High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's assessment of the current stock market is nuanced, acknowledging both the opportunities and risks presented by high valuations. Their analysis relies on a combination of quantitative and qualitative factors, utilizing key valuation metrics to gauge the market's overall health. These metrics provide a crucial benchmark against historical averages, helping to identify potential overvaluation or undervaluation in specific sectors.

- Specific valuation metrics used by BofA: BofA employs a range of metrics, including the price-to-earnings ratio (P/E), the price-to-sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (CAPE), also known as the Shiller P/E ratio. These ratios provide different perspectives on valuation, considering factors such as earnings growth and inflation adjustments.

- BofA's assessment of current market multiples compared to historical averages: BofA's research often compares current market multiples to their historical averages to determine if the market is trading at a premium or discount. This comparison helps to understand whether current valuations are sustainable or represent a potential bubble. (Note: Specific data points would be included here if available from actual BofA reports).

- Specific sectors or indices BofA highlights as overvalued or undervalued: Depending on the current market conditions, BofA may identify specific sectors (e.g., technology, energy) or indices (e.g., S&P 500, Nasdaq) as being relatively overvalued or undervalued based on their chosen valuation metrics. (Note: Specific sectors and indices would be named here with supporting data if available from BofA reports).

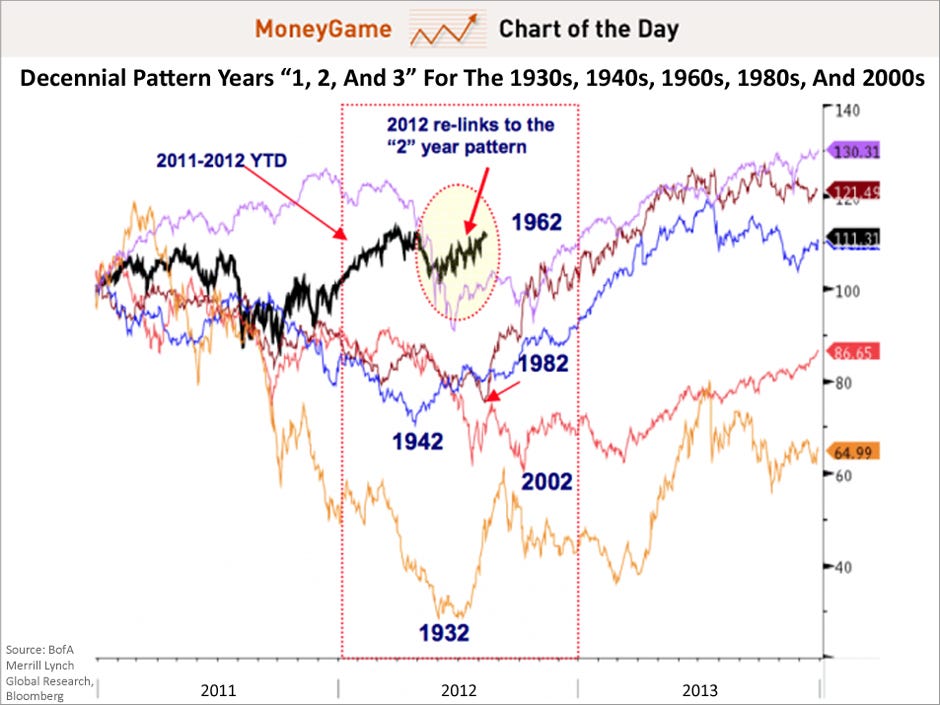

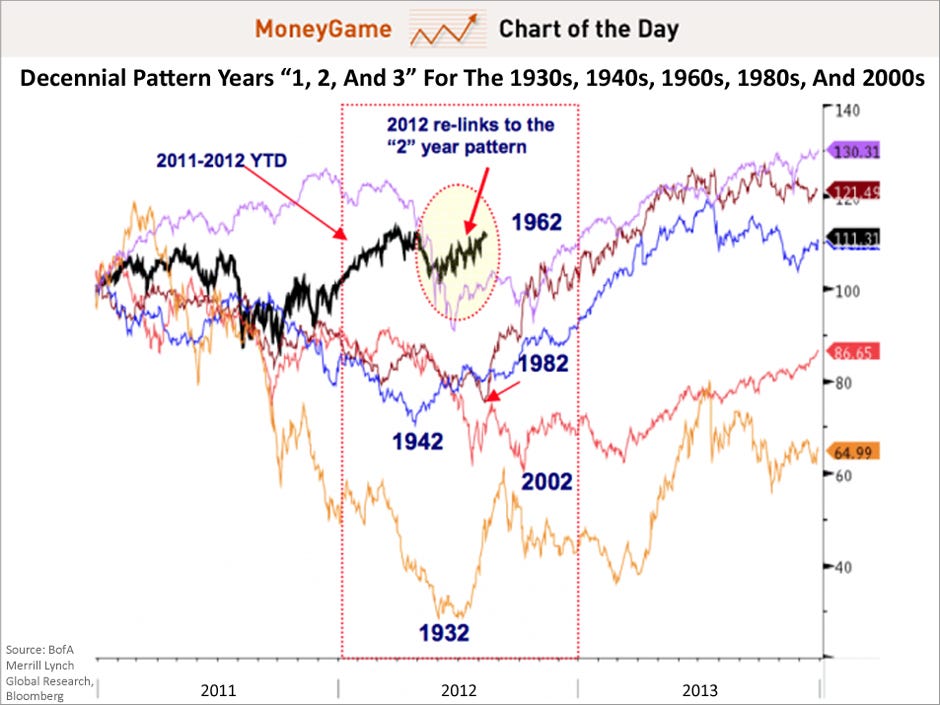

- Relevant charts and graphs from BofA's research: (Note: This section would ideally include relevant charts and graphs directly from BofA's research reports, properly cited and with permission.)

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current high stock market valuations. Understanding these intertwined elements is critical for making informed investment decisions.

- Impact of low interest rates on stock valuations: Low interest rates make borrowing cheaper, encouraging companies to invest and expand, thus boosting earnings and driving up stock prices. Conversely, low interest rates also reduce the attractiveness of fixed-income investments, pushing investors towards equities.

