HMRC System Failure: Thousands Affected By Website Crash In UK

Table of Contents

Extent of the HMRC System Failure

The recent HMRC website outage represents a significant disruption to the UK's tax system. The scale of the problem is substantial, with reports suggesting thousands of users were affected, although precise figures remain unavailable. The impact extended across a wide range of vital services, causing considerable inconvenience and anxiety for many. This HMRC outage affected both individual taxpayers and businesses.

- Number of affected users: While the exact number remains unconfirmed by HMRC, anecdotal evidence and social media reports suggest a vast number of users experienced difficulties accessing online services.

- Specific services unavailable: Key services affected included online tax return filing (crucial for self-assessment deadlines), checking PAYE tax codes, accessing personal tax information, making tax payments, and submitting corporation tax returns. Businesses experienced severe disruptions to VAT returns and payroll processes.

- Geographical areas most affected: While the outage appeared nationwide, some reports suggest certain areas might have experienced more significant disruptions than others, potentially due to localized network issues. Further investigation is required to determine any geographical disparities.

- Duration of the outage: The outage lasted for [Insert Duration Here if available. Otherwise, state "several hours/days," and update when information becomes available]. This prolonged period exacerbated the problems faced by taxpayers and businesses.

Causes of the HMRC System Failure (Speculation and Official Statements)

The precise cause of the HMRC system failure remains unclear at the time of writing. HMRC has yet to issue a comprehensive statement detailing the root cause. However, several potential factors are being speculated upon.

- Official statements from HMRC: [Insert any official statements released by HMRC here. If no statement is available, state "At the time of writing, HMRC has not issued a detailed statement explaining the cause of the outage."].

- Speculative causes: Possible explanations range from a server overload due to high traffic volume around key tax filing deadlines to unforeseen technical difficulties within the HMRC IT infrastructure. A cyberattack, while a possibility, needs to be confirmed by official investigations.

- Lack of transparency from HMRC: The absence of a clear and timely explanation from HMRC has increased public frustration and fueled speculation, highlighting the need for improved communication during such incidents.

Impact on Taxpayers and Businesses

The HMRC system failure has had far-reaching consequences for both individual taxpayers and businesses across the UK. The disruption extends beyond mere inconvenience; it creates serious potential financial and operational implications.

- Potential financial penalties for missed deadlines: Taxpayers facing difficulties accessing the HMRC website risked missing crucial deadlines, leading to potential penalties and interest charges.

- Increased stress and anxiety among taxpayers: The inability to access vital tax information caused significant stress and anxiety, particularly for those with impending deadlines or complex tax situations.

- Disruption to business operations: Businesses reliant on HMRC online services for payroll processing, VAT returns, and other essential tax-related tasks faced significant operational disruptions, potentially impacting their cash flow and financial stability.

- Impact on self-employed individuals: Self-employed individuals, already facing administrative burdens, were disproportionately affected by the outage, as they often rely heavily on timely access to HMRC online services for tax compliance and payments.

HMRC's Response and Future Prevention

HMRC's response to the outage, including the speed and clarity of communication, will be crucial in shaping public perception and confidence. The incident underscores the necessity for robust IT infrastructure and comprehensive disaster recovery plans.

- HMRC's official statement regarding the outage and its resolution: [Insert any official statements from HMRC on their response to the outage and steps taken for resolution. If not available, mention the lack of information.]

- Measures taken to restore services: Details on how HMRC addressed the issue and restored services are needed to evaluate their response and preparedness.

- Promises of future improvements to prevent similar incidents: Assurances from HMRC regarding future system enhancements and preventative measures are crucial for regaining public trust.

- Call for increased investment in IT infrastructure: This incident reinforces the need for substantial investment in upgrading HMRC's IT infrastructure, including implementing more resilient systems and robust disaster recovery capabilities.

Conclusion

The recent HMRC system failure underscores the critical need for robust and reliable IT infrastructure supporting essential government services. The widespread disruption caused significant financial and emotional distress to thousands of taxpayers and businesses. The lack of transparency surrounding the cause and duration of the outage only exacerbated the situation. HMRC must prioritize improved communication, invest in resilient systems, and implement effective disaster recovery plans to prevent future HMRC system failures and maintain public trust. Stay informed about updates regarding the HMRC system and any ongoing issues by regularly checking official government channels. Understanding the potential implications of future HMRC system failures is crucial for all UK taxpayers and businesses.

