High Stock Market Valuations: A BofA Analysis And Investor Reassurance

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's analysis of current market valuations employs several key metrics to gauge the market's health and potential future performance. Understanding these metrics is crucial for interpreting their conclusions.

Understanding BofA's Valuation Metrics

BofA likely utilizes a combination of valuation metrics to arrive at a comprehensive assessment. Let's break down some common ones:

-

Price-to-Earnings Ratio (P/E): This widely used metric compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or a higher level of risk. A low P/E ratio might suggest undervaluation, but could also signal lower future growth potential.

-

Shiller PE Ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, the CAPE smooths out short-term earnings fluctuations by averaging earnings over ten years. This helps to provide a more stable long-term valuation picture, mitigating the impact of short-term economic cycles on the P/E ratio. A high CAPE suggests potentially overvalued markets.

-

Other Relevant Metrics: BofA's analysis likely includes other metrics like price-to-sales ratio (P/S), price-to-book ratio (P/B), and dividend yield. These provide a more holistic view of valuation, considering factors beyond just earnings.

BofA's Perspective on the Current Valuation Landscape

BofA's overall assessment of the current market valuation landscape is crucial. Their report likely provides a nuanced perspective, rather than a simple "overvalued" or "undervalued" label.

-

Direct Quote from BofA Report: (Insert a direct and relevant quote from a recent BofA report regarding market valuations. Ensure proper attribution.)

-

Caveats and Limitations: BofA's analysis, like any other, has limitations. These might include assumptions about future economic growth, interest rates, or corporate profitability. Understanding these limitations is essential for interpreting the findings accurately.

-

Specific Sector Analysis: BofA's report probably highlights specific sectors or asset classes that appear overvalued or undervalued based on their analysis. This granular view allows for more strategic investment decisions. (For example, mention specific sectors BofA might have commented on, e.g., technology, energy, etc.)

Factors Influencing High Stock Market Valuations

Several interconnected factors contribute to high stock market valuations. Understanding these factors is critical for making informed investment decisions.

The Role of Low Interest Rates

Low interest rates significantly impact stock market valuations.

-

Impact on Bond Yields: Low interest rates reduce bond yields, making equities a relatively more attractive investment for yield-seeking investors.

-

Corporate Borrowing and Investment: Low interest rates encourage corporate borrowing, fueling investment and potentially boosting company profits, thereby supporting higher valuations.

-

Quantitative Easing (QE): Central bank policies like QE inject liquidity into the market, potentially driving up asset prices, including stocks.

Impact of Economic Growth and Corporate Earnings

Economic growth and corporate earnings are intrinsically linked to stock market valuations.

-

Strong Earnings Growth: Robust corporate earnings growth generally justifies higher stock valuations, as investors anticipate future profits.

-

Economic Uncertainty: Conversely, economic uncertainty or a potential downturn can dampen investor sentiment, leading to lower valuations.

-

Technological Innovation: Rapid technological advancements and disruptions can drive significant growth in certain sectors, resulting in high valuations for companies in those sectors.

The Influence of Investor Sentiment and Market Psychology

Market psychology and investor sentiment play a significant role in shaping stock prices.

-

Fear and Greed: These powerful emotions often drive market trends, pushing prices beyond fundamental valuations.

-

Market Speculation and Momentum Trading: Speculation and momentum trading can amplify price movements, irrespective of underlying fundamentals.

-

Social Media and News Sentiment: Social media and news coverage can heavily influence investor perception and market sentiment, impacting stock prices.

Strategies for Investors During Periods of High Valuations

Even during periods of high valuations, investors can implement strategies to manage risk and potentially identify opportunities.

Diversification and Risk Management

Diversification is key to managing risk in any market environment, but especially when valuations are high.

-

Asset Class Diversification: Diversify across different asset classes, such as stocks, bonds, real estate, and commodities, to reduce overall portfolio volatility.

-

Risk Tolerance: Clearly define your risk tolerance and invest accordingly. Avoid investments that exceed your comfort level with risk.

