High Stock Valuations: Why BofA Thinks Investors Should Remain Calm

Table of Contents

BofA's Rationale Behind the Calm Approach

BofA's analysis of the current market situation suggests that while stock valuations appear high, they are not necessarily unsustainable or indicative of imminent doom. Their rationale rests on a multi-pronged assessment encompassing several key factors. The bank's research team isn't simply dismissing concerns; instead, they're offering a nuanced perspective grounded in detailed analysis.

-

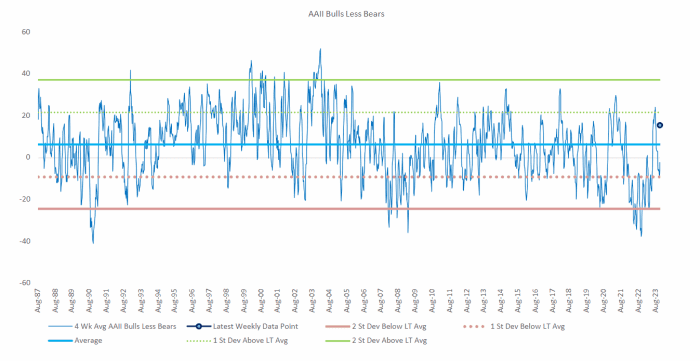

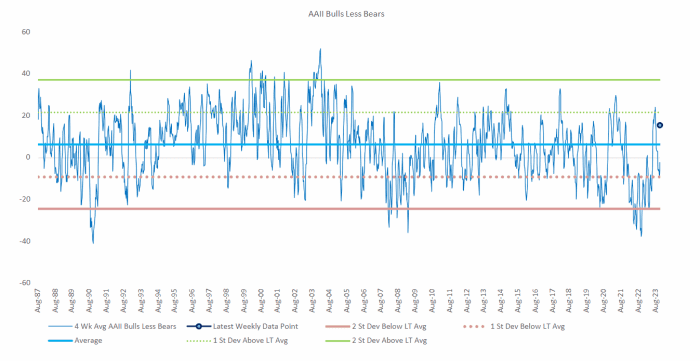

Analysis of key valuation metrics: BofA's reports often consider a range of valuation metrics beyond simple price-to-earnings (P/E) ratios. They delve into price-to-sales ratios, price-to-book ratios, and other metrics to paint a more complete picture. Their analysis often shows that while some sectors might appear overvalued based on traditional metrics, other factors, like robust earnings growth, can justify current prices.

-

Assessment of underlying economic fundamentals: BofA's economists closely monitor macroeconomic indicators, including GDP growth, inflation, and unemployment. Their assessment of these fundamentals often plays a significant role in their valuation judgments. A strong economic outlook can support higher valuations, even if they appear elevated based on historical averages.

-

Perspective on future interest rate movements: Interest rates are a crucial factor influencing stock valuations. BofA's analysis of potential interest rate changes – whether increases or decreases – and their impact on corporate earnings and investor sentiment forms a key part of their overall assessment. They often incorporate various interest rate scenarios into their models to provide a more robust assessment of the potential risks and rewards.

Addressing Investor Concerns About High Stock Valuations

It's understandable that investors feel anxious when confronted with high stock valuations. The fear of a market correction, a sudden and sharp decline in prices, is a legitimate concern. However, BofA's research suggests that a measured approach is warranted.

-

Historical context: History shows that periods of high valuations have been followed by both corrections and continued growth. Looking at past market cycles reveals that while short-term volatility is common, long-term trends tend to be upward, particularly for well-managed companies.

-

Risk management strategies: BofA emphasizes the importance of diversifying portfolios across different asset classes and sectors. This reduces the impact of any single sector's underperformance. Employing strategies like dollar-cost averaging (investing a fixed amount regularly regardless of price) can help mitigate risk and smooth out returns over time.

-

Long-term growth potential: Despite current valuations, BofA points to the long-term growth potential of many companies. Focusing on companies with strong fundamentals, innovative products, and a clear path to future growth can help investors navigate these volatile periods. They emphasize that the long-term growth story remains positive for many sectors.

