Gold Prices Jump After Trump's Conciliatory Remarks

Table of Contents

Trump's Remarks and Their Market Impact

Former President Trump's recent public comments, characterized by a more conciliatory tone than previously observed, sent ripples through the financial markets. While specific quotes require referencing reputable news sources (which are omitted here for brevity, but would be included in a real-world article), the general sentiment was interpreted as a potential de-escalation of certain geopolitical tensions. This perception triggered a chain reaction:

- Specific examples of Trump's conciliatory statements: (This section would include direct quotes and links to verifiable news sources.)

- Investor interpretation: The market interpreted these statements as a reduction in future uncertainty, potentially leading to less demand for safe-haven assets like gold in the short term. However, this initial reaction was followed by a surge in gold prices. The reason behind this apparent contradiction lies in the complexities of market sentiment.

- Trading activity: Increased trading volume and a notable upward trend in gold futures contracts were observed immediately following the release of these statements.

The market's reaction suggests a complex interplay between short-term optimism and longer-term anxieties. While the conciliatory remarks initially offered a sense of relief, underlying economic and geopolitical uncertainties may have persisted, leading to increased demand for gold as a safe haven.

Gold as a Safe Haven Asset

Gold has historically served as a safe-haven asset, a store of value sought during times of economic or political uncertainty. This role stems from several key characteristics:

- Definition of a "safe-haven asset": A safe-haven asset is a non-correlated investment that tends to perform well during times of market stress. Gold's value is often viewed as relatively stable against other assets during periods of crisis.

- Historical examples: The 2008 financial crisis, the European debt crisis, and various geopolitical events have all seen spikes in gold prices as investors sought refuge from riskier assets.

- Correlation between investor fear and gold demand: When investors feel fear and uncertainty, they often shift their investments towards assets perceived as stable, such as gold, driving up demand and prices. This inverse correlation between risk aversion and gold prices is a key factor driving the recent increase.

Analysis of the Price Jump

The gold price increase following Trump's remarks was significant. (This section would include specific data points, charts, and graphs showing the percentage increase, comparisons to previous price fluctuations, etc. The data should be sourced from reputable financial websites). While Trump's statements were a contributing factor, other elements influenced this price jump:

- Percentage increase in gold prices: (Specific data would be included here.)

- Comparison to previous fluctuations: (Comparison with past price movements would provide context).

- Relevant economic indicators: Currency fluctuations, inflation concerns, and potential shifts in central bank policies likely played a role alongside the political news.

Future Outlook for Gold Prices

Predicting future gold prices is inherently challenging, but considering current conditions, several factors may influence the market:

- Short-term price forecast: The short-term trajectory will likely depend on the evolution of geopolitical events and economic data. Further conciliatory statements might lead to reduced demand; however, persistent uncertainty could sustain or even increase prices.

- Long-term price outlook: The long-term outlook is contingent on broader economic trends, including inflation rates and central bank policies. Inflationary pressures could continue to support gold prices, while aggressive interest rate hikes might suppress them.

- Factors influencing future gold prices: Inflation, interest rates, global economic growth, and evolving geopolitical landscapes will all play significant roles.

Conclusion: Understanding the Gold Market's Reaction to Trump's Statements

The surge in gold prices following Trump's conciliatory remarks demonstrates the intricate relationship between political events and gold market dynamics. The initial reaction suggested a reduction in immediate market uncertainty; however, underlying anxieties may have counteracted this effect, highlighting gold's role as a safe-haven asset. Analyzing "gold price fluctuations" requires considering multiple factors beyond immediate political statements. Understanding this relationship is crucial for navigating the complexities of gold market analysis. To stay abreast of these market movements and make informed investment decisions related to gold prices, it is vital to stay informed about political and economic news and consider consulting a qualified financial advisor. Remember to carefully consider your risk tolerance before investing in gold or any other asset.

