Hernando's Economy: How Income Tax Elimination Will Affect Mississippi

Table of Contents

Potential Economic Growth in Hernando Following Income Tax Elimination

Eliminating Mississippi income tax could trigger substantial economic growth in Hernando. This growth would stem from increased investment and population influx.

Increased Investment and Business Development

Lower operational costs resulting from the absence of income tax would make Hernando a highly attractive location for new businesses and industries.

- Attracting new businesses and industries: Reduced tax burdens would incentivize companies to relocate to or establish operations in Hernando, boosting job creation and economic activity. Manufacturing, technology, and logistics are sectors particularly likely to benefit from such a change.

- Increased foreign direct investment (FDI): Hernando could experience a surge in FDI as international companies seek to capitalize on the favorable tax environment. This would further stimulate economic growth and create high-paying jobs.

- Stimulation of entrepreneurship and small business growth in Hernando MS: The lower tax burden would reduce the financial obstacles faced by startups and small businesses, fostering entrepreneurship and creating a more dynamic local economy. This could lead to a diverse range of new businesses contributing to Hernando's economic vitality.

- Examples of thriving industries: The manufacturing sector, particularly industries requiring a large workforce, could see significant expansion. Similarly, the technology sector, particularly companies focused on software development or data centers, might find Hernando an attractive location due to reduced overhead. Logistics and distribution centers could also benefit, drawing from a larger regional workforce and improved transportation access.

Population Growth and Increased Property Values

A reduction in income tax is often associated with population growth as individuals and families seek lower tax burdens.

- Inflow of residents seeking lower tax burdens: Hernando could experience a significant population increase as individuals and families from higher-tax states relocate to Mississippi seeking financial advantages. This increased population will fuel demand for goods and services within the local economy.

- Higher demand for housing, leading to increased property values in Hernando and surrounding areas: Increased population will increase demand for housing, potentially driving up property values and increasing the wealth of existing homeowners.

- Potential strain on infrastructure due to increased population: Rapid population growth could strain existing infrastructure, including roads, schools, and utilities. Planning for infrastructure development to accommodate potential population increases will be crucial for Hernando's long-term success.

- Challenges related to housing affordability and infrastructure development: The influx of new residents could lead to increased competition for housing, potentially driving up rental and housing costs. Ensuring sufficient infrastructure to accommodate the growing population will require strategic planning and investment.

Challenges and Potential Downsides of Income Tax Elimination in Hernando

While income tax elimination offers significant potential upsides, it also presents challenges that require careful consideration.

Impact on Public Services

Reduced state revenue is a primary concern following income tax elimination. This could lead to decreased funding for essential services in Hernando.

- Reduced state revenue impacting funding for essential services like education, healthcare, and infrastructure in Hernando: The loss of income tax revenue would necessitate a significant shift in state and local government budgeting. This could lead to cuts in funding for vital public services, potentially impacting the quality of life in Hernando.

- Potential cuts to public services and their consequences: Cuts in education funding could affect school quality and resources. Reductions in healthcare funding could limit access to healthcare services for residents. Infrastructure development could be delayed or scaled back, impacting the community's long-term growth.

