Goldman Sachs Pay Controversy: The Impact Of CEO's Role Definition

Table of Contents

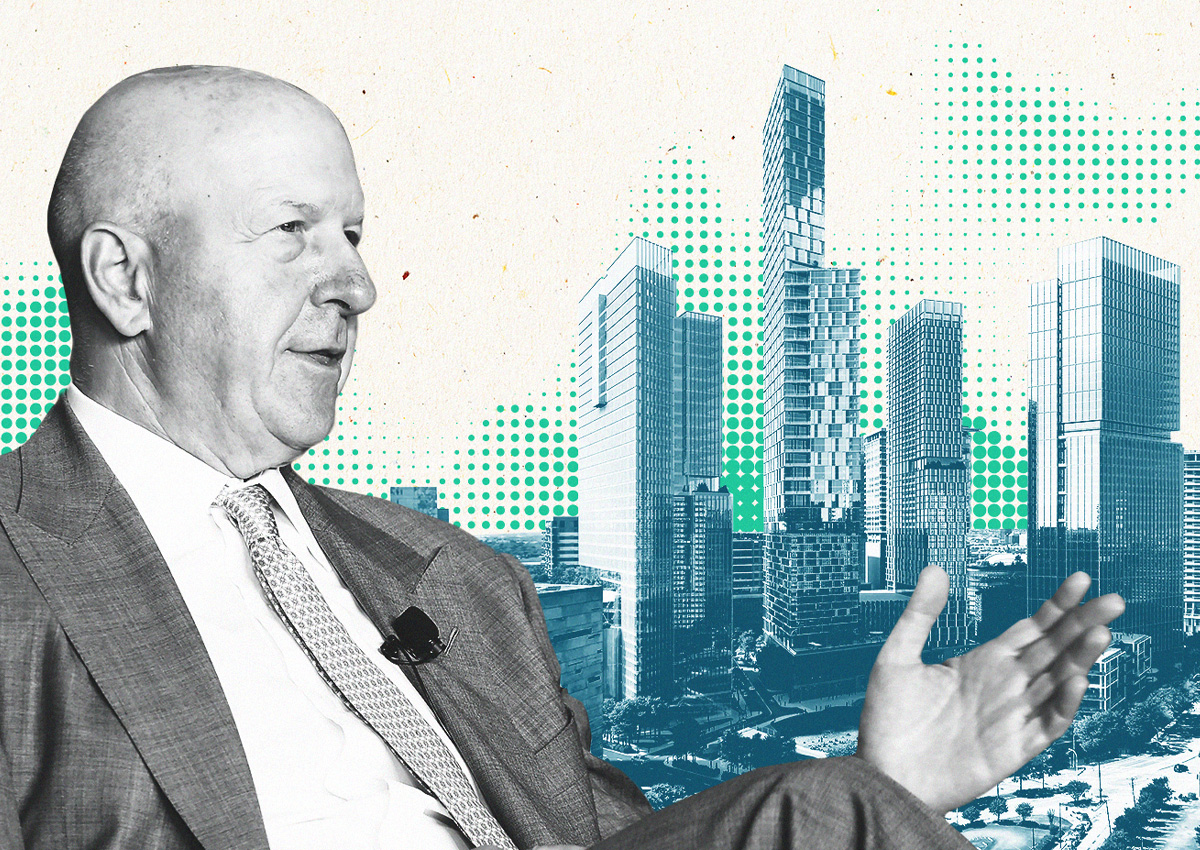

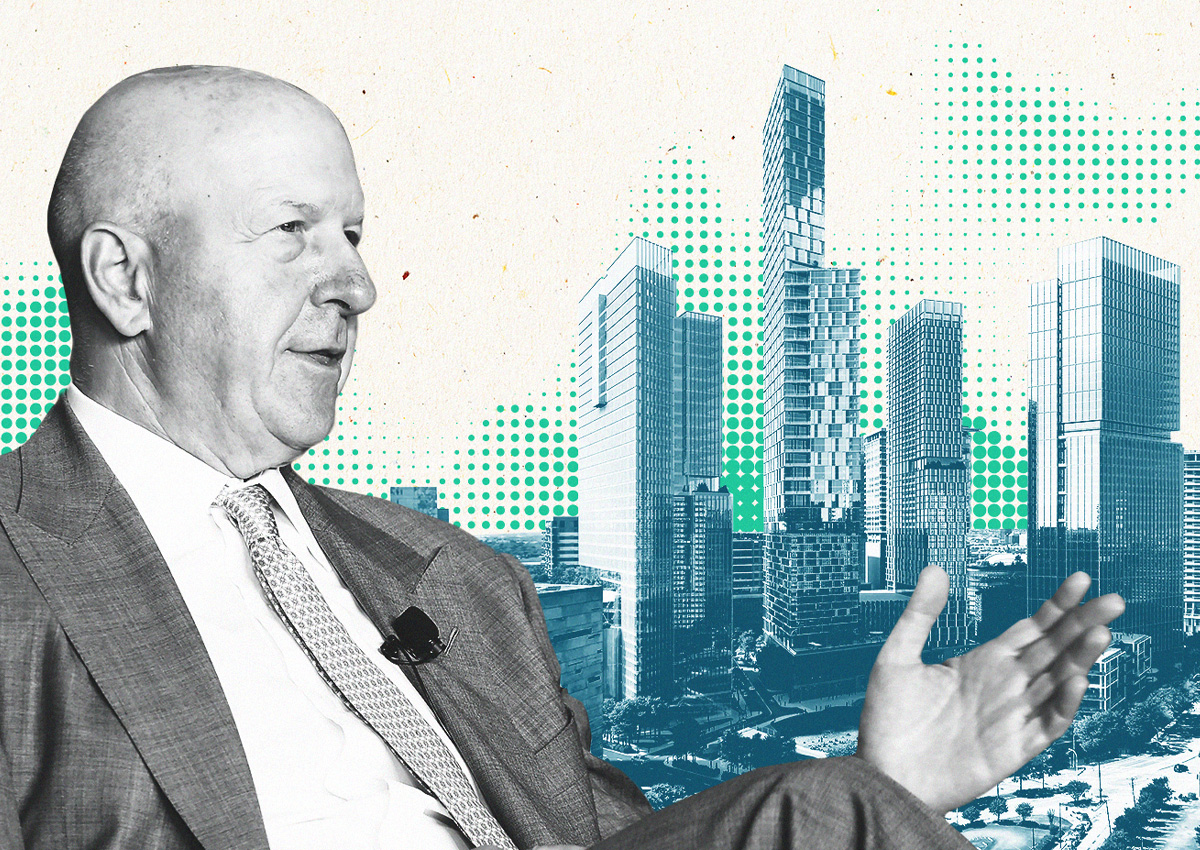

David Solomon's Compensation Package: A Closer Look

David Solomon's compensation at Goldman Sachs has drawn significant scrutiny. Analyzing his total compensation reveals a complex picture involving base salary, bonuses, and stock options. Understanding the structure is crucial to evaluating whether it aligns with both company performance and broader societal expectations of executive pay. Keywords: David Solomon salary, Goldman Sachs CEO pay, bonus structure, performance metrics, shareholder returns.

-

Components of Total Compensation: While precise figures fluctuate year to year and are subject to various reporting nuances, Solomon's compensation package typically includes a substantial base salary, significant bonuses tied to firm profitability and his individual performance, and a considerable amount of stock options.

-

Discrepancies between Compensation and Company Performance: Critics have pointed to instances where Solomon's compensation appeared high relative to Goldman Sachs' overall financial performance or compared to the returns generated for shareholders. These disparities often fuel the debate surrounding the effectiveness of current performance-based pay structures.

-

Criticisms of the Compensation Plan: Some argue that the structure incentivizes short-term gains over long-term sustainable growth, potentially encouraging excessive risk-taking. Others question the transparency and accountability built into the compensation framework. The lack of clear correlation between performance and pay has become a focal point of shareholder activism.

The Role of the Goldman Sachs CEO: Expectations and Responsibilities

The Goldman Sachs CEO's role encompasses a wide range of responsibilities far beyond simply delivering profits. It's a complex interplay of strategic leadership, risk management, navigating regulatory landscapes, and maintaining a strong ethical compass. Keywords: CEO responsibilities, leadership in finance, risk management, shareholder value, corporate governance.

