High Down Payments In Canada: A Barrier To Homeownership

Table of Contents

The Impact of High Down Payments on Affordability

The dream of owning a home in Canada is becoming increasingly elusive, largely due to the substantial down payments required. This section examines the direct correlation between rising housing costs and the ever-increasing down payment hurdle.

Rising Housing Costs and Their Correlation to Down Payments

Canadian home prices have experienced exponential growth in recent years, particularly in major metropolitan areas. This surge in cost directly translates into significantly higher down payment requirements. For example:

- Toronto: Average house prices often exceed $1 million, requiring a down payment of $200,000 or more for a 20% down payment mortgage. A 5% down payment would still necessitate a substantial $50,000 upfront.

- Vancouver: Similar to Toronto, Vancouver's housing market is notoriously expensive, with average prices often exceeding $1.2 million, demanding even larger down payments.

- Calgary: While generally more affordable than Toronto and Vancouver, Calgary still faces increasing housing costs, meaning down payments remain a significant barrier for many.

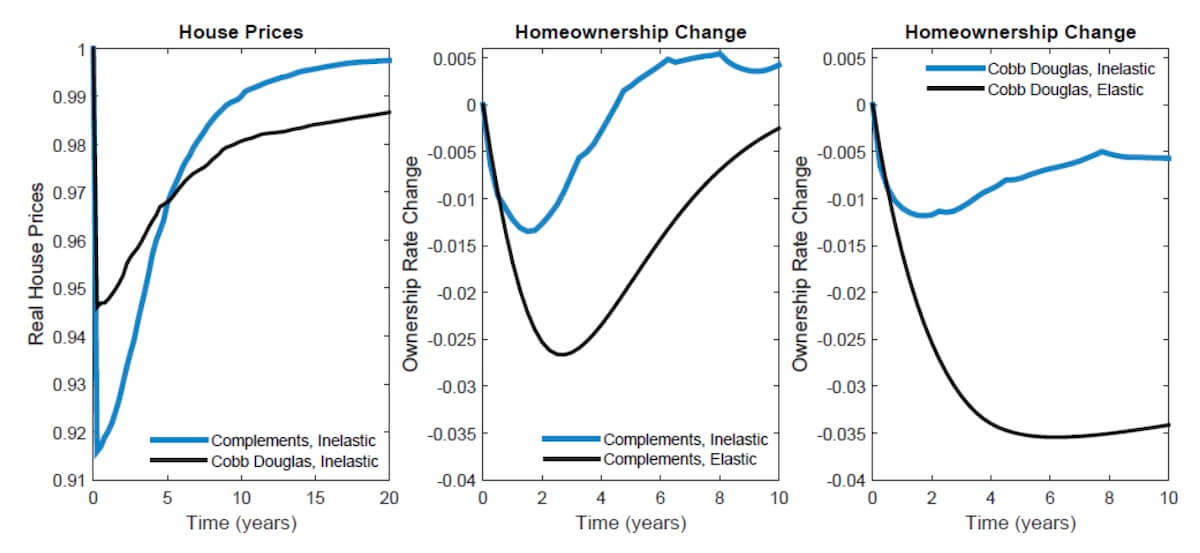

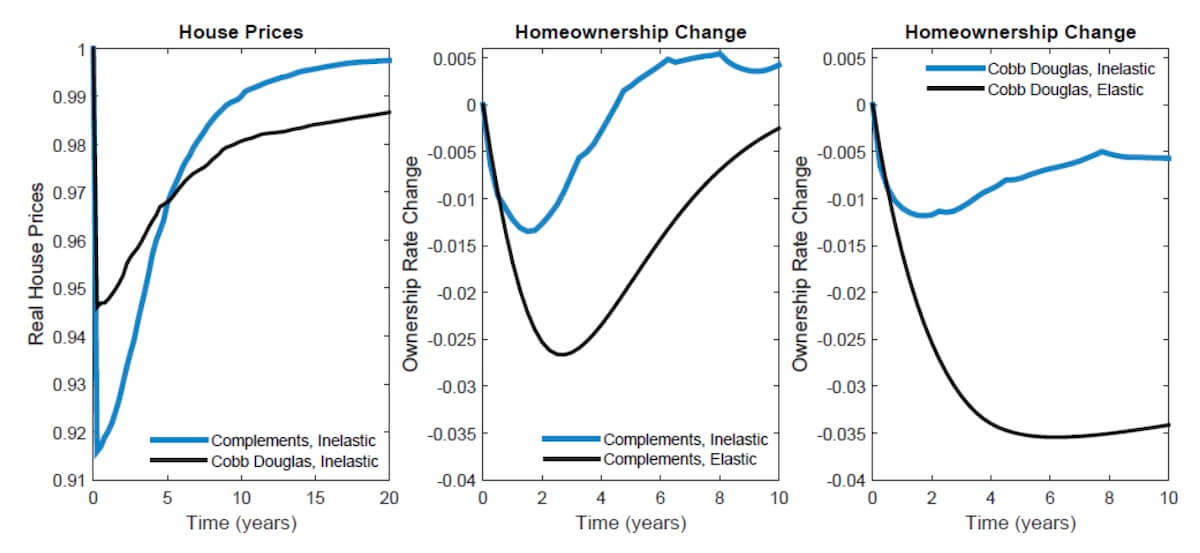

[Insert chart/graph here visualizing the relationship between house prices in these cities and required down payments (5%, 10%, 20%) for a visual representation of the data]

