HMRC Tax Return Changes: Who's Affected And What To Do

Table of Contents

Who is Affected by the HMRC Tax Return Changes?

The recent HMRC tax return changes affect a broad range of taxpayers, particularly those involved in self-assessment. Let's break down who needs to pay close attention:

Self-Assessment Taxpayers

The most significantly impacted group is self-assessment taxpayers. This includes:

- Self-employed individuals: Freelancers, contractors, consultants, and sole traders all fall under this category and must carefully review the changes.

- Landlords: Those with rental income need to understand how new rules affect reporting and tax calculations on their property tax.

- Company directors: Directors of limited companies are also affected by changes related to director tax and company reporting.

- Small business owners: Owners of small businesses, partnerships, and limited liability partnerships should be aware of any changes related to their business' tax obligations.

Changes Affecting Specific Income Types

The alterations impact various income streams differently:

-

Dividend tax: Changes might involve adjustments to dividend allowance or rates.

-

Capital gains tax: New rules may affect the calculation of capital gains tax on the sale of assets, such as property or investments.

-

Rental income tax: Landlords should be aware of updated rules concerning allowable expenses and reporting requirements for rental property income.

-

Examples of Changes:

- Increased Capital Gains Tax rates for higher earners.

- Changes in the allowable expenses for rental properties.

- New reporting requirements for cryptocurrency transactions.

New Thresholds and Allowances

Several tax thresholds and allowances have been modified. These include:

-

Personal allowance: Changes to the personal allowance, the amount you can earn tax-free.

-

Tax bands: Adjustments to the income tax bands affecting the rates applicable to your income.

-

Dividend allowance: Modifications to the allowance for tax-free dividends.

-

Examples of Changes:

- A reduction in the personal allowance for high-income earners.

- An increase in the higher-rate tax band threshold.

- A decrease in the dividend allowance.

Key Changes to the HMRC Tax Return Process

Beyond the tax calculations themselves, the HMRC tax return process itself has undergone several updates.

Online Filing Enhancements

HMRC continues to improve its online self-assessment system. These enhancements aim to make tax filing simpler and more efficient.

- Improved navigation: The online portal is designed to be more intuitive and user-friendly.

- New reporting requirements: Some sections of the online form have been updated to reflect the new tax rules.

- Enhanced security measures: Stronger digital verification methods are in place to protect your information.

- Pre-population of data: HMRC is increasingly pre-populating data from employers and other sources, simplifying the filing process.

New Reporting Requirements

Taxpayers should be aware of new information required for filing:

- More detailed expense records: More thorough documentation of business expenses might be necessary.

- Information on cryptocurrency transactions: Reporting requirements for cryptocurrency gains and losses have been introduced.

- Changes in reporting for foreign income: New rules apply to the reporting of income earned outside the UK.

Deadlines and Penalties

Failing to meet the deadlines can lead to penalties:

- Late filing penalty: Significant penalties are imposed for submitting your tax return after the deadline.

- Late payment penalty: Further penalties apply if you don't pay your tax bill on time.

- Accuracy penalties: Incorrect information can also result in penalties.

What to Do About the HMRC Tax Return Changes

Understanding and adapting to these changes is crucial.

Review Your Tax Situation

Take proactive steps to ensure an accurate tax return:

- Gather your financial records: Collect all relevant documents, including P60s, bank statements, and expense receipts.

- Review your income and expenses: Carefully check your income sources and ensure you've accurately accounted for all allowable expenses.

- Understand the changes: Familiarize yourself with the specific updates relevant to your individual circumstances.

Seek Professional Advice

Consider seeking professional guidance:

- Accountant: A qualified accountant can provide expert advice and assistance with your tax return.

- Tax advisor: Tax advisors specialize in tax matters and can help you navigate complex issues.

- Tax professional: These professionals are trained to prepare tax returns accurately and effectively.

Utilize HMRC Resources

HMRC provides a range of resources to help taxpayers:

- HMRC website: The official HMRC website contains comprehensive guidance and information on tax changes.

- HMRC helpline: The HMRC helpline offers assistance with tax-related queries.

- Tax guides and publications: HMRC provides numerous publications and guides to help with specific tax situations.

Conclusion: Staying Compliant with HMRC Tax Return Changes

The recent HMRC tax return changes significantly impact many UK taxpayers, especially those self-employed or with complex income sources. Understanding these changes, including new reporting requirements, deadlines, and potential penalties, is vital for accurate and timely tax filing. Review your tax situation, seek professional advice if needed, and utilize HMRC resources to stay informed. Don't delay—review your HMRC tax obligations today! Stay informed about HMRC tax return changes and prepare your HMRC tax return accurately to avoid penalties.

Featured Posts

-

Bundesliga Absteiger Bochum Und Kiel Leipzigs Cl Traum Geplatzt

May 20, 2025

Bundesliga Absteiger Bochum Und Kiel Leipzigs Cl Traum Geplatzt

May 20, 2025 -

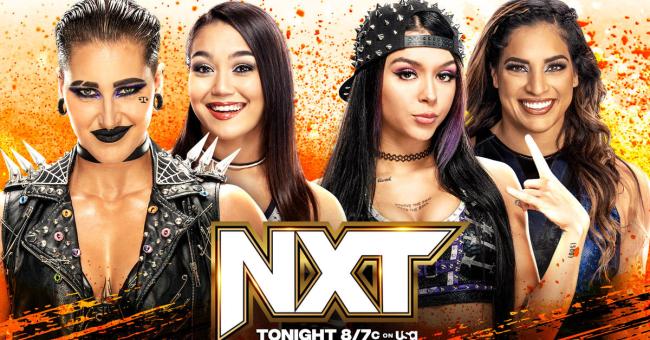

Rhea Ripley And Roxanne Perez Qualified For 2025 Money In The Bank

May 20, 2025

Rhea Ripley And Roxanne Perez Qualified For 2025 Money In The Bank

May 20, 2025 -

Cultivating Resilience Overcoming Challenges And Building Strength

May 20, 2025

Cultivating Resilience Overcoming Challenges And Building Strength

May 20, 2025 -

Analyzing The Sharp Decrease In Big Bear Ai Bbai Stock In 2025

May 20, 2025

Analyzing The Sharp Decrease In Big Bear Ai Bbai Stock In 2025

May 20, 2025 -

Nvidia Ai

May 20, 2025

Nvidia Ai

May 20, 2025