-

Portfolio Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation, mitigating risk and taking advantage of market fluctuations.

Value Investing and Fundamental Analysis

Value investing focuses on identifying undervalued companies based on fundamental analysis.

-

Fundamental Analysis: Thoroughly analyze a company's financial statements, business model, competitive landscape, and management team to assess its intrinsic value.

-

Undervalued Opportunities: Look for companies with strong fundamentals but relatively low valuations compared to their peers or historical trends.

-

Long-Term Investment Horizon: Value investing often requires a long-term perspective, allowing for time to capitalize on undervalued assets.

Conclusion

BofA's analysis of high stock market valuations provides valuable insights for investors. While valuations may seem elevated, various factors contribute to this environment. By understanding these factors—including low interest rates, strong corporate earnings, and investor sentiment—and implementing sound diversification and risk management strategies, investors can navigate this market effectively. Remember, a well-informed approach is crucial when dealing with high stock market valuations. Continue researching and stay updated on market trends to make sound investment decisions. Don't hesitate to consult with a financial advisor to create a personalized investment strategy tailored to your risk tolerance and financial goals in the context of these high stock market valuations.

Featured Posts

-

Another Win For Sf Giants Flores And Lees Key Contributions

Apr 23, 2025

Another Win For Sf Giants Flores And Lees Key Contributions

Apr 23, 2025 -

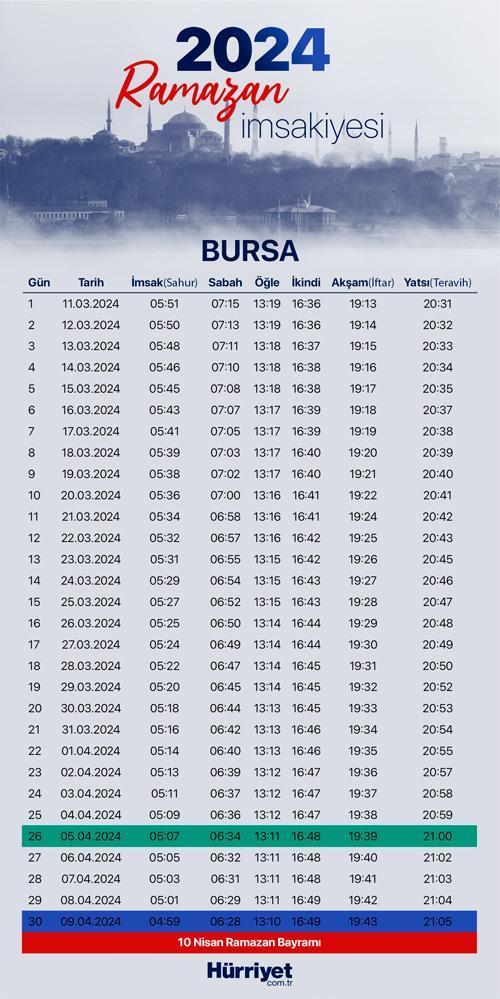

Ankara 3 Mart Pazartesi Iftar Ve Sahur Vakitleri 2024

Apr 23, 2025

Ankara 3 Mart Pazartesi Iftar Ve Sahur Vakitleri 2024

Apr 23, 2025 -

Trade War Fuels Chinas Turn To Canadian Oil A Geopolitical Shift

Apr 23, 2025

Trade War Fuels Chinas Turn To Canadian Oil A Geopolitical Shift

Apr 23, 2025 -

On Refait La Seance Paris Fdj Schneider Electric And Actualites Boursieres 17 02

Apr 23, 2025

On Refait La Seance Paris Fdj Schneider Electric And Actualites Boursieres 17 02

Apr 23, 2025 -

The Untold Story Of Chalet Girls Challenges And Rewards In Luxury Ski Employment

Apr 23, 2025

The Untold Story Of Chalet Girls Challenges And Rewards In Luxury Ski Employment

Apr 23, 2025