Grim Retail Sales: Are Rate Cuts Coming? Economists Weigh In

Table of Contents

Analyzing the Grim Retail Sales Data

Key Indicators of Weakness

Recent retail sales figures paint a concerning picture. Key indicators point to a significant slowdown in consumer spending, raising serious concerns about the overall health of the economy.

- Sales Volume: Preliminary estimates suggest a [insert percentage]% drop in overall retail sales volume compared to the same period last year. This marks the [insert description, e.g., steepest decline] in [insert timeframe].

- Consumer Spending: Consumer spending, a major driver of economic growth, has fallen sharply, indicating a decline in consumer confidence and purchasing power. This is further evidenced by a drop in [mention specific spending categories like clothing, durables, etc. and provide percentages if available].

- Struggling Retail Sectors: The decline isn't uniform across all sectors. Hardest hit are [mention specific sectors like department stores, electronics retailers etc.] which have seen sales plummet by [insert percentage] or more. For example, [mention a specific retailer and the challenges they face].

This widespread weakness in the retail sector reflects a broader trend of decreased consumer confidence and spending habits. Understanding the underlying causes is crucial to formulating effective policy responses.

Underlying Causes of the Decline

Several interconnected factors are contributing to the grim retail sales data.

- Inflationary Pressures: Persistently high inflation continues to erode purchasing power, forcing consumers to cut back on discretionary spending. The rising cost of essential goods and services leaves less money for non-essential purchases.

- Rising Interest Rates: Recent interest rate hikes by central banks, aimed at curbing inflation, have increased borrowing costs for businesses and consumers. This has dampened investment and consumer spending, exacerbating the slowdown.

- Recessionary Risks: Growing fears of a potential recession are causing consumers to adopt a more cautious approach to spending. Uncertainty about the future is prompting many to save rather than spend.

- Changing Consumer Behavior: Shifts in consumer preferences and spending habits, driven by factors like e-commerce growth and changing demographics, are also playing a role.

Economists' Predictions: Rate Cuts on the Horizon?

The grim retail sales figures have sparked intense debate among economists regarding the need for interest rate cuts.

Arguments for Rate Cuts

Many economists argue that rate cuts are necessary to stimulate economic activity and prevent a deeper downturn.

- Stimulating the Economy: They believe that lower interest rates would encourage borrowing, investment, and consumer spending, boosting economic growth.

- Quantitative Easing: Some advocate for additional quantitative easing measures to inject liquidity into the markets.

- Inflation Targeting: Others argue that the current inflationary pressures are easing, making rate cuts a viable option without risking further inflation.

- Expert Opinions: [Quote a prominent economist who supports rate cuts and summarize their reasoning].

Arguments Against Rate Cuts

However, other economists caution against premature rate cuts, citing potential risks.

- Inflationary Risks: They worry that rate cuts could reignite inflationary pressures, undoing the progress made in bringing inflation under control.

- Long-Term Economic Growth: Premature cuts could jeopardize long-term economic growth by undermining confidence in central bank policies.

- Market Stability: Sudden rate cuts could also create market volatility and uncertainty.

- Expert Opinions: [Quote a prominent economist who opposes rate cuts and summarize their reasoning].

The Market's Reaction to Grim Retail Sales

The grim retail sales data has had a significant impact on financial markets.

Stock Market Performance

Stock markets have reacted negatively to the weak retail sales figures, reflecting investor concerns about the economic outlook. Major indices like the [mention specific indices, e.g., Dow Jones Industrial Average, S&P 500] have experienced [describe the market movement, e.g., declines] in recent days. Investor sentiment is currently [describe investor sentiment, e.g., pessimistic].

Impact on the Bond Market

Bond yields have [describe the movement, e.g., fallen] following the release of the grim retail sales data, suggesting that investors anticipate potential interest rate cuts. The spread between different types of bonds has also narrowed, indicating a shift in investor expectations.

Conclusion: Grim Retail Sales and the Outlook for Rate Cuts

The weak retail sales data paints a concerning picture of the current economic climate. While some economists advocate for rate cuts to stimulate the economy, others express concerns about the potential inflationary risks. The market's reaction reflects this uncertainty, with stock prices declining and bond yields falling. The likelihood of rate cuts remains uncertain, dependent on further economic data and the evolving assessment of inflation and growth prospects.

Stay tuned for further updates as we continue to monitor grim retail sales figures and the potential impact on interest rate decisions. Understanding the evolving situation surrounding grim retail sales and potential rate cuts is crucial for both businesses and consumers. [Link to related articles/resources].

