GOP Tax Plan: Does It Really Cut The Deficit? A Mathematical Look

Table of Contents

Projected Revenue Changes Under the GOP Tax Plan

The GOP tax plan significantly altered individual and corporate tax rates and various deductions and credits. Let's analyze the projected revenue changes resulting from these modifications.

Individual Tax Rate Reductions

The plan lowered individual income tax rates across several brackets. This resulted in a substantial decrease in projected federal revenue.

- Specific Tax Bracket Changes: The plan significantly reduced the highest tax brackets, while also making changes to lower brackets. The exact percentage changes varied depending on the specific bracket.

- Estimated Revenue Loss per Bracket: Detailed analysis from the Congressional Budget Office (CBO) and other independent organizations revealed substantial revenue losses in each affected bracket, disproportionately benefiting high-income earners. Precise figures are available in their reports.

- Effect on High-Income Earners vs. Low-Income Earners: The tax cuts disproportionately benefited high-income earners. While lower-income individuals also received tax cuts, the percentage reductions and overall dollar amounts were significantly smaller compared to those for high-income earners. This created a debate regarding income inequality and fairness.

Corporate Tax Rate Cuts

A dramatic reduction in the corporate tax rate was a central feature of the GOP tax plan. This measure aimed to boost corporate investment and job creation.

- Changes to the Corporate Tax Rate: The corporate tax rate was significantly lowered, from a higher rate to a considerably lower one.

- Estimated Revenue Loss: This reduction resulted in a substantial projected loss in corporate tax revenue for the federal government. Quantifiable estimates were provided by the CBO and other independent economic organizations.

- Potential Impact on Corporate Investment and Job Creation: Proponents argued that this reduction would encourage businesses to increase investment and hiring. However, critics questioned the extent to which these benefits would materialize and whether the revenue loss would offset the potential gains. Empirical evidence from past corporate tax cuts offers mixed results, which we'll discuss further below.

Changes to Deductions and Credits

The GOP tax plan also altered several key tax deductions and credits, impacting government revenue.

- Examples of Deductions and Credits Affected: Notable changes included modifications to the state and local tax (SALT) deduction and the standard deduction. The mortgage interest deduction also underwent some alterations.

- Their Impact on Revenue: These changes, while intended to simplify the tax code in some cases, also contributed to overall revenue reduction. The elimination or limitation of certain deductions resulted in increased taxable income for some individuals and businesses. The introduction of new credits, however, could have offset some of this increased tax revenue. This created a complex interplay impacting the overall fiscal picture.

Economic Growth Projections and Their Impact on the Deficit

A key argument in favor of the GOP tax plan centered on the idea that tax cuts would spur economic growth and generate increased tax revenue. However, this claim requires careful examination.

Supply-Side Economics Argument

The plan's supporters relied on supply-side economics, arguing that lower taxes would incentivize increased investment, production, and employment, ultimately leading to higher tax revenue.

- Key Assumptions of Supply-Side Economics: These assumptions include the responsiveness of investment and labor supply to tax changes, and the effectiveness of trickle-down economics.

- Expected Rate of Economic Growth: The projected rate of economic growth needed to offset the revenue losses from the tax cuts was substantial.

- Projected Increase in Tax Revenue: This projection, however, was contingent on the validity of the supply-side assumptions and was disputed by many economists.

Dynamic Scoring vs. Static Scoring

Estimating the impact of tax cuts involves two distinct approaches: static and dynamic scoring.

- Definition of Static and Dynamic Scoring: Static scoring assumes no change in economic behavior in response to tax changes, while dynamic scoring incorporates behavioral changes into the projections.

- Strengths and Weaknesses of Each Method: Static scoring is simpler but may underestimate the potential impact of tax cuts on revenue, while dynamic scoring is more complex and relies on uncertain assumptions about economic responsiveness.

- Implications for Deficit Projections: The choice of scoring method significantly impacts the projected deficit. Dynamic scoring, which proponents of the tax plan often favor, typically produces more optimistic deficit projections.

Empirical Evidence from Past Tax Cuts

Examining the impact of past tax cuts provides valuable insights, although direct comparisons are imperfect.

- Examples of Past Tax Cuts: Several instances of past tax cuts, both at the federal and state levels, can be examined.

- Their Effects on Economic Growth and the Deficit: The effects have been varied, with some cuts resulting in increased growth and others failing to significantly boost the economy or even leading to increased deficits.

