High Stock Valuations: Why BofA Believes Investors Shouldn't Panic

Table of Contents

BofA's Rationale Behind a Cautiously Optimistic Outlook

BofA's core argument against immediate panic rests on several key pillars. Their cautiously optimistic outlook isn't blind faith; it's rooted in a considered analysis of current economic and market conditions. The bank believes that current high stock valuations, while significant, don't necessarily signal an imminent crash. Their reasoning includes:

-

Strong corporate earnings growth despite high valuations: Many companies are demonstrating robust profit growth, even with elevated stock prices. This suggests that the market may be accurately reflecting strong underlying fundamentals, rather than being purely driven by speculation. BofA's research points to specific sectors showing particularly healthy earnings growth, mitigating concerns around overvaluation across the board.

-

Low interest rates supporting continued investment: The current environment of low interest rates continues to encourage investment, supporting higher stock prices. This makes alternative investment options less attractive compared to the potential returns in the stock market. While interest rate hikes are a possibility, their impact, according to BofA's analysis, might be more gradual than many fear.

-

Positive long-term economic projections mitigating short-term valuation concerns: BofA's economists are forecasting continued, albeit moderate, economic growth in the coming years. This positive long-term outlook helps to contextualize the current high stock valuations, suggesting they may be sustainable given the expectation of future earnings growth.

-

Specific sectors or companies identified by BofA as relatively undervalued or resilient: While BofA acknowledges high valuations in some areas, their research identifies specific sectors and individual companies exhibiting relatively stronger value propositions or demonstrating resilience in the face of market volatility. (Note: Specific examples would need to be drawn from actual BofA research reports for complete accuracy.)

Analyzing the Metrics: A Deeper Dive into Valuation Ratios

BofA's analysis relies on a range of valuation metrics to support their argument. They use traditional indicators like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, but also consider more nuanced factors.

-

Comparison of current valuations to historical averages: BofA’s research likely shows that while current valuations are elevated, they are not unprecedented historically. Comparing current P/E ratios to those seen during previous periods of strong economic growth provides crucial context. Simply stating a high P/E ratio without this historical context can be misleading.

-

Consideration of factors beyond simple valuation ratios: BofA's analysis goes beyond simple ratios. They incorporate factors such as projected future earnings growth, the overall market sentiment, and the specific characteristics of individual companies. This holistic approach provides a more accurate picture of the overall market health.

Addressing Investor Concerns: Common Fears and BofA's Rebuttals

High stock valuations naturally raise concerns among investors. BofA addresses several common anxieties:

-

Addressing inflation concerns: While inflation is a legitimate concern, BofA's analysis likely acknowledges the impact but argues that it's manageable, or even already factored into current valuations. They may point to strategies companies are employing to mitigate the effects of inflation on their bottom line.

-

Rebuttal to market crash predictions: BofA likely counters market crash predictions by emphasizing the underlying strength of many companies and the ongoing economic growth projections. They may suggest that any corrections would likely be more moderate and offer opportunities for strategic investors.

-

Analysis of interest rate impact: BofA's analysts likely provide a nuanced view of how interest rate increases would affect stock valuations. They may argue that a gradual increase would be less disruptive than a sharp, unexpected jump.

A Strategic Approach for Investors: Navigating High Valuations

Based on BofA's assessment, investors can adopt several strategies:

-

Diversification strategies to mitigate risk: Diversification across different asset classes and sectors remains crucial, particularly in a high-valuation market.

-

Sector-specific investment recommendations: (Note: Specific recommendations would need to be drawn from actual BofA research reports.)

-

Importance of long-term investment horizons: Maintaining a long-term investment horizon helps to weather short-term market fluctuations and benefit from the potential for long-term growth.

-

Strategies for managing risk, such as dollar-cost averaging: Dollar-cost averaging, where you invest a fixed amount at regular intervals, can help reduce the impact of market volatility.

