HMRC Website Down: Widespread Access Problems In The United Kingdom

Table of Contents

Causes of HMRC Website Downtime

Several factors can contribute to HMRC website downtime, leading to significant inconvenience for users. Understanding these causes is the first step towards preventing future disruptions.

Increased Traffic and Demand

One of the most common reasons for HMRC website outages is a surge in user traffic. This is particularly acute during peak periods, such as self-assessment tax return deadlines in January and October. The sheer volume of users attempting to access the site simultaneously can overwhelm the server capacity, resulting in slowdowns or complete unavailability.

- Peak Demand Periods: January 31st (self-assessment deadline), October 31st (self-assessment deadline for partnerships), and other key tax deadlines throughout the year consistently see dramatic spikes in website traffic.

- Traffic Statistics: While precise figures are often not publicly released for security reasons, anecdotal evidence and news reports regularly highlight the strain placed on HMRC systems during these periods.

- Contributing Factors: New government initiatives, changes in tax regulations (like the introduction of new tax schemes), and major economic events can all exacerbate the problem by driving up the demand for HMRC online services.

Technical Issues and Maintenance

Beyond high traffic, technical issues and maintenance contribute significantly to HMRC website downtime. These can range from planned maintenance activities to unexpected software bugs or server failures.

- Planned Maintenance: Scheduled maintenance is necessary to update systems and improve security, but if not carefully managed, can lead to temporary outages. Transparency about planned maintenance windows is crucial to mitigate disruption.

- Unplanned Maintenance: Unexpected technical issues, such as database errors, network problems, or software bugs, can cause unplanned downtime. Robust system monitoring is vital for early detection and swift resolution of such problems.

- Server Failures: Hardware failures can also cause outages, highlighting the importance of redundancy and disaster recovery planning within the HMRC IT infrastructure.

Cyberattacks and Security Breaches

While less frequent, cyberattacks and security breaches pose a significant threat to the availability of the HMRC website. Distributed Denial of Service (DDoS) attacks, for example, can flood the servers with traffic, rendering them inaccessible to legitimate users.

- Impact of Cyberattacks: Successful cyberattacks can not only cause website downtime but also compromise sensitive taxpayer data, leading to serious security and privacy concerns.

- Cybersecurity Measures: HMRC invests in cybersecurity measures, but the ever-evolving nature of cyber threats necessitates ongoing improvements and proactive defence strategies. Regular security audits and penetration testing are vital components of a robust cybersecurity posture.

Impact of HMRC Website Downtime

The consequences of HMRC website downtime are far-reaching, affecting both individual taxpayers and the UK economy as a whole.

Disruption to Taxpayers

When the HMRC website is unavailable, taxpayers face significant disruption to their financial affairs.

- Inability to File Tax Returns: Missing deadlines due to website issues can lead to penalties and interest charges.

- Payment Delays: Inability to pay taxes online can result in late payment penalties.

- Access to Personal Information: Difficulty accessing personal tax information can create significant uncertainty and anxiety for taxpayers.

- Delays in Receiving Refunds: Website outages can delay the processing and disbursement of tax refunds, causing financial hardship for some individuals.

Economic Consequences

The impact extends beyond individual taxpayers, affecting the wider UK economy.

- Business Cash Flow: Delays in paying taxes can negatively affect businesses' cash flow and financial planning.

- Government Revenue Collection: Website downtime can impede the timely collection of government revenue, potentially impacting public services.

Public Trust and Confidence

Repeated instances of HMRC website downtime can erode public trust and confidence in government services.

- Negative Media Coverage: Outages often receive negative media attention, further damaging public perception.

- Public Dissatisfaction: Frustration and inconvenience caused by website downtime can lead to public dissatisfaction and a loss of faith in the efficiency of government systems.

Solutions and Prevention

Preventing future "HMRC website down" situations requires a multi-pronged approach focused on infrastructure upgrades, enhanced cybersecurity, and improved communication.

Investing in Infrastructure

Addressing the capacity limitations of the current system is crucial.

- Increased Server Capacity: Investing in additional server capacity and implementing load balancing strategies can improve the system's ability to handle peak demand.

- Cloud Computing: Migrating to a cloud-based infrastructure offers scalability and resilience, enabling the system to adapt dynamically to fluctuating traffic levels.

Enhanced Cybersecurity

Strengthening cybersecurity measures is paramount to protect against attacks.

- Advanced Firewalls: Implementing advanced firewalls and intrusion detection systems can mitigate the risk of DDoS attacks and other cyber threats.

- Regular Security Audits: Regular security audits and penetration testing are vital to identify vulnerabilities and strengthen the system's defenses.

Improved Communication

Clear and timely communication with the public is essential during outages.

- Proactive Communication: Proactive communication strategies, including timely updates on social media and the official HMRC website, can help manage public expectations and minimize frustration.

- Multiple Communication Channels: Utilizing multiple channels, including email alerts and SMS notifications, ensures that taxpayers receive timely information.

