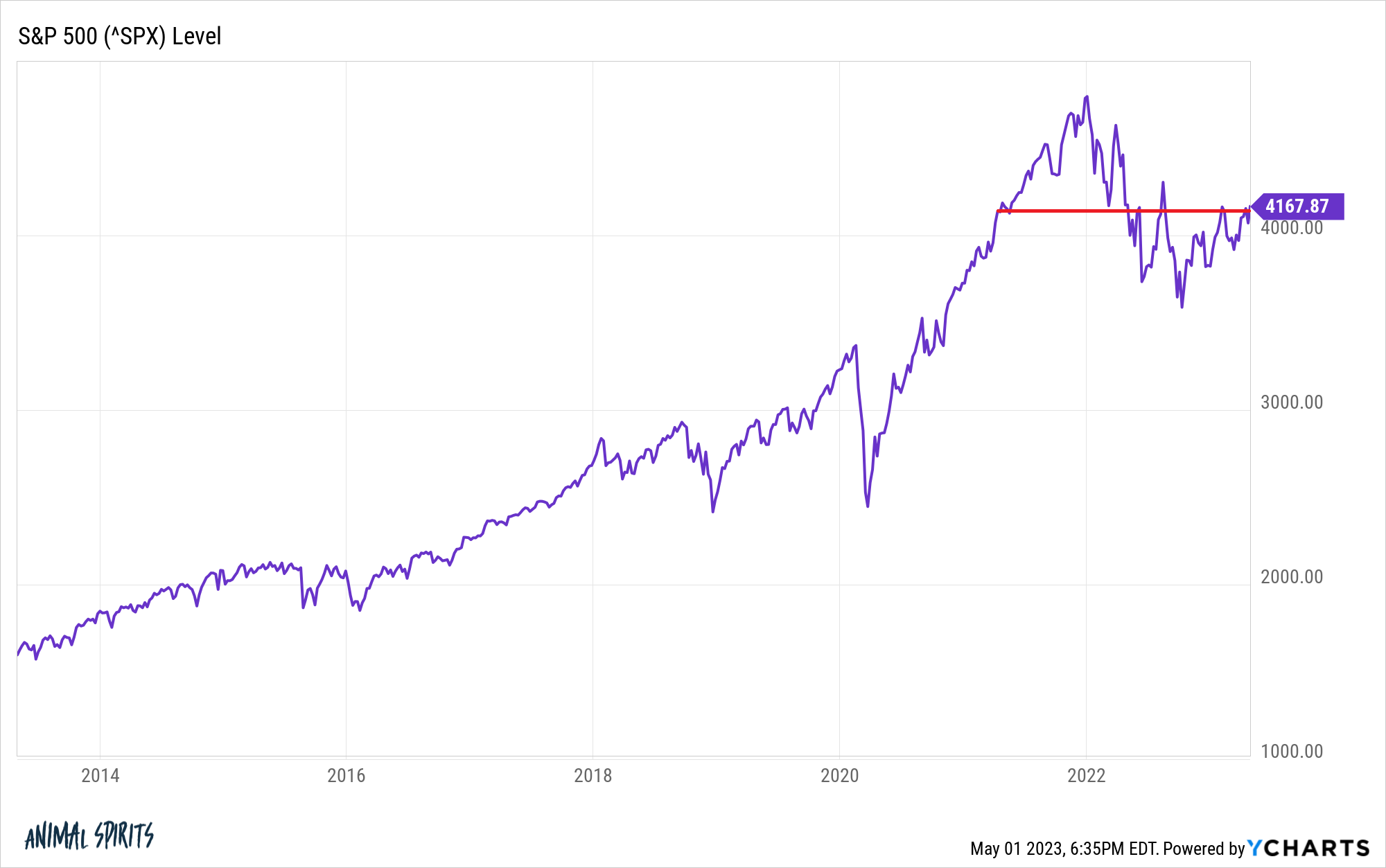

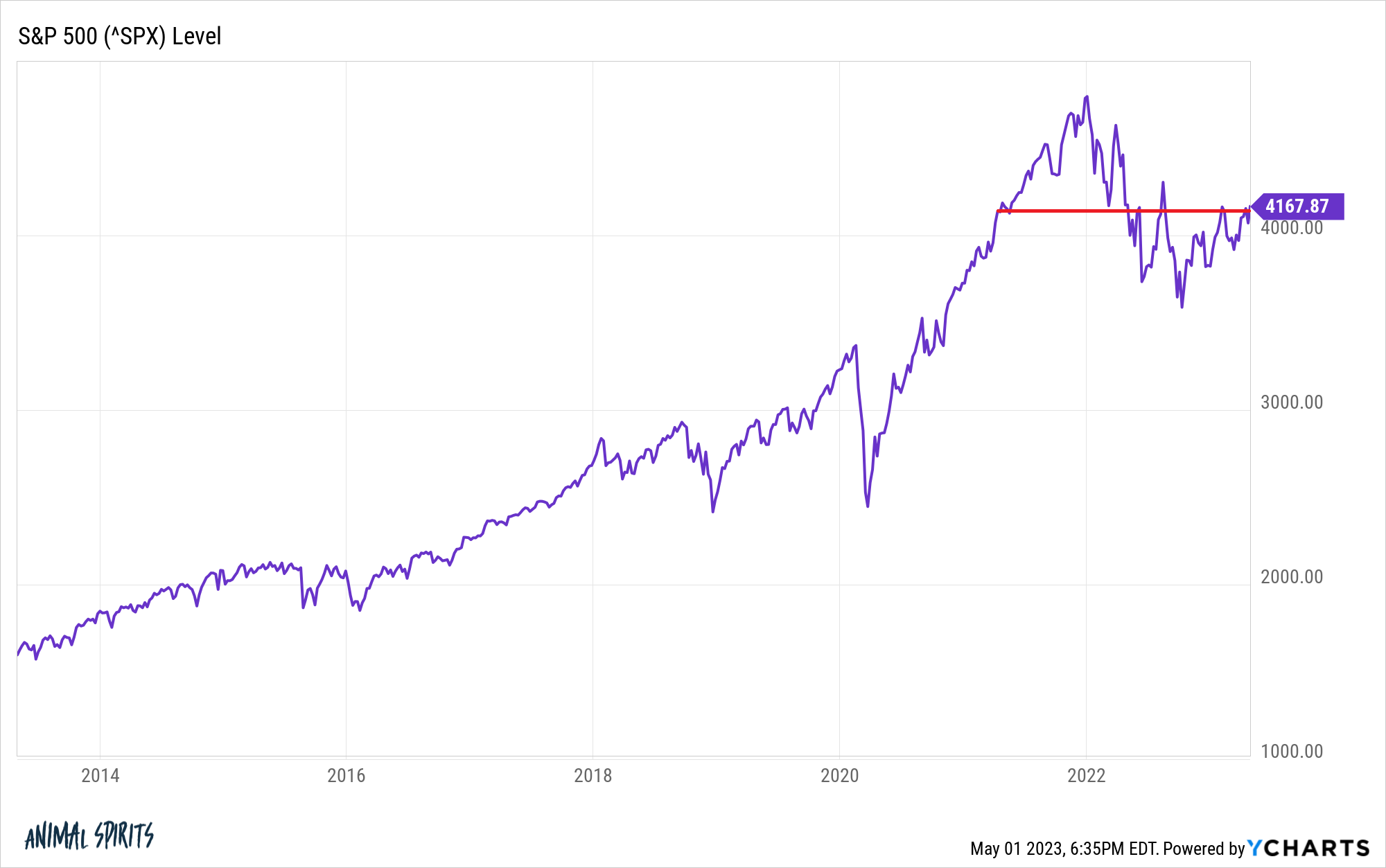

High Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Arguments for Continued Market Strength Despite High Valuations

BofA maintains a positive outlook on the market, despite elevated Price-to-Earnings (P/E) ratios and other valuation metrics typically signaling overvaluation. This bullish stance is supported by several key factors highlighted in recent BofA Securities reports and analyst commentary. Their analysts point to a confluence of factors that continue to fuel market growth:

-

Strong Corporate Earnings Growth Projections: BofA's analysts predict robust earnings growth for many companies in the coming quarters, driven by factors such as increasing consumer spending and strong global demand. This expectation of future earnings justifies, to some extent, the current high valuations.

-

Continued Low Interest Rates (or Expectations of Low Rates): Low interest rates make borrowing cheaper for businesses and consumers, stimulating economic activity and boosting corporate profits. The expectation of continued low interest rate environments, at least in the near term, supports investment in equities over bonds.

-

Positive Economic Forecasts: Several key economic indicators, including GDP growth and employment figures, remain positive, supporting BofA's optimistic forecast. These positive trends suggest a strong underlying economy capable of supporting current market levels, despite high stock market valuations.

