High Stock Market Valuations: Why BofA Thinks Investors Shouldn't Panic

Table of Contents

BofA's Rationale Behind a Cautious, Not Panicked, Approach

BofA's core argument rests on several key pillars that mitigate the immediate risk associated with seemingly high valuations. They concede that valuations are elevated but emphasize several counterbalancing factors. These factors suggest that a market correction, while always a possibility, isn't necessarily inevitable in the near term.

-

Strong Corporate Earnings Growth Potential: BofA's analysts forecast robust earnings growth for many companies, particularly within the technology and consumer discretionary sectors. This positive outlook is fueled by sustained economic expansion and technological innovation. Strong earnings can support current valuations and even justify further increases. Furthermore, companies exhibiting strong revenue growth tend to weather market corrections better than those with stagnant or declining earnings.

-

Low Inflation Expectations: While inflation has been a concern recently, BofA's analysis suggests that inflation expectations remain relatively low compared to previous inflationary periods. Low inflation reduces pressure on the Federal Reserve to aggressively raise interest rates, potentially preventing a sharp economic slowdown that could trigger a market downturn.

-

Sustained Low Interest Rates: Historically low interest rates, although rising, continue to provide a supportive environment for stock valuations. Low borrowing costs allow companies to invest more readily, boosting growth and potentially offsetting the impact of higher valuations. This is especially true for companies with large debt burdens.

-

Positive Long-Term Economic Outlook: Despite short-term economic uncertainties, BofA projects continued positive long-term economic growth globally. This optimistic view underpins their belief that current valuations, while high, may be justifiable given future earnings prospects. The long-term growth potential can mitigate the risks associated with a market correction.

Understanding the Metrics: What "High" Valuations Actually Mean

Understanding "high" stock market valuations requires examining key metrics. Common valuation multiples include the Price-to-Earnings ratio (P/E ratio) and the cyclically adjusted price-to-earnings ratio (Shiller PE). However, relying solely on these metrics can be misleading.

-

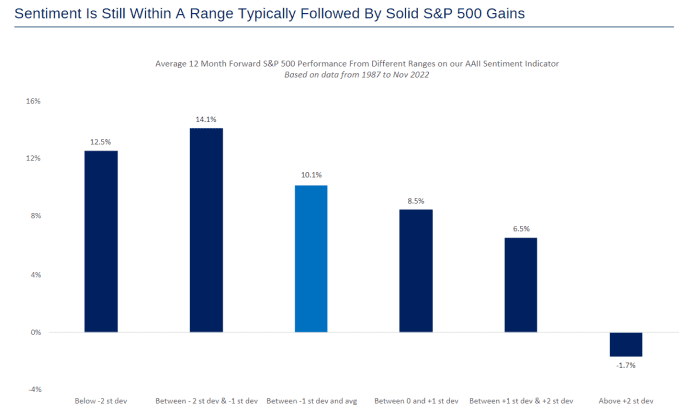

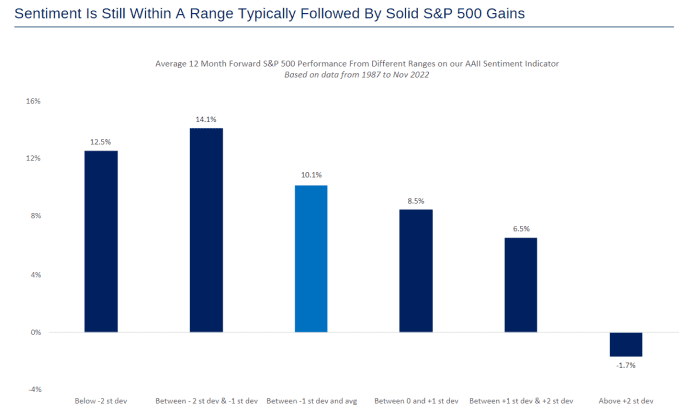

Historical Context of Valuation Multiples: Comparing current valuations to past market cycles is crucial. Historical data reveals that valuations have fluctuated significantly throughout history, often exceeding current levels during periods of strong economic growth and technological innovation. While high, current valuations aren't unprecedented.

-

Impact of Interest Rates on Valuation Multiples: Interest rates significantly impact valuation multiples. Lower interest rates generally lead to higher valuations, as investors seek higher-yielding assets. Conversely, higher interest rates can depress valuations as investors shift to fixed-income investments.

