Homeownership With Student Loans: Tips And Strategies

Table of Contents

Assessing Your Financial Situation & Student Loan Repayment

Before you even start browsing houses, understanding your financial landscape is crucial. This involves a thorough assessment of your student loan debt and a realistic budget for homeownership.

Understanding Your Debt:

- Analyze your total student loan debt: Add up all your federal and private student loans to get a clear picture of your total debt.

- Interest rates and repayment plans: Note the interest rates on each loan. Are you on a standard repayment plan, or an income-driven repayment (IDR) plan? Understanding this will influence your monthly payments and overall repayment timeline. Explore options like Income-Based Repayment (IBR), Pay As You Earn (PAYE), or Revised Pay As You Earn (REPAYE) plans to potentially lower your monthly payments.

- Determine your monthly student loan payment: Knowing your exact monthly payment is essential for budgeting. Use your loan servicer's website or a student loan calculator to determine this amount.

- Project future debt: Use online student loan calculators to estimate how much you'll owe in the future and how long it will take to repay your loans under your current plan. This projection is vital when calculating your debt-to-income ratio for mortgage approval.

Budgeting for Homeownership and Student Loans:

Creating a realistic budget is paramount. You need to accommodate not only your student loan payments but also the significant costs associated with homeownership.

- Comprehensive Budgeting: Include your student loan payments, potential mortgage payments (principal, interest, taxes, and insurance – PITI), property taxes, homeowner's insurance, potential HOA fees, utilities, home maintenance, and other homeownership-related expenses.

- Track your spending: Use budgeting apps or spreadsheets to monitor your income and expenses. This will reveal areas where you can cut back to increase your savings for a down payment. Popular budgeting apps include Mint, YNAB (You Need A Budget), and Personal Capital.

- Emergency fund: Aim to have 3-6 months' worth of living expenses saved in an emergency fund to handle unexpected repairs or job loss without jeopardizing your loan payments or mortgage.

- Prioritize saving: Once you have a realistic budget in place, prioritize saving aggressively for your down payment.

Improving Your Credit Score for Mortgage Approval

A good credit score is essential for securing a favorable mortgage. Lenders use your credit score to assess your creditworthiness and determine the interest rate they'll offer.

Monitoring Your Credit Report:

- Regular checks: Regularly check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) for errors. You can obtain free credit reports annually from AnnualCreditReport.com.

- Dispute inaccuracies: If you find any errors, promptly dispute them with the respective credit bureau.

- Credit monitoring: Consider using free credit monitoring services to track your credit score and receive alerts about changes.

Strategies to Boost Your Credit Score:

Several steps can help improve your credit score:

- On-time payments: Make all your payments on time, including student loan payments, credit card bills, and other debts.

- Low credit utilization: Keep your credit card balances low—ideally, below 30% of your available credit.

- Credit mix: Maintaining a healthy mix of credit accounts (credit cards and installment loans) can positively impact your credit score.

- Secured credit card: If your credit score is poor, consider applying for a secured credit card to rebuild your credit history.

Exploring Mortgage Options and Down Payment Strategies

With your finances in order and your credit score improving, it's time to explore mortgage options and strategies for securing a down payment.

Finding the Right Mortgage:

- Mortgage types: Research different mortgage types, such as FHA loans (for first-time homebuyers), VA loans (for veterans), and conventional loans. Each has its own eligibility requirements and terms.

- Rate comparison: Compare interest rates and loan terms from multiple lenders (banks, credit unions, and online lenders).

- Mortgage broker: Consider using a mortgage broker to navigate the complexities of the mortgage process and find the best options for your situation.

- Closing costs: Understand the closing costs associated with a mortgage. These can be substantial, so factor them into your budget.

Saving for a Down Payment:

Saving for a down payment can be challenging, but several strategies can help:

- Down payment plan: Develop a realistic savings plan and stick to it. Even small, consistent savings add up over time.

- Down payment assistance programs: Explore down payment assistance programs offered by state and local governments or non-profit organizations.

- 529 plan (with caution): If you have a 529 education savings plan, you might be able to use some funds for a down payment, but be aware of potential tax implications. Consult a financial advisor before using these funds.

- Debt reduction: Focus on paying down high-interest debt to free up more money for your down payment.

Seeking Professional Advice

Navigating student loans and homeownership simultaneously can be complex. Seeking professional guidance can significantly improve your chances of success.

Consult a Financial Advisor:

- Personalized advice: A qualified financial advisor can provide personalized advice tailored to your specific financial situation and goals.

- Financial strategies: They can help you develop a comprehensive financial plan that addresses both your student loan debt and your homeownership aspirations.

Work with a Real Estate Agent and Mortgage Broker:

- Real estate agent: A real estate agent can guide you through the home-buying process, helping you find suitable properties and negotiate offers.

- Mortgage broker: A mortgage broker will assist in finding the best mortgage rates and terms available, saving you time and potentially money.

Conclusion

Successfully navigating homeownership while managing student loans requires careful planning, responsible financial management, and strategic decision-making. By assessing your financial situation, improving your credit score, exploring suitable mortgage options, and seeking professional advice, you can significantly increase your chances of achieving your dream of homeownership. Remember, consistent effort in managing your student loans and saving diligently will pave the way for successful homeownership. Start planning your journey towards homeownership with student loans today!