- Lessons Learned: These historical experiences highlight the inherent uncertainties involved in predicting the impact of tax cuts and the importance of considering various factors beyond simple supply-side predictions.

Alternative Analyses and Criticisms of the GOP Tax Plan

Independent analyses and criticisms offer crucial context for evaluating the plan's projected impact.

Independent Analyses

Several reputable organizations, such as the Tax Policy Center and the Committee for a Responsible Federal Budget, produced independent analyses of the GOP tax plan.

- Key Findings from Different Analyses: These analyses often differed in their projections of revenue loss and economic growth, highlighting the inherent uncertainties involved.

- Areas of Agreement and Disagreement: While there might have been agreements on certain aspects, significant disagreements often existed regarding the magnitude of economic effects and their impact on the deficit.

Criticisms and Counterarguments

Criticisms of the plan centered on the magnitude of the projected revenue loss, the disproportionate benefits to high-income earners, and the questionable assumptions underlying the dynamic scoring used to justify the plan.

- Examples of Criticisms: These criticisms frequently pointed out that the projected economic growth was overly optimistic and that the benefits would not be evenly distributed.

- Rebuttals and Counterarguments: Proponents of the plan often countered these criticisms by emphasizing the potential for long-term economic benefits and the importance of simplifying the tax code. However, strong evidence supporting these counterarguments was often lacking.

Conclusion

This mathematical look at the GOP tax plan reveals a complex picture. While proponents argue that tax cuts will stimulate economic growth and ultimately reduce the deficit, the actual impact remains highly debated. The projected revenue losses from lower tax rates are significant, and the extent to which economic growth will offset these losses is uncertain. Different scoring methods yield different results, and historical evidence offers mixed results. A thorough analysis requires considering various economic models, acknowledging the limitations of each, and carefully reviewing independent assessments. To form your own informed opinion on the GOP tax plan's effect on the deficit, it is crucial to delve deeper into the data and consider multiple perspectives. Further research on the GOP tax plan and its projected impact on the national deficit is strongly encouraged.

Featured Posts

-

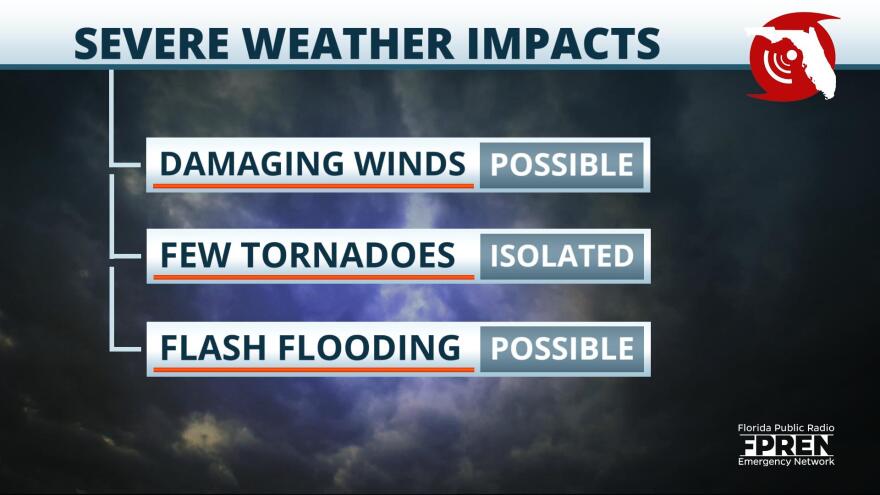

Fast Moving Storms Assessing The Risk Of Damaging Winds

May 20, 2025

Fast Moving Storms Assessing The Risk Of Damaging Winds

May 20, 2025 -

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025 -

Fremantle Q1 Revenue 5 6 Drop Due To Buyer Budget Cuts

May 20, 2025

Fremantle Q1 Revenue 5 6 Drop Due To Buyer Budget Cuts

May 20, 2025 -

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy

May 20, 2025

Moysiki Bradia Synaylia Kathigiton Dimotikoy Odeioy Rodoy

May 20, 2025 -

El Viaje En Helicoptero De Michael Schumacher De Mallorca A Suiza

May 20, 2025

El Viaje En Helicoptero De Michael Schumacher De Mallorca A Suiza

May 20, 2025