Higher Stock Prices, Higher Risks: What Investors Should Know

Table of Contents

Understanding the Correlation Between Higher Stock Prices and Increased Risk

Higher stock prices aren't always a sign of a healthy market. Often, they reflect a complex interplay of factors that can significantly increase your investment risk.

Market Sentiment and Speculation

Higher stock prices can be fueled by optimistic market sentiment and speculation, leading to inflated valuations. This creates a bubble-like effect where prices rise based on expectations rather than fundamentals.

- Increased trading volume: As more investors jump on the bandwagon, driven by fear of missing out (FOMO), trading volume increases dramatically. This frenzied activity often masks underlying vulnerabilities.

- Potential for rapid price corrections: If sentiment shifts negatively – perhaps due to unexpected economic news or company performance – the market can experience a sharp and swift correction. Prices can plummet just as quickly as they rose.

- The danger of FOMO: Emotional decision-making, fueled by FOMO, can lead investors to make irrational investment choices, ignoring fundamental analysis and risk assessment.

Valuation Metrics and Overvaluation

High stock prices don't always reflect the underlying value of a company. Overvalued stocks, those trading at prices significantly higher than their intrinsic value, become highly susceptible to price corrections.

- Importance of analyzing P/E ratios and other key valuation metrics: Investors must carefully analyze Price-to-Earnings (P/E) ratios, Price-to-Book (P/B) ratios, and other key metrics to gauge whether a stock's price is justified by its fundamentals.

- Identifying bubbles and unsustainable growth trends: Recognizing unsustainable growth trends and speculative bubbles is crucial. These situations often lead to dramatic market crashes.

- The need for fundamental analysis: Fundamental analysis, which involves examining a company's financial statements and business model, is essential to support investment choices and avoid overvalued stocks.

Identifying and Assessing Specific Risks Associated with Higher Stock Prices

Higher stock prices often magnify existing risks, creating a potentially volatile investment environment.

Increased Volatility and Market Corrections

Higher prices often precede periods of increased volatility, making your investments more susceptible to sudden drops. Market corrections, sometimes significant, are a natural part of the market cycle but can be devastating for unprepared investors.

- Understanding market cycles and historical patterns: Studying past market cycles can provide valuable insights into the potential for volatility and corrections.

- Diversification as a key risk mitigation strategy: Diversifying your portfolio across different asset classes reduces your exposure to any single market downturn.

- The importance of a long-term investment horizon: A long-term investment strategy allows you to weather short-term market fluctuations and benefit from the market's overall upward trend.

Potential for Overextension and Debt

Companies with soaring stock prices might take on excessive debt to fund expansion or acquisitions. This overextension can jeopardize their financial stability, especially during economic downturns.

- Analyzing a company's debt-to-equity ratio and cash flow: Careful analysis of financial statements is vital to assess a company's debt levels and ability to service its obligations.

- Recognizing signs of financial distress: Understanding the warning signs of financial distress, such as declining profitability and rising debt, is critical.

- The importance of due diligence: Thorough due diligence, including examining a company's financial health and management team, is crucial before investing.

Strategies for Mitigating Risk During Periods of Higher Stock Prices

While higher stock prices present opportunities, managing the inherent risks is essential for successful investing.

Diversification Across Asset Classes

Don't put all your eggs in one basket. Diversifying your investments across stocks, bonds, real estate, and other asset classes reduces your overall risk.

- Understanding asset allocation and its importance in risk reduction: Asset allocation involves strategically distributing your investments across different asset classes to optimize returns while minimizing risk.

- Considering different investment vehicles (e.g., ETFs, mutual funds): ETFs and mutual funds offer diversification within a single investment, simplifying portfolio management.

- Regularly reviewing and rebalancing your portfolio: Regularly review and rebalance your portfolio to maintain your desired asset allocation and adjust to changing market conditions.

Employing a Prudent Investment Strategy

Develop a well-defined investment strategy based on your risk tolerance, financial goals, and time horizon. This framework will guide your investment decisions, even during periods of market uncertainty.

- Defining your investment objectives and risk tolerance: Clearly define your investment goals (e.g., retirement, education) and assess your risk tolerance.

- Setting realistic expectations for returns: Avoid chasing unrealistic returns. Focus on achieving consistent, long-term growth.

- Seeking professional financial advice if needed: Don't hesitate to seek professional financial advice, especially if you're unsure about how to manage your investments.

Understanding Your Exit Strategy

Have a plan for when and how you'll sell your investments, even during periods of high prices. A well-defined exit strategy helps you protect your profits and mitigate losses.

- Setting profit targets and stop-loss orders: Establishing profit targets and stop-loss orders helps you manage risk and lock in profits.