Featured Posts

-

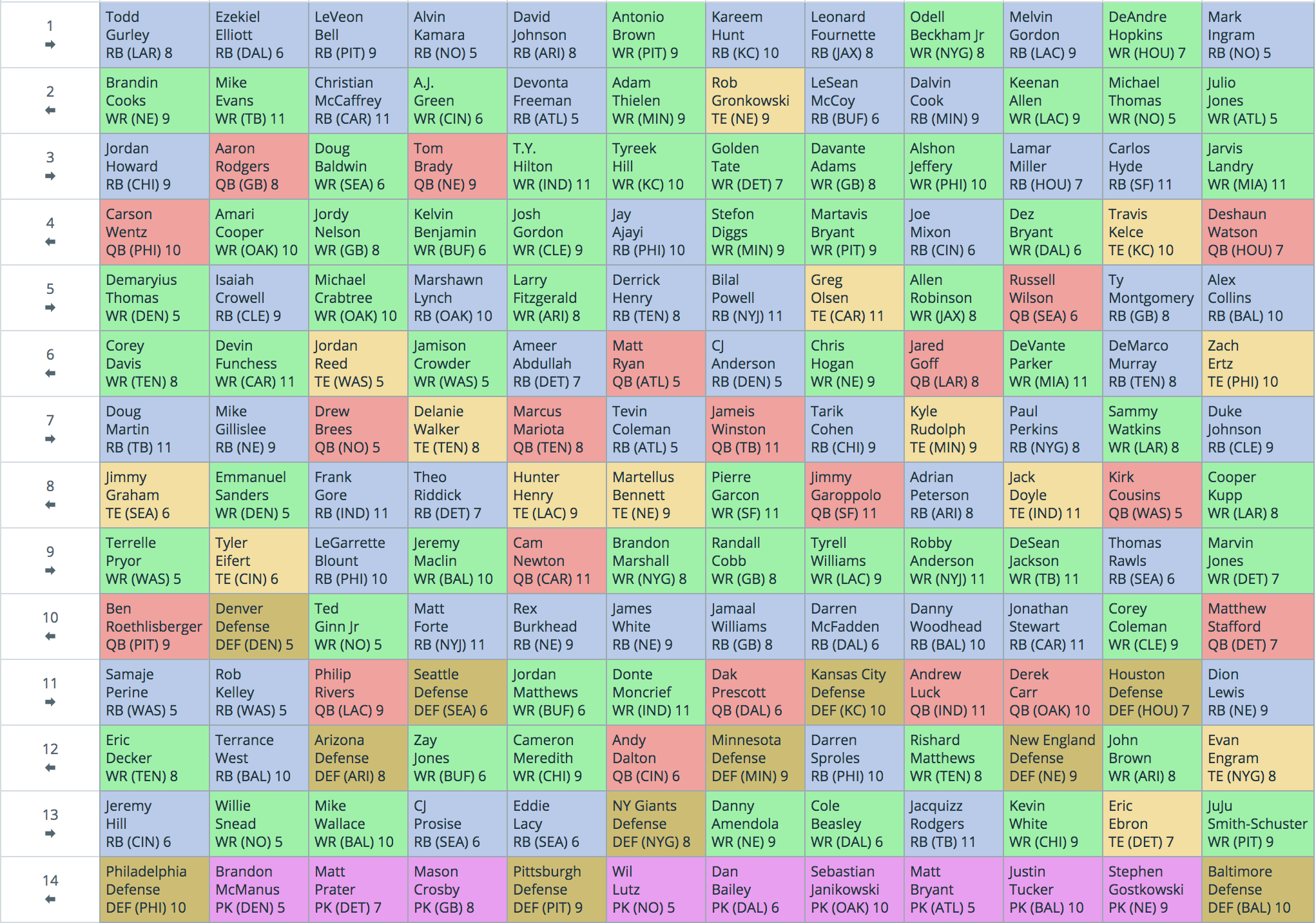

2024 Nfl Mock Draft Projecting The Saints Next Running Back

Apr 25, 2025

2024 Nfl Mock Draft Projecting The Saints Next Running Back

Apr 25, 2025 -

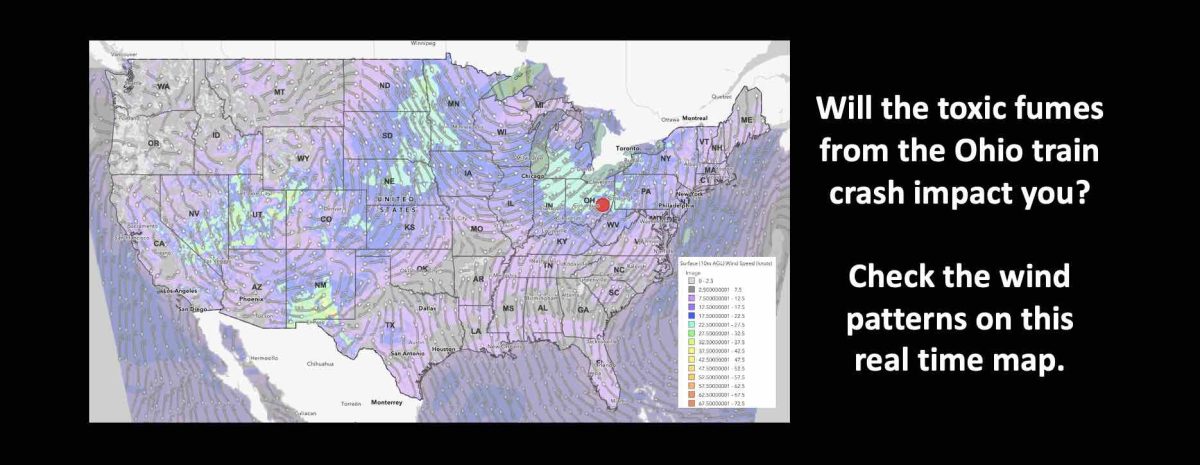

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 25, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 25, 2025 -

Inspirasi Desain Meja Rias 2025 Gaya Modern And Sederhana

Apr 25, 2025

Inspirasi Desain Meja Rias 2025 Gaya Modern And Sederhana

Apr 25, 2025 -

Blue Origins New Shepard Launch Cancelled Technical Glitch

Apr 25, 2025

Blue Origins New Shepard Launch Cancelled Technical Glitch

Apr 25, 2025 -

Basel Greenlights Funding For Eurovision Village In 2025

Apr 25, 2025

Basel Greenlights Funding For Eurovision Village In 2025

Apr 25, 2025

Latest Posts

-

The Political Landscape Assessing Governor Newsoms Actions

Apr 26, 2025

The Political Landscape Assessing Governor Newsoms Actions

Apr 26, 2025 -

Former Republican Representative Slams Gavin Newsom Over Steve Bannon Podcast Interview Shocking Stupidity

Apr 26, 2025

Former Republican Representative Slams Gavin Newsom Over Steve Bannon Podcast Interview Shocking Stupidity

Apr 26, 2025 -

Newsoms Bannon Podcast Appearance Draws Sharp Criticism From Former Gop Representative

Apr 26, 2025

Newsoms Bannon Podcast Appearance Draws Sharp Criticism From Former Gop Representative

Apr 26, 2025 -

Is Gavin Newsom A Leftist Examining His Political Positions

Apr 26, 2025

Is Gavin Newsom A Leftist Examining His Political Positions

Apr 26, 2025 -

Former Republican Rep Condemns Newsoms Bannon Podcast Interview

Apr 26, 2025

Former Republican Rep Condemns Newsoms Bannon Podcast Interview

Apr 26, 2025