Gold's Record High: Understanding The Trade War Impact On Bullion

Table of Contents

Safe Haven Asset: Gold's Rise During Trade Wars

Gold's traditional role as a safe haven asset during times of economic and political instability is amplified during trade wars. Investors flock to gold as a store of value when confidence in traditional markets wavers.

- Inflation Hedge: Investors often see gold as a hedge against inflation and currency devaluation, both common consequences of trade conflicts. Trade wars disrupt supply chains, leading to increased prices for goods and services. Gold, historically holding its value, becomes a preferred asset to protect against this erosion of purchasing power.

- Uncertainty Protection: Increased uncertainty about future economic growth drives investors to seek the security of tangible assets like gold bullion. The unpredictable nature of trade wars creates a climate of fear, pushing investors away from riskier assets (stocks, bonds) and towards the perceived safety of gold.

- Portfolio Diversification: Portfolio diversification strategies often incorporate gold to mitigate risk associated with volatile equity markets affected by trade wars. Gold's low correlation with other asset classes makes it a valuable tool for reducing overall portfolio volatility.

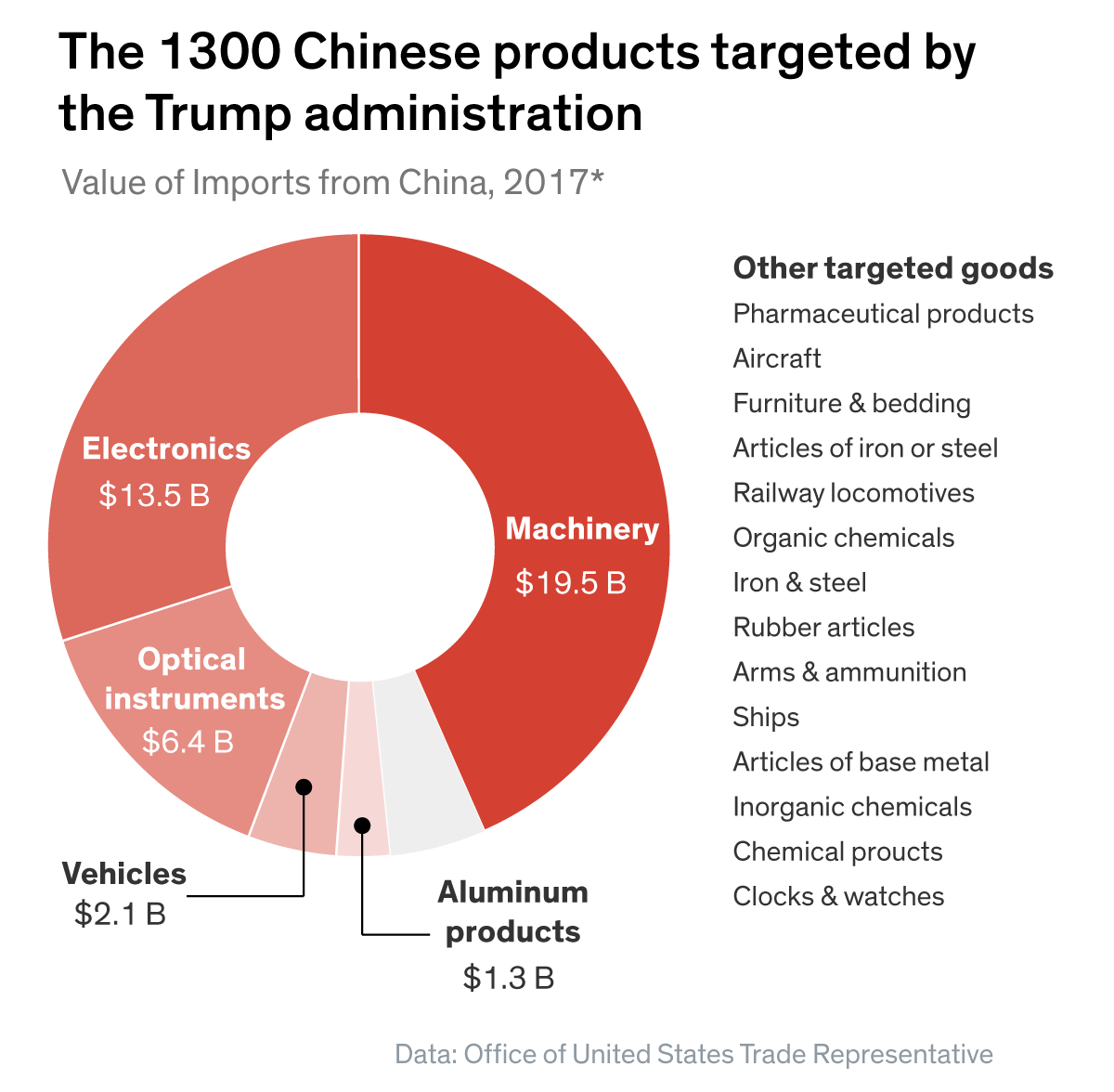

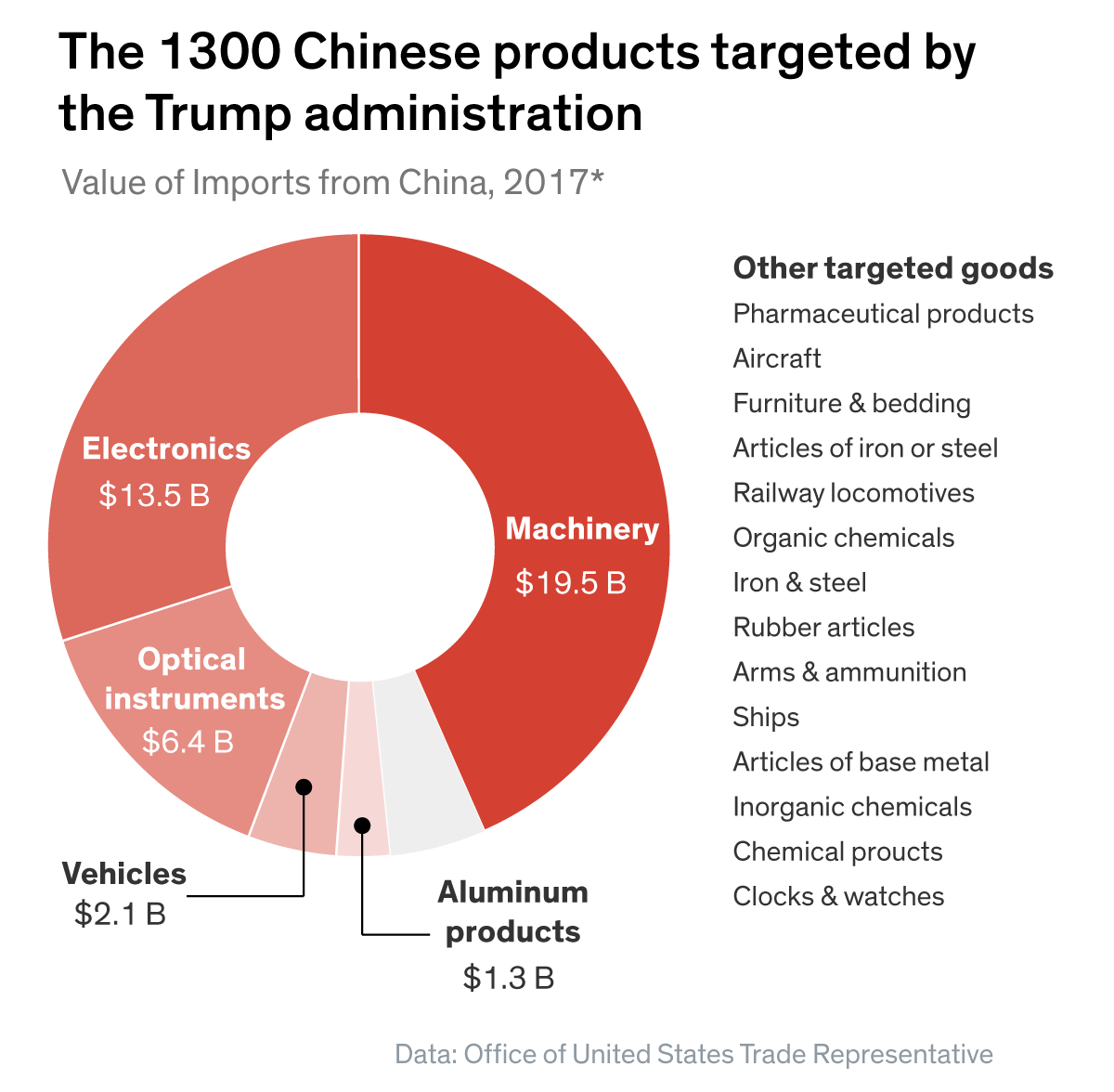

The 2018-2020 US-China trade war, for example, saw a significant rise in gold prices as investors sought refuge from the escalating uncertainty. Capital flowed out of equity markets and into gold as a protective measure, demonstrating the metal's role as a safe haven during periods of geopolitical tension.

