Gold Prices Jump Amidst Renewed Trade War Concerns

Table of Contents

Safe Haven Demand Fuels Gold Price Increase

Gold's price increase is a direct result of its status as a "safe haven" asset. When geopolitical instability rises or economic downturns loom, investors often turn to gold as a store of value, seeking to protect their portfolios from market volatility. This is because gold, unlike stocks or bonds, tends to hold its value or even appreciate during periods of uncertainty.

Historically, gold prices have shown a strong correlation with periods of trade wars and economic stress. For instance, [cite historical examples, e.g., the gold price surge during the 1970s oil crisis or during previous trade disputes]. This trend is fueled by several factors:

- Increased market volatility leads to gold investment: Uncertainty creates risk aversion, pushing investors towards assets perceived as less risky.

- Gold's lack of correlation with other assets makes it attractive: When stock markets fall, gold often rises, providing diversification benefits.

- Central bank gold reserves influence market sentiment: Significant purchases of gold by central banks can signal confidence in the metal as a long-term store of value, boosting prices. Additionally, rising inflation expectations further contribute to increased gold demand. As inflation erodes the purchasing power of fiat currencies, investors see gold as a hedge against inflation.

Impact of Trade War Uncertainty on Global Markets

The current surge in gold prices is directly linked to renewed trade war concerns stemming from [explain specific trade policies or events, e.g., new tariffs imposed, threats of further trade restrictions]. These actions introduce significant uncertainty into the global market, impacting various asset classes.

- Impact on global supply chains: Trade wars disrupt established supply chains, increasing costs and reducing predictability for businesses.

- Increased tariffs and their effect on consumer prices: Tariffs lead to higher prices for goods, impacting consumer spending and potentially slowing economic growth.

- Uncertainty surrounding future trade agreements: The lack of clarity about future trade relations creates a climate of uncertainty, making investors hesitant to commit capital to riskier assets.

This uncertainty significantly impacts investor confidence and risk appetite. Investors, fearing potential losses in other markets, tend to move towards safer investments, like gold, driving up demand and consequently, price.