Conclusion

BofA's analysis suggests that while high stock valuations are a valid concern, a knee-jerk reaction of panic selling may be unwarranted. Their research points to strong corporate earnings, low interest rates, and positive long-term economic projections as mitigating factors. The bank emphasizes the importance of a long-term investment strategy and a measured approach to navigating the current market conditions. Don't let high stock valuations trigger a hasty reaction; instead, take a measured approach to your investment strategy and consider the insights provided by BofA's analysis. Conduct your own thorough research before making any investment decisions.

Featured Posts

-

Navigating The America First Era Harvards Perspective

May 30, 2025

Navigating The America First Era Harvards Perspective

May 30, 2025 -

New Us Duties On Solar Panels From Southeast Asia Impact And Analysis

May 30, 2025

New Us Duties On Solar Panels From Southeast Asia Impact And Analysis

May 30, 2025 -

Ufc Gustafssons Assessment Of Jones And Aspinalls Upcoming Fight

May 30, 2025

Ufc Gustafssons Assessment Of Jones And Aspinalls Upcoming Fight

May 30, 2025 -

Spaendinger Mellem Danmark Og Holder Vejret Hvad Betyder Det For Fremtiden

May 30, 2025

Spaendinger Mellem Danmark Og Holder Vejret Hvad Betyder Det For Fremtiden

May 30, 2025 -

Setlist Fm Y Ticketmaster Integracion Para Una Mejor Gestion De Entradas

May 30, 2025

Setlist Fm Y Ticketmaster Integracion Para Una Mejor Gestion De Entradas

May 30, 2025

Latest Posts

-

Cleveland Browns No 2 Draft Pick Mel Kiper Jr S Analysis

May 31, 2025

Cleveland Browns No 2 Draft Pick Mel Kiper Jr S Analysis

May 31, 2025 -

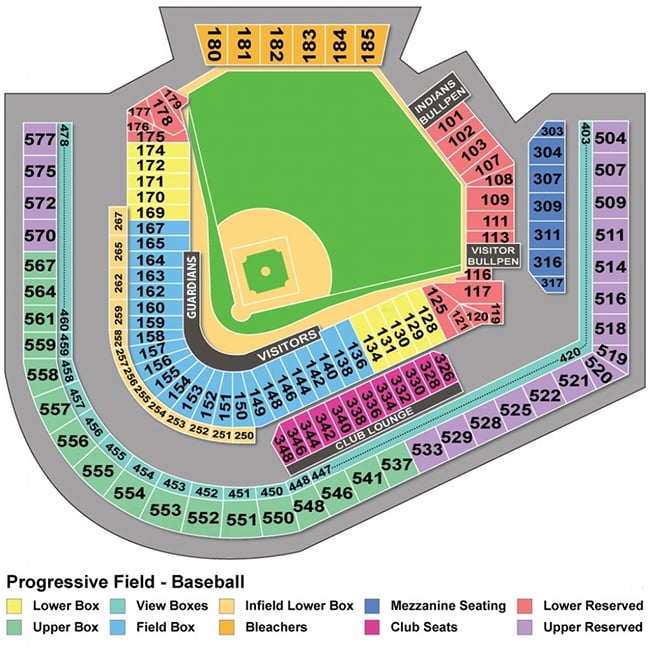

Cleveland Guardians Opening Day Weather Is It Typically This Cold

May 31, 2025

Cleveland Guardians Opening Day Weather Is It Typically This Cold

May 31, 2025 -

Nfl Draft Mel Kiper Jr S Pick For The Cleveland Browns At No 2

May 31, 2025

Nfl Draft Mel Kiper Jr S Pick For The Cleveland Browns At No 2

May 31, 2025 -

Guardians Opening Day Weather History A Chilly Look Back

May 31, 2025

Guardians Opening Day Weather History A Chilly Look Back

May 31, 2025 -

Mel Kiper Jr On The Browns No 2 Pick Who Will They Draft

May 31, 2025

Mel Kiper Jr On The Browns No 2 Pick Who Will They Draft

May 31, 2025