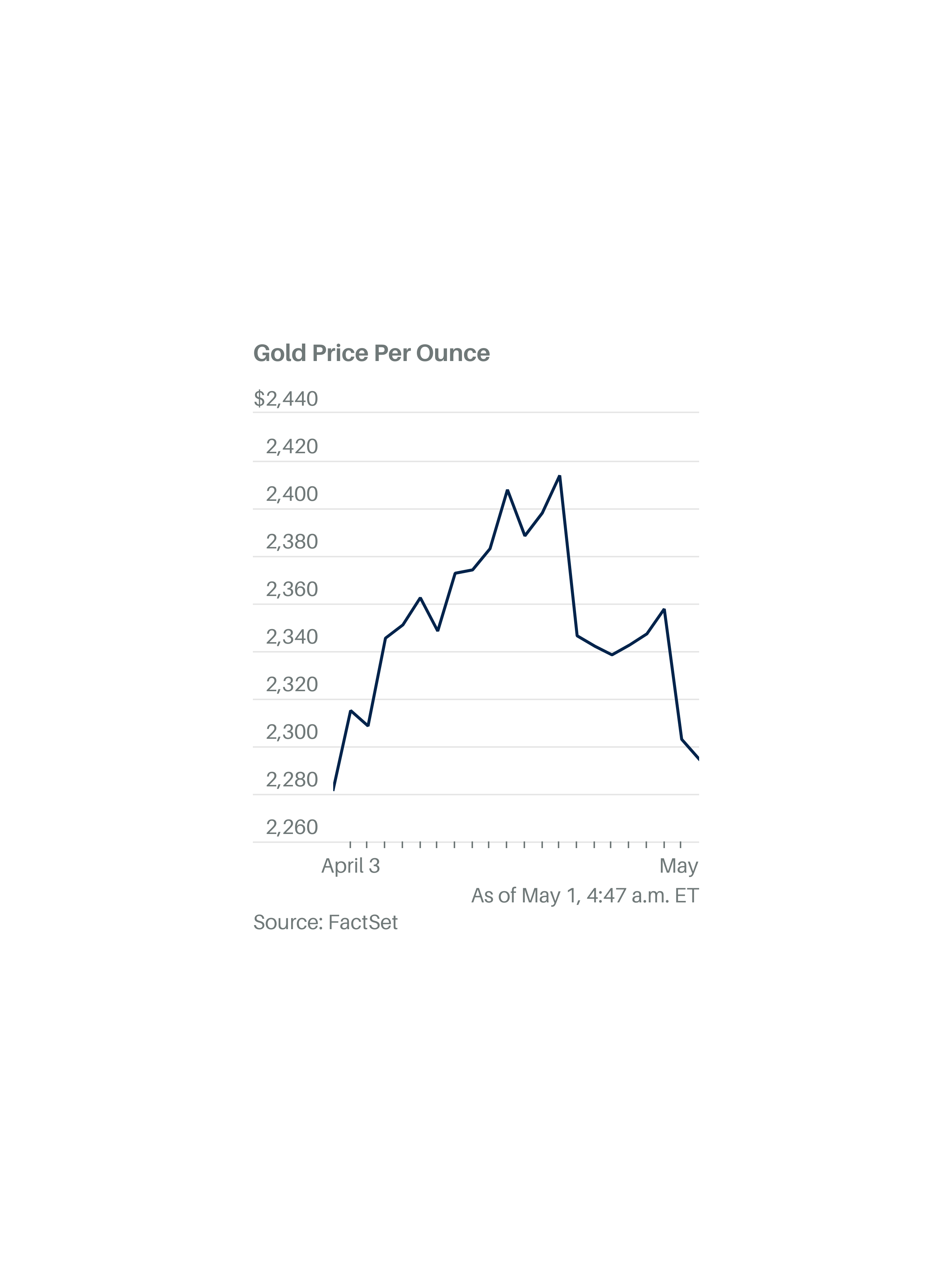

Gold Price Slumps: Consecutive Weekly Losses In 2025

Table of Contents

Factors Contributing to the Gold Price Slumps in 2025

Several interconnected factors contributed to the dramatic gold price slumps observed in 2025. Understanding these elements is crucial for navigating the complexities of this volatile market.

