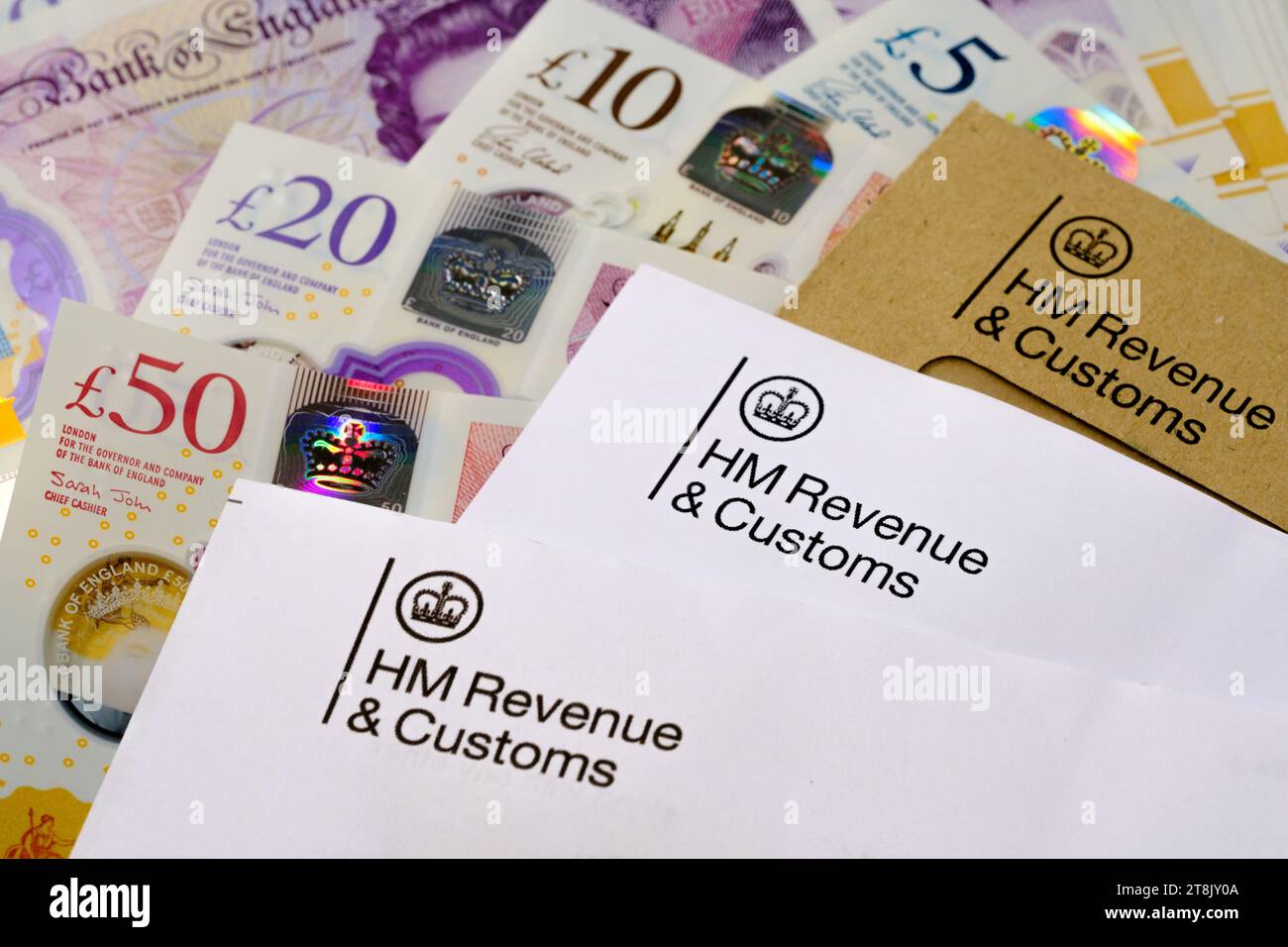

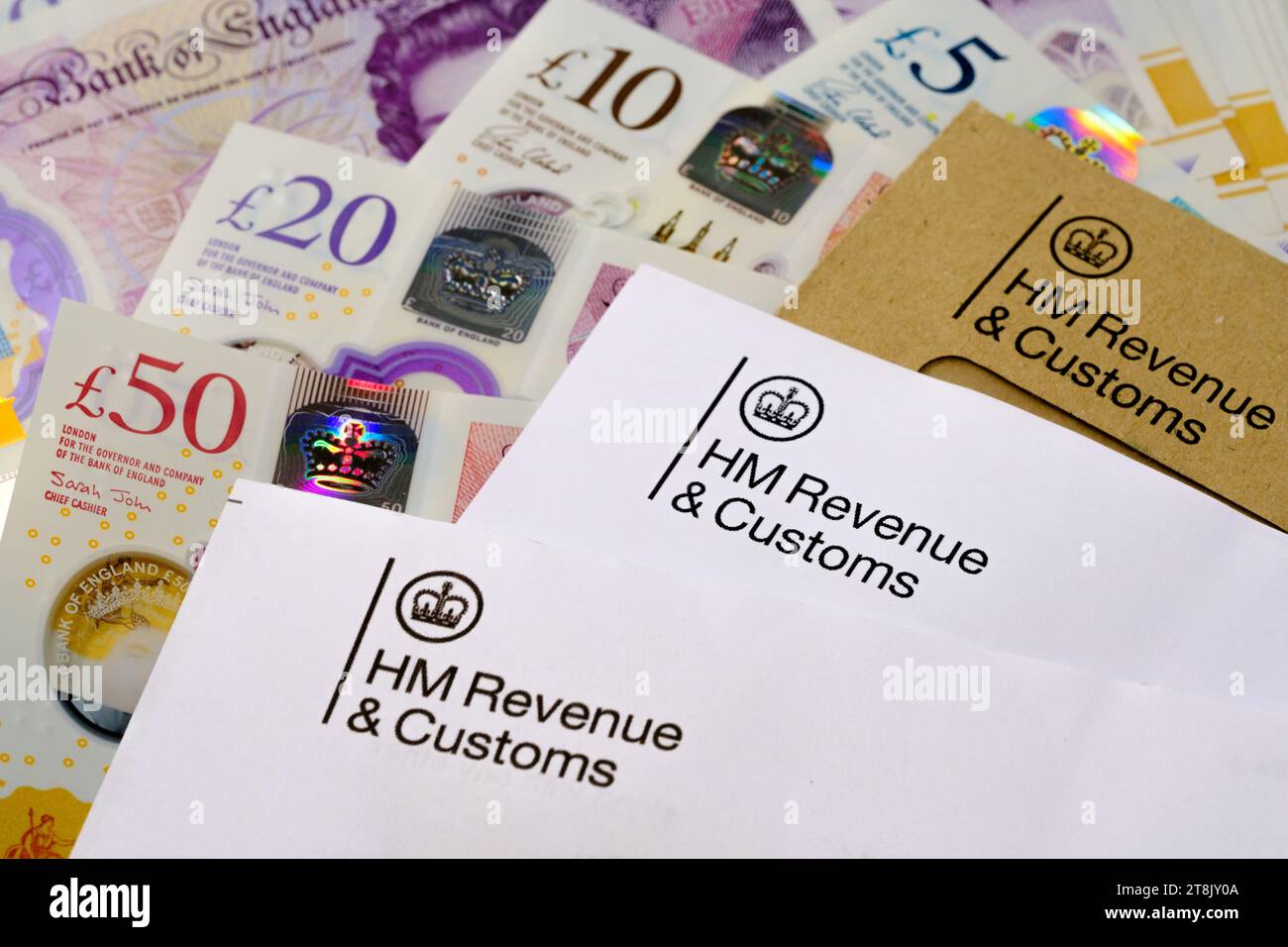

HMRC Tax Letters: A Guide For UK Homeowners

Table of Contents

Common Types of HMRC Tax Letters for Homeowners

Homeowners in the UK can receive various HMRC tax letters concerning their property. Understanding the type of letter is the first step to a successful response.

Council Tax Demands

Council Tax is a local tax levied on residential properties in England, Scotland, Wales, and Northern Ireland. Receiving a Council Tax demand letter means your local council is requesting payment for your property's council tax.

- What the letter will contain: The letter will specify the outstanding amount, the period covered, your council tax band, and payment options.

- Reasons for discrepancies: Discrepancies may arise due to incorrect banding, unpaid bills, or changes in your circumstances.

- How to contact your local council: Contact details for your local council will be provided on the letter or on their website.

- Payment options: Various payment options are usually available, including online payments, direct debit, and cheque.

- Consequences of non-payment: Non-payment can lead to further demands, interest charges, and ultimately, legal action. Keywords: Council Tax, Council Tax Demand, Local Council, Banding, Payment Options, Council Tax arrears.

Capital Gains Tax (CGT) Letters

If you've sold a property, you may receive a letter from HMRC regarding Capital Gains Tax (CGT). CGT is a tax on the profit you make when you sell an asset, including property, for more than you paid for it.

- What constitutes a capital gain: A capital gain is the difference between the sale price and the original purchase price, adjusted for allowable expenses such as estate agent fees and legal costs.

- Calculating CGT: HMRC provides guidelines and resources to help calculate your CGT liability. You may need to factor in any exemptions and allowances.

- Exemptions and allowances: Certain exemptions and allowances may reduce your CGT liability, depending on your circumstances and the type of property.

- Filing requirements: You're required to file a self-assessment tax return if you have a CGT liability.

- Deadlines for submitting returns: Missing the deadline can lead to penalties.

- Penalties for late filing: HMRC imposes penalties for late filing or non-compliance.

- Potential tax relief: There are potential tax reliefs available for certain circumstances, such as reinvesting the proceeds in another property. Keywords: Capital Gains Tax, CGT, Property Sale, Tax Return, Tax Relief, Exemptions, Allowances, Penalties, CGT calculation, property disposal.

Self Assessment Tax Letters

If you receive rental income from a property or have other property-related income, you'll likely need to complete a Self Assessment tax return. HMRC may send you letters requesting information or confirming your tax liability.

