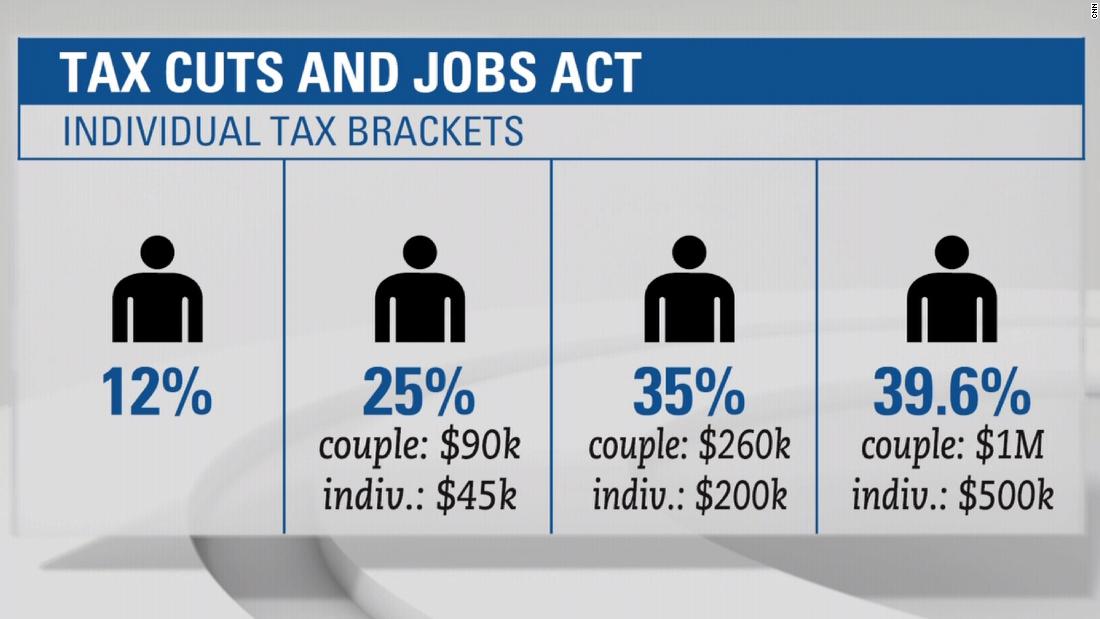

GOP Tax Bill: Conservatives Demand Changes To Medicaid And Clean Energy Provisions

Table of Contents

Medicaid Cuts: A Conservative Revolt?

The GOP tax bill proposes significant reductions in Medicaid funding, potentially amounting to tens of billions of dollars over the next decade. This has sparked a significant backlash from within the conservative movement itself. Many conservatives argue that these cuts are fiscally irresponsible, undermining the social safety net and harming vulnerable populations.

Conservative arguments against the proposed cuts frequently center on the following points:

- Concerns about the impact on vulnerable populations: Reduced Medicaid funding directly impacts access to healthcare for millions of low-income Americans, including children, the elderly, and people with disabilities. This raises serious concerns about health outcomes and exacerbates existing health disparities.

- Arguments against the cost-effectiveness of the proposed cuts: Critics argue that the proposed cuts, while seemingly saving money in the short term, may lead to higher healthcare costs in the long run due to delayed or forgone preventative care, resulting in more expensive emergency room visits and hospitalizations.

- Potential unintended consequences of reduced Medicaid funding: Reduced access to healthcare can lead to worsening chronic conditions, increased mortality rates, and a strain on other parts of the healthcare system. The ripple effect on communities could be substantial.

- Alternative proposals suggested by conservatives: Some conservatives advocate for Medicaid reform focusing on streamlining the system, improving efficiency, and negotiating better drug prices, rather than simply slashing funding. They propose market-based solutions to improve affordability and access.

Keywords: Medicaid reform, healthcare spending, budget cuts, social safety net, conservative opposition, GOP healthcare policy

Clean Energy Provisions: Tax Breaks or Environmental Concerns?

The GOP tax bill includes various provisions impacting clean energy, including tax credits and deductions for renewable energy projects. However, these provisions have drawn significant opposition from some conservatives. The objections are rooted in both fiscal conservatism and ideological concerns about government intervention in the energy market.

Conservatives raise several objections:

- Arguments against government subsidies for renewable energy: Some argue that government subsidies distort the market, picking winners and losers, and that clean energy should stand on its own merits without government support. They champion free-market principles.

