HMRC Tax Refunds: Find Out If You're Eligible - Check Your Payslip

Table of Contents

Understanding Common Reasons for HMRC Tax Refunds

Several factors can lead to an overpayment of tax, resulting in a potential HMRC tax refund. Understanding these reasons is the first step in identifying if you're eligible.

Incorrect Tax Code

Your tax code determines how much Income Tax is deducted from your earnings. An incorrect tax code can significantly impact your tax liability, leading to overpayment. For example, an incorrect code might deduct too much tax throughout the year, resulting in a substantial refund at the end of the tax year.

- How to check your tax code: Your payslip clearly shows your tax code (usually a letter followed by numbers, e.g., 1257L). You can also verify this online through your HMRC online account.

- Examples of Incorrect Codes: A code that's too high (e.g., deducting tax at a higher rate than you should be) is a common cause of overpayment. Compare your code to the expected code based on your circumstances (marital status, pension contributions, etc.).

- Action to Take: If you suspect an incorrect tax code, contact HMRC immediately to have it corrected. This will prevent further overpayment and potentially speed up your tax refund process.

Changes in Circumstances

Life changes often impact your tax situation. Failing to inform HMRC about these changes can result in overpaying tax.

- Situations Leading to Overpayment:

- Marriage or Civil Partnership: The Marriage Allowance can reduce your tax bill, but you need to apply for it.

- Change of Employment Status: Moving from full-time employment to self-employment or part-time work can affect your tax code.

- Significant Reduction in Income: A drop in income might mean your tax code is too high.

- Starting a New Job: Ensure your new employer has the correct tax information.

- Importance of Prompt Notification: Notify HMRC promptly about any significant changes in your circumstances to avoid unnecessary tax overpayments.

Pension Contributions

Pension contributions reduce your taxable income, meaning you pay less Income Tax. Incorrectly recorded pension contributions on your payslip can lead to overpayment.

- Verifying Pension Contributions: Check your payslip for a deduction labeled "pension contributions" and verify it matches your actual contributions.

- Accurate Record Keeping: Keep all your pension contribution statements for tax purposes. This is crucial if you need to prove your contributions to HMRC when claiming a refund.

Marriage Allowance

The Marriage Allowance allows eligible couples to transfer some of their personal allowance to their spouse or civil partner, potentially reducing their tax bill.

- Eligibility: Check the HMRC website for the eligibility criteria.

- Claiming the Allowance: Claim the Marriage Allowance online through the HMRC website.

- Impact on Refunds: Claiming the Marriage Allowance can significantly increase your potential tax refund.

How to Check Your Payslip for Potential HMRC Tax Refunds

Regularly reviewing your payslip is key to identifying potential overpayments.

Key Information to Look For

- Tax Code Accuracy: Ensure your tax code is correct and matches your circumstances.

- Tax Deducted vs. Expected Tax: Compare the tax deducted with what you expect based on your income and tax code.

- Accurate Pension Contributions: Verify your pension contributions are correctly reflected.

- Inconsistencies or Errors: Look for any discrepancies or errors in your payslip.

Keeping Accurate Records

- Secure Storage: Keep all payslips securely, either digitally (using secure cloud storage) or physically (in a safe place).

- Retention Period: Retain your payslips for at least three years.

- Organization: Organize your payslips chronologically for easy access.

Claiming Your HMRC Tax Refund

Once you've identified a potential overpayment, claiming your refund is straightforward.

The Claim Process

- Gather Documents: Collect your payslips, P60 (if applicable), and any other relevant documents.

- HMRC Website: Access the HMRC website and follow the instructions for claiming a tax refund.

- Alternative Contact: If you encounter issues online, you can contact HMRC by phone or letter.

- Claim Reference: Keep a record of your claim reference number.

Timescale for Receiving Your Refund

- Processing Time: HMRC aims to process tax refunds within a certain timeframe, but this can vary.

- Potential Delays: Factors like high claim volumes or complex cases can sometimes cause delays.

- Checking Claim Status: You can usually check the status of your claim online through your HMRC account.

Conclusion

Regularly checking your payslip is crucial for identifying potential HMRC tax refunds. By understanding the common reasons for overpayment and following the steps outlined above, you can reclaim money you're rightfully owed. Don't miss out on potential HMRC tax refunds – check your payslips today and take control of your finances! Start your HMRC tax refund claim now!

