HMRC Nudge Letters: EBay, Vinted, And Depop Sellers Beware

Table of Contents

Understanding HMRC Nudge Letters

What are HMRC Nudge Letters?

HMRC nudge letters are not threatening legal notices; they are essentially gentle reminders from Her Majesty's Revenue and Customs aimed at encouraging tax compliance. They indicate that HMRC has identified potential discrepancies in your tax returns or a possible underreporting of income. The goal is to prompt you to review your tax affairs and make any necessary corrections before more formal action is taken. Think of them as a preliminary warning, a nudge in the right direction.

Why are Online Sellers Targeted?

The rise of online marketplaces like eBay, Vinted, and Depop has made it easier for individuals to sell goods, but it also presents challenges for HMRC in accurately tracking income. Several factors contribute to the increased scrutiny of online sellers:

- Increased use of online selling platforms: The sheer number of individuals now using platforms like eBay, Vinted, and Depop has made it easier for HMRC to identify potential tax avoidance.

- Difficulty tracking income from multiple sales: Unlike traditional businesses with a single income stream, online sellers often have multiple, smaller transactions, making it more difficult to track their overall income accurately.

- Potential for tax avoidance: The ease of online selling can make it tempting for some to underreport income or avoid paying the correct amount of tax.

- HMRC's data-driven approach to identifying non-compliance: HMRC uses sophisticated data analysis techniques to identify individuals who may not be paying their fair share of taxes. They cross-reference data from various sources, including payment platforms and bank statements.

Common Triggers for HMRC Nudge Letters

Inconsistencies in Reported Income

One of the most frequent reasons for receiving an HMRC nudge letter is a discrepancy between the income declared on your self-assessment tax return and the information HMRC has access to. This information might come from your bank statements, payment platform data (like PayPal or Stripe), or even information shared by the online marketplaces themselves.

Missing Tax Returns

Failure to file a self-assessment tax return, or submitting an incomplete or late return, is another common trigger for an HMRC nudge letter. Even minor inaccuracies can raise red flags, leading to further investigation.

High Volume of Transactions

A high volume of transactions, even if individually small, can attract HMRC's attention. Regular and frequent sales suggest a level of trading activity that requires proper tax registration and reporting.

- Failure to register as self-employed: If you're making regular sales, you need to register as self-employed with HMRC. Failure to do so is a significant trigger for an investigation.

- Inaccurate record-keeping: Poor record-keeping makes it difficult to track your income and expenses accurately, leading to potential under-declarations.

- Under-declaring profits: Deliberately underreporting your profits is a serious offense with significant penalties.

- Using cash transactions without proper records: Cash transactions are harder to track and can easily lead to underreporting.

Responding to an HMRC Nudge Letter

Don't Ignore It!

The most crucial piece of advice is: do not ignore an HMRC nudge letter. Ignoring it will only escalate the situation and could lead to significant penalties and interest charges. Respond promptly and professionally.

Gathering Necessary Documents

To respond effectively, you'll need to gather several key documents:

- Detailed sales records (including dates, amounts, and buyer information).

- Bank statements showing all transactions related to your online selling activity.

- Records of all expenses related to your business (e.g., postage, packaging, materials).

- Copies of any relevant invoices or receipts.

Seeking Professional Advice

If you're unsure how to respond or feel overwhelmed by the process, seeking professional advice is highly recommended. A tax advisor or accountant can help you understand your obligations and ensure you respond accurately and completely.

- Respond within the specified timeframe.

- Be accurate and honest in your responses.

- Keep meticulous records of all communication with HMRC.

- Consider the implications of non-compliance (penalties, interest charges).

Preventing HMRC Nudge Letters

Accurate Record Keeping

The best way to avoid HMRC nudge letters is to maintain meticulous records of all your income and expenses. This involves keeping accurate records of every sale and every expense incurred in your online selling business.

Registering as Self-Employed

If you're making regular sales on platforms like eBay, Vinted, or Depop, you must register for self-assessment with HMRC. This ensures that you comply with the relevant tax laws and can accurately report your income and expenses.

Understanding Capital Gains Tax

Understand when Capital Gains Tax applies to your sales. Selling used items might not always be exempt from tax, especially if you're making a significant profit.

- Use accounting software.

- Keep digital and physical records.

- Understand the tax thresholds.

- File your tax return on time and accurately.

Conclusion

Understanding HMRC nudge letters, their triggers, and how to respond effectively is crucial for online sellers. Maintaining accurate records, registering as self-employed if necessary, and understanding Capital Gains Tax are key preventative measures. Don't become another statistic! Review your tax obligations, maintain accurate records, and seek professional advice if needed. Understanding how to avoid HMRC nudge letters could save you significant stress and financial penalties. Proactive tax planning is the best defense against an HMRC investigation and ensures you remain compliant with UK tax law for online selling.

Featured Posts

-

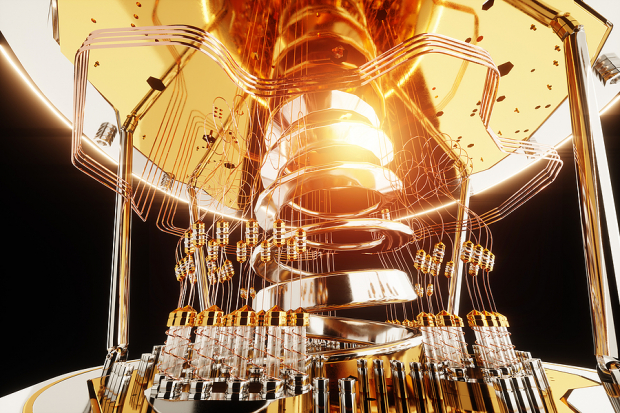

D Wave Quantum Inc Qbts Deciphering Thursdays Stock Price Decline

May 20, 2025

D Wave Quantum Inc Qbts Deciphering Thursdays Stock Price Decline

May 20, 2025 -

Sahrana Andelke Milivojevic Tadic Milica Milsa U Suzama Oprostaj Na Groblju

May 20, 2025

Sahrana Andelke Milivojevic Tadic Milica Milsa U Suzama Oprostaj Na Groblju

May 20, 2025 -

Dzhennifer Lourens Radisna Podiya U Yiyi Zhitti Druga Ditina

May 20, 2025

Dzhennifer Lourens Radisna Podiya U Yiyi Zhitti Druga Ditina

May 20, 2025 -

Cultural Context And Moral Choices Nigeria And The Kite Runners Dilemma

May 20, 2025

Cultural Context And Moral Choices Nigeria And The Kite Runners Dilemma

May 20, 2025 -

Hamiltonin Ferrarin Siirto Kariutui Syitae Ja Seurauksia

May 20, 2025

Hamiltonin Ferrarin Siirto Kariutui Syitae Ja Seurauksia

May 20, 2025