Honeywell In Advanced Talks To Buy Johnson Matthey Unit For £1.8 Billion

Table of Contents

The Target: Johnson Matthey's Emission Control Technologies

The focus of Honeywell's potential acquisition is likely Johnson Matthey's emission control technologies division. This division plays a crucial role in the global automotive industry, providing critical components for reducing harmful emissions from vehicles. Johnson Matthey is a renowned player in this space, specializing in the development and manufacturing of advanced catalysts essential for meeting increasingly stringent environmental regulations. The technologies involved are highly specialized and critical to modern vehicle performance and environmental compliance. Key technologies include:

- Diesel oxidation catalysts (DOC): These catalysts convert harmful emissions from diesel engines into less harmful substances.

- Gasoline particulate filters (GPF): These filters trap and remove harmful particulate matter from gasoline engine exhaust.

- Other relevant emission control catalysts: Johnson Matthey's portfolio likely includes a range of other advanced catalysts designed to meet diverse emission control needs across different vehicle types and fuel systems.

Key aspects of Johnson Matthey's emission control technologies:

- Market share: Johnson Matthey holds a significant market share in the automotive catalyst sector, supplying major automotive manufacturers worldwide.

- Key clients and partnerships: The unit boasts a strong client base comprising some of the largest automotive manufacturers globally, underpinning its market position.

- Technological advantages and innovations: Johnson Matthey continuously invests in R&D, leading to innovative and high-performing emission control technologies.

Honeywell's Strategic Rationale for the Acquisition

Honeywell's pursuit of this acquisition stems from several strategic objectives. The acquisition aligns perfectly with Honeywell's broader growth strategy and diversification efforts. The potential synergies between Honeywell's existing businesses and Johnson Matthey's emission control technologies are substantial.

Key strategic motivations for Honeywell:

- Enhanced market position: The acquisition would significantly boost Honeywell's presence and competitiveness in the rapidly growing automotive emission control sector.

- Access to new technologies and intellectual property: This deal would grant Honeywell access to Johnson Matthey's valuable technology and intellectual property, strengthening its technological capabilities.

- Potential cost savings and operational efficiencies: Consolidation could lead to economies of scale and operational efficiencies, contributing to improved profitability.

- Diversification of Honeywell's revenue streams: Adding a significant player in the emission control sector diversifies Honeywell’s revenue streams, reducing its reliance on any single market segment.

Potential Challenges and Regulatory Hurdles

While the acquisition presents significant opportunities, Honeywell faces potential challenges. Regulatory approvals, particularly antitrust scrutiny, are critical hurdles. A thorough due diligence process is crucial to assess all potential financial and operational risks.

Potential challenges and risks:

- Antitrust scrutiny: Regulatory bodies will likely examine the deal's impact on competition within the automotive emission control market.

- Integration challenges: Merging two distinct corporate cultures and operational structures can be complex and time-consuming.

- Impact on Johnson Matthey's remaining business units: The sale of this division could impact the remaining parts of Johnson Matthey's operations.

- Unforeseen financial or operational risks: Unforeseen financial or operational issues during the integration process pose a risk to the successful completion of the acquisition.

Market Impact and Future Outlook

The acquisition will likely reshape the automotive emission control landscape. The combined entity would command a considerable market share, influencing pricing and the availability of these critical technologies. The deal's impact extends to the broader automotive industry's transition to cleaner vehicles, driven by increasingly stringent environmental regulations globally.

Key market implications:

- Impact on pricing and availability: The acquisition could potentially affect the pricing and availability of emission control technologies.

- Long-term implications for the automotive industry: The deal influences the automotive industry's efforts to comply with increasingly stringent emission standards.

- Further consolidation within the sector: This acquisition could trigger further consolidation and mergers within the automotive emission control sector.

Conclusion

The potential Honeywell acquisition of Johnson Matthey's emission control unit represents a significant development in the automotive and environmental technology sectors. The £1.8 billion deal offers substantial strategic benefits for Honeywell but presents challenges related to regulatory approvals and integration. Its impact on the wider market will be significant, shaping the future landscape of emission control technology. Stay informed about the latest developments in this landmark Honeywell acquisition and its potential impact on the industry by following our updates on the Honeywell and Johnson Matthey merger. Learn more about the evolving landscape of automotive emission control technologies and the impact of major acquisitions.

