Gold Prices Fall: Facing First Double-Digit Weekly Losses Of 2025

Table of Contents

Factors Contributing to the Gold Price Decline

Several interconnected factors have converged to fuel this dramatic fall in gold prices. Understanding these dynamics is crucial for informed decision-making.

Strengthening US Dollar

The inverse relationship between the US dollar and gold prices is well-established. As the US dollar strengthens, gold, priced in dollars, becomes more expensive for holders of other currencies, reducing demand. Recent weeks have witnessed a considerable strengthening of the dollar, largely driven by:

- Aggressive Interest Rate Hikes: The Federal Reserve's ongoing interest rate hikes have boosted the dollar's attractiveness as a safe-haven asset and increased its yield relative to other currencies. The current federal funds rate is [insert current rate], significantly impacting investor flows.

- Positive Economic Indicators: Stronger-than-expected economic data from the US has reinforced confidence in the dollar, further fueling its rise. The recent [insert relevant economic indicator, e.g., GDP growth] figures point towards sustained economic strength.

- Shifting Investor Sentiment: Increased investor confidence in the US economy has led to a shift away from gold, considered a safe-haven asset during times of uncertainty, towards dollar-denominated assets. The US Dollar Index (DXY) has seen a [insert percentage change] increase in the last [time period].

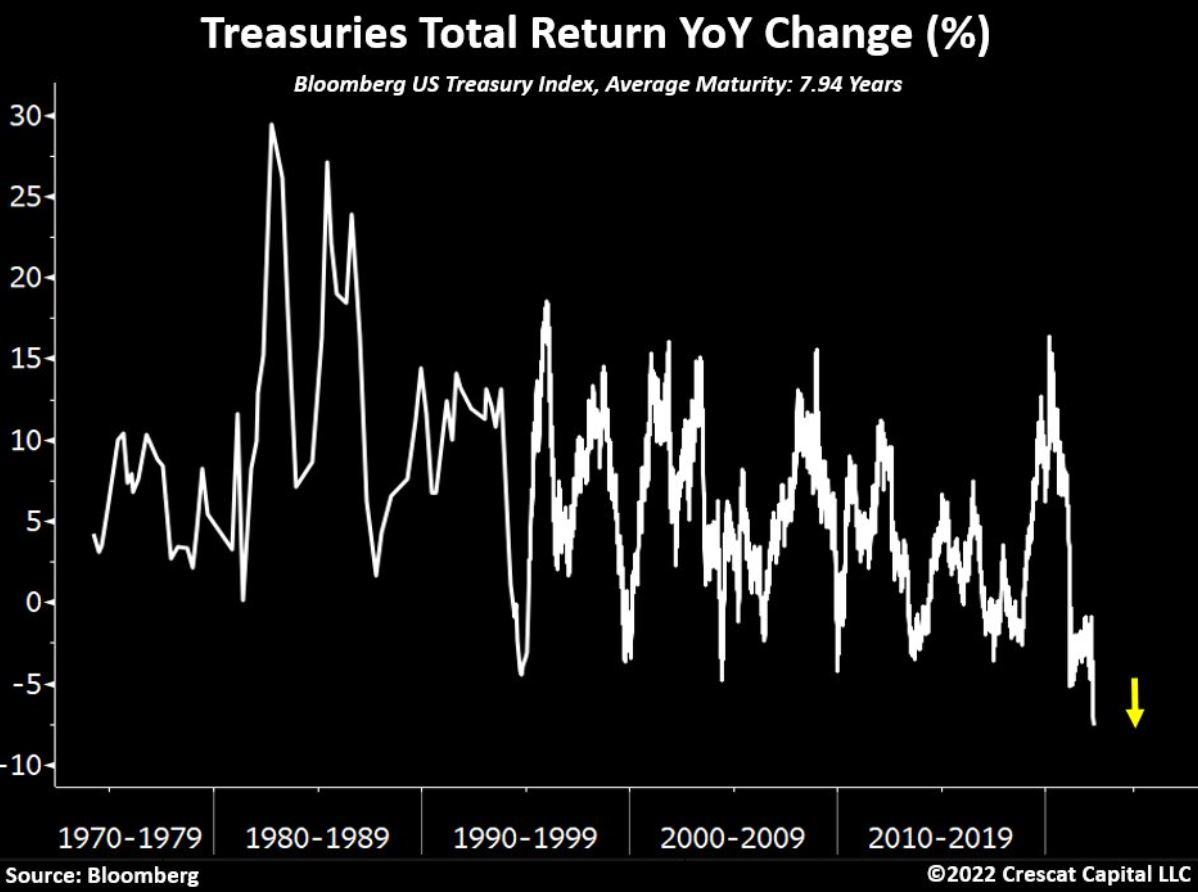

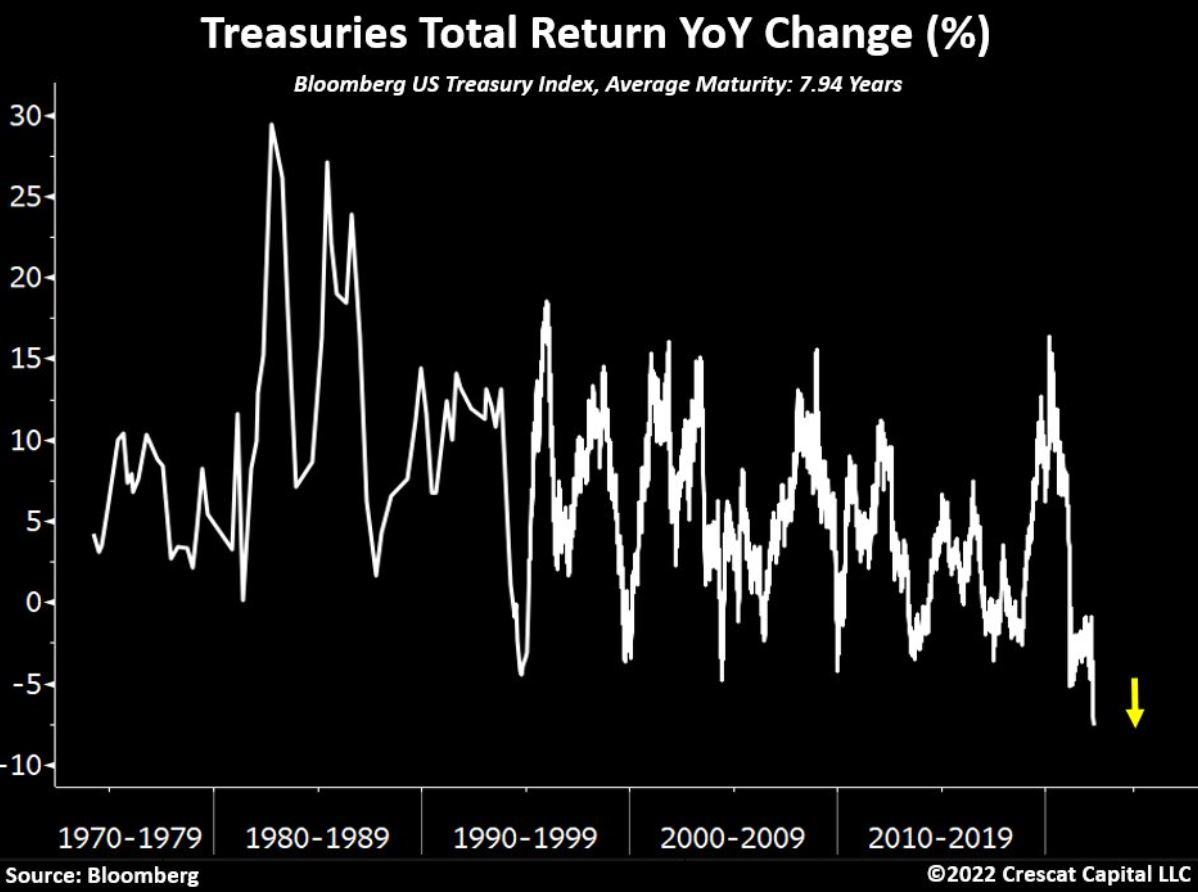

Rising Interest Rates and Bond Yields

Higher interest rates make non-yielding assets like gold less attractive. The opportunity cost of holding gold, which doesn't generate interest income, increases as bond yields rise. This is because investors can earn a return on their investments in bonds, making them a more appealing alternative.

- Opportunity Cost: Holding gold means foregoing the potential returns from higher-yielding bonds and other interest-bearing investments. Current 10-year Treasury yields are at [insert current yield], making bonds a more competitive option for many investors.

- Shift in Investment Preferences: The increased attractiveness of bonds and other fixed-income securities is drawing capital away from gold, contributing to the price decline.

Easing Geopolitical Tensions

Gold often serves as a safe-haven asset during times of geopolitical uncertainty. However, a reduction in global tensions can diminish its appeal. Recent developments, such as [mention specific geopolitical events, e.g., de-escalation of a specific conflict], have contributed to a more stable global environment, reducing the demand for gold as a hedge against risk.

- Reduced Safe-Haven Demand: The easing of geopolitical concerns has led investors to shift their focus away from gold, impacting its price. News sources like [mention reputable news sources] have reported on this shift in investor sentiment.

