House Budget Plan: Significant Tax Increase For Harvard, Yale Endowments

Table of Contents

Details of the Proposed Tax Increase on University Endowments

The House budget plan proposes a new tax on university endowments exceeding a certain threshold, aiming to generate revenue for social programs and address wealth inequality. While the exact percentage and specifics are still subject to change, the current proposal suggests a progressive tax structure. This means that universities with larger endowments will face a higher tax rate than those with smaller ones. The rationale behind this tax is to utilize the vast wealth accumulated by these institutions to fund critical social needs.

- Specific tax rate proposed: Current proposals range from a graduated tax rate starting at X% for endowments above Y dollars, escalating to Z% for endowments exceeding W dollars. (Note: Replace X, Y, Z, and W with actual figures once available).

- Threshold for endowment size triggering the tax: The proposed threshold is likely to be set at a high level, targeting only the wealthiest universities with endowments in the billions.

- Projected revenue generation from the tax: The government projects this tax to generate billions of dollars annually to fund social programs such as affordable housing, healthcare, and education initiatives.

Potential Impact on Harvard and Yale Universities

Harvard and Yale, with their multi-billion dollar endowments, are particularly vulnerable to this proposed tax. The impact could be substantial, potentially affecting various aspects of university operations:

- Estimated impact on Harvard's annual budget: Depending on the final tax rate, Harvard could face a loss of hundreds of millions of dollars annually, significantly impacting its financial planning.

- Potential reduction in financial aid for students: A reduction in endowment income could lead to cuts in financial aid, potentially limiting access for low-income students.

- Possible cuts to research programs: Funding for critical research initiatives could be jeopardized, potentially hindering scientific breakthroughs and innovation.

- Impact on faculty salaries and hiring: The tax could lead to reduced faculty salaries or hiring freezes, impacting the quality of education and research.

Arguments For and Against the Proposed Tax Increase

The proposed endowment tax has sparked a contentious debate.

Arguments in favor emphasize the need to address wealth inequality and utilize the considerable resources held by wealthy institutions for the public good. Proponents argue that this tax will provide much-needed funding for essential social programs, ultimately benefiting society as a whole.

- Pro-tax arguments: Increased social spending, wealth redistribution, funding for public services, addressing systemic inequality.

Conversely, opponents highlight the potential negative consequences for higher education, research, and charitable giving. They warn that the tax could stifle innovation, reduce educational opportunities, and discourage future philanthropy.

- Anti-tax arguments: Harm to research, reduced educational opportunities, decreased charitable giving to universities, potential legal challenges to the tax.

- Alternative funding sources for social programs: Opponents suggest exploring alternative funding mechanisms, such as closing tax loopholes for corporations or high-income earners, to avoid impacting educational institutions.

The Broader Implications for Higher Education Funding

The proposed tax isn't isolated to Harvard and Yale; it sets a precedent that could impact other universities with substantial endowments.

- Impact on other private universities: Universities with large endowments across the country will face similar challenges, potentially altering their financial strategies and long-term planning.

- Potential decrease in charitable donations: The tax could discourage future philanthropic giving to universities, as donors may reconsider their contributions if they are subject to taxation.

- Changes in funding strategies for universities: Universities may need to explore new fundraising methods and strategies to offset the potential loss of revenue from endowments.

Conclusion: The Future of Endowment Taxation and its Effects on Universities like Harvard and Yale

The proposed tax increase on university endowments represents a significant shift in higher education funding. Its impact on institutions like Harvard and Yale, and the broader higher education landscape, remains uncertain. The debate surrounding this proposal highlights the complex interplay between wealth distribution, public funding, and the role of private universities in society. The long-term consequences are far-reaching and will require careful consideration and ongoing discussion. We encourage you to learn more about the House budget plan and share your opinions on this crucial issue. Visit [link to relevant government website] and [link to relevant news article] to stay informed and make your voice heard on the Harvard endowment tax, Yale endowment tax, and the overall House budget plan impact on higher education.

Featured Posts

-

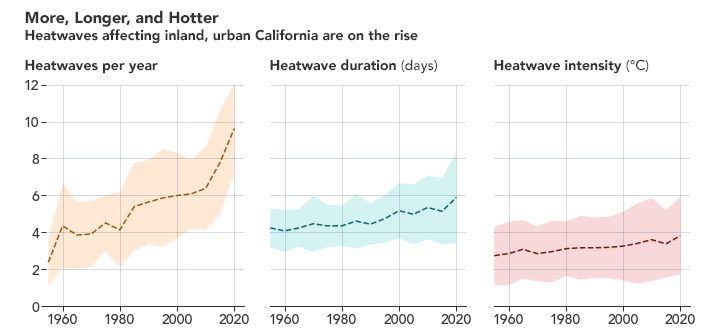

Southern California Heatwave Record Breaking Temperatures In La And Orange Counties

May 13, 2025

Southern California Heatwave Record Breaking Temperatures In La And Orange Counties

May 13, 2025 -

Deja Kellys Game Winning Shot Propels Las Vegas Aces To Victory

May 13, 2025

Deja Kellys Game Winning Shot Propels Las Vegas Aces To Victory

May 13, 2025 -

Longtime Portola Valley Public Servant Sue Crane Dies At 92

May 13, 2025

Longtime Portola Valley Public Servant Sue Crane Dies At 92

May 13, 2025 -

Preobrazba Leonarda Di Caprija Je Li Ga Prepoznala Slobodna Dalmacija

May 13, 2025

Preobrazba Leonarda Di Caprija Je Li Ga Prepoznala Slobodna Dalmacija

May 13, 2025 -

Analyzing Gibraltar Industries Rock Q Quarter Earnings Key Metrics And Predictions

May 13, 2025

Analyzing Gibraltar Industries Rock Q Quarter Earnings Key Metrics And Predictions

May 13, 2025