Strengthening US Dollar

The inverse relationship between the gold price and the US dollar is well-established. A strong dollar typically puts downward pressure on gold prices, as it becomes more expensive for holders of other currencies to purchase gold. In 2025, the US dollar experienced a period of significant strengthening. Hypothetical data suggests a 15% increase in the US Dollar Index (USDX) compared to the previous year, impacting the gold market significantly.

- Increased US interest rates: Aggressive interest rate hikes by the Federal Reserve increased the attractiveness of dollar-denominated assets.

- Safe-haven demand shifting towards the dollar: Investors, seeking refuge from global uncertainty, increasingly favored the dollar over gold as a safe-haven asset.

- Impact of economic policies on the dollar's strength: Favorable economic indicators and robust US economic policies further boosted the dollar's value, putting additional pressure on gold prices.

Rising Interest Rates and Bond Yields

Higher interest rates make bonds a more attractive investment compared to gold, which doesn't offer interest payments. This increased opportunity cost of holding gold influenced investor decisions, leading to decreased demand. In 2025, bond yields rose sharply, further exacerbating the gold price slump.

- Increased opportunity cost of holding gold: Investors could earn higher returns by investing in bonds rather than holding non-interest-bearing gold.

- Attractiveness of high-yield bonds compared to non-interest-bearing gold: The relatively higher returns offered by bonds drew investment away from the gold market.

- Impact of central bank policies on interest rates: Monetary policies implemented by central banks globally contributed to the rise in interest rates and bond yields.

Geopolitical Stability

Contrary to expectations, a period of relative geopolitical stability in 2025 also played a role in the gold price slump. Reduced uncertainty diminished the safe-haven demand for gold, a traditional haven during times of conflict or economic instability.

- Reduced safe-haven demand during periods of peace: With less global turmoil, investors viewed gold as a less necessary hedge against risk.

- Impact of specific geopolitical events (hypothetical examples): The resolution of certain international tensions and the absence of major conflicts reduced the appeal of gold as a safe haven.

- Investor sentiment shifts based on geopolitical factors: Positive geopolitical developments shifted investor sentiment, leading to reduced gold purchases.

Impact of Consecutive Weekly Losses on Investors

The consecutive weekly losses in gold prices significantly impacted investors and the broader market.

Portfolio Diversification Strategies

Investors holding gold as part of a diversified portfolio experienced losses, necessitating a reassessment of their investment strategies.

- Rebalancing portfolios to mitigate losses: Investors needed to adjust their portfolio allocations to compensate for the decline in gold's value.

- Exploring alternative investment options (e.g., real estate, stocks, bonds): Diversification into other asset classes became crucial to mitigate risk and maintain overall portfolio performance.

- Hedging strategies to protect against gold price volatility: Employing hedging strategies, such as options or futures contracts, became essential for managing risk in a volatile gold market.

Impact on Gold Mining Companies

The slump in gold prices directly impacted gold mining companies, affecting their profitability and stock valuations.

- Reduced profitability for mining companies: Lower gold prices reduced the revenue generated by gold mining operations.

- Potential stock price decline for gold mining companies: The reduced profitability translated into lower stock prices for publicly traded gold mining companies.

- Impact on investment in future gold exploration projects: Reduced profitability may lead to decreased investment in new exploration and mining projects.

Predicting Future Gold Price Trends (2025 and Beyond)

Predicting future gold prices is inherently challenging, but analyzing expert opinions and market forecasts offers some insight.

Analyst Predictions and Market Forecasts

While specific predictions vary, many analysts anticipate continued volatility in gold prices.

- Summary of various expert predictions: Analysts' predictions range from further declines to moderate recovery, reflecting diverse viewpoints and varying economic forecasts.

