High-Yield Dividend Investing: Simplicity For Maximum Profit

Table of Contents

Understanding High-Yield Dividend Stocks

High-yield dividend investing focuses on companies that pay out a substantial portion of their earnings as dividends to shareholders. But what constitutes "high-yield"?

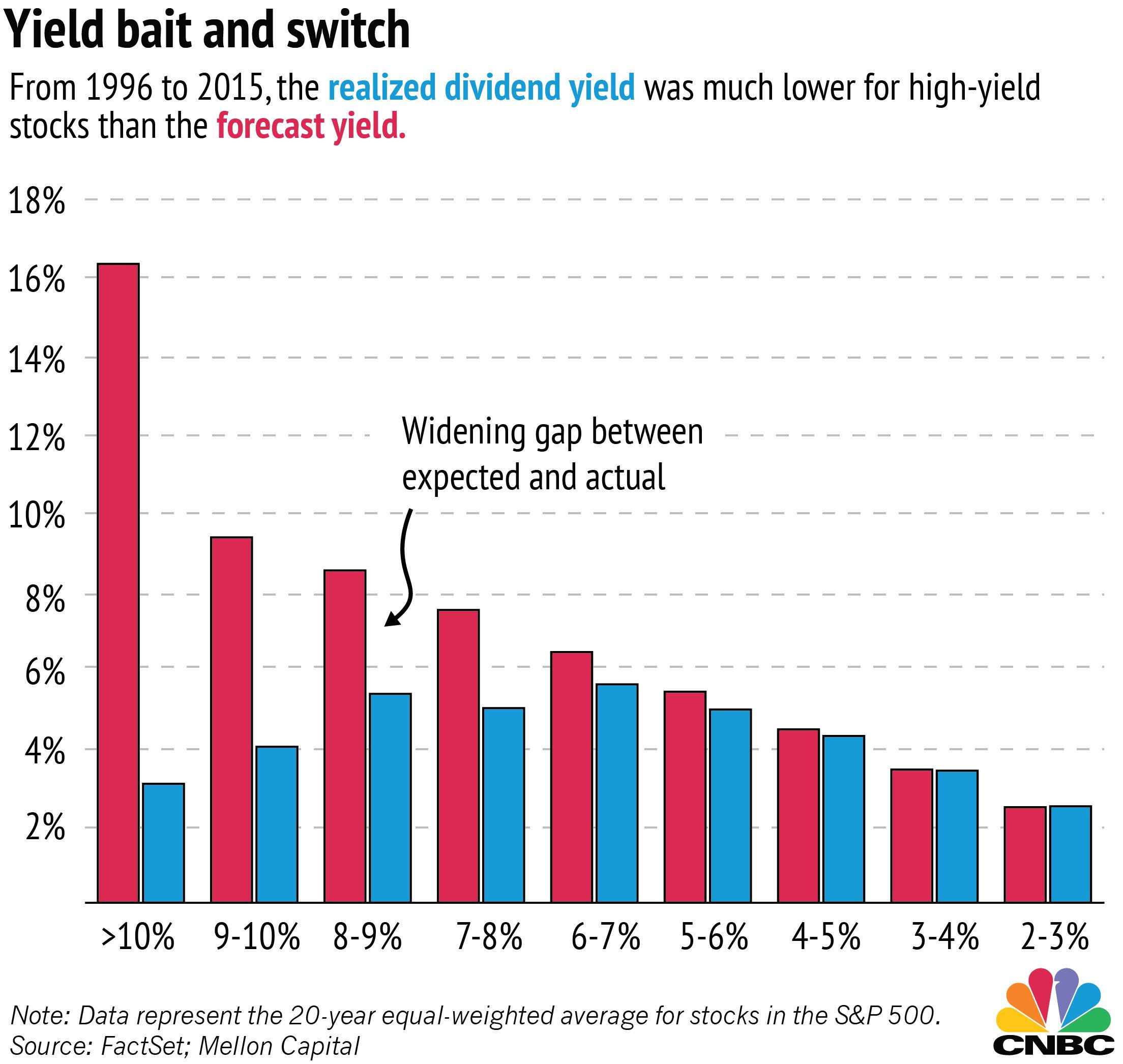

Defining High-Yield: A high-yield dividend stock typically boasts a dividend yield significantly above the average market yield. The dividend yield is calculated by dividing the annual dividend per share by the stock's price. For example, a stock priced at $50 paying an annual dividend of $5 has a 10% dividend yield. Sectors known for higher yields often include Real Estate Investment Trusts (REITs), utilities, and certain consumer staples. However, high yield alone is not a guarantee of success.

Risk Assessment: While the potential for high returns is attractive, high-yield dividend stocks carry inherent risks. Companies with exceptionally high yields might be facing financial difficulties, leading to potential dividend cuts or even bankruptcy. Thorough due diligence is crucial.