Featured Posts

-

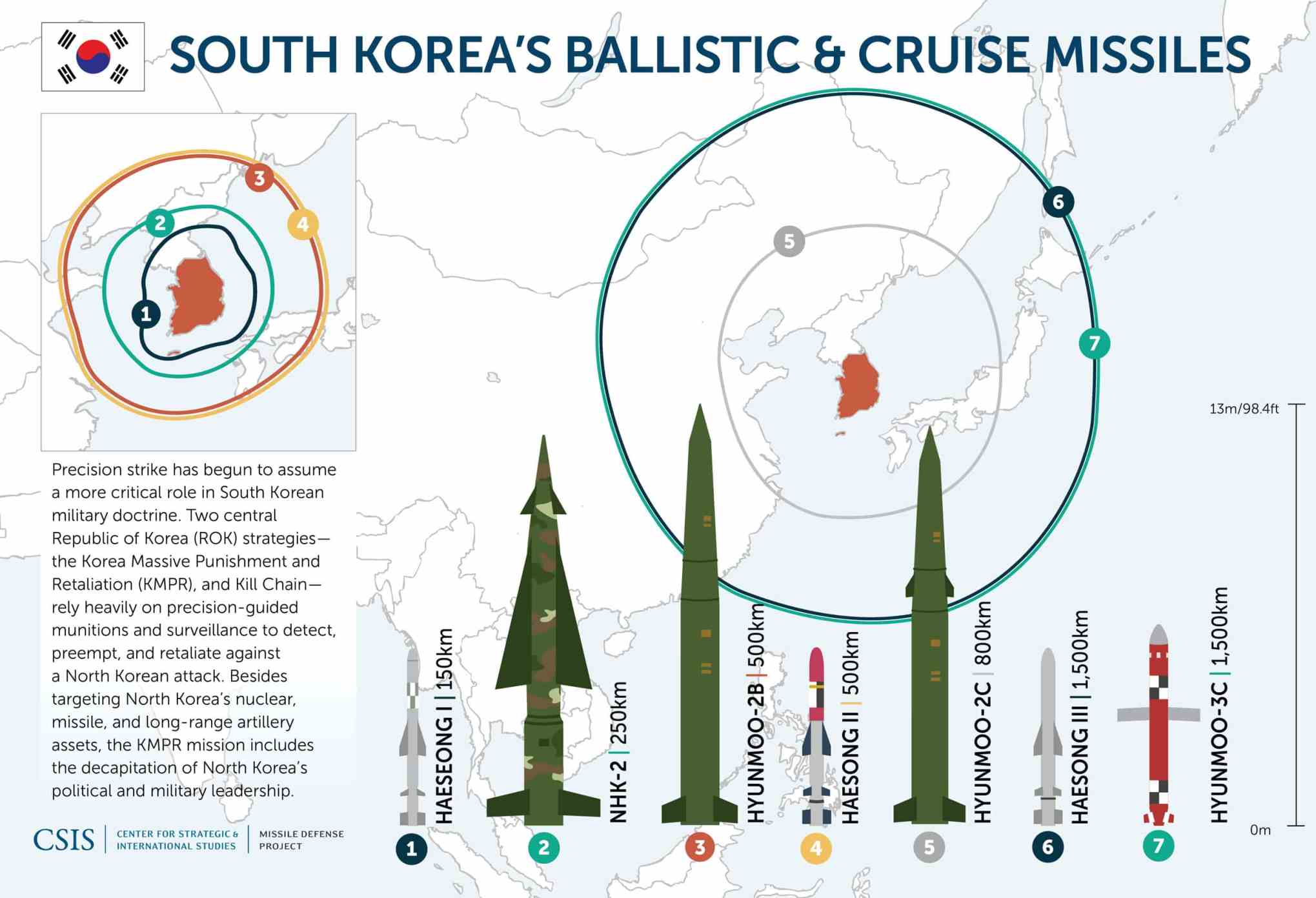

Australia Us Missile Test A Strategic Move Chinas Response

May 20, 2025

Australia Us Missile Test A Strategic Move Chinas Response

May 20, 2025 -

Technologies Spatiales Le Marche Africain Des Solutions Spatiales Mass Lance Sa Premiere Edition A Abidjan

