Harvard, Yale Face Steep Endowment Tax Increase Under New House Proposal

Table of Contents

The Proposed Endowment Tax Increase: Key Details

The proposed legislation aims to impose a significant tax on university endowments exceeding a certain threshold. While the exact details are still being finalized, current proposals suggest a progressive tax structure, with higher tax rates applied to larger endowments. This targets institutions with exceptionally large endowments, aiming to address concerns about wealth inequality within the higher education sector. The legislation specifically targets endowments held by private universities, potentially excluding public institutions.

- Tax rate percentage proposed: Estimates range from 2% to 5% of the endowment value exceeding the threshold. The exact percentage will depend on the final version of the bill.

- Specific dollar amount threshold triggering the tax: The proposed threshold is likely to be set at a high dollar amount, perhaps in the billions, ensuring that only the wealthiest universities are impacted. Specific numbers are still subject to change during legislative review.

- Exemptions (if any): Limited exemptions are being considered, potentially including endowments dedicated solely to specific research areas or those supporting specific types of financial aid.

- Timeline for implementation (if specified): The proposed implementation date is unclear at this stage, but it’s anticipated that if passed, the tax would take effect within a year or two.

Impact on Harvard and Yale's Financial Resources

Harvard and Yale boast some of the largest university endowments globally. Harvard's endowment, for example, is valued in the tens of billions of dollars. A substantial endowment tax increase would significantly reduce their available funds.

The potential reduction in funds could severely impact various aspects of university operations:

-

Financial aid for students: A substantial portion of endowment income funds financial aid programs. A tax increase could force reductions in financial aid packages, limiting access to higher education for many students.

-

Research initiatives and grants: Endowments support crucial research projects and grants, contributing to advancements in various fields. Reduced funding could hinder groundbreaking research and innovation.

-

Campus infrastructure improvements: Maintenance and improvement of campus facilities rely heavily on endowment income. Budget cuts could delay or cancel necessary upgrades.

-

Faculty salaries and recruitment: Attracting and retaining top faculty members requires competitive salaries and benefits. The tax could constrain universities' ability to compete for talent.

-

Estimated dollar amount of tax for Harvard and Yale: The exact amount is difficult to estimate without final legislation but could reach hundreds of millions of dollars annually for each institution.

-

Percentage reduction in endowment value: The percentage reduction will depend on the final tax rate but could represent a significant decline in overall endowment value.

-

Potential impact on financial aid programs (number of affected students): Thousands of students could experience reduced financial aid or lose eligibility altogether.

Broader Implications for Higher Education

The ripple effects of this proposed endowment tax increase extend beyond Harvard and Yale. Other wealthy universities would face similar financial challenges. Smaller universities with less substantial endowments might be indirectly affected as they compete for students, faculty, and research funding.

-

Tuition increases: Universities might respond to reduced endowment income by raising tuition fees, making higher education less accessible for many students.

-

Reduced access to higher education: Increased tuition and reduced financial aid could make higher education unattainable for many, exacerbating existing inequalities.

-

Impact on university research and innovation: Decreased funding for research could slow down scientific advancements and technological innovation, harming the national economy.

-

Potential impact on smaller universities with less substantial endowments: These institutions would face increased competition for students and faculty, potentially impacting their long-term viability.

-

Concerns regarding decreased philanthropic giving: Uncertainty surrounding future taxation policies could deter potential donors from contributing to university endowments.

-

Potential legal challenges to the proposed legislation: Universities may challenge the constitutionality of the tax in court, leading to lengthy legal battles.

Arguments For and Against the Endowment Tax Increase

Arguments in favor of the endowment tax increase emphasize the need to address wealth inequality and ensure a fairer distribution of resources. Proponents argue that these massive endowments represent accumulated wealth that could be used to fund public education initiatives or address social issues.

Counterarguments highlight the potential negative impacts on higher education accessibility, research, and the overall economy. Critics warn that the tax could deter philanthropic giving, hinder research and development, and ultimately limit economic growth.

- Arguments for:

- Addressing wealth inequality.

- Ensuring fairer distribution of resources.

- Funding public education initiatives.

- Arguments against:

- Decreased higher education accessibility.

- Reduced research and development.

- Negative impact on the overall economy.

Political and Economic Considerations

The proposed legislation is currently under review by the House Ways and Means Committee. The political context is crucial; understanding which party sponsors the bill and its level of bipartisan support will help gauge its chances of passage.

The economic ramifications are far-reaching. Decreased charitable giving to universities could harm the economy. Economic models attempting to predict the overall impact are varied and not yet conclusive.

- Name of sponsoring representative/committee: [Insert name of sponsoring representative and committee here—this information needs to be updated based on the current legislative situation]

- Potential for bipartisan support/opposition: [Insert information on current political support here – needs to be updated based on the current legislative situation]

- Predictions of economic models, if available: [Insert information on available economic models and their predictions here – needs to be updated based on the current legislative situation]

Conclusion

The proposed endowment tax increase represents a significant challenge to universities like Harvard and Yale, potentially impacting their financial stability and ability to provide financial aid, fund research, and maintain their infrastructure. The broader implications for higher education and the economy are considerable and require careful consideration. The debate surrounding this legislation highlights fundamental questions about wealth distribution, the role of higher education, and the future of research and innovation.