Analyzing the Current Gold Market Trends

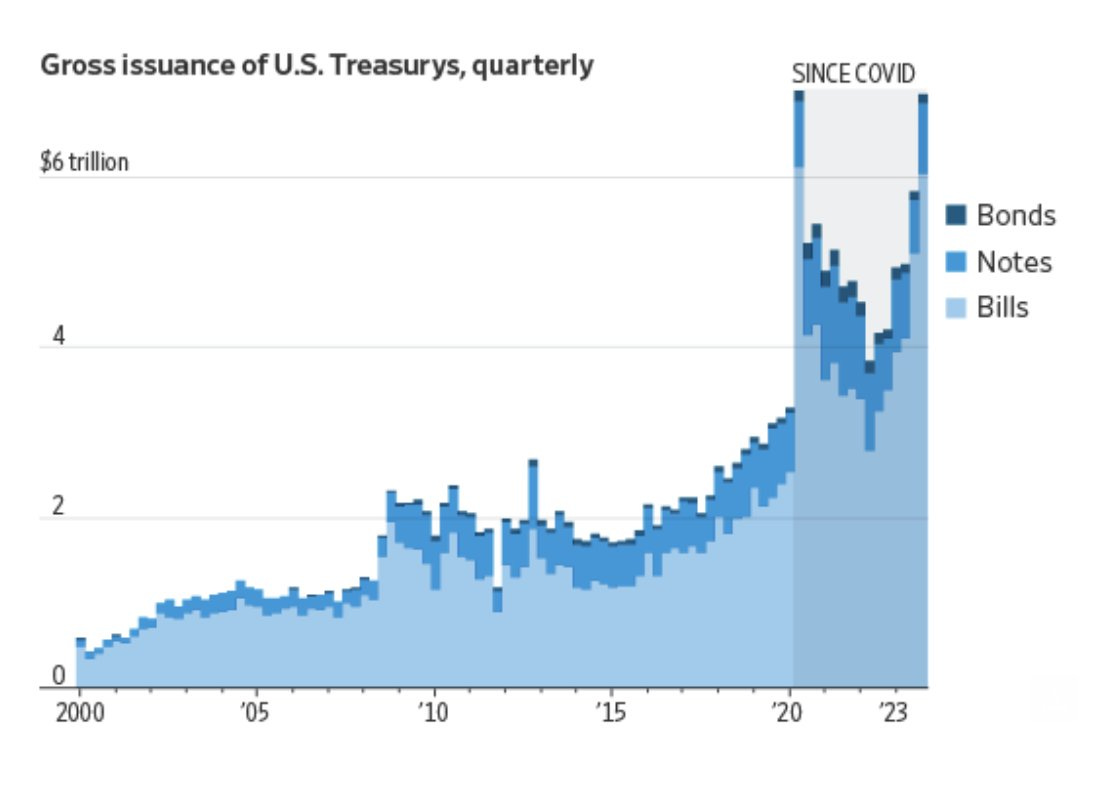

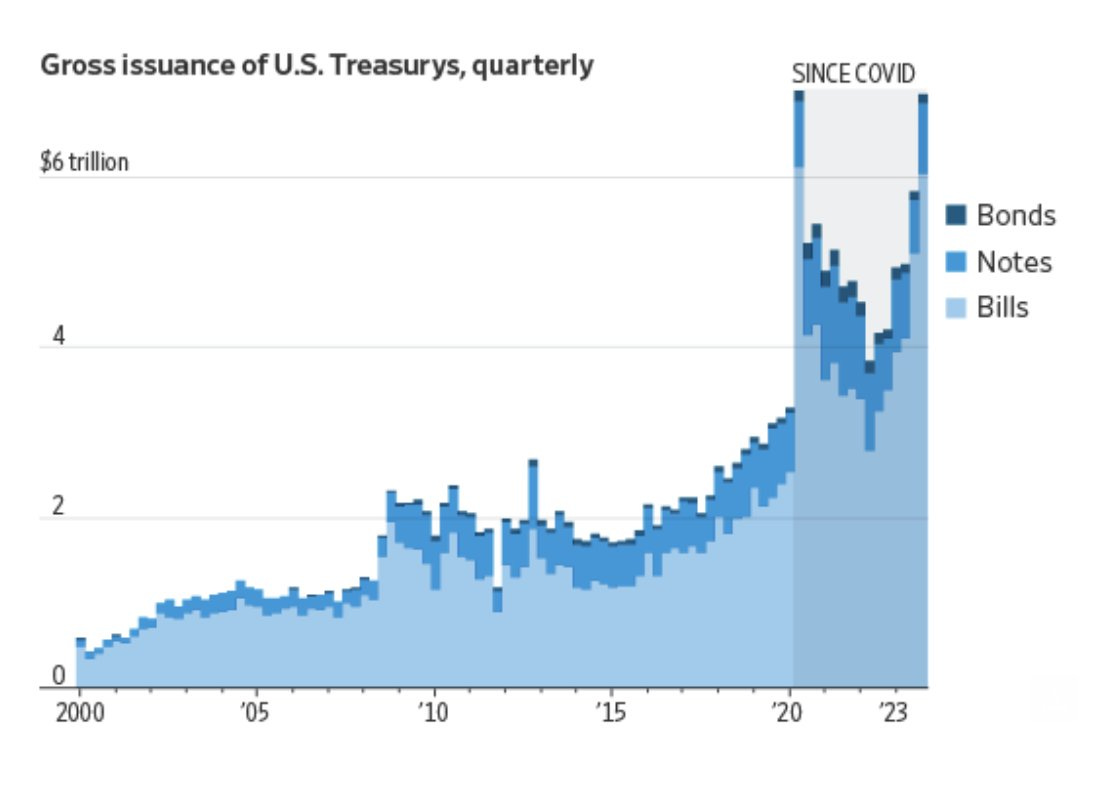

[Insert current gold price data and charts here. Clearly label the data source.] The current gold price trends reflect the escalating trade war anxieties. Short-term price forecasts [cite reputable sources and their predictions], while long-term forecasts [cite reputable sources and their predictions] suggest [summarize the forecast, highlighting potential upward or downward trends].