-

Core Duties: Leading strategic planning, overseeing daily operations, managing risk across diverse business units, representing the firm publicly, and ensuring compliance with regulations are paramount.

-

Ethical Conduct and Responsible Leadership: In the wake of past financial crises, there's a heightened focus on ethical conduct and responsible leadership. The CEO sets the tone for the entire organization, influencing its ethical culture.

-

Navigating Complex Regulatory Landscapes: Goldman Sachs operates in a highly regulated environment. The CEO must ensure the firm adheres to all applicable regulations and proactively manages potential risks.

-

Impact on Shareholders: Ultimately, the CEO's decisions directly impact shareholder value. Balancing short-term gains with long-term sustainability is a key challenge.

The Impact of the Controversy on Shareholder Relations and Public Perception

The controversy surrounding David Solomon's compensation has had a noticeable impact on shareholder relations and Goldman Sachs' public image. Keywords: Shareholder activism, public opinion, reputational risk, corporate social responsibility, ESG investing.

-

Shareholder Responses: Shareholder activism has increased, with some expressing dissatisfaction with Solomon's pay package. This discontent is often voiced through proxy voting, shareholder resolutions, and public statements.

-

Impact on Investor Confidence: Negative public perception and shareholder unrest can erode investor confidence, potentially impacting the company's stock price and its ability to attract and retain talent.

-

Implications for Goldman Sachs' ESG Ratings: Growing concerns over ESG (Environmental, Social, and Governance) factors have made executive compensation a key aspect of ESG ratings. The controversy has likely impacted Goldman Sachs' scores on these metrics.

-

CEO Pay Transparency and Accountability: The debate emphasizes the need for greater transparency and accountability in CEO compensation practices, promoting a more equitable and sustainable approach.

Performance-Based Pay and its Effectiveness in the Financial Sector

Performance-based pay, while intended to align CEO incentives with shareholder interests, has inherent limitations. Keywords: Performance-based compensation, executive incentives, aligning incentives, risk-taking behavior, short-termism. The focus on short-term metrics can incentivize excessive risk-taking and a short-sighted approach to strategic decision-making. A more holistic approach that incorporates long-term value creation and considers broader stakeholder interests is often advocated for.

Conclusion

The Goldman Sachs pay controversy surrounding David Solomon's compensation highlights the ongoing debate about CEO pay and its relationship to performance, shareholder value, and public perception. The controversy raises crucial questions regarding the definition of a CEO’s role and the effectiveness of current compensation structures in fostering responsible leadership within the financial sector. Understanding the nuances of executive compensation and its potential impact on corporate governance is critical.

Call to Action: Understanding the intricacies of the Goldman Sachs CEO pay controversy is vital for navigating the complex landscape of executive compensation and corporate governance. Continue researching the impact of CEO role definition on various organizations to stay informed about the evolving dynamics of leadership in the financial industry. Further analysis of Goldman Sachs’ response and future compensation strategies will be crucial in understanding the long-term consequences of this ongoing debate. The ongoing dialogue around Goldman Sachs CEO pay and its implications will continue to shape discussions about responsible leadership in finance.

Featured Posts

-

Leaked Documents Hegseth Links To Sabotage Of Trumps Plans

Apr 23, 2025

Leaked Documents Hegseth Links To Sabotage Of Trumps Plans

Apr 23, 2025 -

Ohio Train Disaster Persistence Of Toxic Chemicals In Buildings

Apr 23, 2025

Ohio Train Disaster Persistence Of Toxic Chemicals In Buildings

Apr 23, 2025 -

Cocaine Found At White House Secret Service Ends Investigation

Apr 23, 2025

Cocaine Found At White House Secret Service Ends Investigation

Apr 23, 2025 -

Retail Shakeup Hudsons Bay Departures And The Search For Alternative Sales Channels

Apr 23, 2025

Retail Shakeup Hudsons Bay Departures And The Search For Alternative Sales Channels

Apr 23, 2025 -

Auto Dealers Push Back Against Mandatory Electric Vehicle Sales

Apr 23, 2025

Auto Dealers Push Back Against Mandatory Electric Vehicle Sales

Apr 23, 2025