Featured Posts

-

Wildfire Betting A Reflection Of Modern Societys Response To Disaster In Los Angeles

Apr 29, 2025

Wildfire Betting A Reflection Of Modern Societys Response To Disaster In Los Angeles

Apr 29, 2025 -

Mets Rotation Battle Has Pitchers Name Earned A Spot

Apr 29, 2025

Mets Rotation Battle Has Pitchers Name Earned A Spot

Apr 29, 2025 -

Report Country Music Icons Son Not In Wifes Care

Apr 29, 2025

Report Country Music Icons Son Not In Wifes Care

Apr 29, 2025 -

Trump Administration Threatens Harvard Universitys Federal Funding Court Case Details

Apr 29, 2025

Trump Administration Threatens Harvard Universitys Federal Funding Court Case Details

Apr 29, 2025 -

The Impact Of Snow Tornadoes And Historic Flooding On Louisville In 2025

Apr 29, 2025

The Impact Of Snow Tornadoes And Historic Flooding On Louisville In 2025

Apr 29, 2025

Latest Posts

-

The Porsche Puzzle Why Australias Enthusiasm Lags Behind

Apr 29, 2025

The Porsche Puzzle Why Australias Enthusiasm Lags Behind

Apr 29, 2025 -

Dsv Leoben Neues Trainerteam Fuer Die Regionalliga Mitte

Apr 29, 2025

Dsv Leoben Neues Trainerteam Fuer Die Regionalliga Mitte

Apr 29, 2025 -

Is Australia Missing Out Exploring The Global Love For This Porsche

Apr 29, 2025

Is Australia Missing Out Exploring The Global Love For This Porsche

Apr 29, 2025 -

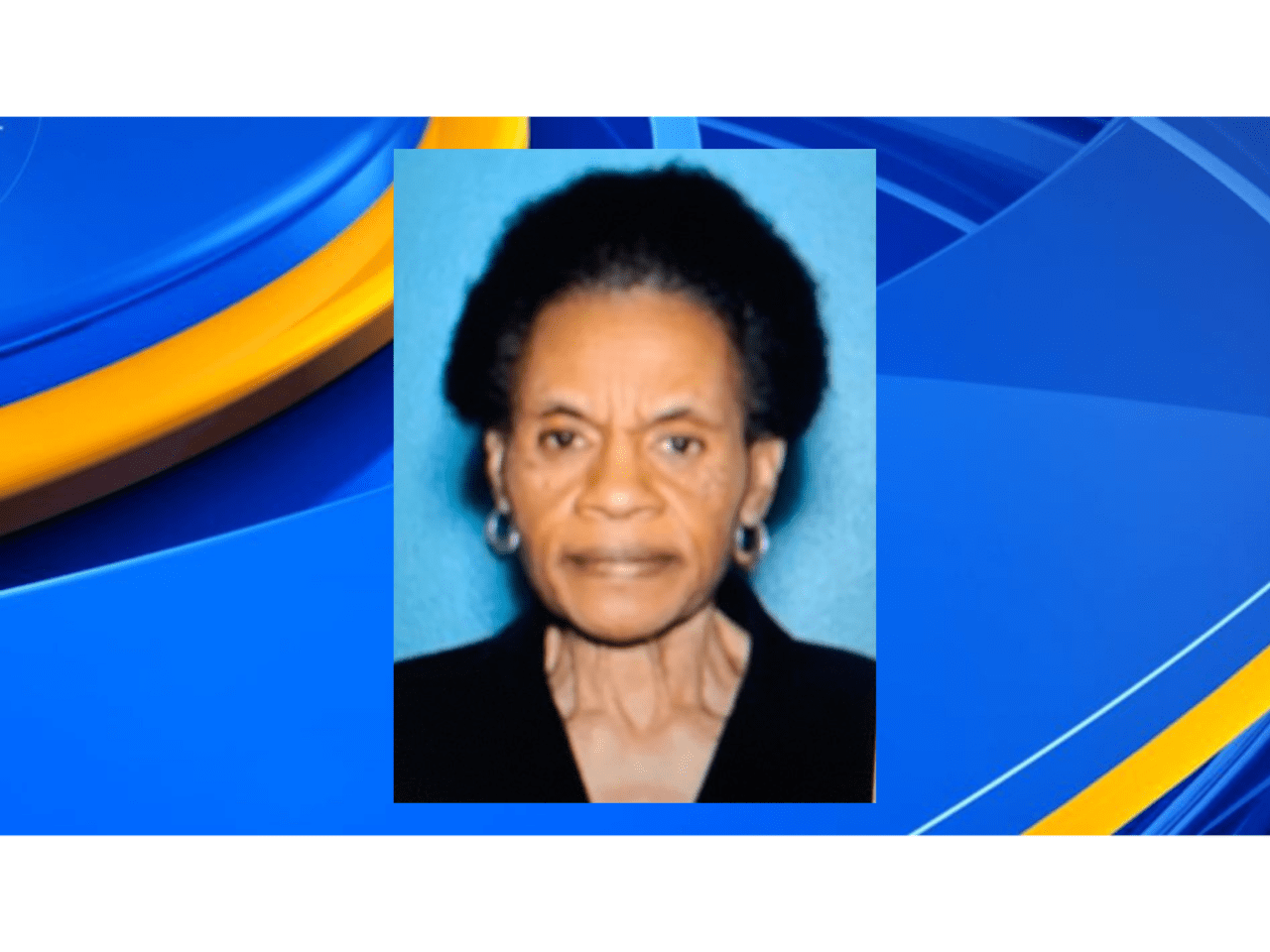

Missing Person British Paralympian Last Seen In Las Vegas Over A Week Ago

Apr 29, 2025

Missing Person British Paralympian Last Seen In Las Vegas Over A Week Ago

Apr 29, 2025 -

Seven Days Missing Las Vegas Police Investigate Paralympians Disappearance

Apr 29, 2025

Seven Days Missing Las Vegas Police Investigate Paralympians Disappearance

Apr 29, 2025