Have Trump's Tariffs Bankrupted His Billionaire Friends? A Look At Post-Liberation Day Finances

Table of Contents

The imposition of Trump's tariffs sent shockwaves through the US economy, impacting various sectors and potentially affecting the financial well-being of even the wealthiest individuals. While the stated goal was to protect American industries and jobs, the actual consequences remain a subject of debate. This article delves into the financial impact of "Trump's Tariffs" on his billionaire associates, examining whether these protectionist measures led to significant economic hardship within his inner circle. We will analyze the post-tariff financial performance of key figures, considering both direct and indirect effects.

1. Identifying Trump's Billionaire Network:

Defining "Billionaire Friends":

Defining who constitutes a "billionaire friend" of Trump requires careful consideration. This article focuses on individuals with demonstrable business dealings with Trump, significant political donations to his campaigns, or prominent social connections suggesting a close relationship. This approach excludes individuals who may simply share similar political affiliations but lack a direct, substantial relationship with the former president. Keywords like "Trump's business associates," "wealthy donors," and "Trump's inner circle" will be used to describe this group.

-

Specific Examples: This analysis will consider individuals such as Wilbur Ross (investment banking), Carl Icahn (investment), and others with known ties to Trump and involvement in industries significantly impacted by tariffs. Pre-tariff net worth estimations will be sourced from reputable financial publications like Forbes and Bloomberg.

-

Supporting Details: The nature of their business relationships with Trump—whether through direct investments, contracts, or advisory roles—will be examined to ascertain their potential vulnerabilities to tariff impacts. The extent of their financial interdependence with Trump's business ventures will be a key factor in assessing the potential for financial repercussions.

2. Analyzing the Economic Impact of Tariffs:

Direct Impacts on Specific Industries:

Trump's tariffs heavily impacted industries like steel, aluminum, and agriculture. The repercussions extended to industries indirectly connected, including manufacturing, real estate, and retail, potentially affecting the fortunes of Trump's billionaire associates involved in these sectors.

-

Examples: We'll examine specific companies and their financial performance before and after the tariffs, using data from reliable sources such as SEC filings and financial news outlets. This "Tariff impact analysis" will focus on key metrics like revenue, profit margins, and stock market fluctuations.

-

Supporting Details: Supply chain disruptions caused by increased import costs, heightened production expenses due to tariff-related increases in raw material prices, and shifts in consumer demand due to price increases will all be factored into the analysis. Keywords such as "financial performance," "stock market fluctuations," and "supply chain disruption" will be consistently used throughout this section.

3. Assessing Post-Tariff Financial Performance:

Evaluating the Net Worth of Trump's Associates:

This section will critically examine the reported net worth changes of the identified billionaires following the implementation of Trump's tariffs. Quantifiable data, including specific numbers and percentage changes, will be used to illustrate any financial shifts.

-

Data Presentation: We will present data on the financial performance of companies owned or significantly influenced by Trump's billionaire friends, comparing pre- and post-tariff performance. Keywords like "net worth change," "financial losses," and "economic hardship" will be used to highlight any negative consequences.

-

Supporting Details: It's crucial to acknowledge that factors beyond tariffs could influence net worth. The general economic climate, global events, and internal company decisions must be considered to provide a comprehensive and balanced analysis.

4. Counterarguments and Alternative Perspectives:

Pro-Tariff Arguments:

It is essential to present counterarguments supporting the positive economic effects claimed for Trump's tariffs. Some proponents argue that the tariffs protected domestic industries, stimulated domestic production, and ultimately benefited the US economy.

-

Arguments for Minimal Impact: We will explore arguments suggesting that the tariffs had a minimal or even positive impact on the selected billionaires’ wealth. This could involve claims that diversification of investment portfolios mitigated the risks.

-

Supporting Details: We will reference studies or economic analyses (if available) that support the pro-tariff stance, providing a balanced perspective and acknowledging the complexities of economic impacts. Keywords such as "economic benefits," "protectionism," and "national security" will be used to appropriately contextualize these arguments.

Conclusion:

This analysis explored the complex relationship between Trump's tariffs and the financial well-being of his billionaire friends. While the article meticulously analyzes the post-tariff financial performance, a definitive conclusion on whether Trump's tariffs bankrupted any of his billionaire friends requires further research and data analysis, taking into account many complex variables. The impact varied across individuals and industries, and a simplistic assertion of bankruptcy would be an oversimplification.

Key Takeaways: The financial impact of Trump's tariffs was not uniform. Some individuals experienced negative effects due to supply chain disruptions and increased costs, while others seemingly weathered the storm without significant losses. The overall economic impact of these policies remains a subject of ongoing debate among economists and policy experts.

Call to Action: Further research into the long-term effects of Trump's trade policies is crucial for understanding their broader implications on the American economy and the global trade landscape. Exploring the effects of such policies on different economic groups, investigating similar trade protectionist policies from other countries, and examining the effectiveness of such policies in achieving their stated goals are avenues for further exploration. We encourage readers to delve deeper into the impact of "Trump's tariffs" and "Trump's trade policies" by consulting resources from reputable economic institutions and academic journals. Investigating the "impact of tariffs on billionaires" and "analyzing the effects of Trump's tariffs" further can offer a more complete understanding.