- Impact on Investor Confidence: A less volatile global landscape has boosted investor confidence, leading them to seek higher-return investments rather than the relative safety of gold.

Increased Gold Supply

An increase in gold supply can also exert downward pressure on prices. This could stem from factors such as:

- Higher Gold Mining Production: Increased efficiency in gold mining operations might lead to a higher volume of gold entering the market. Reports indicate [insert data on gold production, if available].

- Central Bank Gold Sales: While less common, central banks could potentially release gold reserves into the market, impacting supply and demand dynamics. [Insert information regarding central bank gold sales, if available].

Impact on Investors and the Market

The significant fall in gold prices has far-reaching consequences for investors and the broader market.

Implications for Gold Investors

The recent decline represents significant losses for investors holding substantial gold positions. Gold ETFs (Exchange Traded Funds) have also experienced substantial drops, reflecting the overall market trend. Investors are now grappling with the implications and considering various strategies:

- Diversification: Diversifying investment portfolios across different asset classes is crucial to mitigate risk.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, to reduce the impact of volatility.

- Long-Term Holding: Many investors maintain a long-term perspective on gold, viewing the current downturn as a temporary correction.

Market Sentiment and Future Predictions

The market sentiment towards gold is currently bearish, following this significant price drop. However, predictions for future price movements vary widely among analysts.

- Potential Catalysts for Price Increases: Renewed geopolitical uncertainty, a weakening US dollar, or increased inflation could potentially drive gold prices higher.

- Potential for Further Decreases: Continued strength in the US dollar and rising interest rates could further depress gold prices. Technical analysis suggests [mention technical indicators and their implications].

Alternative Investment Opportunities

Given the declining gold prices, investors are exploring alternative investment opportunities, including:

- Other Precious Metals: Silver, platinum, and palladium are often considered alongside gold as safe-haven assets or inflation hedges.

- Commodities: Other commodities such as oil or agricultural products could offer diversification benefits.

- Financial Assets: Stocks, bonds, and real estate represent other investment possibilities, each with its own risk profile.

Conclusion

The substantial fall in gold prices reflects a confluence of factors: a strengthening US dollar, rising interest rates, easing geopolitical tensions, and potentially increased gold supply. This decline has had a significant impact on investors, necessitating a reassessment of investment strategies. While the market sentiment is currently bearish, the future direction of gold prices remains uncertain, influenced by various economic and geopolitical developments. It's crucial to stay informed about these developments and adjust your investment approach accordingly. Stay updated on the latest developments regarding gold prices and make informed decisions about your investment portfolio. Consider consulting with a financial advisor to create a strategy aligned with your individual risk tolerance and financial goals.

Featured Posts

-

Halle Baileys 25th Birthday Cake Cuteness And Love

May 06, 2025

Halle Baileys 25th Birthday Cake Cuteness And Love

May 06, 2025 -

Celtics Vs Heat Tip Off Time Tv Channel And Live Stream February 10th

May 06, 2025

Celtics Vs Heat Tip Off Time Tv Channel And Live Stream February 10th

May 06, 2025 -

Trotyl Z Polski Dla Amerykanskiej Armii Szczegoly Kontraktu

May 06, 2025

Trotyl Z Polski Dla Amerykanskiej Armii Szczegoly Kontraktu

May 06, 2025 -

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025

Celtics Vs Knicks Live Stream Tv Channel And How To Watch

May 06, 2025 -

Analysis Of Ddgs Dont Take My Son Diss Track Targeting Halle Bailey

May 06, 2025

Analysis Of Ddgs Dont Take My Son Diss Track Targeting Halle Bailey

May 06, 2025

Latest Posts

-

Lyrics Breakdown Ddgs Dont Take My Son Diss Aimed At Halle Bailey

May 06, 2025

Lyrics Breakdown Ddgs Dont Take My Son Diss Aimed At Halle Bailey

May 06, 2025 -

Analysis Of Ddgs Dont Take My Son Diss Track Targeting Halle Bailey

May 06, 2025

Analysis Of Ddgs Dont Take My Son Diss Track Targeting Halle Bailey

May 06, 2025 -

Ddg And Halle Bailey The Dont Take My Son Diss Track Explained

May 06, 2025

Ddg And Halle Bailey The Dont Take My Son Diss Track Explained

May 06, 2025 -

The Dont Take My Son Diss Track Ddg Vs Halle Bailey

May 06, 2025

The Dont Take My Son Diss Track Ddg Vs Halle Bailey

May 06, 2025 -

Dont Take My Son Ddgs Diss Track Controversy Involving Halle Bailey

May 06, 2025

Dont Take My Son Ddgs Diss Track Controversy Involving Halle Bailey

May 06, 2025