Conclusion

The recent widespread issues with the HMRC website underscore the critical need for robust and reliable online services. When the HMRC website goes down, it significantly impacts individuals, businesses, and the UK economy. Addressing the causes through improved infrastructure, enhanced cybersecurity, and better communication is crucial to prevent future disruptions and maintain public trust. Staying informed about official updates regarding the HMRC website status is vital for all taxpayers. Regularly check the official HMRC website and social media channels for updates to avoid potential penalties and delays related to HMRC website down situations.

Featured Posts

-

Miami Gp Tea Break Hamilton And Ferraris Heated Exchange

May 20, 2025

Miami Gp Tea Break Hamilton And Ferraris Heated Exchange

May 20, 2025 -

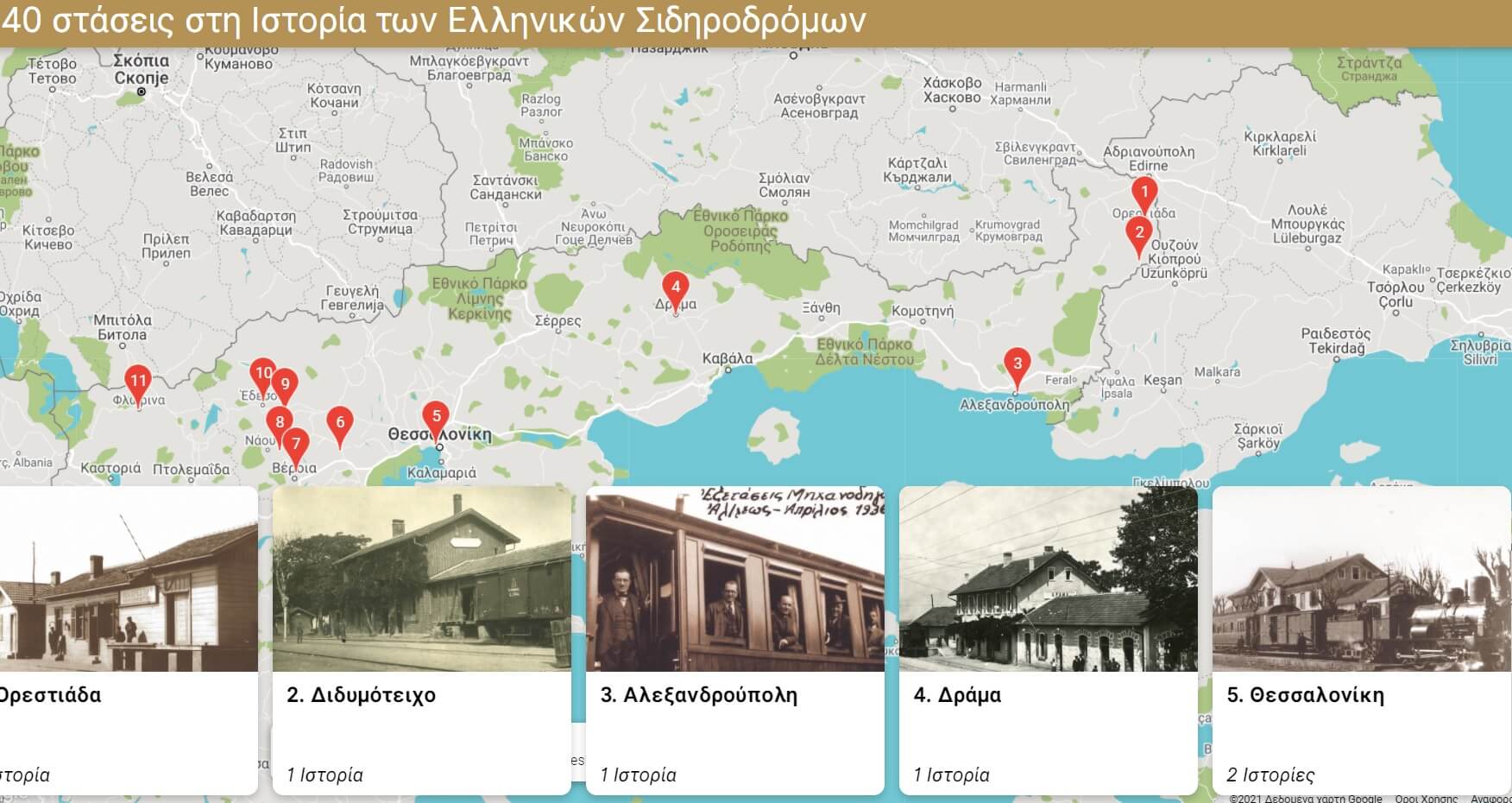

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

May 20, 2025

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 20, 2025 -

Michael Strahans Departure From Good Morning America The Real Reason

May 20, 2025

Michael Strahans Departure From Good Morning America The Real Reason

May 20, 2025 -

Ia Et Agatha Christie Une Nouvelle Methode D Apprentissage De L Ecriture

May 20, 2025

Ia Et Agatha Christie Une Nouvelle Methode D Apprentissage De L Ecriture

May 20, 2025