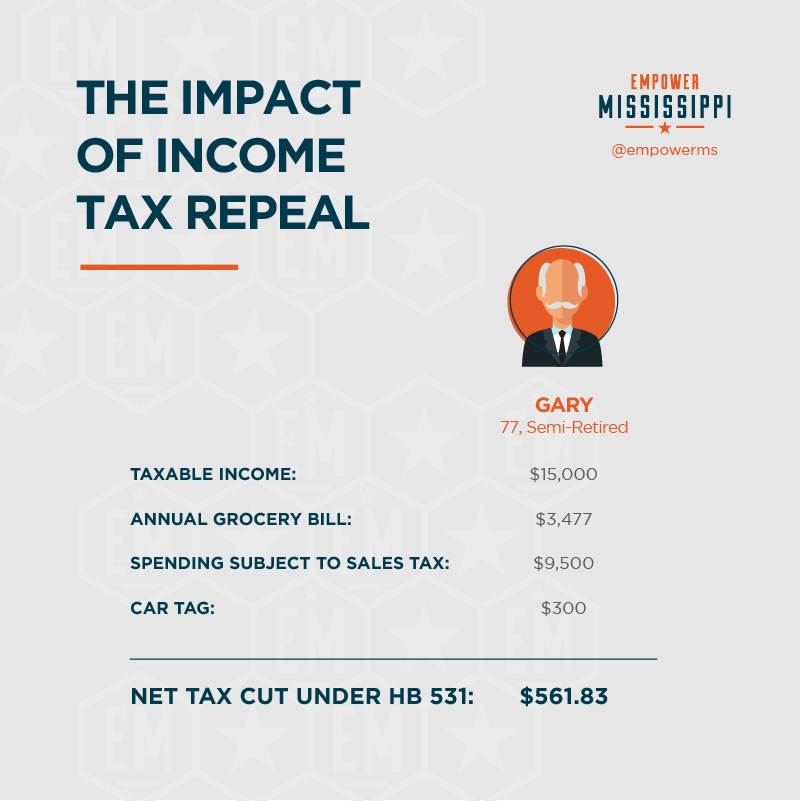

- Potential alternative funding sources (e.g., sales tax increases): To offset the loss of income tax revenue, the state might consider increasing sales taxes or other forms of taxation. This could have a negative impact on consumers and businesses, potentially negating some of the positive economic effects of income tax elimination.

Income Inequality and its Effects

Income tax elimination might disproportionately benefit higher-income earners, potentially exacerbating existing income inequality.

- Analysis of how tax elimination might exacerbate income inequality in Hernando and DeSoto County: Those with higher incomes would experience a greater percentage reduction in their tax burden compared to lower-income earners, leading to an increase in the gap between the rich and the poor.

- Discussion on the potential disproportionate benefits for higher-income earners: Higher-income individuals would retain a larger share of their income after tax, while lower-income individuals might not experience the same level of benefit.

- Potential mitigation strategies to address income inequality: To mitigate the potential for increased inequality, the state could implement targeted programs to assist low- and moderate-income individuals and families. This might include expanded social safety nets, job training programs, and affordable housing initiatives.

Comparative Analysis of Similar Tax Reforms in Other States

Examining similar tax reforms in other states offers valuable insights into potential outcomes in Mississippi.

Success Stories and Case Studies

Several states have successfully implemented income tax reforms. Studying these experiences can illuminate potential benefits for Hernando.

- Examples of states that have successfully implemented similar income tax reforms: States like Florida and Texas, which have no state income tax, offer case studies illustrating the potential long-term effects of such a policy.

- Highlighting positive economic outcomes in those states, relevant to Hernando’s economic context: Analyzing job growth, population growth, and business development in these states provides a framework for projecting potential outcomes in Hernando.

- Comparing and contrasting those states' experiences with Mississippi’s projected scenario: While each state is unique, identifying commonalities and differences can enhance the accuracy of projections for Hernando's economy.

Lessons Learned from Failed Tax Reforms

Conversely, analyzing states where income tax elimination had negative consequences helps avoid potential pitfalls.

- Examples of states where income tax elimination had negative consequences: Examining states that experienced unforeseen economic downturns or challenges following income tax elimination highlights potential risks.

- Analyzing the reasons for failure and their relevance to Mississippi’s economic landscape: Understanding the factors contributing to the failure of income tax reforms in other states helps inform policy decisions in Mississippi.

- Emphasizing the importance of careful planning and implementation to avoid potential pitfalls: Successful implementation of income tax elimination requires comprehensive planning, including addressing potential challenges related to funding public services and mitigating income inequality.

Conclusion

The potential elimination of Mississippi income tax presents a complex picture for Hernando's economy. While it holds the promise of economic growth through increased investment and population, it also poses challenges related to public service funding and income inequality. Comparative analysis of other states' experiences highlights the importance of a well-planned transition.

Call to Action: Understanding the potential impact of Mississippi income tax elimination on Hernando's economy is vital for residents, businesses, and policymakers. Stay informed, participate in community discussions, and advocate for policies ensuring a thriving future for Hernando and Mississippi. Learn more about the projected impacts of Mississippi income tax elimination on Hernando's economy by [link to relevant resource].

Featured Posts

-

Juan Aguilera Recordando Al Primer Espanol En Triunfar En Un Masters 1000

May 19, 2025

Juan Aguilera Recordando Al Primer Espanol En Triunfar En Un Masters 1000

May 19, 2025 -

18 Recursos De Nulidad Plantean Dudas Sobre Las Primarias 2025

May 19, 2025

18 Recursos De Nulidad Plantean Dudas Sobre Las Primarias 2025

May 19, 2025 -

Muere Juan Aguilera El Tenis Espanol Esta De Luto

May 19, 2025

Muere Juan Aguilera El Tenis Espanol Esta De Luto

May 19, 2025 -

Eurovision 2025 The Ultimate Viewers Guide

May 19, 2025

Eurovision 2025 The Ultimate Viewers Guide

May 19, 2025 -

Uber And Heads Up For Tails Partner To Offer Pet Friendly Rides In Delhi And Mumbai

May 19, 2025

Uber And Heads Up For Tails Partner To Offer Pet Friendly Rides In Delhi And Mumbai