The Importance of a Long-Term Investment Strategy

The key takeaway from BofA's analysis is the importance of adopting a long-term investment strategy. This is not simply a suggestion; it's a necessity for weathering market fluctuations and achieving financial goals.

-

Market cycles: Markets naturally experience cycles of expansion and contraction. A long-term perspective allows investors to ride out the downturns and reap the rewards of the upturns. Trying to time the market is usually a losing strategy; a disciplined long-term approach often proves far more successful.

-

Avoiding emotional investing: Fear and greed are powerful emotions that can lead investors to make impulsive decisions. A well-defined, long-term plan helps to mitigate the impact of these emotions, preventing impulsive buying or selling decisions based on short-term market fluctuations.

-

Sticking to the plan: Maintaining discipline and sticking to a long-term investment plan, even during periods of market uncertainty, is crucial. Regular portfolio reviews and rebalancing are important, but drastic changes in response to short-term market noise are generally not advised.

Specific Investment Recommendations (Optional)

(Disclaimer: The following is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.)

While BofA doesn't explicitly offer specific stock picks in their public reports, their sector analysis often highlights sectors they see as promising, even within a high valuation environment. For example, they might point towards certain technology sectors with strong growth potential or consumer staples exhibiting resilience during economic uncertainty. However, individual stock selection requires thorough due diligence and personalized financial planning.

Conclusion

While high stock valuations are indeed a legitimate cause for some concern, BofA's detailed analysis provides a compelling case for maintaining a calm and strategic approach. Their research emphasizes the importance of understanding underlying economic fundamentals, employing robust risk management strategies, and, most critically, adhering to a long-term investment strategy. Don't let the current situation of high stock valuations derail your long-term financial goals. Consider reviewing your investment strategy, diversify your portfolio, and, if needed, seek guidance from a financial advisor to navigate these market conditions effectively. Remember, successful long-term investing requires patience and discipline.

Featured Posts

-

New Olympic Swimming Site To Be Centrepiece Of Nices Aquatic Development

May 21, 2025

New Olympic Swimming Site To Be Centrepiece Of Nices Aquatic Development

May 21, 2025 -

Check The Latest Rain Predictions Timing And Intensity

May 21, 2025

Check The Latest Rain Predictions Timing And Intensity

May 21, 2025 -

Music And Community Delving Into The Sound Perimeter

May 21, 2025

Music And Community Delving Into The Sound Perimeter

May 21, 2025 -

I Hope You Rot In Hell Shocking Video Captures Pub Landlords Tirade At Departing Employee

May 21, 2025

I Hope You Rot In Hell Shocking Video Captures Pub Landlords Tirade At Departing Employee

May 21, 2025 -

Penn Relays Allentowns Historic Sub 43 4x100m Relay

May 21, 2025

Penn Relays Allentowns Historic Sub 43 4x100m Relay

May 21, 2025

Latest Posts

-

Mm Karsinnat 2024 Huuhkajien Uuden Valmennuksen Haasteet

May 21, 2025

Mm Karsinnat 2024 Huuhkajien Uuden Valmennuksen Haasteet

May 21, 2025 -

Zoey Starks Injury Details From Wwe Raw Match

May 21, 2025

Zoey Starks Injury Details From Wwe Raw Match

May 21, 2025 -

Huuhkajien Tulevaisuus Uusi Valmennus Kohti Mm Karsintoja

May 21, 2025

Huuhkajien Tulevaisuus Uusi Valmennus Kohti Mm Karsintoja

May 21, 2025 -

Suomi Mm Karsinnoissa Huuhkajien Valmennuksen Uudistus

May 21, 2025

Suomi Mm Karsinnoissa Huuhkajien Valmennuksen Uudistus

May 21, 2025 -

Huuhkajien Uusi Valmennus Ja Tie Mm Karsintoihin

May 21, 2025

Huuhkajien Uusi Valmennus Ja Tie Mm Karsintoihin

May 21, 2025