- Concerns about the cost of clean energy incentives: Concerns about the overall cost of these incentives to taxpayers are central to the conservative opposition. They argue that the cost outweighs the benefits and that alternative approaches are needed.

- Discussion of market-based alternatives to government intervention: Conservatives often advocate for market-based solutions, such as carbon pricing or deregulation, to encourage the growth of clean energy without direct government subsidies.

- Conservative proposals for changes to clean energy tax provisions: These include either eliminating the existing incentives entirely or replacing them with more targeted and efficient programs.

Keywords: Renewable energy tax credits, clean energy incentives, environmental policy, climate change, fiscal conservatism, tax reform, energy subsidies

The Crossroads of Fiscal Conservatism and Social Policy

The debate over the GOP tax bill highlights a crucial tension within the conservative movement: the balance between fiscal conservatism and social policy. Cutting Medicaid, while seemingly fiscally sound in the short term, clashes with the conservative emphasis on protecting vulnerable populations. This internal conflict creates significant challenges for the party, potentially affecting future elections and political alliances. The implications for the future of the GOP platform are substantial, forcing a reevaluation of its core principles and priorities.

Keywords: Political implications, conservative platform, election strategy, policy debates, social programs

Conclusion: Understanding the Future of the GOP Tax Bill

Conservative opposition to the Medicaid cuts and clean energy provisions within the GOP tax bill reflects deep disagreements within the party regarding the appropriate role of government in healthcare and the energy sector. These disagreements are not merely policy debates; they represent fundamental ideological clashes that will shape the party's future. The GOP tax bill’s implications for Medicaid and clean energy provisions are far-reaching and will continue to be debated for months to come.

To engage with this critical issue, we encourage readers to research the bill's details, contact their elected representatives to voice their concerns, and stay informed about the evolving debate surrounding the GOP tax bill. Understanding the nuances of this complex legislation and its potential consequences is crucial for shaping a responsible and effective future for American policy. The future of the GOP tax bill, and its impact on Medicaid and clean energy, hinges on ongoing dialogue and informed engagement from citizens.