- Influence of quantitative easing (QE) and other monetary policies: Central banks' monetary policies, such as QE, have injected significant liquidity into the markets, increasing the demand for assets, including stocks, and thereby pushing up valuations.

- Role of technological innovation and growth in specific sectors: Rapid technological advancements in sectors like technology and healthcare have fueled significant growth and attracted substantial investment, contributing to elevated valuations in these areas.

- Analysis of investor behavior and market psychology: Investor sentiment, often driven by market momentum and speculation, can significantly influence valuations, leading to periods of exuberance and potentially unsustainable price increases.

The Role of Inflation in Stock Market Valuations

Inflation plays a crucial role in shaping stock market valuations. BofA's analysis meticulously considers the impact of inflation on corporate earnings and the discount rates used in valuation models.

- Impact of rising inflation on corporate earnings: Rising inflation can erode corporate profit margins if companies struggle to pass increased costs onto consumers. This can negatively impact earnings and potentially lead to lower stock valuations.

- How inflation affects discount rates used in valuation models: Higher inflation generally leads to higher discount rates, reducing the present value of future earnings and thus impacting stock valuations. BofA's models incorporate inflation expectations to accurately assess the present value of future cash flows.

- BofA's predictions for inflation and its consequences for the market: (Note: BofA's specific inflation predictions and their impact on the market would be included here if available from their research.)

Investment Strategies in a High-Valuation Market

Navigating a high-valuation market requires a cautious approach, focusing on risk management and portfolio diversification. BofA's analysis informs several potential strategies.

- Strategies for mitigating risk in a high-valuation market: Value investing, focusing on undervalued companies, and defensive strategies, concentrating on companies with resilient earnings, are two approaches that can help mitigate risk in a high-valuation market.

