High Stock Market Valuations: BofA's View And Why Investors Shouldn't Worry

Table of Contents

BofA's Stance on Current Market Valuations

BofA's recent reports haven't outright declared current stock market valuations as dangerously high. Instead, their assessment suggests that while valuations are elevated compared to historical averages, they are arguably justifiable given the current economic climate and projected future growth. They haven't issued a blanket warning of an imminent crash, but rather a call for a cautious, yet optimistic, approach.

- Key arguments presented by BofA: BofA's analysts point to strong corporate earnings growth and the expectation of continued robust economic expansion as key factors supporting current valuations. They emphasize the resilience of the market even amidst geopolitical uncertainty.

- Specific sectors: BofA highlights the technology sector and certain segments of the healthcare industry as particularly strong performers, while expressing some caution regarding sectors heavily reliant on consumer spending in a potentially slowing economy.

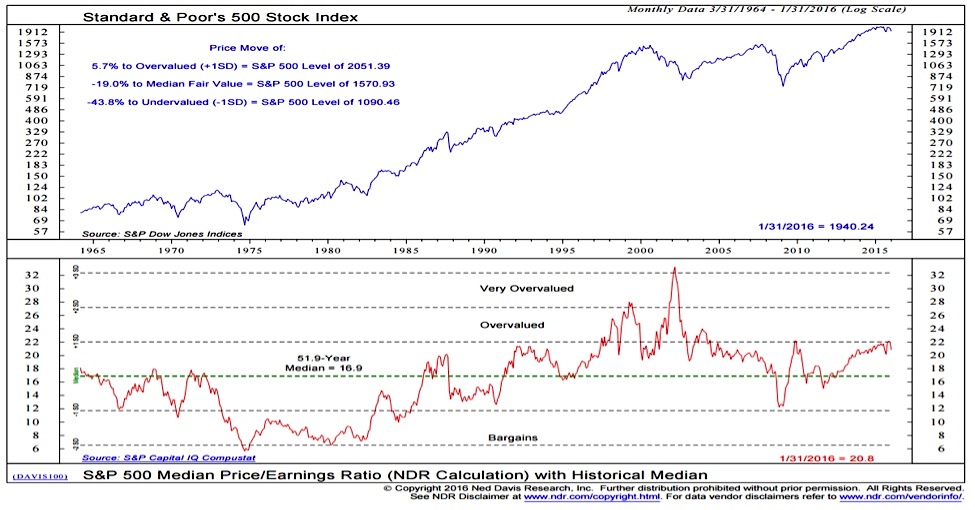

- Relevant data points: While specific P/E ratios vary depending on the index and sector, BofA’s analysis often references forward P/E ratios, which account for projected earnings growth, suggesting valuations, while high, are not necessarily excessive when considering future prospects. They also incorporate factors like interest rate sensitivity and inflation projections into their comprehensive assessment.

Understanding the Factors Driving High Valuations

Several macroeconomic factors contribute to the elevated stock market valuations we're currently seeing. These aren't necessarily indicative of an impending bubble, but rather reflections of a complex interplay of economic forces.

- Low interest rates: Historically low interest rates make bonds less attractive compared to stocks, driving more capital into the equity markets, thus boosting demand and prices. This increased demand, in turn, contributes to higher valuations.

- Strong corporate earnings growth: Many companies have reported robust earnings growth, reflecting a healthy economy and increased consumer spending. This strong performance fuels investor confidence and supports higher stock prices.

- Increased investor confidence: Positive economic data, coupled with ongoing technological advancements, has generally bolstered investor confidence, leading to a more risk-on sentiment and increased willingness to invest in equities.

- Technological advancements and innovation: The continuous innovation in technology, particularly in sectors like artificial intelligence and renewable energy, fuels expectations of future growth, which in turn supports higher valuations for companies in these sectors.

Addressing Concerns about a Market Correction

It's understandable that investors are anxious about a potential market correction. Market volatility is a natural part of the investment cycle.