Featured Posts

-

Get Ready Metallicas M72 Tour Hits Uk And Europe In 2026

May 23, 2025

Get Ready Metallicas M72 Tour Hits Uk And Europe In 2026

May 23, 2025 -

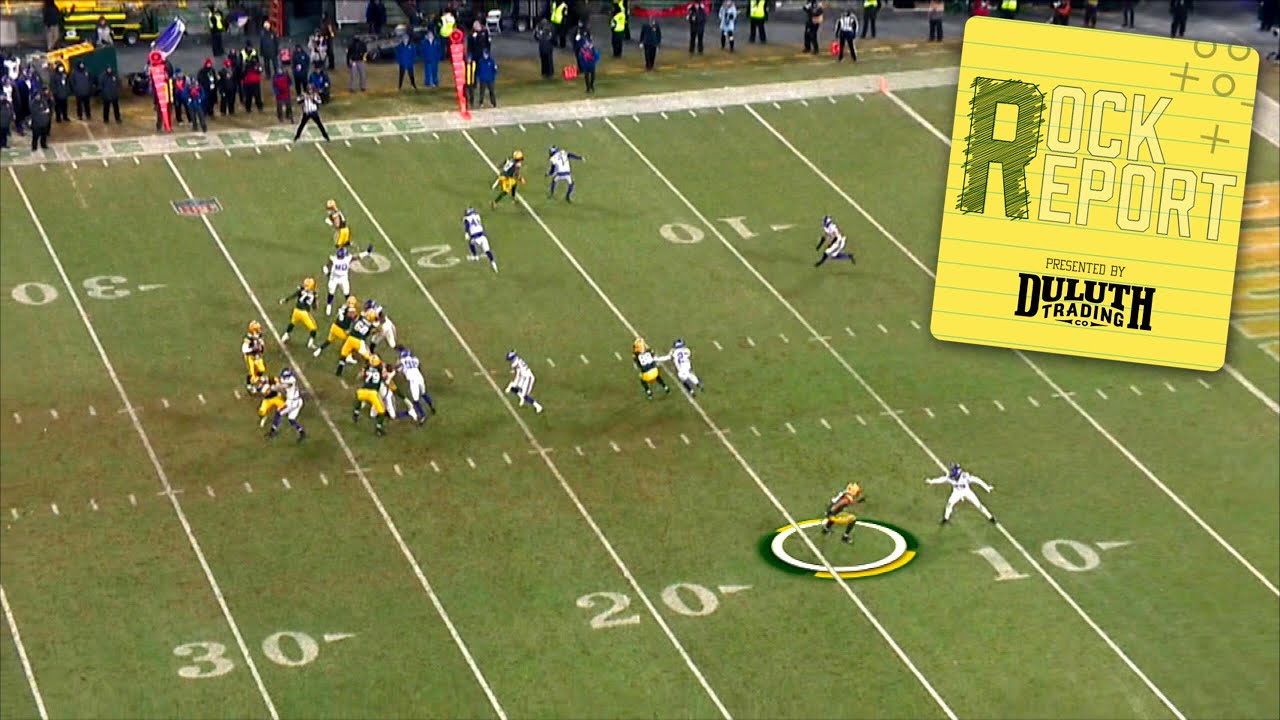

Big Rig Rock Report 3 12 A Comprehensive Rock 101 Overview

May 23, 2025

Big Rig Rock Report 3 12 A Comprehensive Rock 101 Overview

May 23, 2025 -

Brundles Revelation Unsettling Truths About Lewis Hamilton

May 23, 2025

Brundles Revelation Unsettling Truths About Lewis Hamilton

May 23, 2025 -

Jonathan Groffs Potential Tony Awards History With Just In Time

May 23, 2025

Jonathan Groffs Potential Tony Awards History With Just In Time

May 23, 2025 -

Las Novedades En La Convocatoria De Instituto Y El Probable Equipo Ante Lanus

May 23, 2025

Las Novedades En La Convocatoria De Instituto Y El Probable Equipo Ante Lanus

May 23, 2025

Latest Posts

-

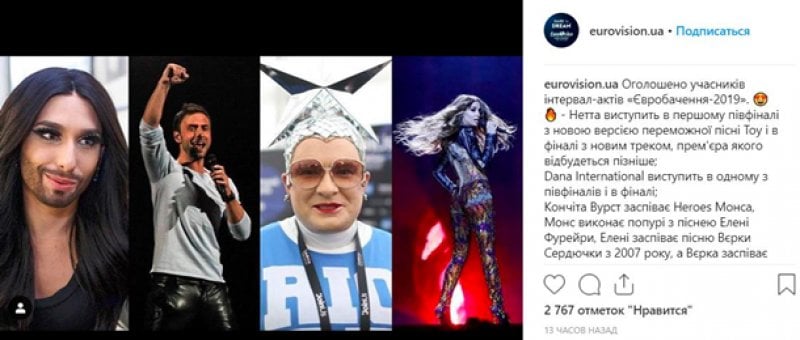

Konchita Vurst O Favoritakh Evrovideniya 2025 Eksklyuziv Ot Unian

May 24, 2025

Konchita Vurst O Favoritakh Evrovideniya 2025 Eksklyuziv Ot Unian

May 24, 2025 -

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 24, 2025

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 24, 2025 -

Evrovidenie 2025 Chetyre Predskazaniya Konchity Vurst Ot Unian

May 24, 2025

Evrovidenie 2025 Chetyre Predskazaniya Konchity Vurst Ot Unian

May 24, 2025 -

Konchita Vurst Zhivott Sled Pobedata Na Evroviziya

May 24, 2025

Konchita Vurst Zhivott Sled Pobedata Na Evroviziya

May 24, 2025 -

Konchita Vurst Prognoz Pobediteley Evrovideniya 2025

May 24, 2025

Konchita Vurst Prognoz Pobediteley Evrovideniya 2025

May 24, 2025