Goldman Sachs CEO Compensation: Banker Or Private Equity Executive?

Table of Contents

Goldman Sachs, a titan of Wall Street, recently reported its CEO's compensation package, sparking debate about its structure. The eye-watering figures raise a crucial question: Is the compensation structure of Goldman Sachs' CEO more aligned with traditional banking models or the highly lucrative world of private equity? This article delves into the details of Goldman Sachs CEO compensation, comparing it to both banker and private equity executive pay to answer this question. We'll explore the base salary, bonuses, stock options, and perks, ultimately determining where the CEO's pay truly sits within the financial landscape. We'll be referencing key terms such as "Goldman Sachs CEO compensation," "banker compensation," and "private equity compensation" throughout our analysis.

Decoding the Components of Goldman Sachs CEO Compensation

H3: Base Salary: The base salary of a Goldman Sachs CEO, while substantial, doesn't fully capture the extent of their compensation. While specific figures fluctuate yearly, comparing them to historical data and analyzing industry trends provides a clearer picture.

- 2022: [Insert data and source – e.g., $2 million (Source: Company filings)]

- 2021: [Insert data and source]

- Trend: [Analyze upward or downward trends and possible reasons – e.g., "The base salary has remained relatively stable compared to the significant fluctuations in bonus and equity compensation."]

This needs to be compared to the "Goldman Sachs CEO salary" of previous years and the average "banker salary" and "private equity executive salary." While the base salary might be comparable to top banking CEOs, it generally falls short of the highest-earning private equity executives.

H3: Bonus Structure: A significant portion of Goldman Sachs CEO compensation comes from performance-based bonuses. This "Goldman Sachs CEO bonus" is intricately tied to the firm's overall financial performance and often includes metrics beyond just profitability.

- Performance Metrics: [Specify metrics used – e.g., Return on Equity (ROE), revenue growth, client acquisition.]

- Payout Structure: [Describe how the bonus is calculated – e.g., a percentage of net income, tiered system based on exceeding targets.]

- Difference from Traditional Banking: Unlike some traditional banking bonus structures heavily reliant on short-term gains, Goldman Sachs' bonus system may incorporate longer-term performance indicators, aligning it more with the private equity model's focus on long-term value creation. The "executive compensation structure" at Goldman Sachs emphasizes this long-term perspective.

H3: Stock Options and Equity: Equity-based compensation, including "Goldman Sachs CEO stock options," forms a crucial element of the CEO's total compensation package. The value of these options and the vesting period significantly influence the overall payout.

- Vesting Periods: [Explain the vesting schedule – e.g., gradual vesting over several years.]

- Stock Performance Impact: [Explain how the stock price directly affects the value of the options. Include relevant charts and data if possible.]

- Unique Aspects: [Highlight any unusual aspects of Goldman Sachs' equity structure compared to industry norms.]

H3: Perks and Benefits: Beyond the core compensation, the "Goldman Sachs CEO benefits" package may include additional perks. While specifics are often undisclosed, these extras can considerably enhance the total compensation.

- Retirement Plans: [Describe the nature and extent of retirement plans.]

- Other Perks: [Mention any other benefits such as company car, health insurance, or other potential benefits, whilst avoiding speculation. Compare these to "executive perks" offered elsewhere.]

Comparing Goldman Sachs CEO Compensation to Industry Benchmarks

H3: Banking Industry Comparison: To accurately assess the "Goldman Sachs CEO compensation" package, it's crucial to compare it to peers in the investment banking sector.

- Data and Charts: [Use charts and tables to compare compensation data across several major investment banks. Cite reliable sources.]

- Benchmarking: [Analyze where the Goldman Sachs CEO's compensation falls within the range of their peers – above, below, or at the average.]

- Key Differences: [Highlight any significant structural differences between Goldman Sachs' compensation model and that of other investment banks.] This includes looking at "investment banking CEO compensation" packages at different banks.

H3: Private Equity Industry Comparison: Comparing Goldman Sachs CEO compensation to major private equity firms provides another critical benchmark.

- Compensation Structure: [Analyze whether the compensation structure leans more toward a fixed salary and performance-related bonuses typical of banking or towards significant carried interest common in private equity.]

- Total Payout Potential: [Compare the potential total payout of the Goldman Sachs CEO’s package to those of private equity CEOs.]