- Considering tax implications of selling investments: Understand the tax implications of selling your investments to minimize your tax burden.

- Maintaining emotional discipline in decision-making: Avoid making impulsive investment decisions based on emotions. Stick to your plan.

Conclusion

Higher stock prices can indeed be tempting, but it's imperative to understand that they often come hand-in-hand with increased risk. By carefully analyzing market trends, employing prudent investment strategies, and diversifying your portfolio, you can mitigate the potential downsides and navigate the complexities of investing in a market characterized by higher stock prices. Remember, informed investing is key to achieving your financial goals. Don't let the allure of higher stock prices overshadow the importance of thorough risk assessment and a well-defined investment plan. Start managing your investment risks today and make informed decisions about your investments in the face of higher stock prices.

Featured Posts

-

Covid 19 Pandemic Lab Owner Pleads Guilty To Faking Test Results

Apr 22, 2025

Covid 19 Pandemic Lab Owner Pleads Guilty To Faking Test Results

Apr 22, 2025 -

Steeper Tariffs A Looming Threat To Chinas Export Oriented Economy

Apr 22, 2025

Steeper Tariffs A Looming Threat To Chinas Export Oriented Economy

Apr 22, 2025 -

Fsu Security Breach Swift Police Response Fails To Quell Student Fears

Apr 22, 2025

Fsu Security Breach Swift Police Response Fails To Quell Student Fears

Apr 22, 2025 -

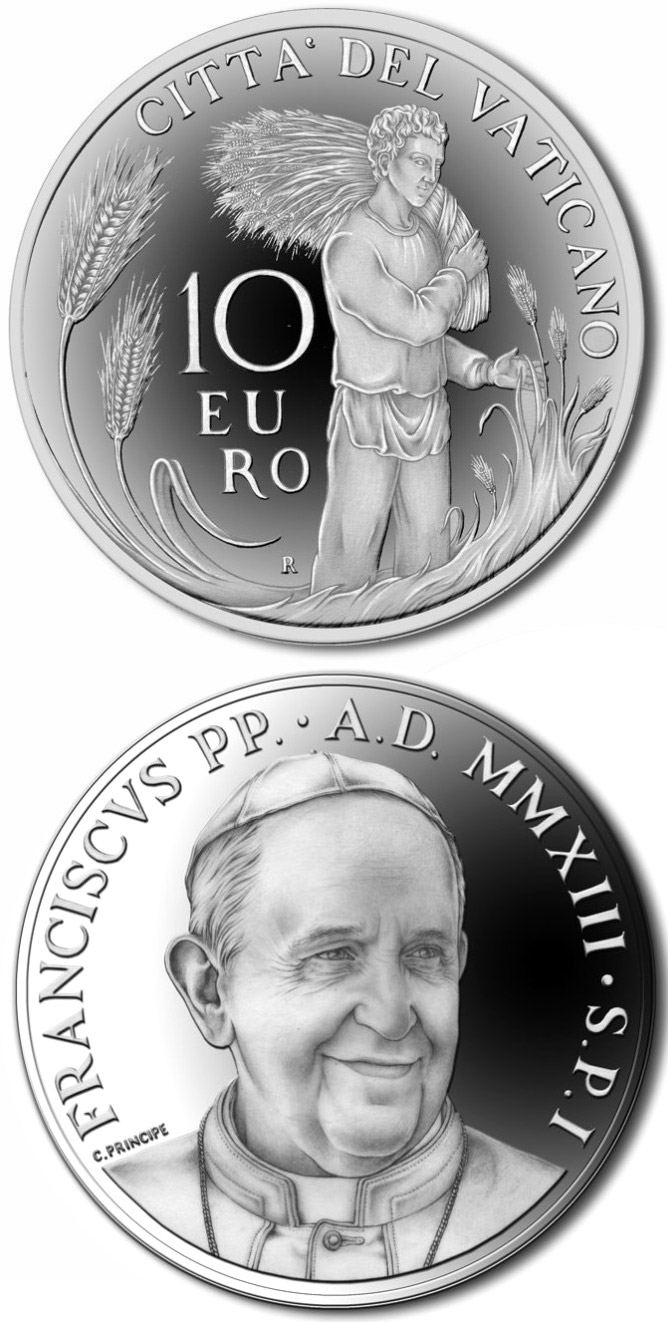

Assessing Pope Franciss Pontificate The Conclaves Verdict

Apr 22, 2025

Assessing Pope Franciss Pontificate The Conclaves Verdict

Apr 22, 2025 -

The Unsung Heroes Of Business The Value Of Middle Managers

Apr 22, 2025

The Unsung Heroes Of Business The Value Of Middle Managers

Apr 22, 2025