Currency Devaluation & Inflation: The Trade War-Gold Connection

Trade wars can significantly impact currency valuations and inflationary pressures, further boosting gold's appeal.

- Supply Chain Disruptions: Trade tariffs and retaliatory measures can disrupt global supply chains, leading to higher prices for goods and services – inflation.

- Weakening Currencies: Weakening currencies, a common outcome of trade conflicts, make gold, priced in US dollars, more attractive to international investors. A weaker domestic currency increases the relative price of gold in local markets, stimulating demand.

- Quantitative Easing: Central banks may resort to quantitative easing (QE) to combat economic slowdown caused by trade wars. QE, which involves injecting money into the economy, can lead to inflation, further increasing gold's value as a hedge.

The devaluation of various currencies during past trade disputes, combined with inflationary pressures, has historically propelled gold prices upwards. This highlights the interconnectedness of trade policy, monetary policy, and gold's role as an inflation hedge.

Increased Investment Demand: Fueling the Gold Rush

The uncertainty created by trade wars fuels increased demand for gold bullion from both individual and institutional investors.

- Institutional Investment: Hedge funds and large institutional investors often increase their gold holdings during periods of heightened global uncertainty. Gold is seen as a reliable store of value in their diversified portfolios.

- Retail Investor Demand: Retail investors, seeking to protect their savings, also tend to invest more in gold bullion during trade wars. The accessibility of gold through ETFs and other investment vehicles makes it easier for everyday investors to participate in the market.

- Central Bank Accumulation: Central banks of various countries may increase their gold reserves as a way to protect their monetary policies from external shocks caused by trade wars. This adds another layer of demand to the gold market.

Analysis of investment flows into gold during previous trade disputes reveals a clear pattern: uncertainty equates to increased demand, driving up prices.

Impact on Gold Mining Companies: A Supply-Side Perspective

Trade wars can also impact the gold mining sector, affecting supply and potentially influencing prices.

- Tariffs & Restrictions: Tariffs on mining equipment or restrictions on the trade of essential mining materials can impact the profitability of gold mining operations. This can lead to reduced production and potentially higher gold prices due to constrained supply.

- Exchange Rate Fluctuations: Changes in the exchange rates can also affect the profitability of gold mining companies, depending on their location and operating costs. A weaker domestic currency can make exports more expensive, decreasing profitability.

Understanding the impact of trade wars on both the demand and supply sides of the gold market provides a comprehensive view of the price dynamics.

Conclusion: Navigating the Gold Market in a Time of Trade Wars

The surge in gold prices to record highs is inextricably linked to the ongoing uncertainty generated by global trade wars. Gold's status as a safe haven asset, its ability to act as a hedge against inflation and currency devaluation, and the increased investment demand during times of economic turmoil all contribute to this phenomenon. Understanding the intricate relationship between trade conflicts and the gold market is crucial for investors navigating the complexities of the global economy. To learn more about how trade wars and other factors affect gold prices and to make informed investment decisions regarding gold bullion, continue your research and stay updated on market trends. Consider diversifying your portfolio with gold bullion as a hedge against the uncertainty created by global trade disputes.

Featured Posts

-

Unlocking The Nyt Spelling Bee Hints And Answers For March 25th Puzzle 387

Apr 26, 2025

Unlocking The Nyt Spelling Bee Hints And Answers For March 25th Puzzle 387

Apr 26, 2025 -

Nepotism In Television Examining The Success Of Nepo Babies

Apr 26, 2025

Nepotism In Television Examining The Success Of Nepo Babies

Apr 26, 2025 -

Situatia Critica De La Santierul Naval Mangalia Interventie Solicitata De Sindicat

Apr 26, 2025

Situatia Critica De La Santierul Naval Mangalia Interventie Solicitata De Sindicat

Apr 26, 2025 -

Ajax 125th Anniversary Celebrations Dam Safety Concerns

Apr 26, 2025

Ajax 125th Anniversary Celebrations Dam Safety Concerns

Apr 26, 2025 -

Pentagon Chaos Exclusive Report On Hegseth Leaks And Infighting

Apr 26, 2025

Pentagon Chaos Exclusive Report On Hegseth Leaks And Infighting

Apr 26, 2025