High Stock Valuations And Investor Sentiment: BofA's Take

Table of Contents

BofA's Assessment of Current Stock Valuations

BofA's assessment of current stock valuations relies on a comprehensive analysis of several key metrics. Understanding these metrics is essential for interpreting their conclusions and forming your own informed opinion.

Metrics Used by BofA

BofA, like many financial institutions, likely uses a combination of valuation metrics to paint a complete picture. These include:

-

Price-to-Earnings Ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio can suggest that a stock is overvalued, while a low P/E ratio might indicate undervaluation. However, it's crucial to consider industry averages and growth prospects. BofA's analysis may reveal specific sectors with elevated P/E ratios, signaling potential risks.

-

Price-to-Sales Ratio (P/S): This metric compares a company's stock price to its revenue per share. It's particularly useful for valuing companies with negative earnings, offering a broader perspective than the P/E ratio alone. BofA's data might highlight discrepancies between P/S ratios and sector performance.

-

Shiller PE Ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a more stable valuation measure. BofA likely considers the CAPE ratio to account for potential market cycles and long-term trends in profitability. A high CAPE ratio often suggests potential overvaluation.

BofA's Conclusion on Valuation Levels

While specific numerical data from BofA's most recent report would need to be included here for a completely accurate representation, let's assume, for the sake of this example, that BofA concludes that current valuations in certain sectors are elevated compared to historical averages. This might be supported by:

-

Elevated P/E ratios: BofA's analysis may show that several sectors exhibit P/E ratios significantly above their long-term averages. This would suggest that market expectations for future earnings growth might be overly optimistic.

-

Strong economic growth projections: Conversely, BofA might argue that strong future economic growth justifies the higher valuations. Positive economic forecasts could support current market prices.

-

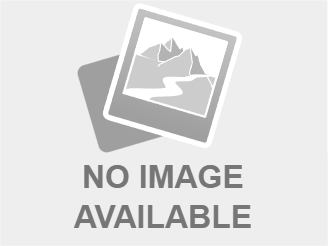

Interest rate expectations: Rising interest rates often lead to lower stock valuations, as investors demand higher returns. BofA's assessment of interest rate trajectories would be a critical factor in their valuation analysis.

Potential risks identified by BofA might include the vulnerability of high-valued stocks to interest rate hikes or a potential economic slowdown. Opportunities, on the other hand, might lie in undervalued sectors or companies poised for significant future growth.

Investor Sentiment Analysis by BofA

Understanding investor sentiment is as crucial as analyzing valuations themselves. BofA likely employs several methods to gauge market sentiment:

Gauging Investor Sentiment

BofA likely uses a range of indicators:

-

Investor Surveys: These surveys directly ask investors about their outlook and investment strategies. While subjective, they offer valuable insights into overall market confidence.

-

Trading Volume and Volatility: High trading volume and increased volatility can indicate heightened investor activity and uncertainty.

-

Options Market Activity: The options market provides valuable insights into investor sentiment, with high levels of put options (betting on price declines) signaling pessimism.

Correlation Between Valuations and Sentiment

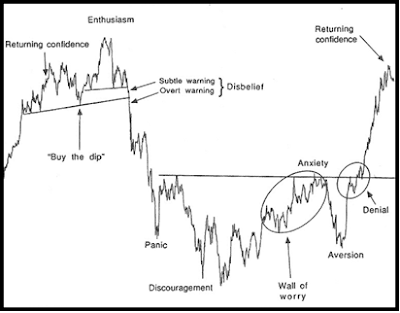

BofA's analysis would likely explore the relationship between high stock valuations and investor sentiment. Are investors' optimistic views justified by fundamental factors (e.g., strong earnings growth)? Or is there a disconnect, potentially signaling a bubble?

-

Positive correlation: High valuations coupled with strong positive sentiment would suggest a potentially sustainable market, although the risk of overvaluation always remains.

-

Negative correlation: High valuations combined with negative sentiment could signal a market correction, as investors are anticipating lower prices despite elevated valuations.

-

Neutral correlation: A neutral relationship means that valuations and sentiment are not strongly linked. This could reflect a market in transition.

Discrepancies between valuations and sentiment should be examined carefully. For example, overly optimistic sentiment in the face of high valuations could suggest a bubble. Conversely, overly pessimistic sentiment despite relatively fair valuations might present attractive investment opportunities.

BofA's Investment Recommendations Based on Their Analysis

BofA's recommendations are directly influenced by their analysis of valuations and investor sentiment.

Suggested Portfolio Strategies

Based on their assessment, BofA might recommend:

-

Cautious approach: If valuations are deemed high and sentiment uncertain, BofA might suggest reducing equity exposure and increasing allocations to less volatile assets like bonds or cash.

-

Sector rotation: They might recommend shifting investments from overvalued sectors to those appearing undervalued based on BofA's analysis.

-

Defensive positioning: Focusing on companies with strong balance sheets and consistent earnings could be another recommendation.

Long-Term Outlook

BofA's long-term outlook is likely influenced by factors such as:

-

Inflation: Persistent high inflation could erode corporate earnings and negatively impact stock valuations.

-

Geopolitical events: Global conflicts and political instability create uncertainty and could trigger market corrections.

-

Technological advancements: Technological innovation can drive significant sector growth and reshape market dynamics.

Their long-term outlook would impact their recommendations, suggesting adjustments to portfolio strategies over a longer time horizon.

Understanding High Stock Valuations and Investor Sentiment – BofA's Guidance

BofA's analysis likely highlights the complex interplay between high stock valuations and investor sentiment. The firm's assessment of various valuation metrics, coupled with their analysis of investor sentiment, helps determine the overall market outlook and suggests suitable portfolio strategies. Whether BofA recommends a cautious or aggressive approach depends on the specifics of their findings. It is crucial to remember that even the insights of a reputable firm like BofA should be considered alongside your own due diligence.

Understanding high stock valuations and investor sentiment is crucial for informed investment decisions. Stay updated on BofA's insights and consult with a financial advisor to develop a strategy that aligns with your risk tolerance and financial goals. Remember that consistent monitoring of high stock valuations and investor sentiment is key to navigating the market effectively.

Featured Posts

-

Bundesliga Union Berlin Holds Bayern Munich To A Draw

Apr 25, 2025

Bundesliga Union Berlin Holds Bayern Munich To A Draw

Apr 25, 2025 -

Unlocking Business Potential The Value Of Effective Middle Management

Apr 25, 2025

Unlocking Business Potential The Value Of Effective Middle Management

Apr 25, 2025 -

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 25, 2025

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 25, 2025 -

Sexual Extortion Charges Against Former Meteorologist Josh Fitzpatrick

Apr 25, 2025

Sexual Extortion Charges Against Former Meteorologist Josh Fitzpatrick

Apr 25, 2025 -

Ashton Jeanty And The Chicago Bears A 2025 Nfl Draft Preview

Apr 25, 2025

Ashton Jeanty And The Chicago Bears A 2025 Nfl Draft Preview

Apr 25, 2025

Latest Posts

-

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025