The Savings Gap: Challenges Faced by First-Time Homebuyers

Saving for a substantial down payment presents a formidable challenge for first-time homebuyers in Canada. The reality is that the savings required often significantly outpaces the average Canadian's savings capacity. Factors contributing to this "savings gap" include:

- High Rent Costs: Rent in major Canadian cities is exorbitant, leaving little room for substantial savings.

- Increasing Inflation: The rising cost of living erodes savings, making it harder to accumulate the necessary funds.

- Student Loan Repayments: Many young Canadians are burdened with student loan debt, further hindering their ability to save for a down payment.

Case studies highlighting the struggles of first-time homebuyers facing these challenges would further illustrate the severity of this issue. For example, a young couple in Toronto might find themselves saving diligently but still falling short of the down payment needed for even a modest home after years of effort.

Government Policies and their Influence on Down Payment Requirements

Government policies play a crucial role in shaping down payment requirements and mortgage accessibility. This section examines how these policies influence affordability and potential solutions.

Stress Test and Mortgage Qualification

The Canadian government's stress test and mortgage qualification rules significantly impact the amount of down payment needed to secure a mortgage. These rules are designed to ensure borrowers can handle higher interest rates, but they increase the financial burden on prospective homebuyers.

- Interest Rate Increases: Interest rate hikes directly impact mortgage affordability, increasing the required down payment to qualify. A higher interest rate means less borrowing capacity, necessitating a larger down payment to compensate.

While these measures aim to promote financial stability, they inadvertently exacerbate the challenges faced by those striving for homeownership.

Current Government Initiatives and Their Effectiveness

The Canadian government has introduced several initiatives aimed at assisting first-time homebuyers, such as the First-Time Home Buyers' Incentive. However, the effectiveness of these programs remains a subject of debate.

- First-Time Home Buyers' Incentive: This program offers shared-equity mortgages, reducing the down payment burden. However, its reach is limited due to eligibility criteria and limited funding.

Analyzing the uptake and success rates of these initiatives provides crucial insights into their impact on overall housing affordability.

Alternative Strategies for Entering the Housing Market

For many, the traditional mortgage route may seem insurmountable due to high down payment requirements. This section explores alternative pathways to homeownership.

Exploring Options Beyond Traditional Mortgages

Several alternative financing options exist that can make homeownership more accessible:

- Rent-to-Own Programs: This allows renters to gradually build equity while renting, eventually purchasing the property.

- Co-ownership Models: Sharing ownership with others can significantly reduce the individual down payment required.

- Shared Equity Mortgages: In this arrangement, a third party invests a portion of the home's equity, reducing the down payment needed from the buyer.

Each option has its advantages and disadvantages, and careful consideration is vital to choose a suitable path.

The Importance of Financial Planning and Budgeting

Achieving homeownership requires careful financial planning and disciplined budgeting.

- Effective Saving Strategies: Developing a robust savings plan, including automating savings and tracking expenses, is essential.

- Budgeting: Creating and sticking to a realistic budget that prioritizes saving for a down payment is crucial.

- Seeking Professional Advice: Consulting a financial advisor can provide personalized guidance and strategic planning.

Conclusion

High down payments in Canada are a significant barrier to homeownership, disproportionately affecting first-time buyers and exacerbating the affordability crisis. The combination of rising housing costs, stringent mortgage qualification rules, and the challenges of saving enough for a substantial down payment creates a complex and daunting landscape. Understanding these challenges is crucial for navigating the current housing market. Take control of your financial future and explore resources to improve your savings strategy to achieve your homeownership goals. Together, we can work towards a more accessible housing market in Canada.

Featured Posts

-

Universitaria Transgenero Arrestada Uso De Bano Femenino Y La Ley

May 10, 2025

Universitaria Transgenero Arrestada Uso De Bano Femenino Y La Ley

May 10, 2025 -

Dakota Johnson And Chris Martin A Look At Her Career Choices

May 10, 2025

Dakota Johnson And Chris Martin A Look At Her Career Choices

May 10, 2025 -

Analysis Perus Mining Ban And The 200 Million Gold Price Tag

May 10, 2025

Analysis Perus Mining Ban And The 200 Million Gold Price Tag

May 10, 2025 -

How Bert Kreischers Wife Reacts To His Racy Netflix Specials

May 10, 2025

How Bert Kreischers Wife Reacts To His Racy Netflix Specials

May 10, 2025 -

Tarlov Vs Pirro Heated Debate On Us Canada Trade Conflict

May 10, 2025

Tarlov Vs Pirro Heated Debate On Us Canada Trade Conflict

May 10, 2025