HMRC Child Benefit Warning: Urgent Messages You Shouldn't Ignore

Table of Contents

Recognizing Genuine HMRC Child Benefit Communications

It's vital to be able to distinguish official HMRC correspondence from fraudulent attempts to steal your information. Phishing scams are increasingly sophisticated, mimicking genuine HMRC emails and letters. Therefore, carefully examining any communication supposedly from HMRC is crucial.

- Official Letterhead and Branding: Genuine HMRC letters will always feature the official HMRC letterhead and branding. This includes the government crest and specific formatting. Look closely for inconsistencies.

- Contact Details and Reference Numbers: Check the contact details. They should match the official HMRC website. Every official communication will have a unique reference number.

- Communication Methods: HMRC typically communicates via post, email (using a government email address, often ending in @gov.uk), and through your online HMRC account. Be wary of unexpected calls or texts claiming to be from HMRC.

- Suspicious Links and Attachments: Never click on links or open attachments from emails you’re unsure about. Always verify the sender's identity through official HMRC channels before engaging with any communication.

- Verify Directly: If you are uncertain about the authenticity of any HMRC Child Benefit communication, contact HMRC directly through their official website or telephone number to verify its legitimacy. Never use contact information provided in a suspicious email or letter.

Understanding Common Reasons for HMRC Child Benefit Contact

HMRC may contact you regarding your Child Benefit for several reasons:

- Changes in Income: A change in your income, either an increase or a decrease, could affect your eligibility for Child Benefit. HMRC needs to verify your income details to ensure you are receiving the correct amount.

- Overpayments: If an overpayment of Child Benefit has been identified, HMRC will contact you to arrange repayment. This may be due to an error in your application or a change in circumstances.

- Updates to Personal Details: Any changes to your address, bank account details, or other personal information must be reported to HMRC to ensure continued payments. Failure to update this information may lead to payment delays or interruptions.

- Information Verification: HMRC may periodically contact you to verify the information you have provided. This is to ensure the accuracy of your records and prevent fraud.

Examples of potential actions required:

- Income Change: You might need to provide updated income documentation (payslips, tax returns).

- Overpayment: HMRC will outline a repayment plan.

- Personal Details Update: You'll be asked to confirm the updated information.

- Information Verification: You may need to confirm details about your children or your household income.

For further information, visit the official HMRC website and search for "Child Benefit" to access relevant guidance.

How to Respond to HMRC Child Benefit Messages

Responding promptly and accurately to HMRC communication is crucial. Failure to do so can have serious consequences.

- Responding to a Letter: Note down the reference number, read all instructions carefully, and respond by the stated deadline. Provide all requested information accurately and completely.

- Responding to an Email: Again, note the reference number. Verify that the email is indeed from HMRC using the methods described above. Respond by email using the address provided in the original communication and follow all instructions carefully.

- Using the HMRC Online Portal: The online portal offers a secure and convenient way to manage your Child Benefit details and communicate with HMRC. Log in using your Government Gateway user ID and password.

- Contacting HMRC: If you have any questions or require clarification, contact HMRC directly through their official website or telephone number.

Remember: always provide accurate information. Inaccurate or incomplete responses can delay processing and potentially lead to further investigation.

Consequences of Ignoring HMRC Child Benefit Messages

Ignoring HMRC communications regarding Child Benefit can have serious repercussions:

- Further Investigation: HMRC will likely investigate further, potentially leading to delays in future payments.

- Penalties: Failure to comply with requests for information or repay overpayments can result in penalties, which can be substantial. These penalties could significantly increase the amount you owe.

- Debt Collection Actions: Persistent non-compliance may result in debt collection actions, including potential legal proceedings. This could severely impact your credit rating.

Examples of potential penalties (amounts vary and are subject to change):

- Late repayment penalties on overpayments.

- Penalties for providing inaccurate information.

- Potential legal fees.

For detailed information on penalties, visit the HMRC website and search for "Child Benefit penalties".

Conclusion: Taking Action on Your HMRC Child Benefit Warning

This article highlighted the importance of recognizing genuine HMRC Child Benefit communications, understanding why they might contact you, and responding promptly and accurately. Ignoring these messages can lead to serious financial and legal consequences. Review your HMRC communications immediately. If you have any questions or concerns about your Child Benefit, contact HMRC directly through their official website: [Insert Link to HMRC Child Benefit Page]. Don't delay; addressing any HMRC Child Benefit communication promptly is vital to avoid potential issues and maintain your eligibility for this crucial benefit. Take action today to ensure you receive the correct payments and avoid any penalties associated with late responses to important Child Benefit HMRC messages or urgent Child Benefit notices from HMRC.

