High Stock Market Valuations: A BofA Analyst's Take And Investor Reassurance

Table of Contents

Understanding Current High Stock Market Valuations

High stock market valuations are a significant concern for many investors. Understanding how these valuations are measured and the factors driving them is crucial for making informed investment decisions.

Metrics Used to Assess Valuation:

Several key metrics are used to gauge stock market valuations. These include:

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or overvaluation.

- Price-to-Sales Ratio (P/S): This compares a company's stock price to its revenue per share. It's often used for companies with negative earnings or those in high-growth sectors. A higher P/S ratio might signal strong future growth potential or overvaluation, depending on other factors.

- Price-to-Book Ratio (P/B): This compares a company's stock price to its book value (assets minus liabilities). A high P/B ratio could suggest the market expects higher future profitability than what's reflected in the book value.

- Cyclically Adjusted Price-to-Earnings Ratio (CAPE): This metric smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable measure of valuation compared to the standard P/E ratio.

Current market valuations, as measured by these metrics, vary widely across sectors and individual companies. However, many indices show elevated multiples compared to historical averages, raising concerns about potential overvaluation. It's crucial to remember that using these metrics in isolation can be misleading. A holistic assessment considering other factors is essential.

Factors Contributing to High Valuations:

Several factors have contributed to the current high stock market valuations:

- Low Interest Rates: Extremely low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks.

- Strong Corporate Earnings (and Expectations): Strong corporate earnings, or expectations of future strong earnings, can justify higher stock prices.

- Increased Investor Confidence (and Speculation): Periods of high investor confidence and speculation can inflate stock prices beyond what fundamentals might suggest.

- Quantitative Easing and Government Stimulus: Monetary policy measures like quantitative easing and government stimulus packages have injected significant liquidity into the market, boosting asset prices.

- Technological Advancements: Rapid technological advancements in sectors like technology and healthcare drive significant growth and higher valuations for companies in these sectors.

BofA Analyst's Perspective on High Stock Market Valuations

Bank of America's analysts have published several reports addressing current stock market valuations. Understanding their perspective provides valuable insights for investors.

Summary of BofA's Findings:

(Note: This section would require citing specific BofA reports and incorporating their findings. For example, if a BofA report stated that "the S&P 500 is currently trading at a 25% premium to its long-term average," you would include that information here, properly attributed.) BofA's research typically includes analysis of various valuation metrics, economic forecasts, and potential risks. Their recommendations often involve a balanced approach, considering both the potential for further growth and the risks associated with high valuations.

BofA's Assessment of Potential Risks:

BofA analysts likely identify several potential risks associated with high valuations, such as:

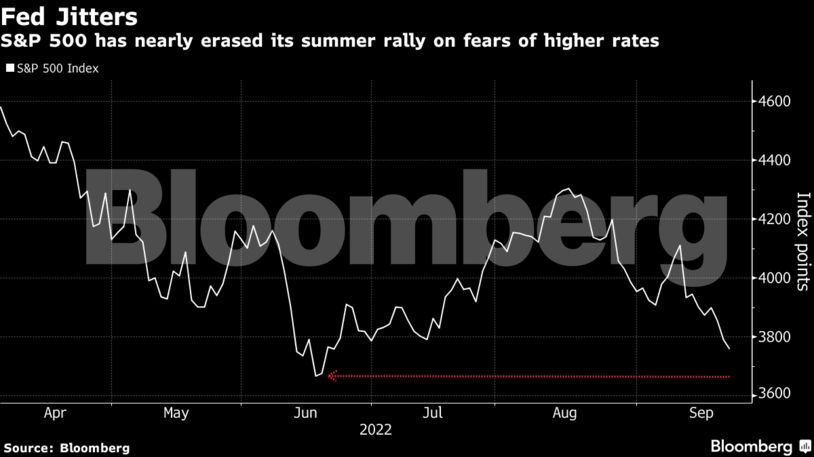

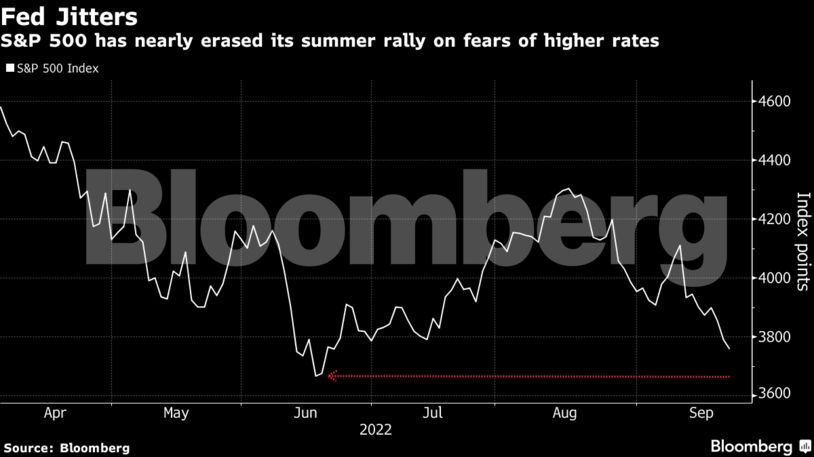

- Increased Market Volatility: High valuations can make the market more susceptible to sharp corrections.