Featured Posts

-

Analysts Reset Palantir Stock Forecast Understanding The Recent Rally

May 10, 2025

Analysts Reset Palantir Stock Forecast Understanding The Recent Rally

May 10, 2025 -

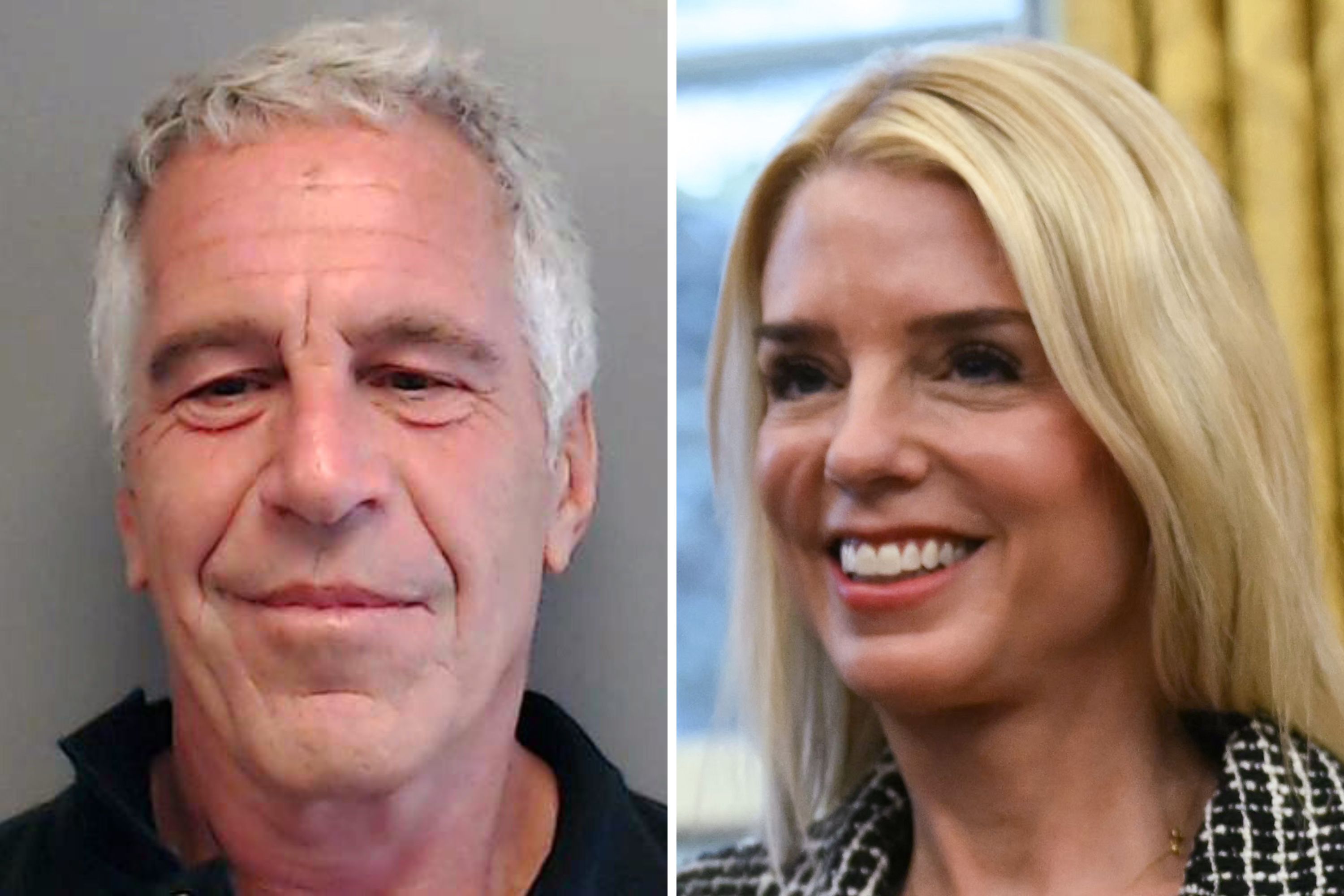

Pam Bondi On Epstein Diddy Jfk And Mlk Documents Release Imminent

May 10, 2025

Pam Bondi On Epstein Diddy Jfk And Mlk Documents Release Imminent

May 10, 2025 -

Palantir And Nato A New Era Of Ai Driven Public Sector Predictions

May 10, 2025

Palantir And Nato A New Era Of Ai Driven Public Sector Predictions

May 10, 2025 -

Lightning Defeat Oilers 4 1 Behind Kucherovs Stellar Performance

May 10, 2025

Lightning Defeat Oilers 4 1 Behind Kucherovs Stellar Performance

May 10, 2025 -

New Details Emerge Leaked Photos Of The Microsoft And Asus Xbox Handheld

May 10, 2025

New Details Emerge Leaked Photos Of The Microsoft And Asus Xbox Handheld

May 10, 2025