- Potential range of gold price fluctuations: The predicted range of gold price fluctuations emphasizes the market’s uncertainty and the need for careful investment decisions.

- Factors influencing future price movements: Future price movements will likely be influenced by US monetary policy, geopolitical developments, and global inflation levels.

Long-Term Outlook for Gold

Despite short-term volatility, the long-term outlook for gold remains relatively positive for many investors.

- Inflationary pressures and their impact on gold's value: Gold is often considered a hedge against inflation; significant inflationary pressures could support gold prices in the long run.

- Long-term demand drivers for gold (e.g., jewelry, technology): Sustained demand from jewelry and technology sectors continues to support gold's value.

- Potential for future price recovery: Many analysts believe that the current gold price slump presents a potential buying opportunity for long-term investors anticipating a future price recovery.

Conclusion: Navigating the 2025 Gold Price Slumps

The gold price slumps of 2025 were driven by a combination of factors, including a strengthening US dollar, rising interest rates, and unexpectedly stable geopolitical conditions. These slumps had a significant impact on investors' portfolios and the gold mining industry. While predicting the future is impossible, understanding the dynamics at play allows for more informed decision-making. Stay informed about future gold price slumps and consult with a financial advisor to optimize your gold investment strategy in 2025 and beyond.

Featured Posts

-

Marvels Quality Control Addressing Criticisms Of Its Films And Series

May 05, 2025

Marvels Quality Control Addressing Criticisms Of Its Films And Series

May 05, 2025 -

Public Reaction To Lizzos Comments On Britney Spears And Janet Jackson

May 05, 2025

Public Reaction To Lizzos Comments On Britney Spears And Janet Jackson

May 05, 2025 -

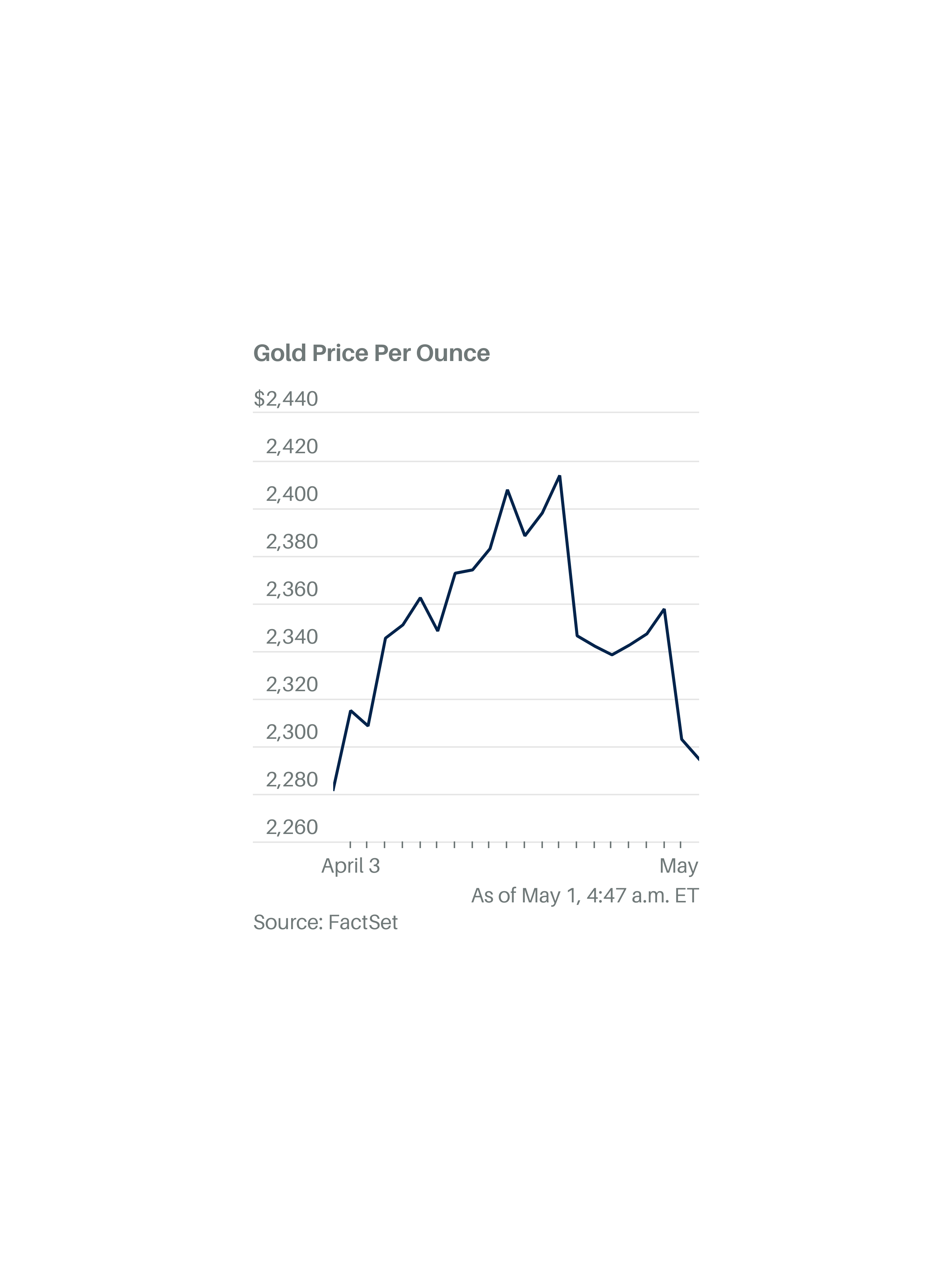

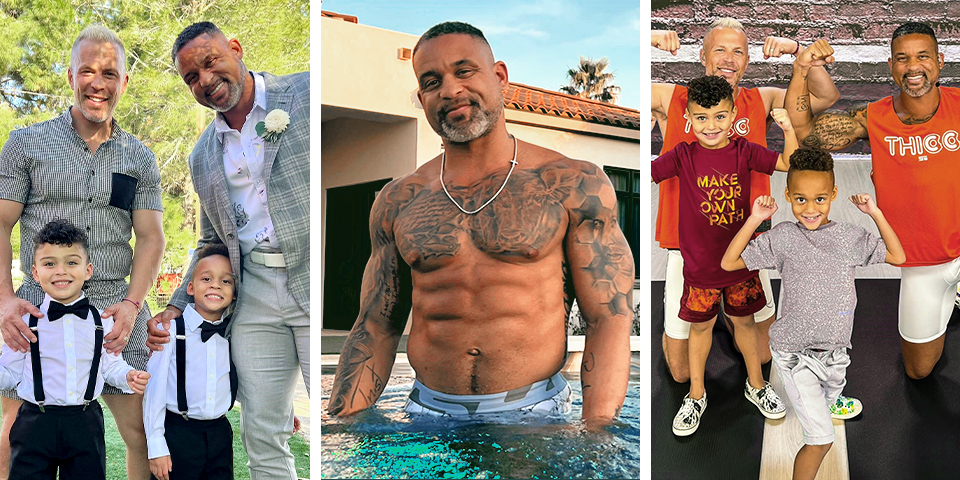

Lizzos Trainer Shaun T On Ozempic Claims Annoying

May 05, 2025

Lizzos Trainer Shaun T On Ozempic Claims Annoying

May 05, 2025 -

When Is The Partial Solar Eclipse On Saturday In Nyc

May 05, 2025

When Is The Partial Solar Eclipse On Saturday In Nyc

May 05, 2025 -

Lizzo Faces Backlash For Britney Spears And Janet Jackson Comparison

May 05, 2025

Lizzo Faces Backlash For Britney Spears And Janet Jackson Comparison

May 05, 2025

Latest Posts

-

Criminal Neglect Mother Charged In Death Of Tortured 16 Year Old

May 05, 2025

Criminal Neglect Mother Charged In Death Of Tortured 16 Year Old

May 05, 2025 -

Alleged Torture Starvation And Beatings Lead To Stepfathers Murder Charge In 16 Year Olds Death