May 19, 2025

Latest Posts

-

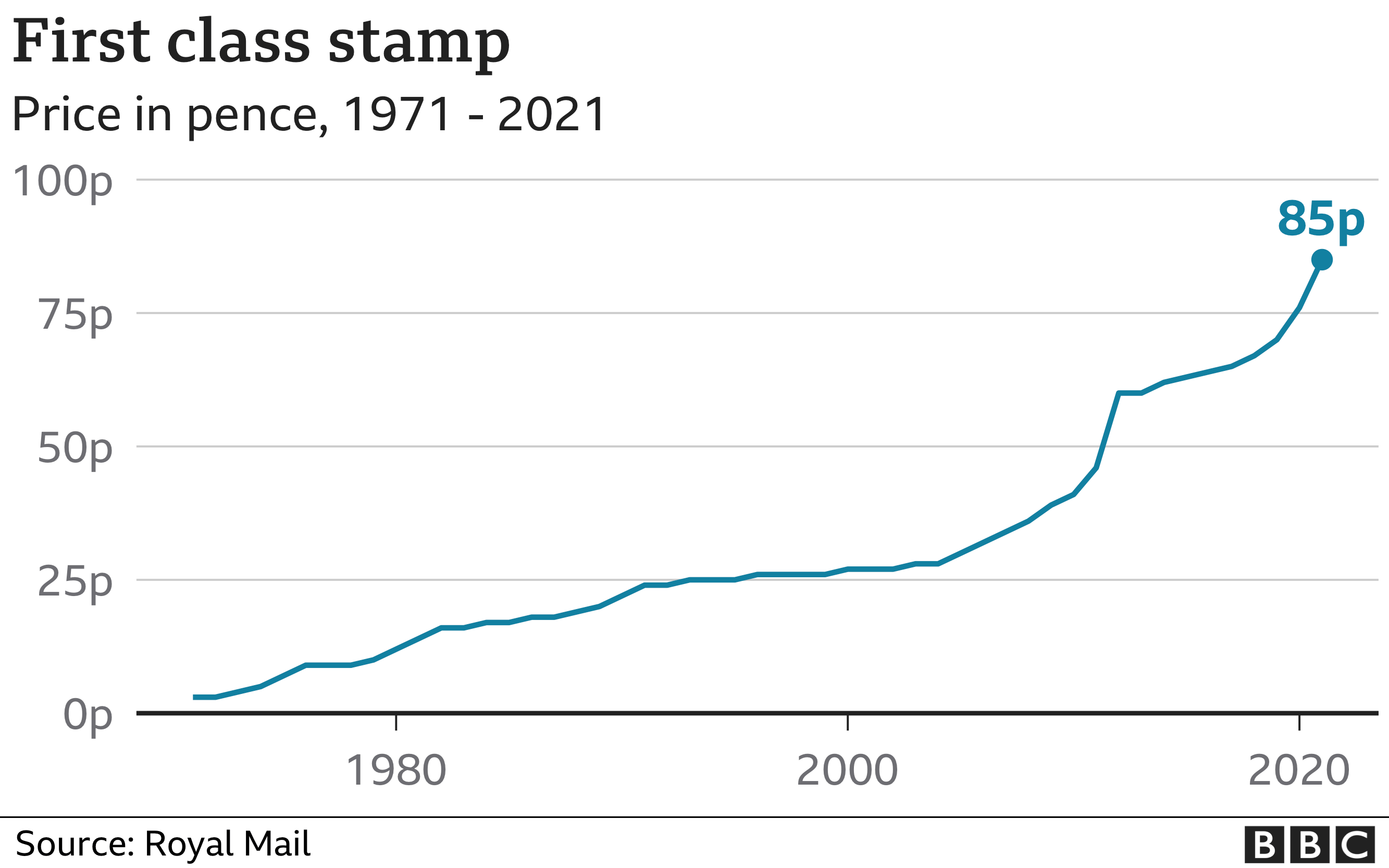

First Class Stamp Price Increase 1 70 And The Impact On Mail Costs

May 19, 2025

First Class Stamp Price Increase 1 70 And The Impact On Mail Costs

May 19, 2025 -

South Londoners Launch Legal Battle Against Brockwell Park Music Festivals

May 19, 2025

South Londoners Launch Legal Battle Against Brockwell Park Music Festivals

May 19, 2025 -

Huge Uk Festivals Future Uncertain Environmental Campaigners Raise 31 000

May 19, 2025

Huge Uk Festivals Future Uncertain Environmental Campaigners Raise 31 000

May 19, 2025 -

Significant First Class Stamp Price Rise To 1 70

May 19, 2025

Significant First Class Stamp Price Rise To 1 70

May 19, 2025 -

Uk Festival Faces Cancellation Amid Environmental Concerns 31 000 Raised In Protest

May 19, 2025

Uk Festival Faces Cancellation Amid Environmental Concerns 31 000 Raised In Protest

May 19, 2025