Hanwha And OCI Aim For Larger Solar Market Share Amidst US Import Duties

Table of Contents

Hanwha's Strategic Response to US Import Tariffs

Hanwha, a multinational conglomerate with a significant presence in the solar industry, has adopted a multi-pronged approach to counteract the impact of US import duties. This strategy focuses on bolstering domestic manufacturing, leveraging technological advantages, and diversifying its product portfolio and customer base.

Increased Domestic Manufacturing and Investment

Hanwha's commitment to US-based manufacturing is evident in its substantial investments in domestic solar facilities. This includes:

- [Specific project 1: e.g., Investment in a new solar panel manufacturing plant in Georgia, creating X number of jobs.]

- [Specific project 2: e.g., Partnership with a US-based company to produce key solar components domestically.]

- [Specific project 3: e.g., Expansion of existing facilities to increase production capacity by X%.]

This strategy significantly reduces Hanwha's reliance on imported components, mitigating the impact of tariffs and fostering economic growth in the US. The increased domestic production also leads to job creation and strengthens the US solar supply chain.

Focus on High-Efficiency Solar Technology

Hanwha's competitive edge lies in its investment in advanced solar panel technology. They are focusing on:

- Higher efficiency solar cells, leading to greater energy output per unit area.

- Increased durability and longevity of their panels, reducing long-term replacement costs.

- Innovative designs that optimize energy production in various climates and conditions.

These technological advantages allow Hanwha to command a premium price, offsetting the increased costs associated with tariffs and attracting customers seeking high-performance solar solutions.

Diversification of Product Portfolio and Customer Base

Hanwha's strategy extends beyond simply manufacturing solar panels. They are actively pursuing:

- Expansion into residential, commercial, and utility-scale solar projects, catering to a wider range of customers.

- Strategic partnerships with installers and developers to secure projects and expand market reach.

- Aggressive pursuit of large-scale contracts with government agencies and corporations.

This diversified approach reduces the risk associated with relying on a single market segment and strengthens Hanwha's overall position in the US solar market.

OCI's Counter-Strategies to Navigate the Tariff Landscape

OCI, a major producer of polysilicon – a crucial raw material for solar panel manufacturing – employs a different, yet equally effective, strategy to navigate the tariff challenges. Their approach centers around optimizing its supply chain, offering innovative solutions, and forging strong US partnerships.

Polysilicon Production and Supply Chain Optimization

OCI's position as a leading polysilicon producer provides it with significant leverage in the solar supply chain. Their strategies include:

- Investing in efficient and cost-effective polysilicon production facilities.

- Securing long-term supply contracts with key customers, ensuring price stability.

- Developing strategic partnerships with other solar manufacturers to guarantee a reliable supply of polysilicon.

This control over the supply chain helps OCI mitigate the impact of tariffs on its downstream partners and maintain a competitive advantage.

Focus on Innovative Solar Solutions and Value-Added Services

Beyond raw material production, OCI is investing in:

- Research and development of advanced solar technologies, such as next-generation polysilicon and more efficient solar cells.

- Developing value-added services, such as customized solutions and long-term maintenance contracts, to enhance customer loyalty.

- Offering financing options and project development services to facilitate solar adoption.

These value-added offerings differentiate OCI from competitors and justify potentially higher prices due to tariffs.

Strengthening US Partnerships and Local Collaborations

OCI recognizes the importance of building strong relationships within the US solar industry. Their approach involves:

- Collaborations with US-based solar companies and research institutions to develop new technologies and improve manufacturing processes.

- Engagement with local communities to address concerns and build trust.

- Active participation in industry events and advocacy groups to influence policy discussions.

The Broader Implications for the US Solar Industry

The impact of import duties on the US solar market is significant, affecting prices, competition, and job creation. Hanwha and OCI's responses, however, are playing a crucial role in shaping the future of the US solar industry. Their investments in domestic manufacturing and technological innovation are bolstering the domestic supply chain and creating jobs. Government policies and regulations will undoubtedly continue to play a crucial role in the industry's trajectory, influencing investment decisions and market growth. The long-term effects will include greater domestic production capacity, more competitive pricing, and ultimately, increased solar energy adoption across the US.