- Inflationary Pressures: Sustained inflation could erode corporate earnings and negatively impact stock prices.

- Interest Rate Hikes: A rise in interest rates could decrease the attractiveness of equities and lead to capital outflow from the stock market.

Investors can mitigate these risks through diversification, careful portfolio management, and a long-term investment horizon.

Investor Reassurance and Strategies for Navigating High Valuations

Even with high stock market valuations, there are strategies to help investors manage their portfolios effectively.

Long-Term Investing Perspective:

The most important strategy is maintaining a long-term perspective. Short-term market fluctuations are inevitable. Focusing on long-term growth minimizes the impact of these fluctuations. Dollar-cost averaging, a strategy involving regular investments regardless of market conditions, can be particularly beneficial during periods of high valuations.

Diversification and Portfolio Management:

Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to manage risk. Rebalancing your portfolio periodically ensures you maintain your desired asset allocation. Consider incorporating defensive assets like high-quality bonds into your portfolio to mitigate potential downside risk.

Seeking Professional Financial Advice:

Consulting with a qualified financial advisor is highly recommended. A professional can help you tailor an investment strategy that aligns with your individual risk tolerance, financial goals, and time horizon. They can provide personalized guidance on navigating high stock market valuations and making informed investment decisions.

Conclusion: Addressing High Stock Market Valuations and Your Investment Strategy

High stock market valuations present a complex scenario. While BofA analysts and other experts acknowledge the elevated multiples, they also consider factors such as strong corporate earnings and low interest rates. The key takeaway is that a long-term investment perspective, diversification, and prudent portfolio management are essential for navigating this environment. Don't let high stock market valuations paralyze you. Take control of your financial future by carefully reviewing your investment strategy, diversifying your portfolio, and seeking professional advice. Understanding the current market landscape, as highlighted by analysts at BofA and others, allows you to make informed decisions and navigate the complexities of high stock market valuations effectively.

Featured Posts

-

Survivor 48 Finale Your Guide To Watching Tonights Episode

May 27, 2025

Survivor 48 Finale Your Guide To Watching Tonights Episode

May 27, 2025 -

Alifraj En Eshrt Alaf Sfht Mn Wthayq Aghtyal Rwbrt Kynydy Ma Tkshfh Alsjlat

May 27, 2025

Alifraj En Eshrt Alaf Sfht Mn Wthayq Aghtyal Rwbrt Kynydy Ma Tkshfh Alsjlat

May 27, 2025 -

Coupe De La Caf L Asec Eliminee L Usma Decoit Face A Berkane

May 27, 2025

Coupe De La Caf L Asec Eliminee L Usma Decoit Face A Berkane

May 27, 2025 -

Tramp Sanktsii Protiv Rusi A Ako Nema Primir E Do Kra Ot Na April

May 27, 2025

Tramp Sanktsii Protiv Rusi A Ako Nema Primir E Do Kra Ot Na April

May 27, 2025 -

Top Premier League Striker In Chelsea Transfer Talks

May 27, 2025

Top Premier League Striker In Chelsea Transfer Talks

May 27, 2025

Latest Posts

-

Vivian Wilsons Modeling Debut A New Chapter In Her Life

May 30, 2025

Vivian Wilsons Modeling Debut A New Chapter In Her Life

May 30, 2025 -

From Billionaires Daughter To Model Vivians Journey

May 30, 2025

From Billionaires Daughter To Model Vivians Journey

May 30, 2025 -

Elon Musk And Daughter Vivian A Complex Family Relationship

May 30, 2025

Elon Musk And Daughter Vivian A Complex Family Relationship

May 30, 2025 -

The Publics Response To Vivian Jenna Wilsons Modeling Career

May 30, 2025

The Publics Response To Vivian Jenna Wilsons Modeling Career

May 30, 2025 -

Vivian Musks Modeling Career Separating From Family Legacy

May 30, 2025

Vivian Musks Modeling Career Separating From Family Legacy

May 30, 2025