Gridlock On Capitol Hill: GOP Tax Bill Snagged By Conservative Demands

Table of Contents

Conservative Demands Fueling the Gridlock

The core issue lies in the disagreements between the Republican party's leadership and its conservative wing regarding the specifics of the proposed tax cuts. Conservative objections center on several key points, arguing that the current bill doesn't go far enough in achieving their goals. These demands are directly contributing to the legislative stalemate.

- Lower individual income tax rates: Conservatives are pushing for even steeper reductions in individual income tax rates than those currently proposed, arguing for a significant tax cut for high-income earners.

- Elimination of specific tax deductions: Certain deductions, viewed as loopholes by conservatives, are targeted for elimination to offset the cost of other tax cuts. This has led to intense lobbying from affected groups.

- Increased spending on defense: A substantial increase in defense spending is a key demand, further complicating fiscal balancing within the bill.

- Reduced federal debt: Despite the proposed tax cuts, conservatives insist on a commitment to reducing the federal debt, creating a tension between tax cuts and fiscal responsibility.

Key conservative figures, including influential members of the House Freedom Caucus, wield considerable power and are actively lobbying for these changes. Their influence is palpable, and their resistance to the current version of the bill is a major driver of the gridlock. [Link to relevant news source 1] [Link to relevant news source 2]

The Impact of Intra-Party Divisions

The current situation highlights the deep divisions within the Republican party itself. These internal conflicts are directly hindering the passage of the GOP tax bill and threatening the party's legislative agenda.

- Moderate Republicans seeking compromise: A faction of moderate Republicans is pushing for a more moderate approach, prioritizing compromise and a bipartisan solution. They are concerned about the potential economic consequences of excessively aggressive tax cuts.

- Hardline conservatives pushing for stricter measures: The hardline conservatives, on the other hand, remain steadfast in their demands for deeper tax cuts and are unwilling to compromise. They view any concessions as a betrayal of their core principles.

- The role of party leadership in navigating these divisions: Republican leadership faces the challenging task of balancing the demands of these competing factions, a task that has so far proven insurmountable.

This Republican infighting has created a legislative stalemate, with significant consequences for the party's overall agenda. The failure to pass the GOP tax bill could have a devastating effect on their chances in the upcoming midterm elections, potentially leading to a loss of control in Congress.

Potential Outcomes and Next Steps

Several scenarios could unfold in the coming weeks and months. The path forward remains uncertain, with the potential for significant political fallout.

- Compromise leading to a revised bill: Negotiations and compromises might result in a revised version of the GOP tax bill, incorporating some of the conservative demands while addressing concerns raised by moderate Republicans.

- Failure to pass the bill, resulting in political fallout: The inability to reach a consensus could lead to the bill's failure, resulting in significant political ramifications for the Republican party.

- Delaying tactics and potential impact on upcoming elections: Delaying tactics employed by either side could significantly impact the timing of the bill's passage and its potential influence on the upcoming midterm elections.

Possible future legislative actions include further negotiations, compromises between different factions within the Republican party, and the potential introduction of a revised GOP tax bill. The political consequences of each scenario are far-reaching and could profoundly impact the upcoming midterm elections and the future of the Republican party.

Conclusion: The Future of the GOP Tax Bill and Capitol Hill Gridlock

The current gridlock on Capitol Hill, primarily driven by conservative demands, casts a long shadow over the future of the GOP tax bill. The internal divisions within the Republican party, coupled with the unwavering stance of conservative factions, have created a significant obstacle to the bill's passage. The consequences of failure extend far beyond the bill itself, potentially impacting the economic outlook and the political landscape of the nation. The ongoing saga of the GOP tax bill and the resulting Capitol Hill gridlock warrants continued attention. Stay tuned for updates on this evolving situation and its impact on the upcoming elections and the national agenda. Stay informed about the future of the GOP tax bill and the political maneuvering on Capitol Hill.

Featured Posts

-

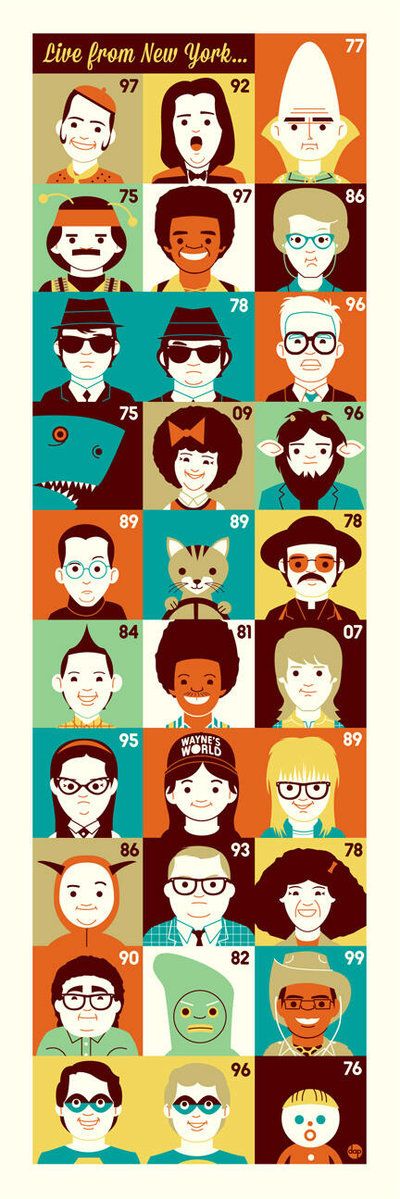

Ego Nwodims Snl Sketch Goes Wrong Audience Reacts

May 18, 2025

Ego Nwodims Snl Sketch Goes Wrong Audience Reacts

May 18, 2025 -

Explore Taylor Swifts Stunning Eras Tour Outfits Detailed Photo Gallery

May 18, 2025

Explore Taylor Swifts Stunning Eras Tour Outfits Detailed Photo Gallery

May 18, 2025 -

Former Red Sox Closers Free Agency Decision An Inside Look

May 18, 2025

Former Red Sox Closers Free Agency Decision An Inside Look

May 18, 2025 -

Turning Renovation Nightmares Into Dreams The Power Of A House Therapist

May 18, 2025

Turning Renovation Nightmares Into Dreams The Power Of A House Therapist

May 18, 2025 -

Amanda Bynes Only Fans A Controversial New Venture

May 18, 2025

Amanda Bynes Only Fans A Controversial New Venture

May 18, 2025

Latest Posts

-

Stephen Miller Eyed For National Security Advisor Role Amidst Waltz Speculation

May 18, 2025

Stephen Miller Eyed For National Security Advisor Role Amidst Waltz Speculation

May 18, 2025 -

Understanding The Dying For Sex Clasp Michelle Williams Perspective

May 18, 2025

Understanding The Dying For Sex Clasp Michelle Williams Perspective

May 18, 2025 -

Snls Signal Group Chat Sketch Features Mikey Madison And Government Officials

May 18, 2025

Snls Signal Group Chat Sketch Features Mikey Madison And Government Officials

May 18, 2025 -

Snl Spoofs Signal Leak With Mikey Madison Texting Government Officials

May 18, 2025

Snl Spoofs Signal Leak With Mikey Madison Texting Government Officials

May 18, 2025 -

Michelle Williams Clarifies Dying For Sex Scene With Marcello Hernandez

May 18, 2025

Michelle Williams Clarifies Dying For Sex Scene With Marcello Hernandez

May 18, 2025