Conclusion: Hanwha and OCI's Race for US Solar Market Leadership

Hanwha and OCI's strategic responses to US import duties demonstrate their commitment to the US solar market. By investing in domestic manufacturing, innovating in solar technology, and strengthening partnerships, both companies are actively shaping the future of solar energy in the United States. Their actions have significant implications for consumers, businesses, and the environment, driving the transition towards a cleaner energy future. To learn more about Hanwha and OCI's contributions to the US solar market and the ongoing debate surrounding import duties on solar products, [insert link to relevant resources or further reading]. Understanding their strategies is crucial to comprehending the evolving dynamics of the US solar energy landscape and the ongoing race for market leadership within the sector.

Featured Posts

-

Augsburg Op Zoek Naar Vervanger Voor Thorup

May 30, 2025

Augsburg Op Zoek Naar Vervanger Voor Thorup

May 30, 2025 -

Taylor Swift Ticketmaster Queue Your Spot In Line Revealed

May 30, 2025

Taylor Swift Ticketmaster Queue Your Spot In Line Revealed

May 30, 2025 -

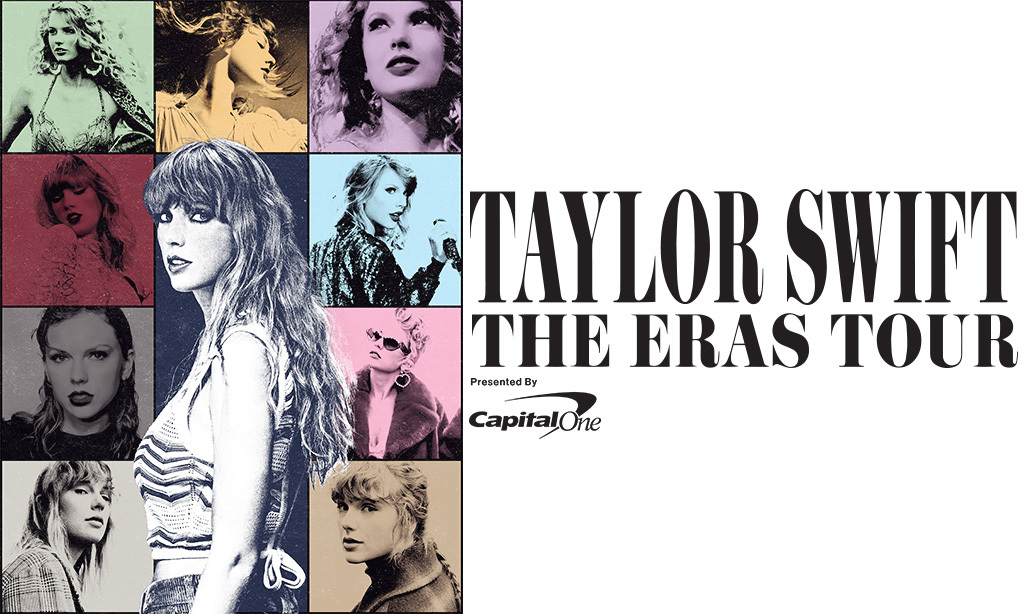

San Diegos Latest Rainfall Totals Cbs 8 Com Weather

May 30, 2025

San Diegos Latest Rainfall Totals Cbs 8 Com Weather

May 30, 2025 -

Alcaraz And Musetti Predicting The 2025 Monte Carlo Masters Final

May 30, 2025

Alcaraz And Musetti Predicting The 2025 Monte Carlo Masters Final

May 30, 2025 -

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 30, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 30, 2025

Latest Posts

-

Sanofi Aktie Rilzabrutinib Erhaelt Orphan Drug Status Kursgewinne Erwartet

May 31, 2025

Sanofi Aktie Rilzabrutinib Erhaelt Orphan Drug Status Kursgewinne Erwartet

May 31, 2025 -

Anticorps Bispecifiques Sanofi Investit Dans L Innovation De Dren Bio

May 31, 2025

Anticorps Bispecifiques Sanofi Investit Dans L Innovation De Dren Bio

May 31, 2025 -

Acquisition Sanofi Dren Bio Nouvelles Perspectives En Immunotherapie

May 31, 2025

Acquisition Sanofi Dren Bio Nouvelles Perspectives En Immunotherapie

May 31, 2025 -

Dren Bio Et Sanofi Partenariat Pour Le Developpement D Anticorps Bispecifiques

May 31, 2025

Dren Bio Et Sanofi Partenariat Pour Le Developpement D Anticorps Bispecifiques

May 31, 2025 -

Sanofi Acquisition D Anticorps Bispecifiques De Dren Bio

May 31, 2025

Sanofi Acquisition D Anticorps Bispecifiques De Dren Bio

May 31, 2025