High Stock Valuations And Investor Concerns: A BofA Analysis

Table of Contents

Market volatility is on the rise, leaving investors grappling with the implications of high stock valuations. A recent analysis by Bank of America (BofA) offers crucial insights into this precarious market landscape, shedding light on the potential risks and suggesting strategic adjustments for navigating these uncertain times. Understanding stock valuations is paramount for investors; overvalued assets carry significant risk of substantial losses. This article delves into BofA's findings regarding high stock valuations and the resulting concerns for investors, providing a comprehensive overview of the current market situation.

BofA's Key Findings on High Stock Valuations:

Elevated Price-to-Earnings Ratios:

BofA's analysis reveals significantly elevated Price-to-Earnings (P/E) ratios across numerous sectors. P/E ratios, a key valuation metric, compare a company's stock price to its earnings per share, providing insight into how much investors are willing to pay for each dollar of earnings.

- Sectors with High P/E Ratios: Technology, consumer discretionary, and communication services sectors exhibit particularly high P/E ratios, suggesting potentially inflated valuations. This could indicate a market susceptible to corrections should earnings fail to meet expectations.

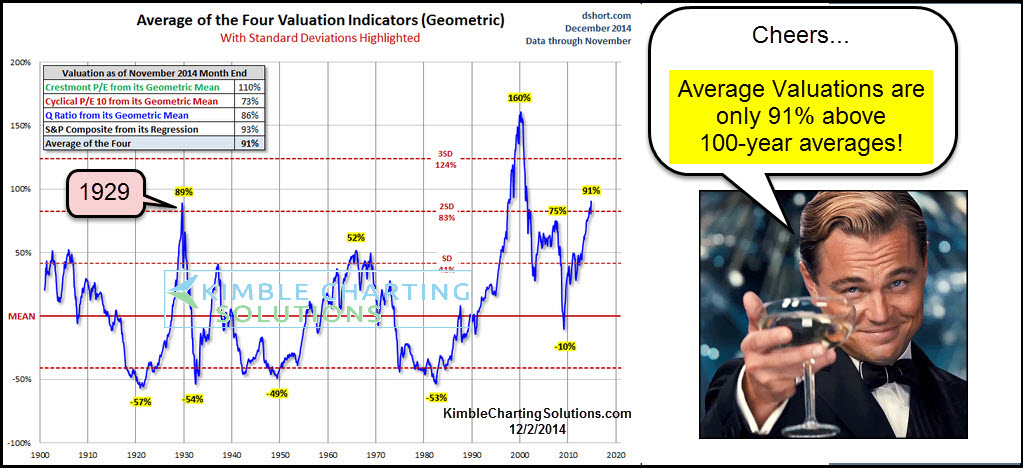

- Comparison to Historical Averages: Current P/E ratios are notably higher than historical averages for many sectors, indicating a potential disconnect between current market prices and long-term earning potential. This divergence from historical norms raises serious concerns about sustainability.

- Significance of P/E Ratios: Understanding P/E ratios is crucial for determining whether a stock is undervalued or overvalued relative to its earnings. High P/E ratios often suggest investors anticipate substantial future earnings growth, but this expectation isn’t always realized.

Impact of Interest Rate Hikes:

BofA highlights the significant impact of rising interest rates on stock valuations. The Federal Reserve's monetary policy tightening directly affects companies' borrowing costs and investor sentiment.

- Impact on Profitability and Sentiment: Higher interest rates increase borrowing costs for companies, potentially squeezing profit margins and dampening investor enthusiasm for riskier assets. This can lead to a decrease in overall stock prices.

- Impact on Bond Yields: Rising interest rates make bonds more attractive, offering a safer alternative to stocks, thereby diverting investment capital away from the equity market. This competition for capital further impacts stock valuations.

- Relationship with Discounted Cash Flow: Interest rates are a critical component of discounted cash flow (DCF) valuation models. Higher rates reduce the present value of future cash flows, thus lowering the intrinsic value of a company's stock.