- Similarities and Differences: [Highlight the similarities and differences in terms of structure, risk, and reward, comparing "private equity CEO compensation" models to Goldman Sach's CEO compensation.] Consider comparing this also to "hedge fund manager compensation" and "alternative investment compensation".

The Impact of Regulatory Scrutiny on Goldman Sachs CEO Compensation

H3: Dodd-Frank and its Influence: The Dodd-Frank Act and other regulatory changes have profoundly impacted executive pay in the financial sector, including Goldman Sachs CEO compensation.

- Regulatory Changes: [Outline specific regulations affecting executive compensation and explain how they limit or constrain certain aspects, such as excessive bonuses.]

- Impact on Structure: [Explain how Dodd-Frank and other regulations have reshaped the structure of executive pay packages.]

H3: Public Perception and Stakeholder Pressure: Public opinion and shareholder activism are increasingly influencing executive compensation practices.

- Transparency Demands: [Discuss the growing demand for transparency in executive pay, and how this affects Goldman Sachs.]

- Ethical Considerations: [Analyze the ethical considerations surrounding CEO compensation, particularly within the context of regulatory changes and public scrutiny of "executive pay transparency" and "corporate governance".]

- Shareholder Activism: [Describe instances of shareholder activism targeting executive compensation at Goldman Sachs or other financial institutions. Analyze the influence of "shareholder activism" on executive pay practices.]

Conclusion: Goldman Sachs CEO Compensation – A Banker, a Private Equity Executive, or Something Else?

Analyzing the components of Goldman Sachs CEO compensation reveals a complex picture. While the base salary might align with the top tier of traditional banking CEOs, the significant emphasis on performance-based bonuses and substantial equity grants brings it closer to the private equity model. The impact of regulatory scrutiny and public pressure adds another layer of complexity. Ultimately, the "Goldman Sachs CEO compensation" model exhibits a hybrid structure, borrowing aspects from both traditional banking and private equity, reflecting the evolving financial landscape.

To gain a complete understanding of the intricacies of "Goldman Sachs CEO compensation," further research is encouraged. Exploring detailed financial reports, regulatory filings, and analysis from financial experts will provide a more comprehensive picture. Consider researching "Understanding Goldman Sachs CEO compensation," "Analyzing executive pay in the financial sector," or "Researching Goldman Sachs executive compensation" to continue your investigation.