- Sector-specific investment opportunities based on BofA's outlook: (Note: Specific sectors identified by BofA as having attractive investment opportunities would be included here, along with supporting rationale.)

- Importance of diversification across asset classes: Diversification across different asset classes, such as stocks, bonds, and real estate, is crucial to reduce overall portfolio risk.

- Potential benefits of alternative investments: Alternative investments, such as private equity or hedge funds, can offer diversification benefits and potentially higher returns but often come with higher risk.

Potential Risks and Future Outlook

High stock market valuations inherently carry risks, including the potential for market corrections or even bubbles.

- Probability of a market correction and potential triggers: Several factors could trigger a market correction, such as rising interest rates, geopolitical instability, or a significant economic slowdown. BofA's analysis would help assess the probability and potential magnitude of such corrections. (Note: Specific data points and probabilities would be included here if available from BofA's reports).

- BofA's forecast for future market performance: (Note: BofA's forecasts for future market performance would be inserted here, with proper attribution).

- Key risks to watch out for: Rising interest rates, geopolitical uncertainty, and shifts in investor sentiment are all key risks to monitor.

- Long-term outlook for different sectors: BofA's analysis might highlight specific sectors expected to perform better or worse over the long term. (Note: Specific sector outlooks would be included here with supporting rationale from BofA research, if available.)

Conclusion

BofA's analysis of high stock market valuations highlights a complex interplay of macroeconomic factors, monetary policy, technological innovation, and investor sentiment. While current valuations may appear elevated compared to historical averages, understanding the contributing factors and potential risks is crucial for developing a well-informed investment strategy. Remember to diversify your portfolio across different asset classes and consider employing strategies such as value investing to mitigate potential risks. By staying informed about BofA's ongoing research and utilizing their resources, you can make more informed decisions regarding your investments in the context of high stock market valuations. Consult a financial advisor for personalized guidance tailored to your risk tolerance and financial goals. Understanding and managing the implications of high stock market valuations is key to long-term investment success.

Featured Posts

-

Britney Spearss Janet Jackson Impression Lizzo Weighs In Fans Divided

May 05, 2025

Britney Spearss Janet Jackson Impression Lizzo Weighs In Fans Divided

May 05, 2025 -

Ftc Investigation Into Open Ais Chat Gpt What It Means

May 05, 2025

Ftc Investigation Into Open Ais Chat Gpt What It Means

May 05, 2025 -

Ufc 314 Suffers Setback Neal Vs Prates Bout Cancelled

May 05, 2025

Ufc 314 Suffers Setback Neal Vs Prates Bout Cancelled

May 05, 2025 -

Subdued Glamour Blake Lively And Anna Kendricks Premiere Competition

May 05, 2025

Subdued Glamour Blake Lively And Anna Kendricks Premiere Competition

May 05, 2025 -

Customize Your Spotify Payments I Phone App Update

May 05, 2025

Customize Your Spotify Payments I Phone App Update

May 05, 2025

Latest Posts

-

Ufc 314 Complete Fight Card Date And Where To Watch

May 05, 2025

Ufc 314 Complete Fight Card Date And Where To Watch

May 05, 2025 -

Ufc 314 Suffers Setback Neal Vs Prates Bout Cancelled

May 05, 2025

Ufc 314 Suffers Setback Neal Vs Prates Bout Cancelled

May 05, 2025 -

Betting On Ufc 314 Chandler Vs Pimblett Co Main Event Odds And Predictions

May 05, 2025

Betting On Ufc 314 Chandler Vs Pimblett Co Main Event Odds And Predictions

May 05, 2025 -

Geoff Neal Vs Carlos Prates Cancellation Impacts Ufc 314 Lineup

May 05, 2025

Geoff Neal Vs Carlos Prates Cancellation Impacts Ufc 314 Lineup

May 05, 2025 -

Ufc 314 Co Main Event Analysis Chandler Vs Pimblett Fight Odds

May 05, 2025

Ufc 314 Co Main Event Analysis Chandler Vs Pimblett Fight Odds

May 05, 2025