Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings

![Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings](https://denx-cs.de/image/home-depot-stock-impact-of-tariffs-on-q-quarter-earnings.jpeg)

Table of Contents

Tariff Impact on Home Depot's Supply Chain

Tariffs significantly increased the cost of imported goods for Home Depot, impacting its profitability and requiring strategic adjustments. The imposition of tariffs on various imported goods directly affected the cost of materials crucial to Home Depot's business.

-

Increased costs for lumber, appliances, and other building materials sourced internationally. A substantial portion of Home Depot's inventory relies on international sourcing, making them highly vulnerable to tariff increases. The higher costs of lumber, for instance, directly impacted their profit margins on lumber sales and projects involving lumber. Similarly, appliances and other building materials faced price hikes, squeezing profit margins.

-

Potential supply chain disruptions due to trade tensions. The uncertainty surrounding trade policies created disruptions in Home Depot's supply chain. Delayed shipments and difficulties in securing consistent supplies added further complexities to their operations.

-

Strategies employed by Home Depot to mitigate tariff impacts (e.g., sourcing from alternative markets, price adjustments). Home Depot actively sought to mitigate the impact of tariffs through several strategies. This included exploring alternative sourcing markets to diversify their supply chain and reduce reliance on tariff-affected countries. They also implemented price adjustments, albeit carefully, to maintain competitiveness while absorbing some of the increased costs.

-

Analysis of the impact on profit margins. While precise figures require accessing Home Depot's Q3 financial reports, it's evident that increased costs impacted profit margins. The degree of impact likely varied across product categories, with higher-value items potentially absorbing the increased costs more effectively than lower-margin products.

Sourcing Diversification and Mitigation Strategies

Home Depot's response to tariffs included actively diversifying its supply chain. They explored sourcing lumber from Canada and the US more extensively, and sought alternative suppliers for appliances and other building materials from countries unaffected by the specific tariffs.

The success of these mitigation strategies in protecting their bottom line is a complex issue. While diversification lessened the dependence on single-source countries, the full impact on profits is reflected in their Q3 financial statements. A thorough review of these reports is essential for a complete analysis.

Consumer Behavior and Spending in Relation to Tariffs

Increased prices due to tariffs inevitably impacted consumer spending at Home Depot. Understanding this consumer response is key to analyzing Home Depot's Q3 performance.

-

Analysis of sales figures in Q3 compared to previous quarters. Comparing Q3 sales figures to previous quarters reveals the impact of tariff-induced price increases on consumer purchasing decisions. A decline in sales volume, adjusted for normal seasonal fluctuations, could indicate a negative effect from increased pricing.

-

Discussion on changes in consumer demand for specific products. Some product categories might have been affected more severely than others. For example, price-sensitive customers may have reduced their spending on lumber or delayed larger home improvement projects, impacting sales figures.

-

Examination of potential shifts in consumer purchasing behavior (e.g., delaying purchases, opting for cheaper alternatives). Consumers might have adjusted their spending habits, opting to delay major purchases or choosing cheaper alternatives. This shift in consumer behavior is a crucial factor in assessing the long-term effects of tariffs on Home Depot.

-

How did Home Depot attempt to maintain sales volume in the face of increased prices? Discuss marketing strategies. Home Depot likely employed various marketing strategies to mitigate the impact of price increases on sales volume. These strategies might include emphasizing value, highlighting quality, and focusing on promotions and discounts on specific products.

Home Depot Stock Performance During and After Tariff Implementation

Analyzing Home Depot's stock performance during and after the tariff implementation provides valuable insights.

-

Stock price fluctuations during the quarter. Tracking Home Depot's stock price throughout Q3 provides a clear indication of market reactions to the tariffs and their impact on the company's performance.

-

Investor sentiment and reactions to the earnings report. Investor sentiment surrounding Home Depot’s Q3 earnings release is crucial to understanding the market's perception of the company's ability to navigate the challenges of tariffs.

-

Comparison to competitor stock performance (e.g., Lowe's). Comparing Home Depot's stock performance to its main competitor, Lowe's, helps determine whether the impact of tariffs was industry-wide or specific to Home Depot.

-

Long-term outlook for Home Depot stock considering tariff implications. The long-term impact of tariffs on Home Depot's stock price will depend on factors such as tariff resolution, consumer spending patterns, and the company's ability to adapt to these challenges.

-

Mention analyst predictions and ratings. Analyst predictions and ratings for Home Depot stock following the Q3 earnings report offer further insights into the market's expectations for the company's future performance.

Future Outlook and Predictions for Home Depot Stock (Considering Tariffs)

The potential long-term impact of tariffs on Home Depot remains a key concern for investors.

-

Predictions for future earnings, considering potential tariff changes or resolutions. Future earnings will heavily depend on the evolution of trade policies. A resolution or easing of tariffs would positively impact future earnings, while continued or increased tariffs could pose ongoing challenges.

-

Assessment of the company's resilience to future trade policy changes. Home Depot's adaptability and resilience to future trade policy changes are crucial factors in assessing its long-term outlook.

-

Discussion of potential investment strategies based on the analysis. Based on this analysis, investors can develop more informed investment strategies. This could include maintaining a current position, adjusting holdings, or exploring alternative investments.

-

Considerations for investors in light of continued tariff uncertainty. Continued tariff uncertainty presents a risk, necessitating a cautious approach to investing in Home Depot stock.

Conclusion

This analysis of Home Depot stock in Q3 reveals the significant impact of tariffs on the company's earnings and supply chain. While Home Depot implemented strategies to mitigate the negative effects, the increased costs and potential consumer behavior shifts presented challenges. Understanding the interplay between tariffs, consumer spending, and Home Depot’s stock performance provides valuable insights for investors. For a comprehensive understanding of the effects of tariffs on Home Depot and informed investment decisions, continue your research and regularly monitor the company's financial reports and news regarding trade policies. Stay informed on future developments related to Home Depot stock and tariffs to make sound investment choices.

![Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings Home Depot Stock: Impact Of Tariffs On Q[Quarter] Earnings](https://denx-cs.de/image/home-depot-stock-impact-of-tariffs-on-q-quarter-earnings.jpeg)

Featured Posts

-

Antiques Roadshow Couple Jailed After Stolen Goods Appraisal

May 22, 2025

Antiques Roadshow Couple Jailed After Stolen Goods Appraisal

May 22, 2025 -

The David Walliams Simon Cowell Britains Got Talent Dispute What Happened

May 22, 2025

The David Walliams Simon Cowell Britains Got Talent Dispute What Happened

May 22, 2025 -

Abn Amro Amerikaanse Invoertarieven Halveren Voedselexport

May 22, 2025

Abn Amro Amerikaanse Invoertarieven Halveren Voedselexport

May 22, 2025 -

Through Generations The Traverso Familys Enduring Presence At Cannes

May 22, 2025

Through Generations The Traverso Familys Enduring Presence At Cannes

May 22, 2025 -

Trinidad Trip Curtailed Dancehall Artist Accepts Restrictions Receives Kartels Backing

May 22, 2025

Trinidad Trip Curtailed Dancehall Artist Accepts Restrictions Receives Kartels Backing

May 22, 2025

Latest Posts

-

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025

Large Fire Engulfs Used Car Dealership Crews Respond

May 22, 2025 -

Used Car Dealership Fire Crews On Scene

May 22, 2025

Used Car Dealership Fire Crews On Scene

May 22, 2025 -

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025 -

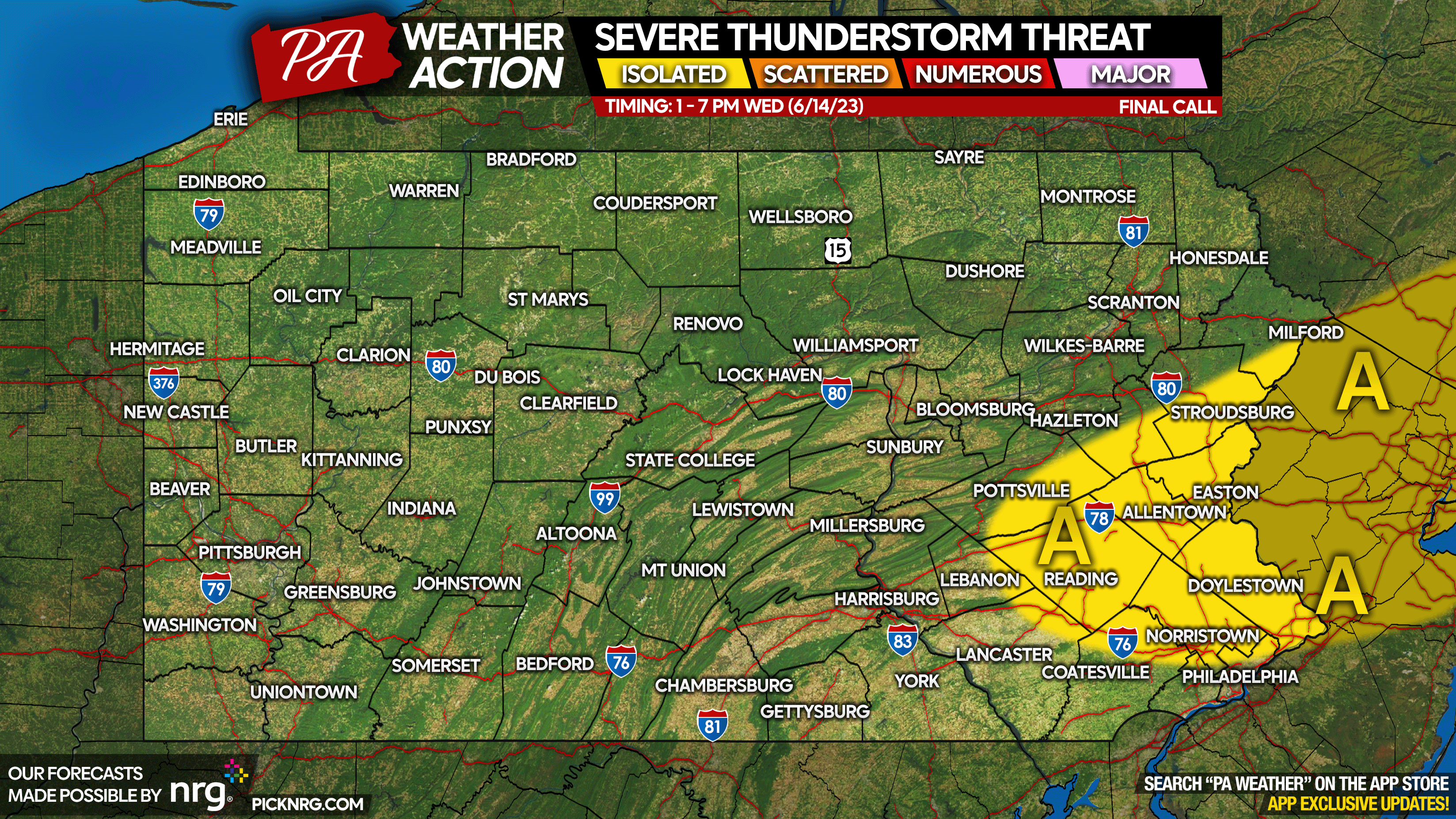

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025