- Analyze payout ratios: A high payout ratio (dividends paid out as a percentage of earnings) can be a red flag, suggesting the company may struggle to maintain its dividend payments.

- Consider the company's financial health: Examine key financial metrics like the debt-to-equity ratio, which indicates the company's leverage. High debt can increase the risk of dividend cuts.

- Research industry trends and competitive landscape: Understand the company's position within its industry and its ability to compete effectively.

- Diversify your portfolio: Never put all your eggs in one basket. Diversification across multiple high-yield stocks from different sectors reduces risk.

Strategies for Successful High-Yield Dividend Investing

Building a successful high-yield dividend portfolio requires a well-defined strategy.

Diversification: Diversification is paramount in mitigating risk. Don't concentrate your investments in a single sector or geographic region. Spread your investments across different industries and countries to reduce the impact of any single company's underperformance.

DRIP (Dividend Reinvestment Plan): A DRIP allows you to automatically reinvest your dividend payments back into the same stock, buying additional shares. This power of compounding significantly accelerates your wealth building over time.

Long-Term Perspective: High-yield dividend investing is a long-term game. Don't expect overnight riches. Focus on building a diversified portfolio of strong companies and let the power of compounding work its magic over time.

- Consider ETFs and mutual funds: These offer diversified exposure to a basket of high-yield stocks, simplifying your investment process.

- Regularly review and rebalance your portfolio: Periodically assess your portfolio's performance and rebalance it to maintain your desired asset allocation.

- Stay informed about market trends and company news: Keep abreast of relevant news that could impact your investments.

- Develop a disciplined investment plan and stick to it: Avoid emotional decision-making; stick to your plan through market fluctuations.

Identifying Promising High-Yield Dividend Stocks

Finding suitable high-yield dividend stocks requires a combination of research and analysis.

Fundamental Analysis: Dive deep into a company's financial statements (income statement, balance sheet, cash flow statement). Analyze profitability, revenue growth, debt levels, and free cash flow to assess its long-term viability and its ability to sustain dividend payments.

Technical Analysis (Optional): While not essential for beginners, technical analysis uses chart patterns and indicators to identify potential buying and selling opportunities.

Reliable Resources: Leverage reputable sources to gather information. Financial news websites, stock screeners, and company websites provide valuable data.

- Look for companies with a history of consistent dividend payments: A long track record of consistent dividend payouts is a positive sign.

- Consider dividend growth potential: Companies that have a history of increasing their dividends are more attractive long-term investments.

- Use stock screeners: Online stock screeners allow you to filter stocks based on specific criteria, such as dividend yield, payout ratio, and market capitalization.

- Read company annual reports and investor presentations: These documents provide valuable insights into a company's performance, strategy, and future plans.

Tax Implications of High-Yield Dividend Investing

Understanding the tax implications is crucial for maximizing your returns.

Qualified vs. Non-Qualified Dividends: Qualified dividends are taxed at a lower rate than ordinary income, while non-qualified dividends are taxed at your ordinary income tax rate. The classification depends on factors like the holding period of the stock.

Tax-Advantaged Accounts: Utilizing tax-advantaged accounts like IRAs and 401(k)s can significantly reduce your tax burden on dividend income.

- Consult with a tax professional: Seek personalized advice from a qualified tax advisor to optimize your tax strategy.

- Understand the tax implications in your specific jurisdiction: Tax laws vary by location, so it's essential to be aware of your specific circumstances.

Conclusion

High-yield dividend investing offers a compelling path to financial growth. By understanding the basics, diversifying your portfolio, conducting thorough due diligence, and adopting a long-term perspective, you can significantly enhance your investment returns. Remember to consider the tax implications and stay informed about market trends. Ready to unlock the potential of high-yield dividend investing and build a stronger financial future? Start researching promising stocks today and build your portfolio for long-term growth! Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Itv 4s Kojak Schedule When And Where To Watch

May 11, 2025

Itv 4s Kojak Schedule When And Where To Watch

May 11, 2025 -

Ryan Reynolds Mntn Ipo Launch Expected Next Week

May 11, 2025

Ryan Reynolds Mntn Ipo Launch Expected Next Week

May 11, 2025 -

The Complete Guide To Tom Cruises Dating History

May 11, 2025

The Complete Guide To Tom Cruises Dating History

May 11, 2025 -

Pope Leo Is First Mass A Strong Warning Against De Facto Atheism

May 11, 2025

Pope Leo Is First Mass A Strong Warning Against De Facto Atheism

May 11, 2025 -

Retragerea Lui Thomas Mueller Un Capitol Inchis Cu Emotii Intense

May 11, 2025

Retragerea Lui Thomas Mueller Un Capitol Inchis Cu Emotii Intense

May 11, 2025