High Stock Market Valuations: BofA's Take And Why Investors Shouldn't Panic

Table of Contents

BofA's Analysis of Current Market Conditions

BofA's Valuation Metrics and Their Interpretations

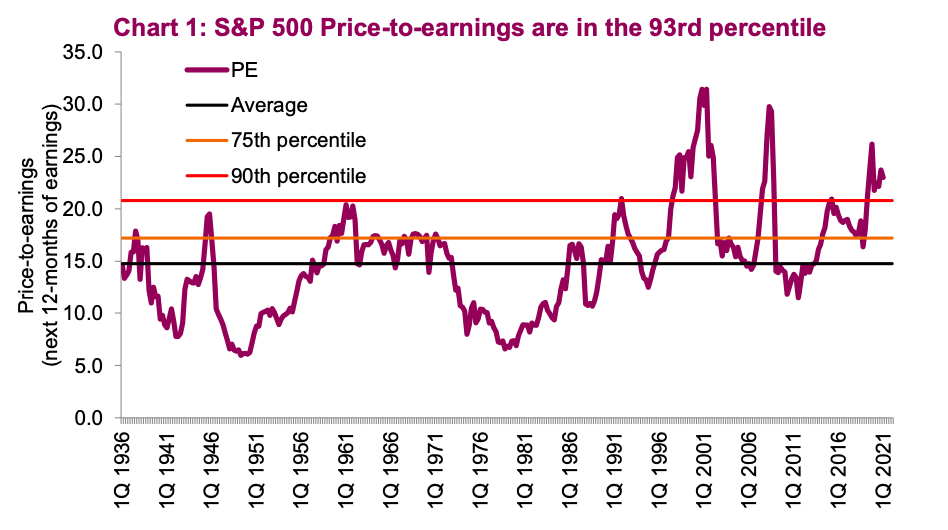

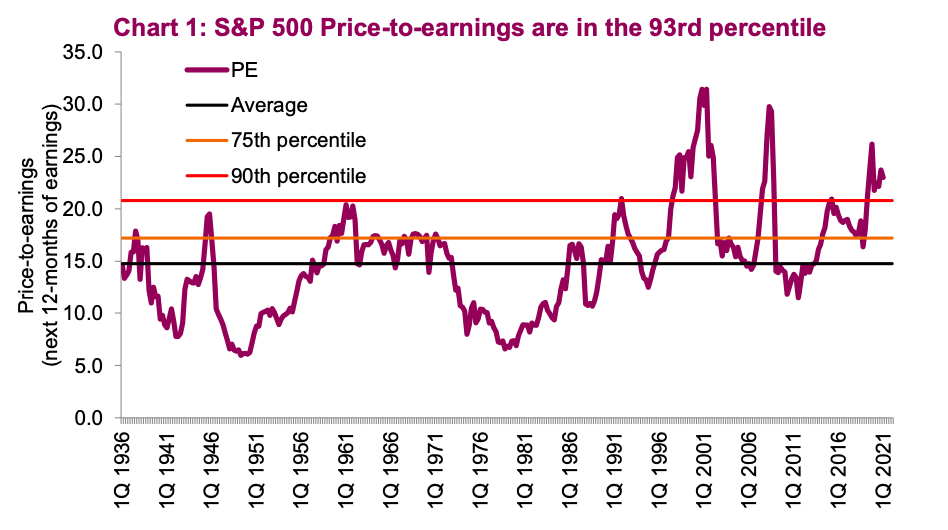

BofA employs a range of valuation metrics to gauge the current market health. These include, but aren't limited to, the widely-used Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and various other industry-specific ratios. BofA's interpretation of these metrics isn't necessarily one of outright overvaluation; instead, their analysis often incorporates mitigating factors.

- P/E Ratio: While current P/E ratios might appear elevated compared to historical averages, BofA notes that exceptionally low interest rates and strong corporate earnings growth can partially justify these valuations.

- Shiller PE: BofA acknowledges that the Shiller PE (also known as the CAPE ratio) suggests a higher valuation than the average, yet they point to factors like technological disruption and continued global economic growth as potentially offsetting this perceived risk.