Call to Action: Stay informed about the ongoing debate surrounding this crucial endowment tax increase and contact your representatives to voice your opinion on this potentially transformative legislation. Understanding the potential ramifications of this proposed endowment tax increase is vital for anyone concerned about the future of higher education.

Featured Posts

-

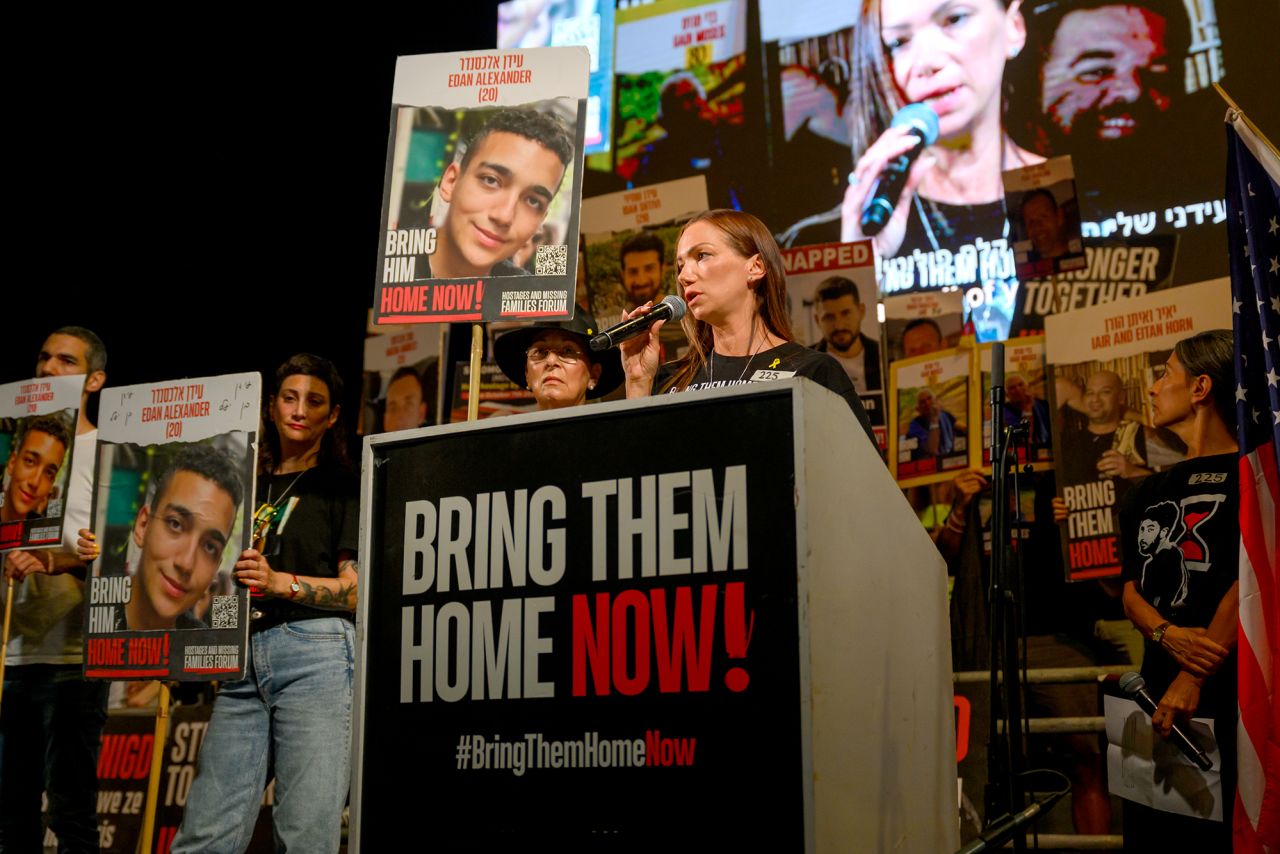

Edan Alexander Updates On The Kidnapping In Gaza

May 13, 2025

Edan Alexander Updates On The Kidnapping In Gaza

May 13, 2025 -

Doom The Dark Ages Xbox Limited Edition Collection Rumor

May 13, 2025

Doom The Dark Ages Xbox Limited Edition Collection Rumor

May 13, 2025 -

Athlitikes Metadoseis Serie A Odigos Gia Toys Agones

May 13, 2025

Athlitikes Metadoseis Serie A Odigos Gia Toys Agones

May 13, 2025 -

District Final Archbishop Bergan Triumphs Over Norfolk Catholic

May 13, 2025

District Final Archbishop Bergan Triumphs Over Norfolk Catholic

May 13, 2025 -

Scarlett Johansson And Chris Evans Hidden Comedy Gem Added To Netflix

May 13, 2025

Scarlett Johansson And Chris Evans Hidden Comedy Gem Added To Netflix

May 13, 2025