HMRC Targeting EBay, Vinted & Depop Sellers With Nudge Letters

Table of Contents

Understanding HMRC's "Nudge Letters"

HMRC nudge letters are not formal investigations but rather friendly warnings, designed to encourage voluntary tax compliance among online marketplace sellers. They're sent when HMRC identifies potential discrepancies between declared income and the volume of sales activity detected on platforms like eBay, Vinted, and Depop. These letters aren't accusations of wrongdoing, but they signal a need to review your tax liabilities.

- Purpose: To encourage voluntary tax compliance and prevent more serious investigations.

- Information Included: The letter usually includes details of your sales activity on the platform(s), estimated income, and potentially the amount of tax HMRC believes is owed.

- Importance: Responding promptly and accurately is crucial. Failure to do so may escalate the situation, leading to a full-blown tax investigation.

Common Tax Mistakes Made by Online Sellers

Many online sellers, particularly those new to the game, unintentionally make mistakes that attract HMRC's attention. These errors often stem from a lack of understanding of the relevant tax regulations.

- Failing to Register for Self-Assessment: If your online selling generates a profit above a certain threshold, you are legally required to register for self-assessment and file an annual tax return.

- Incorrectly Calculating Taxable Income or Profits: Accurately deducting allowable business expenses is crucial. Miscalculations can lead to underpayment of income tax.

- Misunderstanding the VAT Threshold and Registration Requirements: If your turnover exceeds the VAT threshold, you'll need to register for VAT and charge VAT on your sales.

- Neglecting to Declare Capital Gains Tax: Selling high-value items, such as antiques or collectibles, can trigger capital gains tax liability. Failing to declare these gains is a serious offense.

- Incorrectly Claiming Expenses: Only business-related expenses are deductible. Claiming personal expenses as business expenses is a common mistake.

How to Respond to an HMRC Nudge Letter

Receiving an HMRC nudge letter can be unsettling, but a prompt and accurate response is key.

- Review Carefully and Gather Records: Thoroughly review the letter and gather all relevant financial records, including bank statements, sales records, and expense receipts.

- Calculate Taxable Income Accurately: Carefully calculate your taxable income, ensuring you've correctly accounted for all sales and allowable expenses. Seek professional help if unsure.

- File Your Self-Assessment Tax Return: File your self-assessment tax return online via the HMRC website. Be accurate and ensure everything is complete.

- Seek Professional Help: If you're struggling to understand the letter or calculate your tax liability, seek advice from a qualified accountant or tax advisor specializing in online selling tax.

- Keep Detailed Records: Maintain meticulous records of all sales and expenses. This is crucial for future tax compliance.

Preventing Future HMRC Scrutiny: Best Practices for Online Sellers

Proactive measures are the best way to avoid future problems with HMRC.

- Meticulous Record Keeping: Maintain detailed records of every sale, including date, item sold, price, buyer's details, and any expenses incurred.

- Understanding Tax Implications: Familiarize yourself with the different tax implications for different types of goods sold.

- On-Time Tax Returns: Register for self-assessment and file your tax return promptly each year.

- Stay Informed: Keep up-to-date with changes in tax laws and regulations affecting online sellers.

- Professional Advice: Regularly review your tax obligations and seek professional advice when needed.

Conclusion

HMRC is actively monitoring online sales, and nudge letters serve as a clear indication that your tax affairs need attention. Ignoring these letters can lead to serious consequences. Don't wait for a formal investigation – take action today! Ensure HMRC compliance for your eBay, Vinted, and Depop sales by reviewing your records, understanding your tax obligations, and seeking professional help if necessary. Understand your tax responsibilities when selling online; it's crucial for your peace of mind and financial future.

Featured Posts

-

Tadic Upozorava Rusenje Daytonskog Sporazuma Steti Sarajevu

May 20, 2025

Tadic Upozorava Rusenje Daytonskog Sporazuma Steti Sarajevu

May 20, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki Rodoy Programma And Eisitiria

May 20, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Dimokratiki Rodoy Programma And Eisitiria

May 20, 2025 -

Pro D2 Le Deplacement De L Asbh A Biarritz Et La Preparation Mentale

May 20, 2025

Pro D2 Le Deplacement De L Asbh A Biarritz Et La Preparation Mentale

May 20, 2025 -

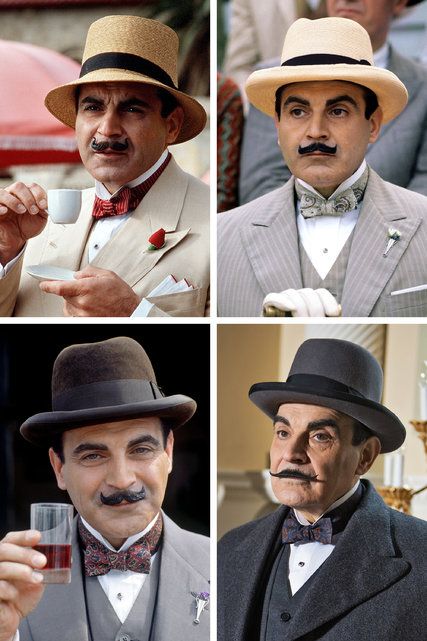

Exploring The Enduring Appeal Of Agatha Christies Poirot

May 20, 2025

Exploring The Enduring Appeal Of Agatha Christies Poirot

May 20, 2025 -

Numerotation Des Batiments A Abidjan Guide Du Projet D Adressage

May 20, 2025

Numerotation Des Batiments A Abidjan Guide Du Projet D Adressage

May 20, 2025