-

The Influence of Technological Advancements and Innovation on Future Earnings: Technological advancements drive significant growth and reshape entire industries, impacting future earnings potential. This influence is not always adequately captured by traditional valuation metrics. Companies leading innovation may justify higher valuations.

Alternative Investment Strategies in a High-Valuation Market

Navigating a market with high stock market valuations demands a nuanced investment strategy. Instead of panicking, investors can adopt several approaches:

-

Diversification Across Asset Classes: Diversifying across asset classes—such as stocks, bonds, real estate, and commodities—reduces overall portfolio risk. This strategy mitigates the impact of any single asset class underperforming.

-

Focus on Value Investing and Identifying Undervalued Stocks: Value investing involves identifying stocks trading below their intrinsic value. This approach can generate superior returns even in a high-valuation market. Careful fundamental analysis is key here.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is crucial. Short-term market fluctuations should not dictate long-term investment decisions. Focusing on long-term growth reduces the impact of short-term volatility.

-

Regular Portfolio Rebalancing: Regularly rebalancing your portfolio helps maintain your desired asset allocation and prevents any single asset class from becoming overly weighted. This systematic approach provides discipline and reduces emotional investment decisions.

The Role of Macroeconomic Factors

Global macroeconomic factors significantly influence stock market valuations and should be considered.

-

Impact of Potential Interest Rate Hikes: Interest rate increases can negatively affect stock valuations by increasing borrowing costs for companies and reducing investor demand for equities.

-

Effects of Global Economic Growth: Global economic growth directly impacts corporate earnings and overall market performance. Strong global growth typically supports higher valuations.

-

Influence of Technological Disruptions: Technological disruptions can reshape industries and create both opportunities and risks for investors. Adapting to these changes is vital for successful long-term investment.

Navigating High Stock Market Valuations: A Call to Action

BofA's analysis suggests that while high stock market valuations exist, panic selling isn't necessarily warranted. Their reasoning centers on factors like strong earnings growth potential, low inflation, and continued positive long-term economic prospects. However, understanding these high stock market valuations doesn’t mean ignoring potential risks. The key takeaway is to focus on long-term investment strategies rather than reacting to short-term market fluctuations.

To effectively manage your investments in this environment, conduct thorough research, consult with financial advisors, and develop a well-informed investment strategy tailored to your individual risk tolerance and financial goals. Understanding high stock market valuations and implementing a robust, diversified approach will enable you to make informed investment decisions and navigate this dynamic market successfully.