May 20, 2025

Technologies Spatiales Le Marche Africain Des Solutions Spatiales Mass Lance Sa Premiere Edition A Abidjan

May 20, 2025 -

Ofitsialno Potvrzhdenie Dzhenifr Lorns Otnovo E Mayka

May 20, 2025

Ofitsialno Potvrzhdenie Dzhenifr Lorns Otnovo E Mayka

May 20, 2025 -

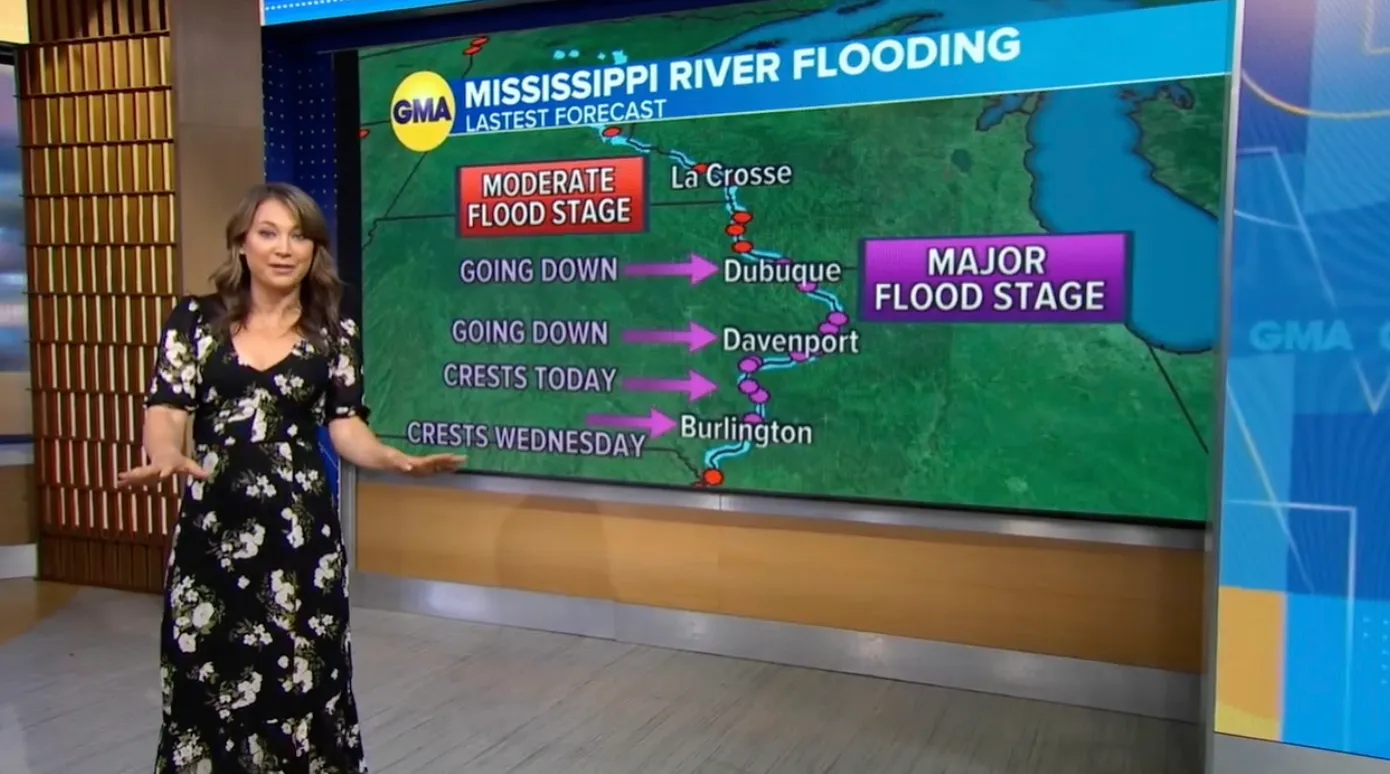

Weather Anchor Ginger Zee Claps Back At Aging Comments

May 20, 2025

Weather Anchor Ginger Zee Claps Back At Aging Comments

May 20, 2025 -

Ai Companies Win Big With Trump Bill Cautious Celebration Ahead

May 20, 2025

Ai Companies Win Big With Trump Bill Cautious Celebration Ahead

May 20, 2025