May 05, 2025

Alleged Torture Starvation And Beatings Lead To Stepfathers Murder Charge In 16 Year Olds Death

May 05, 2025 -

Mother Charged In 16 Year Olds Torture Murder Criminal Neglect Allegations

May 05, 2025

Mother Charged In 16 Year Olds Torture Murder Criminal Neglect Allegations

May 05, 2025 -

16 Year Old Stepsons Murder Stepfather Accused Of Brutal Abuse And Neglect

May 05, 2025

16 Year Old Stepsons Murder Stepfather Accused Of Brutal Abuse And Neglect

May 05, 2025 -

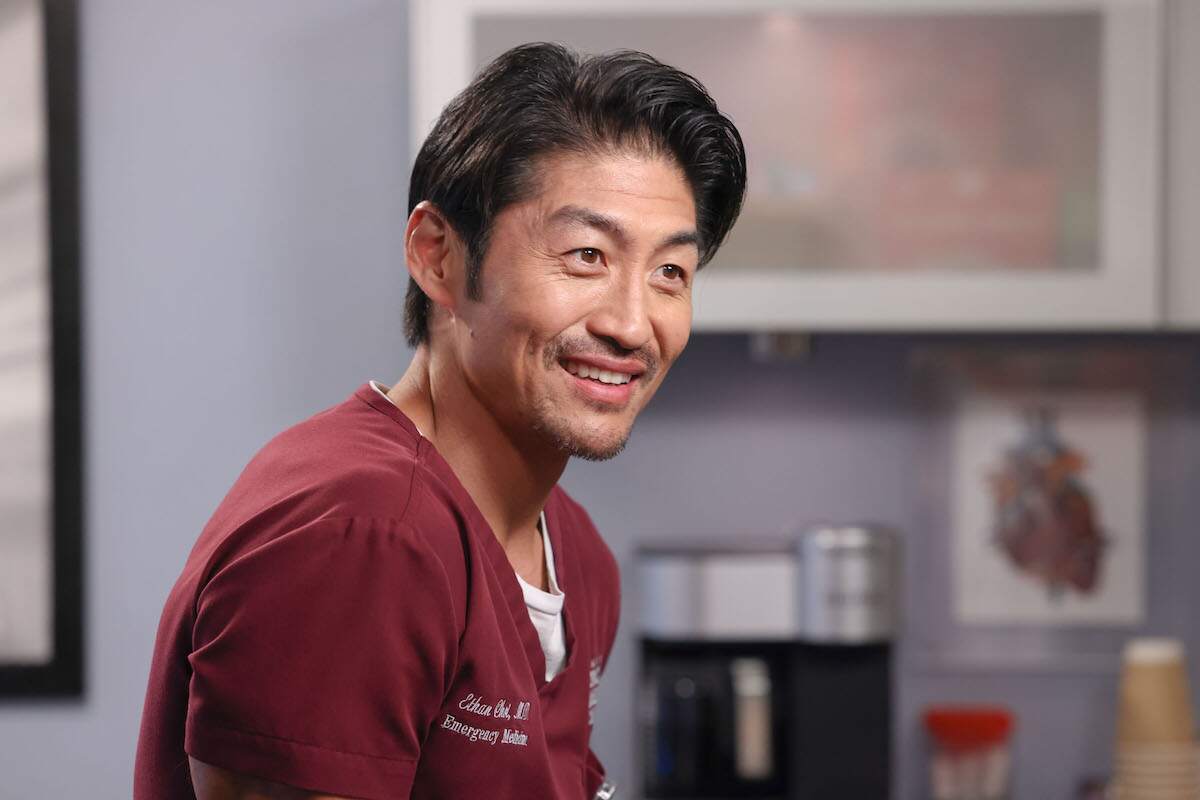

Chicago Med Season 10 Episode 14 Features Brian Tees Return

May 05, 2025

Chicago Med Season 10 Episode 14 Features Brian Tees Return

May 05, 2025