Concerns Regarding Future Earnings Growth:

BofA expresses concerns about projected earnings growth, particularly given current economic uncertainties. The sustainability of current high stock valuations hinges on these growth expectations.

- Sectors with Earnings Concerns: Several sectors, including retail and some technology sub-sectors, face challenges in maintaining strong earnings growth due to inflation, supply chain disruptions, and slowing consumer demand.

- Inflation and Economic Uncertainty: Inflationary pressures and global economic uncertainty significantly impact earnings forecasts, potentially leading to downward revisions and triggering market corrections.

- Influence on Stock Prices: Expectations of future earnings growth are a primary driver of current stock prices. If these expectations are not met, it can lead to a significant drop in stock valuations.

Investor Concerns Stemming from High Stock Valuations:

Market Volatility and Correction Risks:

BofA warns of increased market volatility and the potential for a significant market correction. High valuations often precede periods of market downturn.

- Historical Examples: History demonstrates that extended periods of high valuations often culminate in substantial market corrections, reminding investors of the inherent risks involved.

- BofA's Volatility Projections: BofA's models suggest a heightened probability of increased market volatility in the near term, potentially leading to sharp price declines.

- Triggers for a Correction: Several factors could trigger a correction, including unexpected negative economic data, geopolitical events, or a further tightening of monetary policy.

Impact on Investment Strategies:

BofA advises investors to adjust their strategies considering the elevated valuations and potential risks. This involves implementing effective risk management techniques.

- Portfolio Diversification: Diversifying investment portfolios across various asset classes is crucial to mitigate risk, lessening the impact of any single sector's underperformance.

- Risk Management Strategies: Employing strategies like hedging, stop-loss orders, and position sizing can significantly reduce potential losses during market downturns.

- Alternative Investments: Exploring alternative investment options, such as bonds, real estate, or commodities, can help balance portfolio risk and potentially offer better returns in a volatile market.

The Role of Quantitative Easing (QE) and its Tapering:

BofA acknowledges the significant role played by quantitative easing (QE) in inflating asset prices and the implications of its tapering.

- Impact of Reduced Liquidity: The withdrawal of QE reduces market liquidity, potentially impacting asset prices across various markets. The reduced availability of easy money directly impacts valuations.

- Investor Reaction to Monetary Policy Changes: Investors need to anticipate how changes in monetary policy might affect stock valuations and adjust their strategies accordingly. A shift in monetary policy often results in shifts in market sentiment.

- Understanding QE and Tapering: Understanding the mechanisms of QE and its subsequent tapering is vital for investors to comprehend the broader economic forces shaping market dynamics and valuations.

Conclusion:

BofA's analysis underscores the significant risks associated with current high stock valuations. Elevated P/E ratios, rising interest rates, concerns about future earnings growth, and the tapering of QE contribute to a heightened risk of market volatility and potential corrections. Investors should prioritize cautious strategies, including portfolio diversification, robust risk management, and potentially exploring alternative investments. The key takeaway is the need for a thorough understanding of the current market environment and the development of informed investment strategies that account for the risks associated with high stock valuations. Conduct further research on high stock valuations and consult with a financial advisor to develop a personalized investment plan aligned with your risk tolerance. Proactive management is crucial to navigate the challenges presented by these elevated valuations and ensure long-term financial success.

Featured Posts

-

Mark Zuckerberg And The Trump Era A New Phase For Meta

Apr 26, 2025

Mark Zuckerberg And The Trump Era A New Phase For Meta

Apr 26, 2025 -

Milan Design Week 2025 Saint Laurent Showcases The Legacy Of Charlotte Perriand

Apr 26, 2025

Milan Design Week 2025 Saint Laurent Showcases The Legacy Of Charlotte Perriand

Apr 26, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Saab Ceo Shorter Lead Times For Defense Orders

Apr 26, 2025

Saab Ceo Shorter Lead Times For Defense Orders

Apr 26, 2025 -

Chainalysis And Alterya A Strategic Merger In Blockchain And Ai

Apr 26, 2025

Chainalysis And Alterya A Strategic Merger In Blockchain And Ai

Apr 26, 2025