Beyond trade war concerns, other factors contribute to gold price fluctuations:

- Currency fluctuations: The value of gold is influenced by the relative strength of the US dollar and other major currencies.

- Interest rates: Lower interest rates generally make gold more attractive as an investment, since the opportunity cost of holding non-interest-bearing gold is reduced.

Where to Invest in Gold During Times of Uncertainty?

Investors seeking exposure to gold have several options:

- Physical gold: Buying physical gold bars or coins offers tangible ownership but requires secure storage.

- Gold ETFs (Exchange-Traded Funds): ETFs provide exposure to gold prices without the need for physical storage, offering liquidity and diversification.

- Gold mining stocks: Investing in companies involved in gold mining offers leverage to gold price movements but entails higher risk due to operational and market-specific factors.

Each approach has advantages and disadvantages, and the best choice depends on individual risk tolerance and investment goals. Careful consideration should be given to factors like storage costs, potential for price volatility, and management fees.

Conclusion: Navigating the Gold Market Amidst Trade War Volatility

The recent jump in gold prices is a clear indicator of the market's reaction to renewed trade war concerns. The increased demand for gold as a safe haven asset, coupled with the negative impact of trade uncertainties on global markets, has driven prices higher. Understanding these market dynamics is crucial for making informed investment decisions. Stay updated on the latest developments concerning gold prices jump amidst renewed trade war concerns and make informed investment choices. Consider diversifying your portfolio with gold to mitigate risks and navigate the volatility inherent in uncertain global economic conditions. Learn more about how to navigate gold market volatility amidst trade war concerns and protect your investments.

Featured Posts

-

Nora Fatehi A Target For Celebrity Marketing Gimmicks

May 27, 2025

Nora Fatehi A Target For Celebrity Marketing Gimmicks

May 27, 2025 -

Katsina Police Foil Bandit Attack Rescue Two Farmers In Matazu

May 27, 2025

Katsina Police Foil Bandit Attack Rescue Two Farmers In Matazu

May 27, 2025 -

Tramp Sanktsii Protiv Rusi A Ako Nema Primir E Do Kra Ot Na April

May 27, 2025

Tramp Sanktsii Protiv Rusi A Ako Nema Primir E Do Kra Ot Na April

May 27, 2025 -

The Nippon Steel Deal And Trumps Influence A Critical Examination

May 27, 2025

The Nippon Steel Deal And Trumps Influence A Critical Examination

May 27, 2025 -

Lizzo Responds Addressing Claims Of Challenging Janet Jacksons Pop Queen Status

May 27, 2025

Lizzo Responds Addressing Claims Of Challenging Janet Jacksons Pop Queen Status

May 27, 2025

Latest Posts

-

Marine Le Pen Condamnee Analyse De La Decision De 5 Ans D Ineligibilite

May 30, 2025

Marine Le Pen Condamnee Analyse De La Decision De 5 Ans D Ineligibilite

May 30, 2025 -

Polemique Autour D Une Subvention Regionale Pour Un Concert De Medine En Grand Est

May 30, 2025

Polemique Autour D Une Subvention Regionale Pour Un Concert De Medine En Grand Est

May 30, 2025 -

Assemblee Nationale Le Rassemblement National Et La Strategie De La Confrontation

May 30, 2025

Assemblee Nationale Le Rassemblement National Et La Strategie De La Confrontation

May 30, 2025 -

Medine En Concert En Grand Est La Region Accorde Une Subvention Polemique Au Rn

May 30, 2025

Medine En Concert En Grand Est La Region Accorde Une Subvention Polemique Au Rn

May 30, 2025 -

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisee

May 30, 2025

Cinq Ans D Ineligibilite Pour Marine Le Pen Une Decision Judiciaire Divisee

May 30, 2025