-

Technological Innovation Driving Growth in Specific Sectors: Rapid technological advancements are driving significant growth in sectors such as technology, healthcare, and renewable energy. This innovation fuels high valuations in these sectors and contributes to the overall market strength.

Addressing the "High Valuations" Concern: BofA's Counterarguments

The central concern, of course, revolves around the high stock market valuations. BofA addresses this by offering several counterarguments:

-

Comparison to Historical Valuations: BofA's analysis compares current valuations to historical levels, arguing that while high, they aren't necessarily unprecedented. Considering past market cycles and the influence of factors like low interest rates, current valuations may not be as extreme as they initially appear.

-

Discussion of Different Valuation Metrics Beyond P/E Ratios: Reliance solely on P/E ratios can be misleading. BofA employs a broader range of valuation metrics, including Price-to-Sales (P/S) and Price-to-Book (P/B) ratios, offering a more nuanced perspective. This diversified approach provides a more complete picture of market valuation.

-

Analysis of Specific Sectors Showing Resilience Despite High Valuations: BofA's analysts focus on specific sectors exhibiting resilience despite high valuations, highlighting their underlying strength and future growth potential.

-

Mention of Factors Influencing Valuation Beyond Traditional Metrics: BofA acknowledges that factors beyond traditional metrics, such as future growth potential, technological disruption, and intangible assets, significantly influence valuations. These factors are often not fully captured by standard valuation ratios.

Potential Risks and Caveats According to BofA (or other experts)

While BofA maintains a positive outlook, they also acknowledge potential risks:

-

Inflationary Pressures and Their Potential Impact: Rising inflation could erode corporate profits and lead to higher interest rates, potentially impacting market valuations.

-

Geopolitical Risks and Uncertainties: Global geopolitical instability, such as trade wars or political crises, could create market uncertainty and trigger corrections.

-

Potential Interest Rate Hikes and Their Influence on Valuations: A shift in monetary policy, involving interest rate hikes, would increase borrowing costs, potentially dampening economic growth and negatively impacting stock prices.

-

Regulatory Changes Impacting Specific Sectors: Changes in regulations, particularly those impacting specific sectors, could significantly affect company performance and valuations.

Investor Behavior and Sentiment in the Face of High Stock Market Valuations

Despite high stock market valuations, investor sentiment remains relatively optimistic. BofA's observations reveal several contributing factors:

-

Increased Inflows into Equity Markets: Investors continue to pour money into equity markets, reflecting their confidence in future growth.

-

Investor Confidence in Future Growth: Despite the high valuations, investors remain confident in the long-term growth potential of the economy and many individual companies.

-

Lack of Attractive Alternatives: Low bond yields make equities a more attractive investment option for many investors seeking higher returns.

-

Behavioral Biases Influencing Investor Decisions: Behavioral biases, such as herding behavior and overconfidence, may be influencing investor decisions, leading them to overlook the risks associated with high valuations.

Conclusion: Navigating High Stock Market Valuations – A Summary and Call to Action

BofA's analysis suggests that while high stock market valuations are a legitimate concern, several factors, including strong earnings growth projections, low interest rates, and positive economic forecasts, support their optimistic outlook. However, investors should remain aware of potential risks, including inflationary pressures, geopolitical uncertainty, and the possibility of interest rate hikes. Understanding high stock market valuations is crucial for making informed investment decisions. Continue your research and develop a well-informed investment strategy that aligns with your risk tolerance and understanding of the current market conditions. Don't solely rely on one perspective; conduct thorough due diligence before making any investment decisions related to high stock market valuations.

Featured Posts

-

The Church After Francis Ensuring Lasting Reform On Sexual Abuse

Apr 25, 2025

The Church After Francis Ensuring Lasting Reform On Sexual Abuse

Apr 25, 2025 -

Can China And Canada Forge An Alliance To Challenge Us Power

Apr 25, 2025

Can China And Canada Forge An Alliance To Challenge Us Power

Apr 25, 2025 -

Tendencias De Maquiagem Descubra O Charme Da Aquarela

Apr 25, 2025

Tendencias De Maquiagem Descubra O Charme Da Aquarela

Apr 25, 2025 -

Amazon Primes Jack O Connell Drama Dont Miss It Before Its Gone

Apr 25, 2025

Amazon Primes Jack O Connell Drama Dont Miss It Before Its Gone

Apr 25, 2025 -

Local Runner Bob Fickel Prepares For 40th Canberra Marathon

Apr 25, 2025

Local Runner Bob Fickel Prepares For 40th Canberra Marathon

Apr 25, 2025

Latest Posts

-

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025 -

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025