Featured Posts

-

Srochno Bolee 200 Raket I Dronov Atakovali Ukrainu

May 17, 2025

Srochno Bolee 200 Raket I Dronov Atakovali Ukrainu

May 17, 2025 -

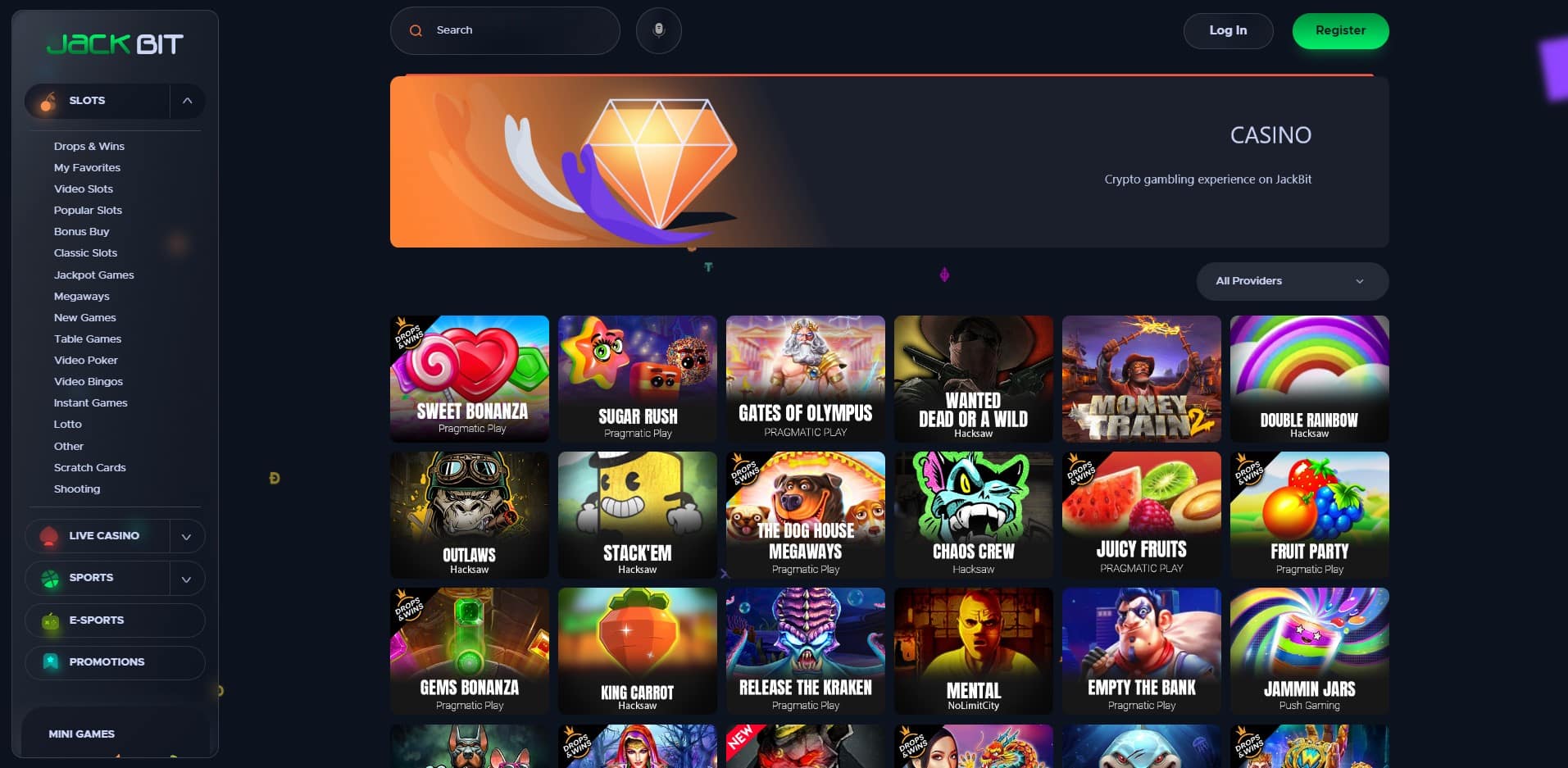

Find The Best Crypto Casinos In 2025 Compare Bitcoin Casinos With Easy Withdrawals

May 17, 2025

Find The Best Crypto Casinos In 2025 Compare Bitcoin Casinos With Easy Withdrawals

May 17, 2025 -

Jim Morrison Sighting New York Maintenance Man Claim Investigated

May 17, 2025

Jim Morrison Sighting New York Maintenance Man Claim Investigated

May 17, 2025 -

Tom Hanks And Tom Cruise The 1 Debt That Wont Go Away

May 17, 2025

Tom Hanks And Tom Cruise The 1 Debt That Wont Go Away

May 17, 2025 -

How Josh Cavallo Is Changing The Game His Impact After Coming Out

May 17, 2025

How Josh Cavallo Is Changing The Game His Impact After Coming Out

May 17, 2025

Latest Posts

-

Best Crypto Casinos In The United States Is Jack Bit Number One

May 17, 2025

Best Crypto Casinos In The United States Is Jack Bit Number One

May 17, 2025 -

Top Bitcoin Casinos Usa Jack Bits Rise To The Top

May 17, 2025

Top Bitcoin Casinos Usa Jack Bits Rise To The Top

May 17, 2025 -

Choosing The Best Crypto Casino For 2025 Jackbit Analysis

May 17, 2025

Choosing The Best Crypto Casino For 2025 Jackbit Analysis

May 17, 2025 -

Jack Bit The Best Crypto Casino In The United States A Top Bitcoin Casino Review

May 17, 2025

Jack Bit The Best Crypto Casino In The United States A Top Bitcoin Casino Review

May 17, 2025 -

Best Crypto Casino 2025 A Jackbit Deep Dive

May 17, 2025

Best Crypto Casino 2025 A Jackbit Deep Dive

May 17, 2025