- Reporting rental income: You must accurately report all rental income received during the tax year.

- Allowable expenses: You can deduct certain allowable expenses, such as mortgage interest, repairs, and maintenance costs, from your rental income.

- Completing a Self Assessment tax return: The return requires detailed information about your income and expenses.

- Understanding tax bands: Your tax liability depends on your total income and the applicable tax bands.

- Paying tax due: Payment is typically due by January 31st following the end of the tax year.

- Penalties for late filing or non-compliance: Late filing or inaccuracies can result in penalties. Keywords: Self Assessment, Rental Income, Property Income, Tax Return, Tax Bands, Allowable Expenses, Penalties, Self Assessment tax return deadline, landlord tax.

Stamp Duty Land Tax (SDLT) Letters

When purchasing a property, you may be liable for Stamp Duty Land Tax (SDLT). HMRC may send letters regarding your SDLT liability, potential adjustments, or refunds.

- Understanding SDLT liability: SDLT is payable on the purchase price of most properties above a certain threshold.

- Calculating SDLT: The calculation depends on the property's price and the applicable rates.

- Possible adjustments or refunds: In certain situations, adjustments or refunds may be possible.

- Appeals process: If you disagree with the assessment, you have the right to appeal. Keywords: Stamp Duty, Stamp Duty Land Tax, SDLT, Property Purchase, Tax Calculation, Refunds, Appeals, SDLT rates, property transaction tax.

Understanding the Language of HMRC Letters

Navigating HMRC correspondence requires understanding their specific terminology.

Deciphering the Jargon

HMRC letters often use specific jargon. Familiarity with these terms is crucial.

- Glossary of common HMRC terms: We recommend referring to the official HMRC website for a complete glossary. Familiarizing yourself with terms like "taxable income," "allowable expenses," and "tax year" is essential.

- Explaining their meaning in simple terms: Many resources are available online to help decipher HMRC's language.

Identifying Genuine HMRC Correspondence

It's crucial to identify genuine HMRC communications to avoid scams.

- Characteristics of genuine HMRC letters: Genuine letters have official letterheads, unique reference numbers, and clear contact details.

- How to verify the authenticity of a letter: Never click on links in suspicious emails. Contact HMRC directly using verified contact information to confirm the letter's authenticity.

- Steps to take if you suspect a scam: Report suspected scams to HMRC and Action Fraud immediately. Keywords: HMRC Jargon, Tax Terminology, Glossary, Abbreviations, HMRC Scam, Fake Letters, Fraud Prevention, Authenticity Verification, tax fraud.

What to Do if You Receive an HMRC Tax Letter

Prompt and accurate responses to HMRC letters are vital.

Responding to HMRC

Timely responses are essential to avoid penalties.

- Understanding deadlines: Pay close attention to deadlines mentioned in the letter.

- Methods of communication: Respond via the HMRC online portal or by post, as instructed.

- Gathering required documents: Gather all necessary documents to support your response.

- Seeking professional advice if needed: Don't hesitate to seek professional advice from a tax advisor if needed. Keywords: HMRC Response, Deadlines, Communication Methods, Professional Advice, HMRC online services.

Seeking Help and Advice

Various resources are available to assist you.

- Contacting HMRC directly: Use the official HMRC contact details.

- Seeking advice from a tax advisor: A tax advisor can provide personalized guidance.

- Using online resources and guides: The HMRC website and other reputable websites offer helpful information. Keywords: Tax Advice, HMRC Helpline, Tax Advisor, Online Resources, tax professional.

Conclusion

Receiving an HMRC tax letter relating to your property can be stressful, but understanding the common types of letters and how to respond effectively can alleviate anxiety considerably. This guide has provided an overview of common HMRC tax letters for UK homeowners, from Council Tax demands to Capital Gains Tax assessments. Remember to always respond to HMRC correspondence promptly and accurately, and seek professional advice if you require assistance interpreting complex tax regulations. Don't hesitate to explore further resources on the official HMRC website for more detailed information on managing your HMRC tax letters and responsibilities. If you need assistance, consult a qualified tax professional to navigate your specific tax situation effectively. Understanding your HMRC tax letters is key to responsible property ownership.

Featured Posts

-

Lewis Hamilton And Ferraris Tense Miami Gp Tea Break

May 20, 2025

Lewis Hamilton And Ferraris Tense Miami Gp Tea Break

May 20, 2025 -

Tonci Tadic Sto Je Putin Zelio Postici Pregovorima

May 20, 2025

Tonci Tadic Sto Je Putin Zelio Postici Pregovorima

May 20, 2025 -

Updated Rain Forecast Knowing When To Expect Showers

May 20, 2025

Updated Rain Forecast Knowing When To Expect Showers

May 20, 2025 -

Nyt Mini Crossword Puzzle Solutions April 18 2025

May 20, 2025

Nyt Mini Crossword Puzzle Solutions April 18 2025

May 20, 2025 -

Suki Waterhouses Met Gala Look A Retrospective On Her Style Evolution

May 20, 2025

Suki Waterhouses Met Gala Look A Retrospective On Her Style Evolution

May 20, 2025