Gold's Unexpected Dip: Two Weeks Of Losses In Early 2025

Table of Contents

The Role of a Strengthening US Dollar

The Dollar's Impact on Gold Prices

Gold, often viewed as a safe-haven asset, has an inverse relationship with the US dollar. A stronger dollar makes gold more expensive for international buyers, thus reducing demand and consequently, the price. This is because gold is priced in US dollars; when the dollar strengthens against other currencies, the price of gold in those currencies rises, making it less affordable and lowering demand.

- During the first two weeks of 2025, the US Dollar Index (DXY) experienced a notable surge, climbing by approximately 3%. This strengthening of the dollar played a significant role in gold's unexpected dip.

- Several factors contributed to this dollar surge. Positive economic data releases in the US, coupled with expectations of continued monetary tightening by the Federal Reserve, boosted investor confidence in the dollar.

- The resulting increase in currency exchange rates made gold less attractive to international investors, contributing significantly to the price decline.

Rising Interest Rates and Their Influence

Increased Interest Rates and Safe-Haven Demand

Rising interest rates impact the allure of gold as a safe-haven asset. Higher rates make alternative investments, like bonds and other fixed-income securities, more appealing. This shift in investor preference away from gold contributes to decreased demand and a subsequent price drop.

- The connection between interest rates, inflation expectations, and gold demand is crucial. When interest rates rise, it often reflects expectations of controlled inflation. This reduces the perceived need for a hedge against inflation, which gold traditionally serves.

- Central banks across the globe, including the Federal Reserve, implemented further interest rate hikes during this period. These hikes signaled a more hawkish monetary policy, indirectly influencing the gold market.

- Consequently, higher bond yields offered a more attractive return compared to the non-yielding gold, diverting investment capital away from the precious metal.

Geopolitical Factors and Market Sentiment

Geopolitical Uncertainty and Gold's Performance

Geopolitical events and the resulting market sentiment significantly influence gold prices. Periods of heightened uncertainty often drive investors towards safe-haven assets like gold. However, a reduction in global tensions or positive geopolitical developments can lead to a decline in gold demand.

- Interestingly, during these two weeks, positive developments in certain geopolitical hotspots were reported, reducing some investor anxiety and consequently reducing the perceived need for a safe-haven asset.

- This shift in market sentiment, fueled by relatively less geopolitical risk, contributed to the downward pressure on gold prices.

- Specific events, such as easing tensions between major global powers or positive economic news from emerging markets, might have played a role in shaping investor optimism and reducing demand for gold.

Technical Analysis and Chart Patterns

Technical Indicators Suggesting a Price Correction

Technical analysis, utilizing indicators like moving averages and the Relative Strength Index (RSI), can provide insights into market trends and potential price corrections. While not the sole cause, these indicators often highlight shifts in momentum and potential turning points.

- During the period of gold's unexpected dip, some technical analysts observed chart patterns suggesting an impending price correction. For example, a bearish head-and-shoulders pattern might have been identified.

- Moving average crossovers and RSI readings below oversold levels could have further reinforced the prediction of a price decline. However, it's important to note that technical analysis is not an exact science.

- While these technical indicators might have hinted at the price correction, they don't fully explain the underlying economic and geopolitical forces driving the decline.

Conclusion: Navigating the Volatility in the Gold Market

Gold's unexpected dip in early 2025 was a result of a confluence of factors: a strengthening US dollar, rising interest rates reducing safe-haven demand, relatively positive geopolitical developments easing market anxieties, and technical indicators suggesting a price correction. Understanding these interconnected elements is critical for investors navigating the gold market's inherent volatility. While the future price of gold remains uncertain, staying informed about these impacting factors is crucial. Continue to monitor gold's unexpected dips and price fluctuations through reliable financial news and analysis to make informed investment decisions. Further research into the intricate interplay of economic and geopolitical events impacting gold prices is highly recommended.

Featured Posts

-

Darjeeling Tea Production Growing Concerns

May 04, 2025

Darjeeling Tea Production Growing Concerns

May 04, 2025 -

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 04, 2025

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 04, 2025 -

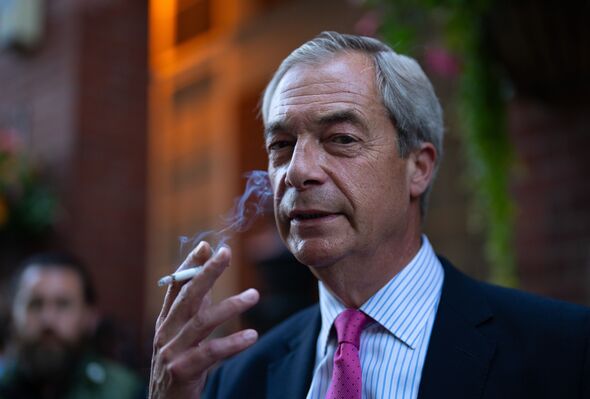

Rupert Lowes Defamation Lawsuit Against Nigel Farage False Allegations

May 04, 2025

Rupert Lowes Defamation Lawsuit Against Nigel Farage False Allegations

May 04, 2025 -

Kivinin Kabugu Yenir Mi Oence Bilmeniz Gerekenler Tam Bir Rehber

May 04, 2025

Kivinin Kabugu Yenir Mi Oence Bilmeniz Gerekenler Tam Bir Rehber

May 04, 2025 -

Lizzo Opens Up About Her Weight Loss A Healthier Lifestyle

May 04, 2025

Lizzo Opens Up About Her Weight Loss A Healthier Lifestyle

May 04, 2025

Latest Posts

-

Ufc 314 Co Main Event Analyzing Chandler Vs Pimblett Odds

May 04, 2025

Ufc 314 Co Main Event Analyzing Chandler Vs Pimblett Odds

May 04, 2025 -

Ufc 314 Suffers Setback Neal Prates Fight Cancelled

May 04, 2025

Ufc 314 Suffers Setback Neal Prates Fight Cancelled

May 04, 2025 -

Chandler Vs Pimblett Ufc 314 Co Main Event Predictions And Betting Odds

May 04, 2025

Chandler Vs Pimblett Ufc 314 Co Main Event Predictions And Betting Odds

May 04, 2025 -

Geoff Neal Vs Carlos Prates Cancellation A Major Blow To Ufc 314

May 04, 2025

Geoff Neal Vs Carlos Prates Cancellation A Major Blow To Ufc 314

May 04, 2025 -

Ufc 314 Co Main Event Chandler Vs Pimblett Odds And Predictions

May 04, 2025

Ufc 314 Co Main Event Chandler Vs Pimblett Odds And Predictions

May 04, 2025