Featured Posts

-

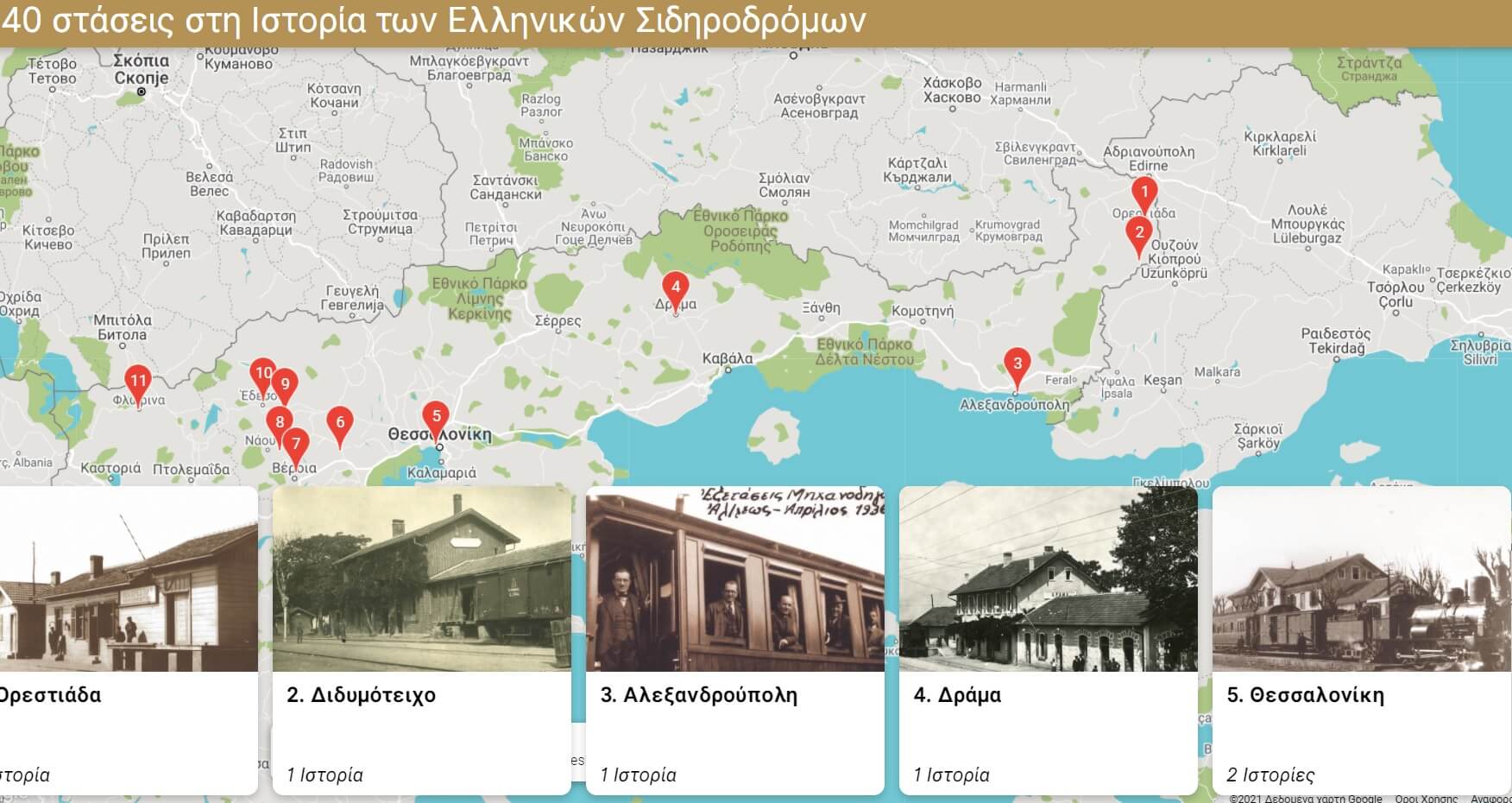

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

May 20, 2025

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

May 20, 2025 -

Ferrari Risks Leclercs Loyalty By Focusing On Hamiltons Comfort

May 20, 2025

Ferrari Risks Leclercs Loyalty By Focusing On Hamiltons Comfort

May 20, 2025 -

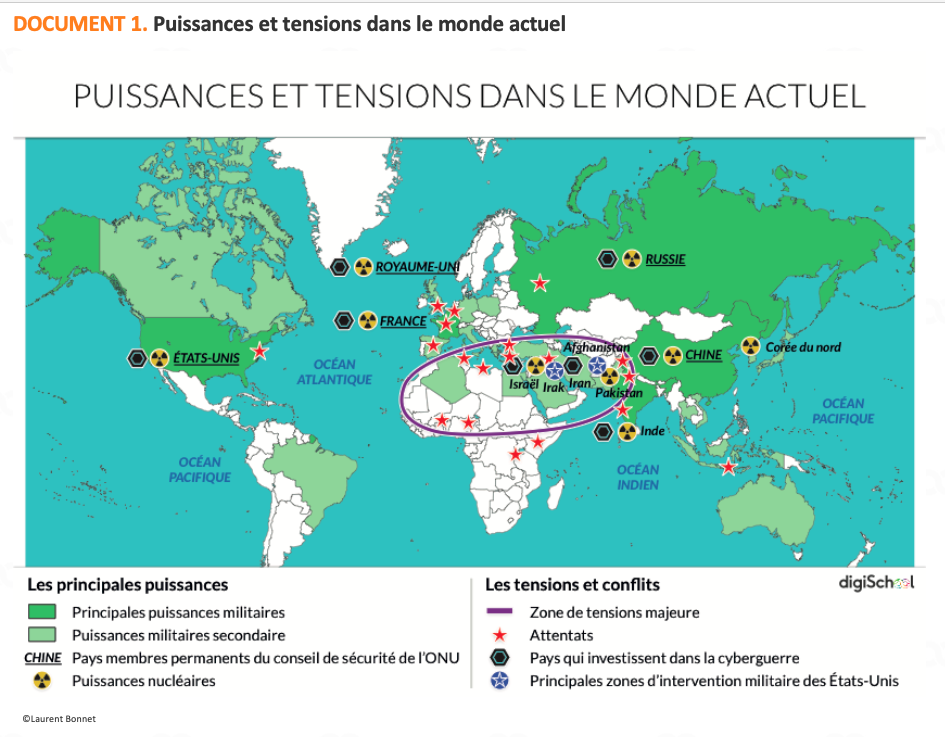

Ghana Cote D Ivoire Visite D Etat Du President Mahama Enjeux Et Perspectives Diplomatiques

May 20, 2025

Ghana Cote D Ivoire Visite D Etat Du President Mahama Enjeux Et Perspectives Diplomatiques

May 20, 2025 -

Fp Video Navigating Tariff Turbulence At Home And Abroad

May 20, 2025

Fp Video Navigating Tariff Turbulence At Home And Abroad

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Kaellmanin Kehitys Ja Tulevaisuus

May 20, 2025

Huuhkajat Saavat Vahvistusta Kaellmanin Kehitys Ja Tulevaisuus

May 20, 2025