Featured Posts

-

Coronation Street Spoiler Daisy Midgeleys Shocking Farewell

May 01, 2025

Coronation Street Spoiler Daisy Midgeleys Shocking Farewell

May 01, 2025 -

Maikel Garcia And Bobby Witt Jr Power Royals Past Cleveland Guardians

May 01, 2025

Maikel Garcia And Bobby Witt Jr Power Royals Past Cleveland Guardians

May 01, 2025 -

Kansas City Royals Win Garcias Blast And Witts Double Secure Victory

May 01, 2025

Kansas City Royals Win Garcias Blast And Witts Double Secure Victory

May 01, 2025 -

England Vs France Six Nations Dalys Late Show Delivers Victory

May 01, 2025

England Vs France Six Nations Dalys Late Show Delivers Victory

May 01, 2025 -

Kort Geding Kampen Vs Enexis Probleem Stroomnetaansluiting

May 01, 2025

Kort Geding Kampen Vs Enexis Probleem Stroomnetaansluiting

May 01, 2025

Latest Posts

-

Guardians Series Victory Over Yankees Analysis And Insights

May 01, 2025

Guardians Series Victory Over Yankees Analysis And Insights

May 01, 2025 -

Cleveland Guardians Sweep Yankees Key Takeaways From The Series Win

May 01, 2025

Cleveland Guardians Sweep Yankees Key Takeaways From The Series Win

May 01, 2025 -

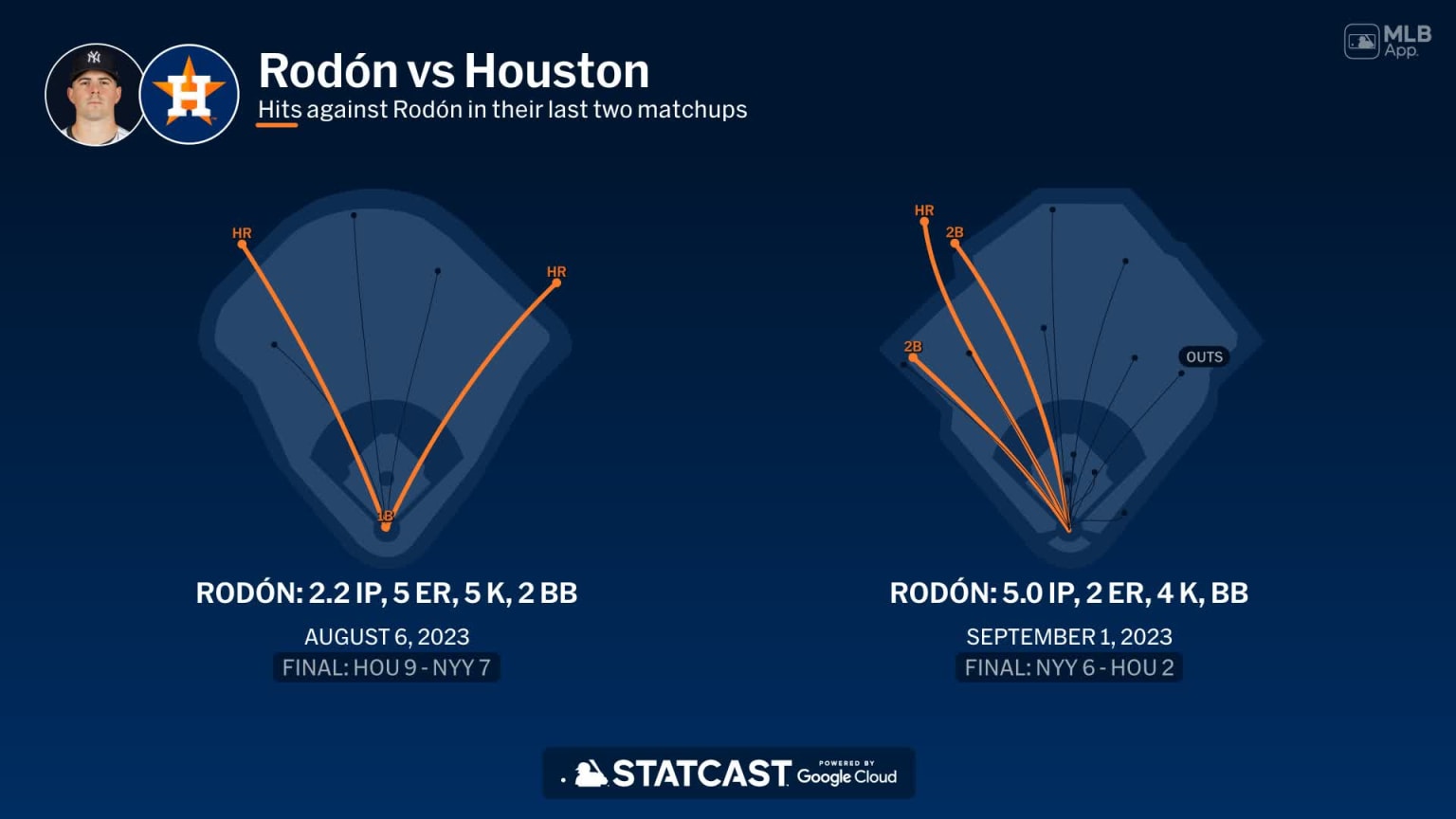

Yankees Salvage Series Finale Rodons Dominant Performance Against Guardians

May 01, 2025

Yankees Salvage Series Finale Rodons Dominant Performance Against Guardians

May 01, 2025 -

Yankees Salvage Series Finale Rodons Gem Fuels 5 1 Win Over Guardians

May 01, 2025

Yankees Salvage Series Finale Rodons Gem Fuels 5 1 Win Over Guardians

May 01, 2025 -

New York Yankees Rodon Silences Guardians In 5 1 Win

May 01, 2025

New York Yankees Rodon Silences Guardians In 5 1 Win

May 01, 2025