Featured Posts

-

9 11 The Untold Story Of A Man Engulfed In Flames Netflix

May 18, 2025

9 11 The Untold Story Of A Man Engulfed In Flames Netflix

May 18, 2025 -

Evaluating The Brooklyn Bridge A Comprehensive Structural Review

May 18, 2025

Evaluating The Brooklyn Bridge A Comprehensive Structural Review

May 18, 2025 -

Doom The Dark Ages Why It Appeals To Diverse Players

May 18, 2025

Doom The Dark Ages Why It Appeals To Diverse Players

May 18, 2025 -

Michael Confortos Hot Streak Continues In Dodgers Victory Over Mariners

May 18, 2025

Michael Confortos Hot Streak Continues In Dodgers Victory Over Mariners

May 18, 2025 -

Poker Stars Casino How To Participate In The St Patricks Day Spin Of The Day

May 18, 2025

Poker Stars Casino How To Participate In The St Patricks Day Spin Of The Day

May 18, 2025

Latest Posts

-

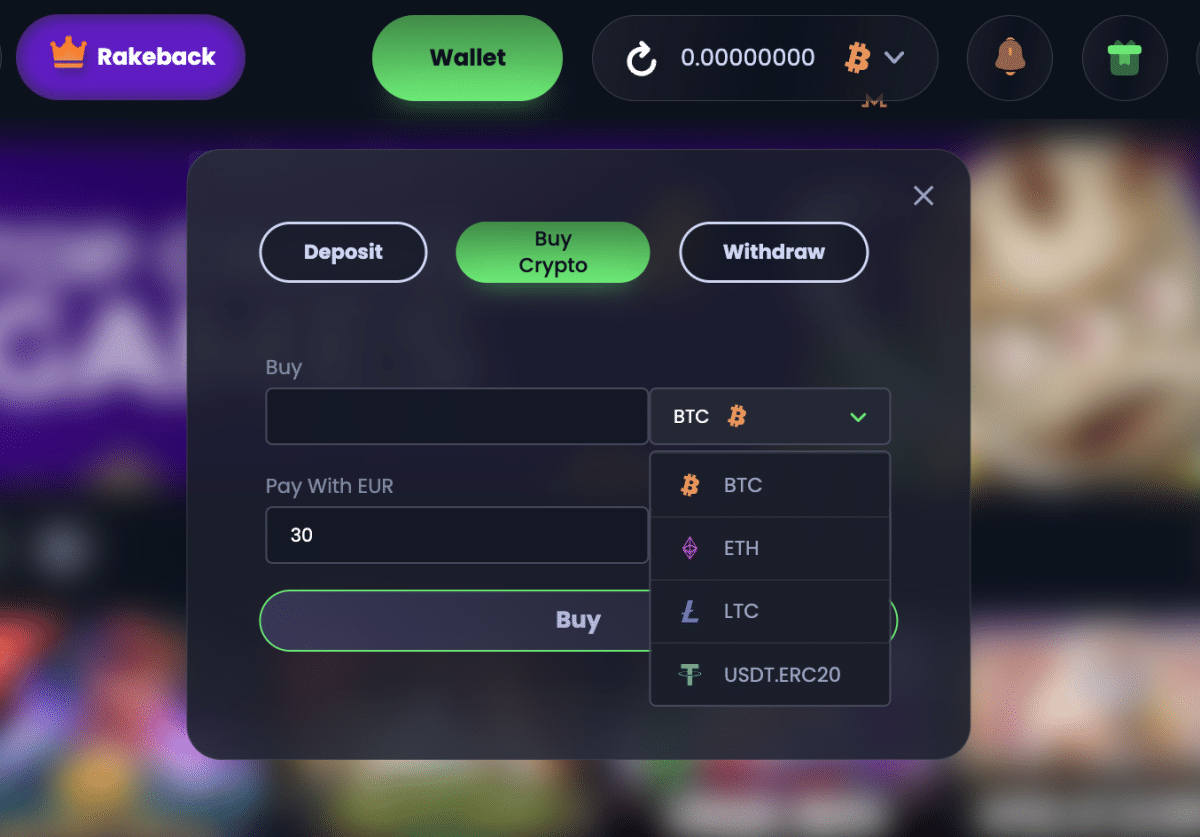

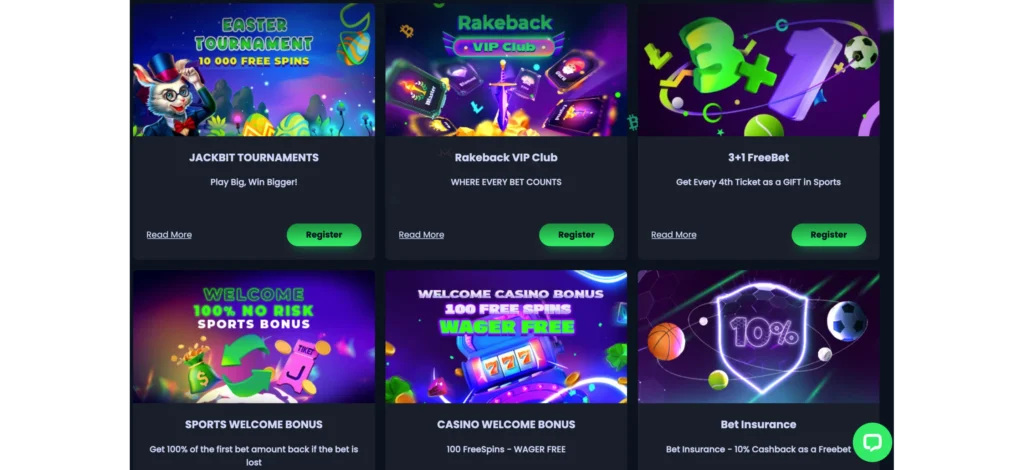

Jackbit Casino Instant Withdrawals And Top Crypto Gaming

May 18, 2025

Jackbit Casino Instant Withdrawals And Top Crypto Gaming

May 18, 2025 -

Best Bitcoin Casino Jackbit Review And Instant Withdrawal Guide

May 18, 2025

Best Bitcoin Casino Jackbit Review And Instant Withdrawal Guide

May 18, 2025 -

Jackbit Best Crypto Casino With Instant Withdrawals

May 18, 2025

Jackbit Best Crypto Casino With Instant Withdrawals

May 18, 2025 -

Review Of The Best Bitcoin Casinos For 2025 A Players Perspective

May 18, 2025

Review Of The Best Bitcoin Casinos For 2025 A Players Perspective

May 18, 2025 -

Choosing The Best Bitcoin Casino For 2025 Safety Games And Bonuses

May 18, 2025

Choosing The Best Bitcoin Casino For 2025 Safety Games And Bonuses

May 18, 2025