- Other Metrics: BofA also considers other metrics like dividend yields and free cash flow to sales to create a holistic understanding of the market's valuation.

BofA's Predictions and Outlook for Stock Market Growth

BofA's outlook isn't uniformly pessimistic despite acknowledging the elevated valuations. Their predictions for future market performance are generally positive, albeit tempered with caution.

- Moderate Growth: BofA generally forecasts moderate, rather than explosive, stock market growth in the coming years.

- Inflationary Pressures: They acknowledge inflationary pressures as a potential risk, but believe the Federal Reserve’s actions will help to keep inflation in check.

- Interest Rate Sensitivity: Increased interest rates are a key factor impacting BofA's outlook, potentially slowing economic growth and impacting valuations.

Reasons Why Investors Shouldn't Panic Despite High Valuations

The Importance of Long-Term Investing

The most crucial point to remember when facing high stock market valuations is the importance of a long-term investment strategy. Short-term market fluctuations are completely normal; they are an inherent characteristic of the market.

- Historical Perspective: Looking back at market history reveals that periods of high valuations have been followed by periods of growth and correction. Focusing on long-term gains will help reduce stress about the short-term market swings.

- Compounding Returns: The power of compounding significantly benefits long-term investors. Short-term anxieties can easily disrupt this positive trajectory.

- Dollar-Cost Averaging: This strategy mitigates the impact of market volatility, making it a robust approach during periods of high valuations.

Considering Mitigating Factors and Economic Indicators

Several mitigating factors and positive economic indicators temper concerns around high stock market valuations.

- Technological Innovation: Continuous technological advancements fuel economic growth and drive corporate earnings, supporting higher valuations.

- Strong Corporate Earnings: Many companies continue to deliver robust earnings, providing a foundation for future growth.

- Global Growth (with caveats): While global economic growth shows some signs of slowing, many key economies are continuing to show considerable strength.

Diversification and Risk Management Strategies

Diversification remains a critical component of any successful investment strategy, particularly during periods of high valuations.

- Asset Allocation: A well-diversified portfolio includes a range of assets, including stocks, bonds, and possibly alternative investments like real estate or commodities, reducing the overall risk exposure.

- Sector Diversification: Spreading investments across various market sectors minimizes the impact of any one sector underperforming.

- Regular Rebalancing: Periodically rebalancing your portfolio ensures you maintain your desired asset allocation, helping to manage risk effectively.

Conclusion: Maintaining Perspective on High Stock Market Valuations

BofA's analysis suggests that while high stock market valuations are a valid concern, they aren't necessarily a cause for immediate panic. Their outlook incorporates both risks and opportunities. The key takeaway is the importance of a long-term investment strategy, proper diversification, and a nuanced understanding of the current economic environment. Investors shouldn’t let fear dictate their actions. By focusing on long-term goals and employing effective risk management strategies, investors can effectively navigate high stock market valuations. To create a personalized strategy tailored to your individual risk tolerance and financial goals, consult with a qualified financial advisor for guidance on managing high stock market valuations effectively. Remember, measured action and a long-term perspective are key to successfully navigating the complexities of the market.

Featured Posts

-

Trumps Tariffs And The Billionaire Fallout A Financial Analysis

May 10, 2025

Trumps Tariffs And The Billionaire Fallout A Financial Analysis

May 10, 2025 -

Sensex Today Live Stock Market Updates 100 Points Higher Nifty Above 17 950

May 10, 2025

Sensex Today Live Stock Market Updates 100 Points Higher Nifty Above 17 950

May 10, 2025 -

Palantir Technologies Should You Buy Before May 5th A Detailed Look At The Stock

May 10, 2025

Palantir Technologies Should You Buy Before May 5th A Detailed Look At The Stock

May 10, 2025 -

Harry Styles Retro Mustache Makes A Statement In London

May 10, 2025

Harry Styles Retro Mustache Makes A Statement In London

May 10, 2025 -

Greenlands Dependence On Denmark Examining The Post Trump Era

May 10, 2025

Greenlands Dependence On Denmark Examining The Post Trump Era

May 10, 2025