HMRC Contacting Earners Over £23,000: Understanding The Correspondence

Table of Contents

Common Reasons for HMRC Contacting High Earners

Earning over £23,000 often triggers correspondence from HMRC for several reasons. Let's explore the most common:

Self-Assessment Tax Returns

If your income exceeds the personal allowance (£12,570 for the 2023/24 tax year), you're likely required to file a self-assessment tax return. The £23,000 mark often signifies crossing into a higher tax bracket, making a tax return mandatory. Failing to file on time can lead to penalties.

- Penalties for late filing: HMRC imposes penalties for late submission, increasing with each missed deadline.

- Common mistakes to avoid: Double-check your income figures, ensure accurate expense claims, and use HMRC's online resources for guidance.

- Resources for filing online: The HMRC website provides comprehensive guides and tools for completing and submitting your online tax return. This is the most efficient method. Keywords: self-assessment, tax return deadline, online tax return, HMRC penalties.

National Insurance Contributions (NICs)

Higher earners contribute more to National Insurance. HMRC might contact you if there are discrepancies between your reported income and your NICs payments.

- Understanding Class 1, Class 2, and Class 4 NICs: Different classes of NICs apply based on your employment status and income. Understanding these is crucial for accurate payments.

- Potential discrepancies: Errors can occur due to changes in employment or self-employment income.

- How to check NIC contributions: Use the HMRC website or your payslip to verify your NIC contributions. Keywords: National Insurance, NICs, Class 1 NICs, Class 4 NICs, National Insurance contributions calculator.

Tax Code Changes

Changes in your employment status, benefits received, or other circumstances can affect your tax code. HMRC will adjust your tax code accordingly, often triggering correspondence.

- Understanding PAYE: Pay As You Earn (PAYE) is the system used to deduct income tax from your salary. Changes to your tax code directly impact this deduction.

- Common reasons for tax code changes: New job, marriage, changes in pension contributions, or other significant life events can all lead to tax code adjustments.

- How to verify your tax code: Check your payslip or access your HMRC online account to confirm your current tax code. Keywords: PAYE, tax code, HMRC tax code change, understanding your tax code.

Tax Investigations

While less common, HMRC may initiate a tax investigation. Cooperation is vital; professional advice is strongly recommended.

- Signs of a tax investigation: A formal letter from HMRC, requests for specific documentation, or contact from an HMRC officer.

- Seeking professional help from an accountant or tax advisor: An accountant can guide you through the process and ensure compliance. Keywords: tax investigation, HMRC enquiry, tax advisor, tax accountant.

Identifying Genuine HMRC Correspondence

It's crucial to distinguish official HMRC communication from scams.

Recognizing Official Communication

HMRC uses secure methods for contacting taxpayers.

- Security features on official letters: Look for official letterheads, security features like watermarks, and a unique reference number.

- Checking the HMRC website: The HMRC website provides details on how they communicate with taxpayers and what to expect.

- Using the Government Gateway: Access your HMRC account securely through the Government Gateway to verify communication. Keywords: HMRC fraud, phishing scams, HMRC email, Government Gateway.

Dealing with Suspicious Correspondence

If you suspect a communication is fraudulent:

- Contacting HMRC directly using verified contact information: Use the official HMRC website to find their contact details. Never click links in suspicious emails or letters.

- Reporting suspected scams to Action Fraud: Action Fraud is the UK's national reporting centre for fraud and cybercrime. Keywords: HMRC scam, tax fraud, Action Fraud, reporting a scam.

Conclusion: Understanding HMRC Contact – Taking Action

HMRC may contact higher earners (above £23,000) regarding self-assessment tax returns, National Insurance contributions, tax code changes, or, less frequently, tax investigations. Verifying the authenticity of all communication is paramount. If you've received correspondence from HMRC regarding your earnings above £23,000, ensure you act promptly. Review your tax affairs, file your self-assessment returns on time, and seek professional advice if necessary. Understanding HMRC's contact regarding earnings over £23,000 is crucial for avoiding penalties and maintaining compliance. For further information and resources, visit the official HMRC website: [Insert HMRC Website Link Here].

Featured Posts

-

Record Battu Le Diletta Le Plus Grand Navire Jamais Vu Au Port D Abidjan

May 20, 2025

Record Battu Le Diletta Le Plus Grand Navire Jamais Vu Au Port D Abidjan

May 20, 2025 -

Voice Recognition Revolutionizing Hmrc Call Handling

May 20, 2025

Voice Recognition Revolutionizing Hmrc Call Handling

May 20, 2025 -

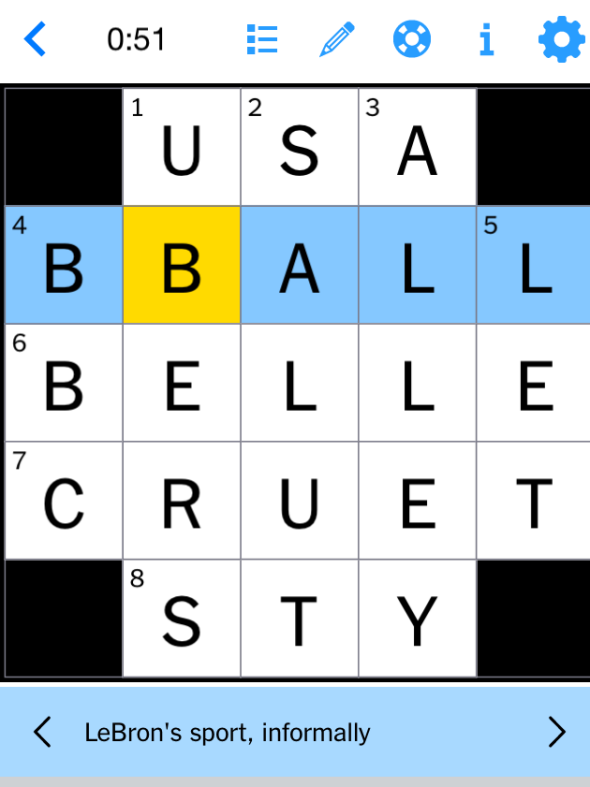

Nyt Mini Crossword March 16 2025 Complete Answers

May 20, 2025

Nyt Mini Crossword March 16 2025 Complete Answers

May 20, 2025 -

Dusan Tadic Fenerbahce Ye Tarihi Bir Imza

May 20, 2025

Dusan Tadic Fenerbahce Ye Tarihi Bir Imza

May 20, 2025 -

Thursdays D Wave Quantum Qbts Stock Dip A Detailed Explanation

May 20, 2025

Thursdays D Wave Quantum Qbts Stock Dip A Detailed Explanation

May 20, 2025