Featured Posts

-

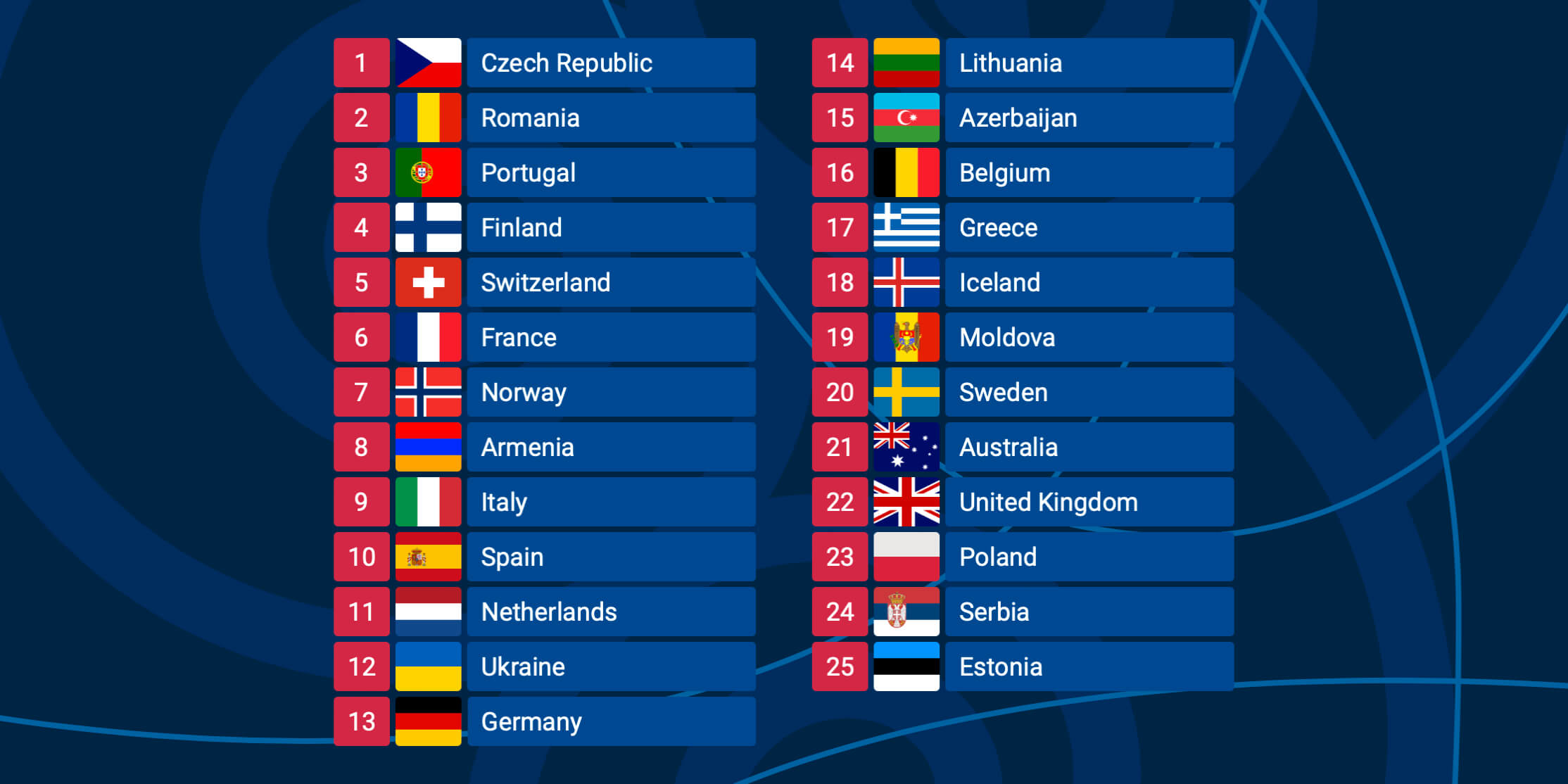

Eurovision 2025 Finalists A Ranking From Hypnotic To Atrocious

May 20, 2025

Eurovision 2025 Finalists A Ranking From Hypnotic To Atrocious

May 20, 2025 -

L Integrale Agatha Christie Biographie Et Uvre Complete

May 20, 2025

L Integrale Agatha Christie Biographie Et Uvre Complete

May 20, 2025 -

Journees Thematiques A Biarritz Parcours De Femmes Et Egalite

May 20, 2025

Journees Thematiques A Biarritz Parcours De Femmes Et Egalite

May 20, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Laehtevaet Puolasta

May 20, 2025 -

Prestons Fa Cup Run Ends As Rashford Leads Manchester United To Victory

May 20, 2025

Prestons Fa Cup Run Ends As Rashford Leads Manchester United To Victory

May 20, 2025