- BofA's perspective on correction likelihood: BofA acknowledges the possibility of a correction, but doesn't foresee a significant market crash. They emphasize the difference between a healthy, necessary correction and a catastrophic market collapse.

- Healthy correction vs. market crash: A healthy correction involves a temporary pullback in prices, allowing the market to adjust to new information and rebalance. A market crash, on the other hand, is a sharp and sudden decline, often triggered by significant economic or geopolitical events.

- Mitigating factors: BofA points to the robust corporate earnings, relatively low unemployment rates, and continued economic growth as potential mitigating factors that could soften any downturn.

Strategies for Investors in a High-Valuation Market

Navigating a high-valuation market requires a strategic approach that prioritizes risk management and long-term goals.

- Diversification strategies: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors can help mitigate risk and reduce the impact of any potential market downturn.

- Long-term investing: Focusing on a long-term investment horizon allows you to ride out short-term market fluctuations and benefit from the long-term growth potential of the market. Ignore short-term noise and stick to your investment plan.

- Potential investment opportunities: While broad market valuations are high, BofA and other analysts may identify specific sectors or undervalued companies presenting attractive opportunities. Thorough due diligence is always critical.

- Professional financial advice: Consulting with a qualified financial advisor can provide personalized guidance tailored to your specific financial goals, risk tolerance, and investment timeline.

Conclusion

While high stock market valuations are a reality, BofA's analysis provides a reasoned perspective, suggesting a measured approach is warranted. The factors contributing to current valuations – strong corporate earnings, low interest rates, and technological innovation – create a complex picture. Don't let fear dictate your investment decisions. Conduct thorough research, consider a diversified portfolio, and consult with a financial advisor to navigate the complexities of high stock market valuations effectively. Learn more about BofA's insights and develop a sound investment strategy for a potentially robust future. Understanding and managing your exposure to high stock market valuations is key to long-term success.

Featured Posts

-

The Biden Presidency And Economic Performance Fact Based Analysis

May 02, 2025

The Biden Presidency And Economic Performance Fact Based Analysis

May 02, 2025 -

Home Court Disadvantage Lady Raiders Fall To Cincinnati 56 59

May 02, 2025

Home Court Disadvantage Lady Raiders Fall To Cincinnati 56 59

May 02, 2025 -

Eco Flow Wave 3 Review Strengths Weaknesses And Verdict

May 02, 2025

Eco Flow Wave 3 Review Strengths Weaknesses And Verdict

May 02, 2025 -

Watch Newsround Bbc Two Hd Broadcast Information

May 02, 2025

Watch Newsround Bbc Two Hd Broadcast Information

May 02, 2025 -

A Harry Potter Remakes Path To Success Six Key Considerations

May 02, 2025

A Harry Potter Remakes Path To Success Six Key Considerations

May 02, 2025

Latest Posts

-

Great Yarmouth Residents React To Rupert Lowe Dispute

May 02, 2025

Great Yarmouth Residents React To Rupert Lowe Dispute

May 02, 2025 -

Former Uk Mp Rupert Lowe Analysis Of Evidence Related To Toxic Workplace Claims

May 02, 2025

Former Uk Mp Rupert Lowe Analysis Of Evidence Related To Toxic Workplace Claims

May 02, 2025 -

Assessing The Credible Evidence Against Rupert Lowe Regarding A Toxic Work Environment

May 02, 2025

Assessing The Credible Evidence Against Rupert Lowe Regarding A Toxic Work Environment

May 02, 2025 -

Analyzing Ap Decision Notes Implications For The Minnesota House Race

May 02, 2025

Analyzing Ap Decision Notes Implications For The Minnesota House Race

May 02, 2025 -

Ap Decision Notes Your Guide To The Minnesota Special House Election

May 02, 2025

Ap Decision Notes Your Guide To The Minnesota Special House Election

May 02, 2025