Featured Posts

-

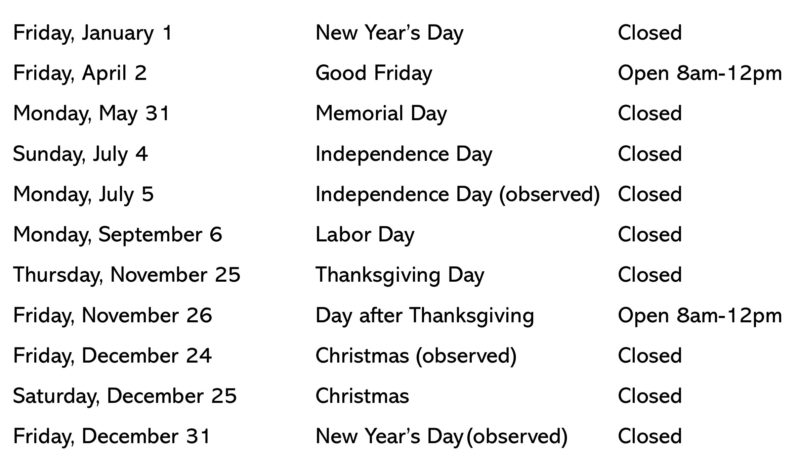

Pe I Easter Weekend Business Hours And Holiday Closures

Apr 23, 2025

Pe I Easter Weekend Business Hours And Holiday Closures

Apr 23, 2025 -

Le Responsable Du Portefeuille Bfm Arbitrage Semaine Du 17 Fevrier

Apr 23, 2025

Le Responsable Du Portefeuille Bfm Arbitrage Semaine Du 17 Fevrier

Apr 23, 2025 -

Go Delete Yourself From The Internet A Practical Guide

Apr 23, 2025

Go Delete Yourself From The Internet A Practical Guide

Apr 23, 2025 -

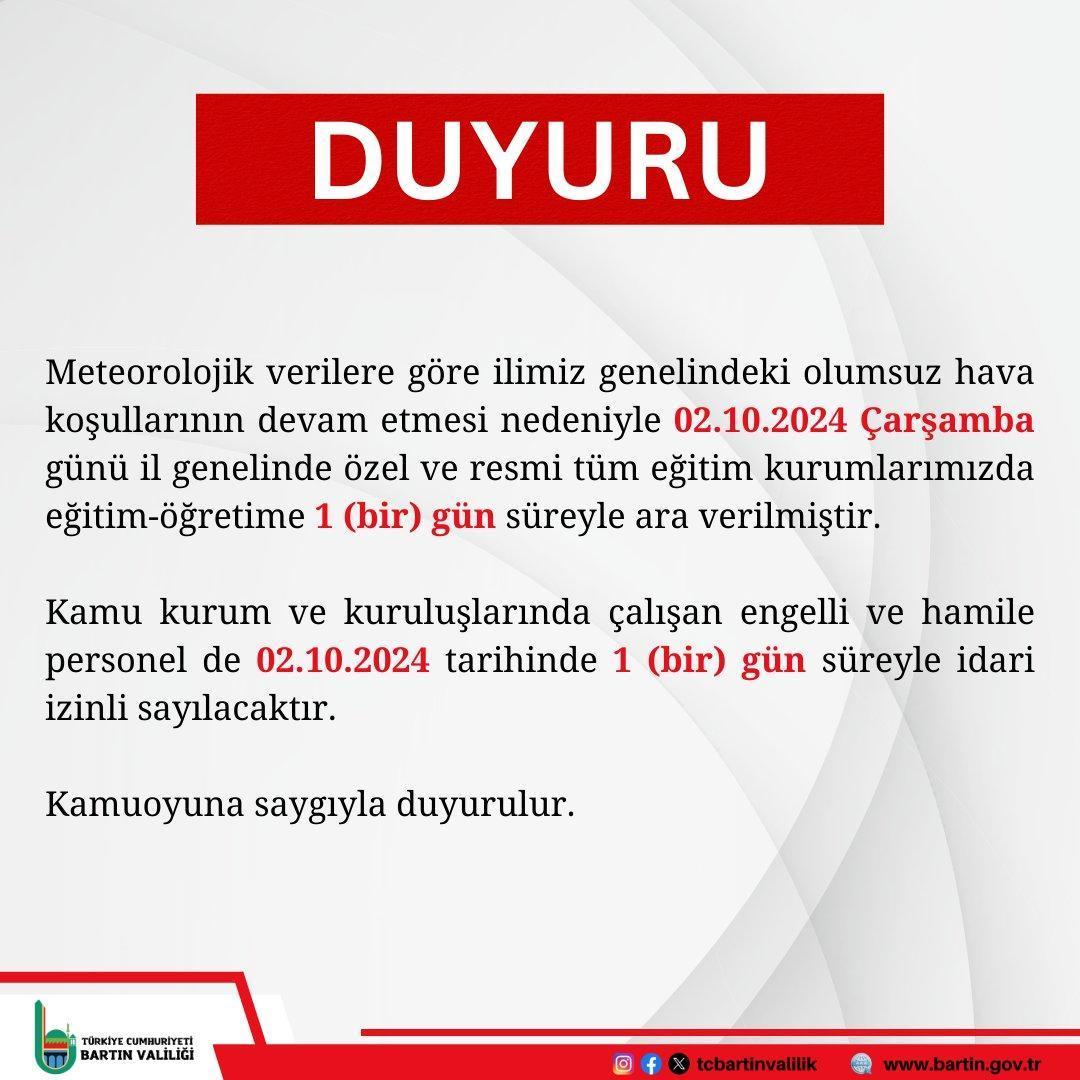

Pazartesi Guenue Okullar Tatil Mi Istanbul Da Son Dakika Haberleri

Apr 23, 2025

Pazartesi Guenue Okullar Tatil Mi Istanbul Da Son Dakika Haberleri

Apr 23, 2025 -

3 Mart 2024 Pazartesi Ankara Iftar Ve Sahur Vakitleri

Apr 23, 2025

3 Mart 2024 Pazartesi Ankara Iftar Ve Sahur Vakitleri

Apr 23, 2025